Commodity prices falling for very different reasons

Concerns about Chinese growth and US protectionism sink industrial metal prices. Gaza ceasefire hopes reduce oil prices

Published by Luca Sazzini. .

Conjunctural Indicators Commodities Financial Week

This week was characterized by a significant reduction in non-ferrous metal prices, accompanied by a 2.5% decrease in oil prices on the last day of the week. In the past three days, prices on the London Metal Exchange (LME) for non-ferrous metals have seen reductions ranging from 2% to 7%.

The main cause of the reduction in non-ferrous metal prices is attributable to market concerns regarding lower-than-expected economic growth in China and the protectionist policies of the United States supported by both presidential candidates. Trump announced protectionist policies during his mid-week convention nomination; the Biden administration introduced tariffs on Chinese metals transiting through Mexico. These protectionist policies will increase prices in the American market but reduce them in the global market.

The sharp drop in oil prices recorded on Friday is attributed to a possible ceasefire in Gaza.

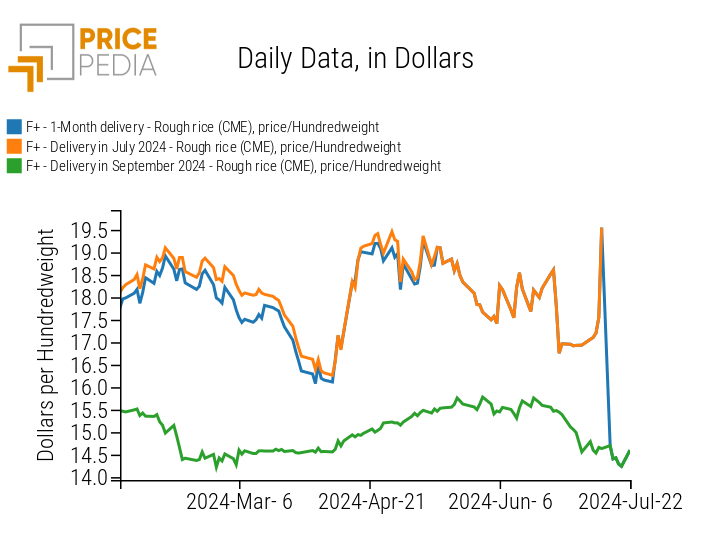

Besides the prices of non-ferrous metals and oil, another price that recorded a significant drop is that of rice. However, in this case, the reasons are not economic but technical, as shown in the graph below. It shows the price of the continuous future of rough rice, along with the dynamics of the futures contract expiring on July 15, 2024, and the one expiring in September 2024.

Dynamics of rough rice futures contracts, quoted at the CME

From May 15 to July 12, the price of the continuous future on rough rice with a one-month maturity (blue line) is represented by the price of the future expiring in July 2024 (orange line). From July 15, the future expiring in July ends its trading, and the continuous future becomes the September contract (green line), characterized by significantly lower prices compared to those in July.

In September, in fact, the rice harvest begins, leading to a significant increase in supply that meets market demand and lowers prices.

The variation recorded by the continuous future is therefore not an anomaly but is simply due to the natural seasonality of rice.

China's GDP

Data regarding China's GDP for the second quarter of the year showed a slowdown in the Chinese economy both in quarterly and annual terms.

From the first to the second quarter, China's GDP went from 1.5% q/q to 0.7% q/q.

On an annual basis, GDP in the first quarter grew by 5.3% y/y, while in the second quarter it grew by only 4.7% y/y, below consensus expectations (5.1% y/y).

This economic slowdown is mainly attributable to a deceleration in the industrial sector and services.

Furthermore, China's June cyclical data, in addition to indicating a slowdown in industrial production, also signal a slowdown in retail sales. Finally, the reduction in real estate investments continues, which also fell in June at a double-digit rate.

ECB: unchanged rates

The European Central Bank (ECB) left interest rates unchanged at its July 18, 2024 meeting. The deposit rate thus remains at 3.75%, while the main refinancing operations rate remains at 4.25%. This decision aligned with analysts' forecasts, who assigned almost no probability to a rate cut.

What was more surprising, however, was the total lack of indications regarding the September meeting, for which the market is pricing in a 25 basis point rate cut.

The ECB's approach seems to be solely data-driven, so monitoring the inflation trend will remain crucial to predicting the central bank's next moves.

Currently, the market continues to price in a 25 basis point rate cut for the September 2024 meeting with a probability of about 70%, as improvements on the inflation front are expected. However, if these do not materialize, the ECB will continue to keep current interest rate levels unchanged.

ENERGY

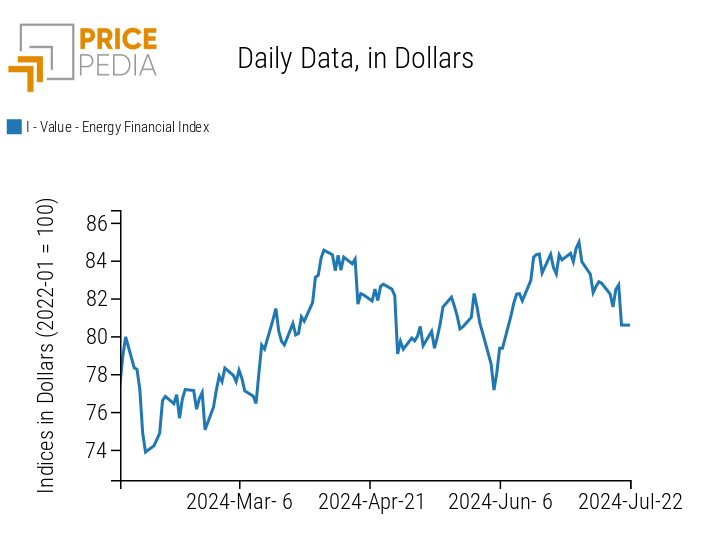

The PricePedia financial index of energy products recorded a significant decrease on the last day of the week, driven by the reduction in oil prices.

PricePedia Financial Index of Energy Prices in Dollars

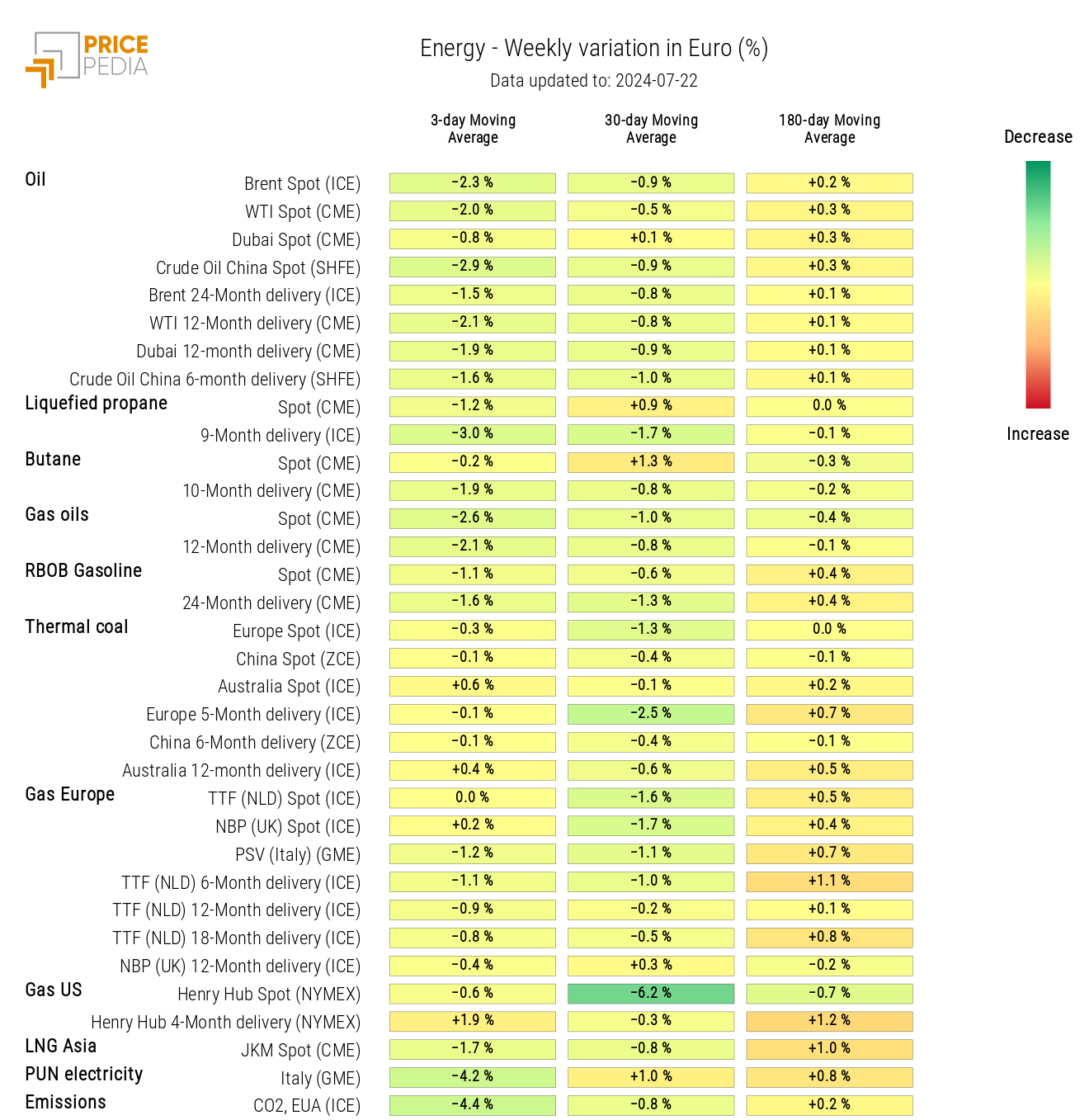

The heatmap of energy products indicates the decrease in prices across the entire oil supply chain.

HeatMap of Energy Prices in Euros

PLASTICS

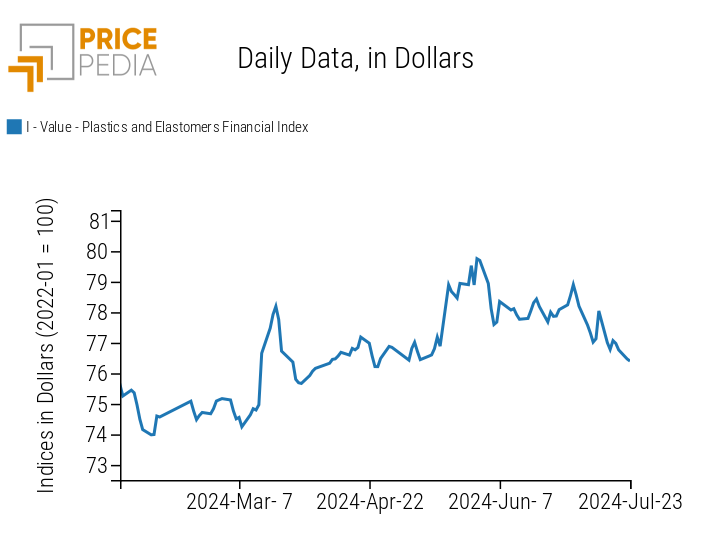

The financial index of plastics quoted in China indicates a trend of price reduction, interrupted by brief moments of recovery.

PricePedia Financial Index of Plastic Prices in Dollars

FERROUS

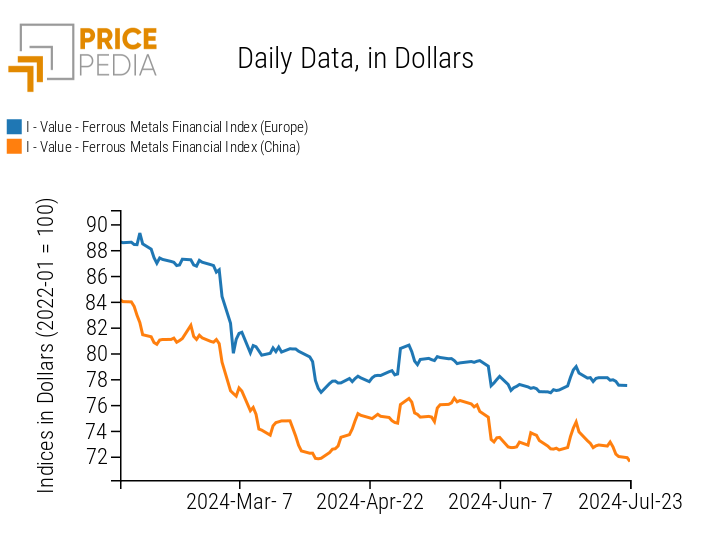

The financial index of ferrous metals in Europe continues to remain relatively stable, while the ferrous index in China shows a slight weekly decline in prices.

PricePedia Financial Index of Ferrous Metal Prices in Dollars

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

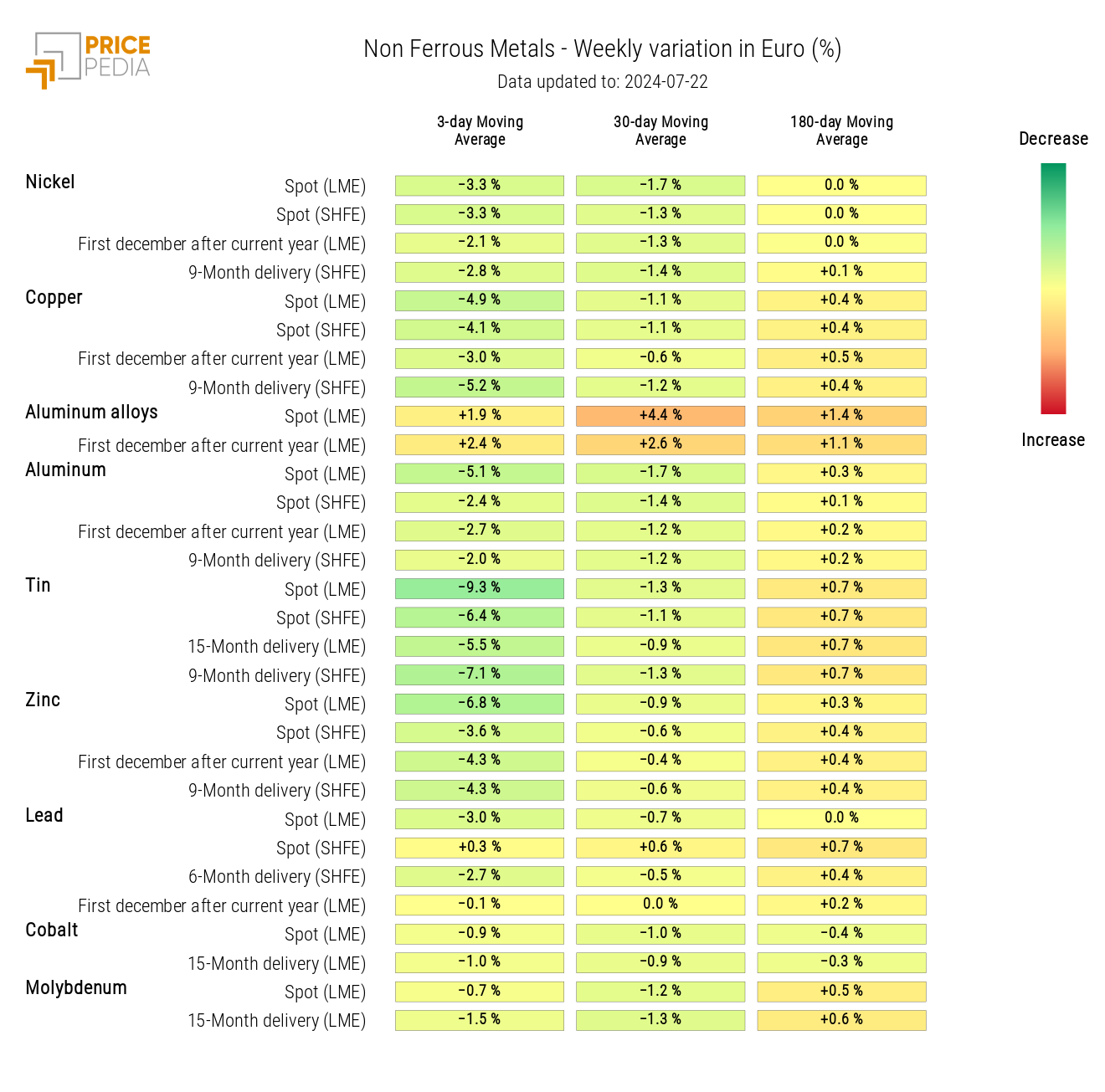

INDUSTRIAL NON-FERROUS

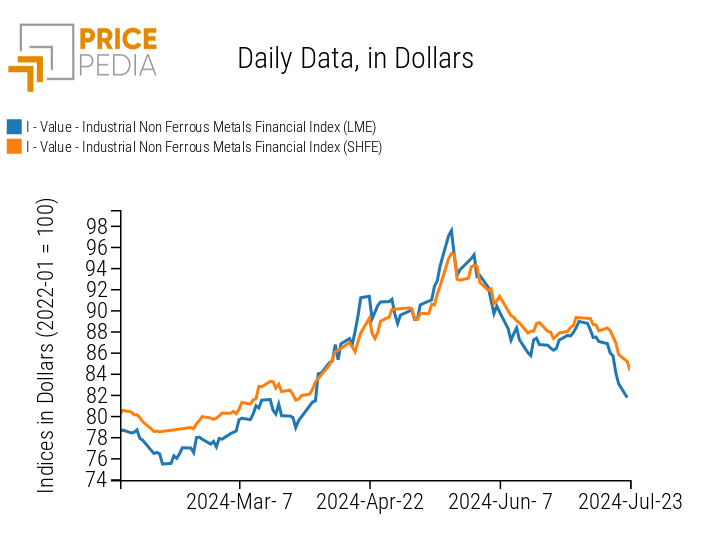

Both financial indices of non-ferrous metals, quoted on the London Metal Exchange (LME) and the Shanghai Futures Exchange (SHFE), continue to indicate a general reduction in price levels.

PricePedia Financial Index of Industrial Non-Ferrous Metal Prices in Dollars

With the exception of the increase in secondary aluminum alloy prices, due to uncertain functioning of this LME market, the non-ferrous heatmap shows a general decline in price levels, more pronounced for spot prices of tin.

HeatMap of Non-Ferrous Prices in Euros

FOOD

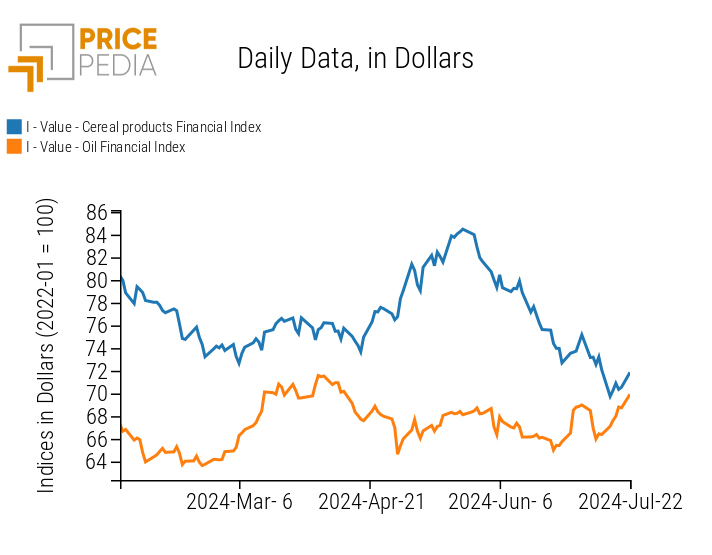

This week, the financial indices of cereals and oils have approached relatively similar levels.

The cereals index, despite some fluctuations, continues to be characterized by a negative trend, while the food oils index records a slight upward fluctuation during the week.

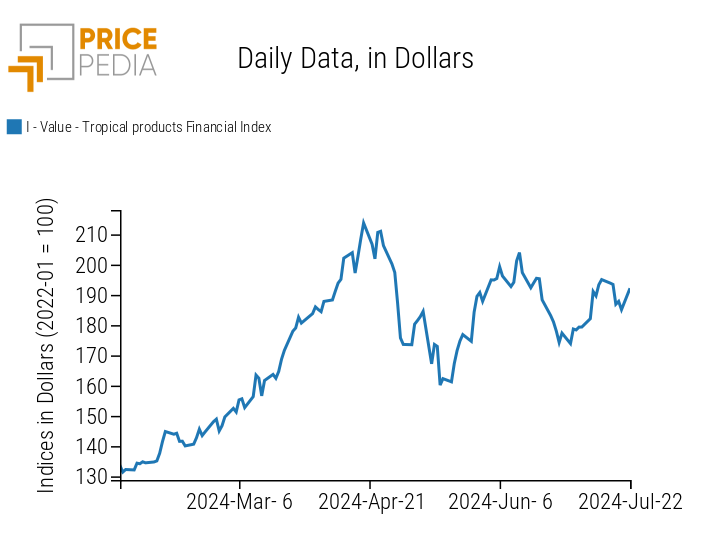

The financial price index of tropicals products undergoes another fluctuation that does not change its current price level.

| PricePedia Financial Indices of Food Prices in Dollars | |

| Cereals and Oils | Tropicals |

|

|

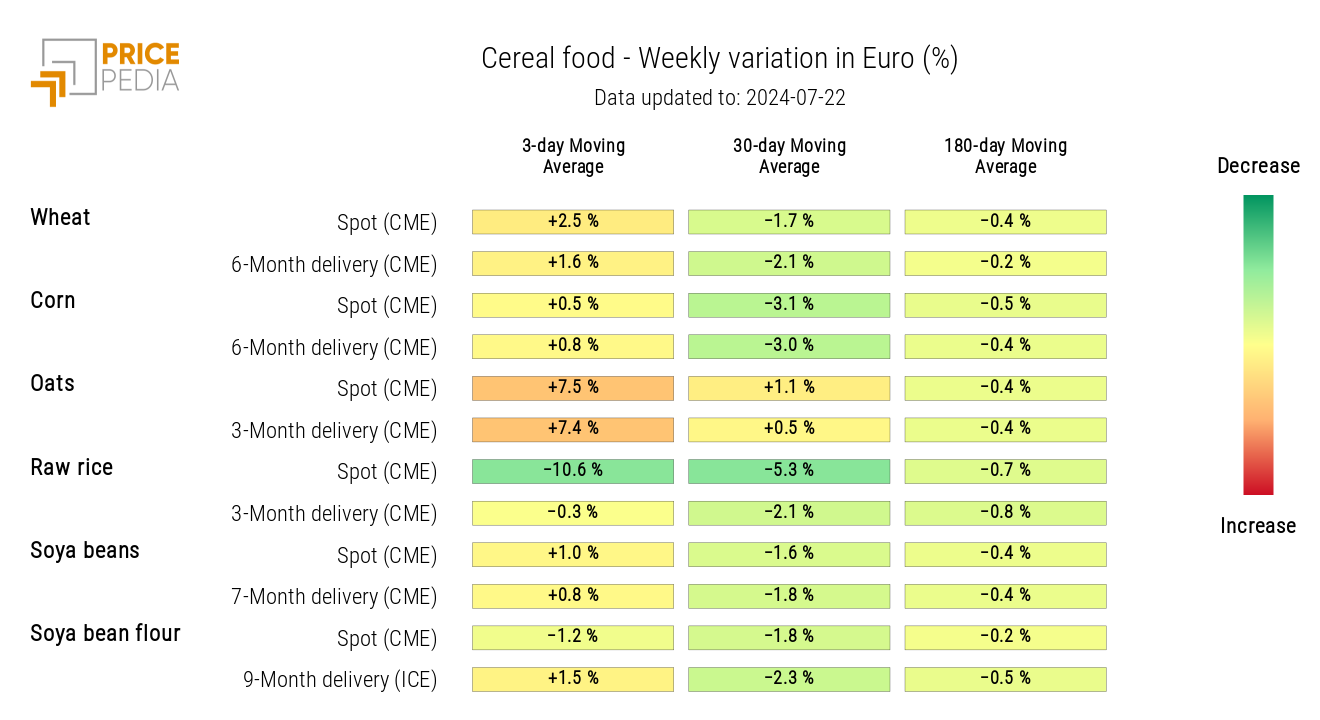

CEREALS

The cereals heatmap highlights the sharp reduction in the prices of the continuous future on rough rice.

This week, in fact, the continuous index of rough rice switched from replicating the price of the July future to that of the September future, the month when the rice harvest occurs. This price reduction is therefore due to the seasonality of rice, whose supply depends on the early September harvest.

In the rice financial markets, it is not uncommon to see significantly lower prices in futures contracts expiring in September compared to those expiring in July.

HeatMap of Cereals Prices in Euros

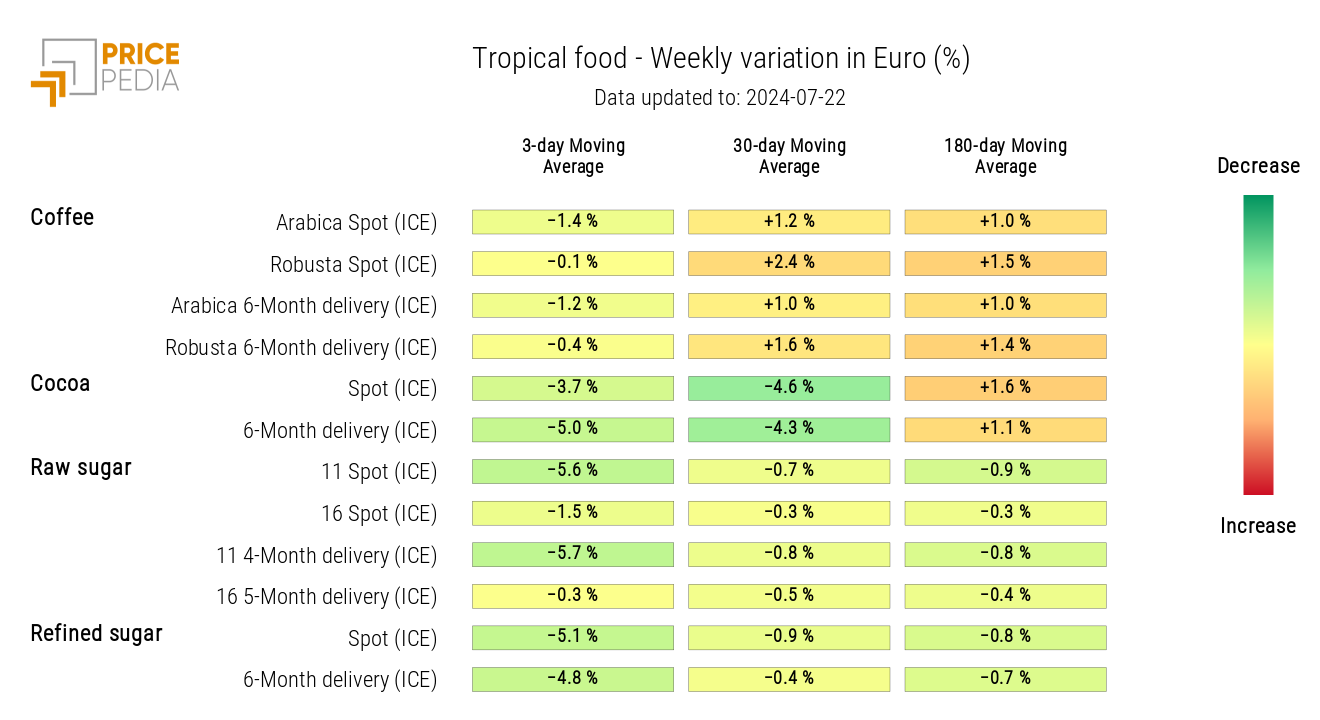

TROPICALS

The tropical heatmap shows a decline in tropical food prices.

The most pronounced reductions are the price of cocoa, which remains a particularly volatile commodity, and the price of refined sugar.

HeatMap of Tropical Food Prices in Euros

OILS

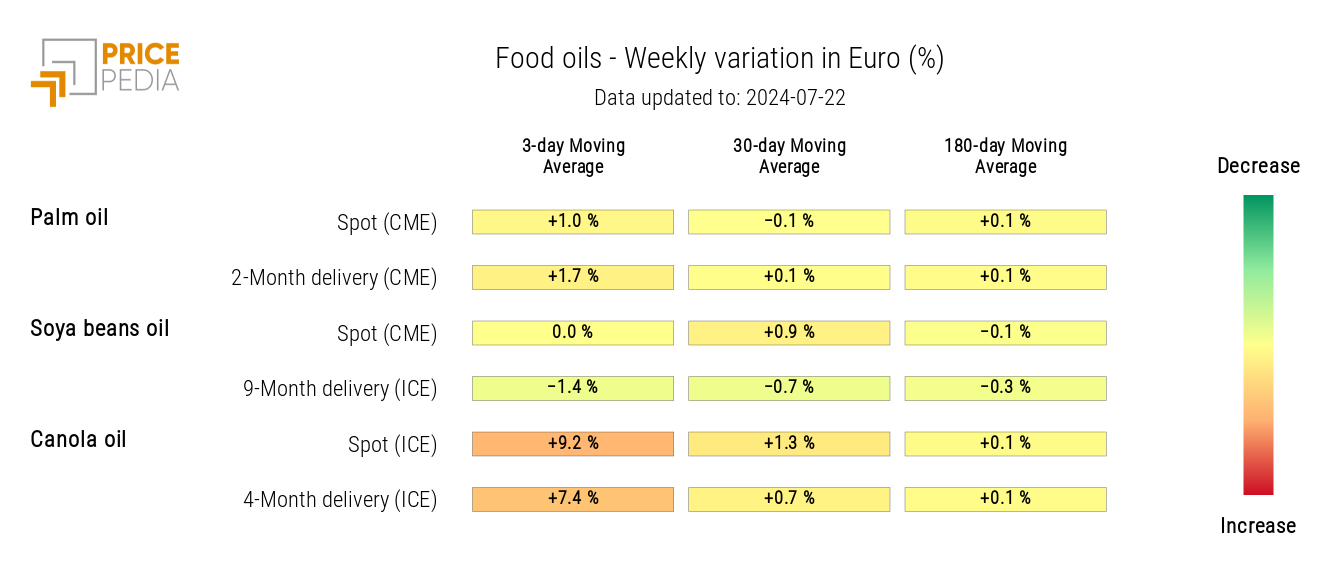

The heatmap of food oils indicates a weekly increase in the three-day moving average of canola oil.

HeatMap of Food Oil Prices in Euros