China is strengthening its position in the global phosphate industry

Particularly in calcium phosphate chemicals, the Chinese industry is increasingly a leader

Published by Luigi Bidoia. .

Fertilizers Phosphorus Critical raw materialsPhosphorus is a fundamental component of many fertilizers. It is particularly critical[1] because there are no valid substitutes for phosphorus in agriculture[2]. With the continuous growth of the world population, and limited increases in cultivated land, the ability to produce the food needed to feed the entire world population necessarily depends on an increase in agricultural yields. Along with agricultural mechanization and more efficient irrigation techniques, fertilizers play a crucial role in enabling the increase in crop yields.

Natural and chemical phosphates

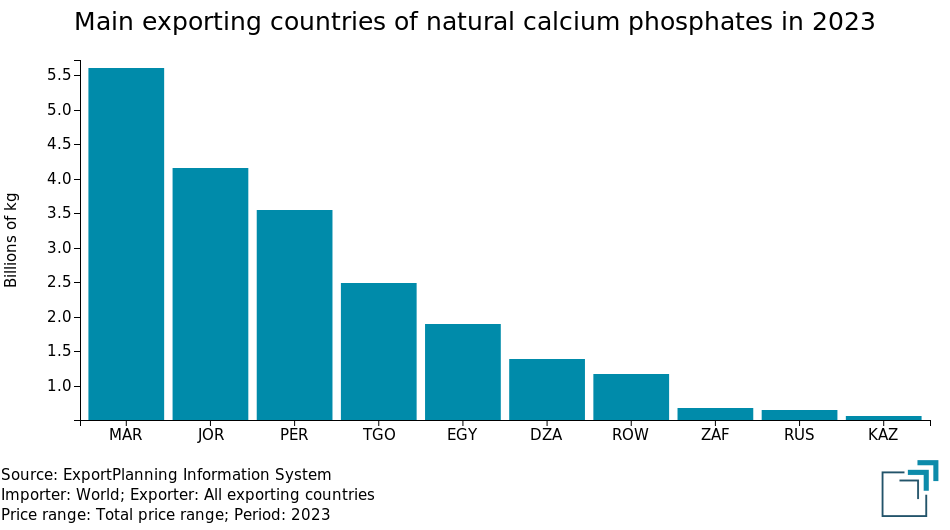

Phosphorus is found in nature in significant percentages in minerals such as apatite and phosphorite. These minerals are sources of natural calcium phosphates, supplied internationally by a significant number of countries. Chart 1 lists the main exporting countries of natural calcium phosphates. The concentration is relatively low: the top 3 exporters (Morocco, Jordan, and Peru) hold a global demand share of less than 50%. Among the major global exporters of natural calcium phosphates, China is not listed, despite being the largest producer. China does not export natural calcium phosphates due to high domestic demand in its chemical industry.

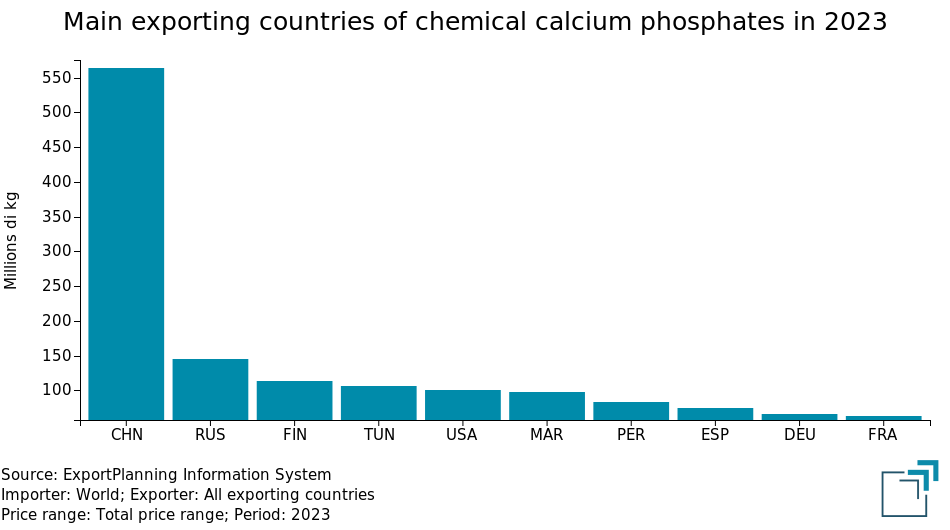

| Main exporting countries of calcium phosphates | |

| Chart 1: Natural | Chart 2: Chemical |

|

|

Natural calcium phosphates have too many impurities to be used in industrial processes, except for the production of some very crude phosphorus fertilizers. The best way to purify them is to transform them into phosphoric acid[3] and then into various formulations of phosphates, including chemical calcium phosphates[4], with a purity suitable for uses such as:

- animal feed;

- high-purity fertilizers;

- food additives;

- excipients in pharmaceuticals;

- detergents in household chemical products.

- Lithium Iron Phosphate (LFP) batteries were developed to reduce costs compared to more traditional lithium-ion batteries (such as lithium-cobalt) and are used both for electric vehicles and renewable energy applications.

The composition of the main exporting countries of chemical calcium phosphates is completely different from the structure of the international supply of natural calcium phosphates. As shown in Chart 2, in this case, the supply is highly concentrated, with China alone accounting for more than 40% of global trade.

These data provide a clear idea of the global importance of the Chinese phosphate industry.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Price of chemical calcium phosphates

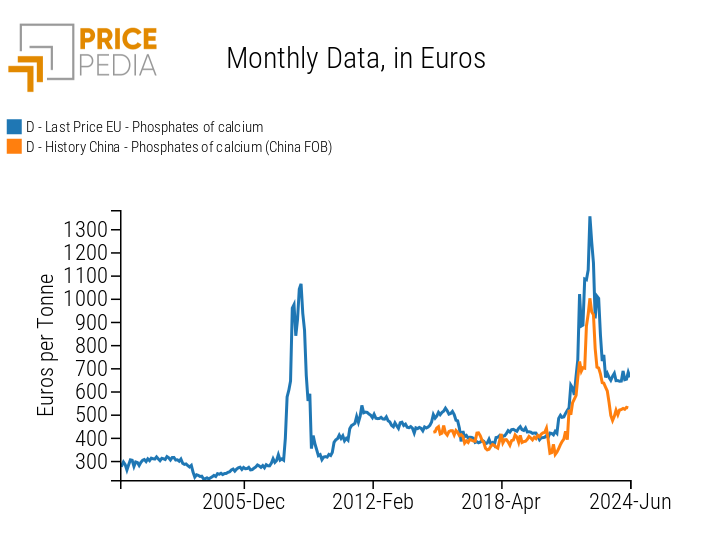

Another piece of information that demonstrates the significance of the Chinese industry in driving the global phosphate market can be gleaned from the comparison between the Chinese export prices of calcium phosphates and the prices on the European market, shown below.

Chemical calcium phosphates: Chinese export prices and EU customs prices

The two price series are perfectly aligned, with the Chinese price acting as a stabilizer for the European price. Over the last 4 years, the price of Chinese exports has been on average 20% lower than the EU customs price. Even when considering the 5.5% import duties from China and other clearance costs (administrative and veterinary controls), the price of imports from China is lower than the EU customs price.

China begins importing natural calcium phosphates

Finally, it is worth noting the significant growth in imports of natural calcium phosphates recorded by China in 2023. While annual import values had always been below 10 million dollars, Chinese imports reached a record 150 million dollars in 2023, indicating high processing activity in the Chinese phosphate industry.

Conclusions

The extractive industry is a strength of the Chinese economy. In this century, it has provided China with the raw materials necessary for the robust development of its industry. The case of calcium phosphates is emblematic in this regard. China is the world's largest producer. Unlike other global producers, China does not export the extracted phosphates but purifies them into chemical calcium phosphates, making them suitable for various industrial uses. In this chemical sector, China has built a strong leadership that is difficult for other countries to challenge. In recent years, the environmental degradation associated with extractive activities has led Chinese companies to limit internal extraction activities and to import phosphate rocks from abroad to maintain their competitive advantage in phosphates.

This advantage helps strengthen China's leadership in the electric vehicle supply chain. The development of lithium iron phosphate batteries has helped reduce the cost of car batteries.

[1] For a specific analysis of the EU Commission on the criticality of phosphate rocks and phosphorus, see the EU fact sheet on phosphorus.

[2] Source: U.S. Geological Survey (USGS): MINERAL COMMODITY SUMMARIES 2024.

[3] The wet process is the most common method for producing phosphoric acid, by reacting calcium phosphates with sulfuric acid.

[4] Phosphoric acid reacts with calcium carbonate or calcium hydroxide (slaked lime) to produce various types of chemical calcium phosphates.