PricePedia broadens its database: China Customs prices now available

The platform's development continues

Published by Pasquale Marzano. .

Strumenti Analysis tools and methodologies

The new China Customs[1] section is now available, expanding the data base on PricePedia and continuing the development process started with the new version of the platform[2]. This section contains prices of raw materials and semi-finished products processed by PricePedia from incoming or outgoing flows from the Asian country, and are therefore representative of the Chinese physical market.

In recent decades, China has taken an increasingly central role within commodity markets, becoming in many cases the main producer and/or consumer globally. For numerous commodities, this has established its position as a price-maker, capable of directly or indirectly influencing, and often anticipating, what happens in European markets and, in general, in international markets.

China Customs

Within the China Customs section, organized by typologies and families as well as the EU Customs and USA Customs sections, prices related to individual products are distinguished between CIF prices, concerning imports, and FOB prices, concerning exports.

China Customs Section

In the CIF price (Cost, Insurance and Freight), the value of the product, insurance services, and transportation from the customs of the exporting country to the Chinese customs are included. The FOB price (Free On Board), on the other hand, includes the production value and the costs of insurance and transportation to the Chinese customs. For commodities in which China has taken a leadership position worldwide, the FOB value is particularly important because it represents the price of Chinese supply in international markets.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

The availability of CIF and/or FOB prices depends on the role that China plays in the commodity market considered. If China is predominantly an importer, the most significant price is the CIF one. Conversely, in cases where China has a significant role as a global exporter, the relevant price is the FOB one. Cases where both prices are significant are limited.

A comparison between the European market and the Chinese market

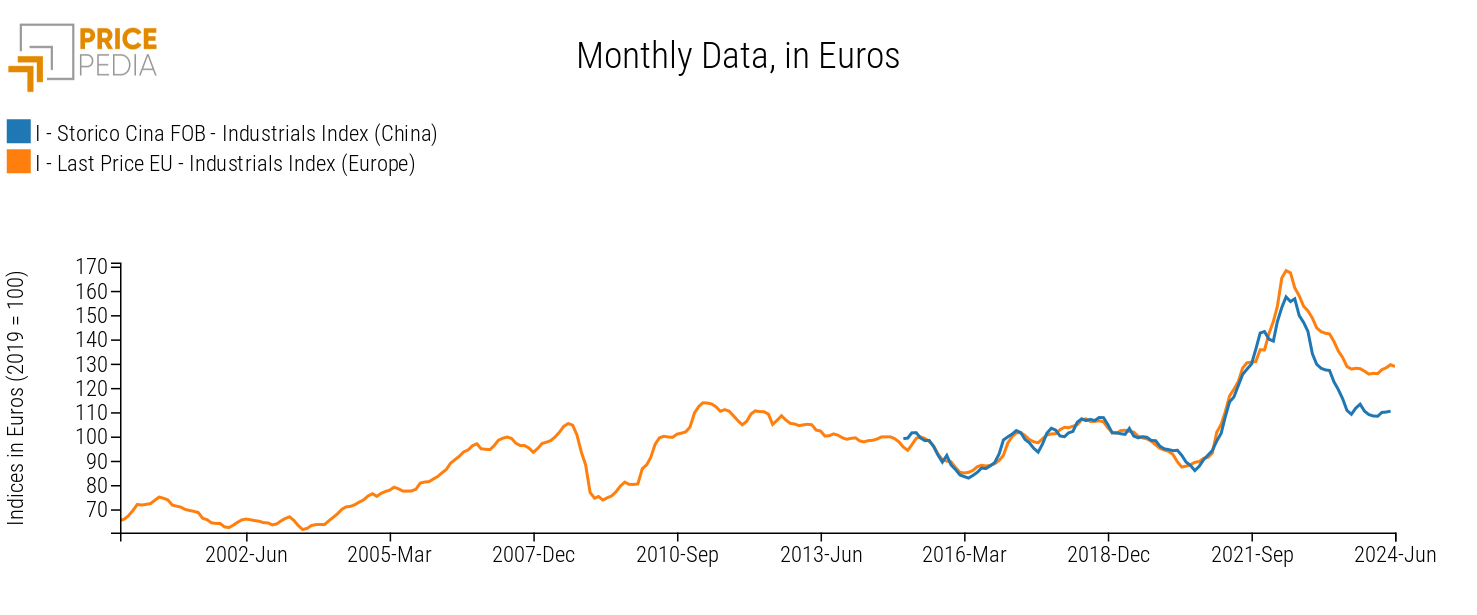

The presence of several sections related to the physical markets of different areas allows for more information on global price dynamics. The following chart compares the aggregate price indices of industrial commodities related to the European market and the Chinese market, expressed in euros with a base of 100 in 2019. For China, the FOB price index is considered, aiming to measure the impact that Chinese supply has had on international commodity markets.

Comparison of Industrial Prices China FOB vs. European Prices (indices in €, 2019 = 100)

The aggregate index of Chinese FOB prices and the corresponding European price index are characterized by a common dynamic, with the former tending to anticipate the trend of prices in the European market.

The comparison also highlights China's role as a price moderator for raw materials in international markets: during the increase phase of 2021-2022, Chinese FOB prices recorded a less strong growth compared to European prices, while in the subsequent phase, more intense decreases occurred for the former compared to the corresponding European quotes.

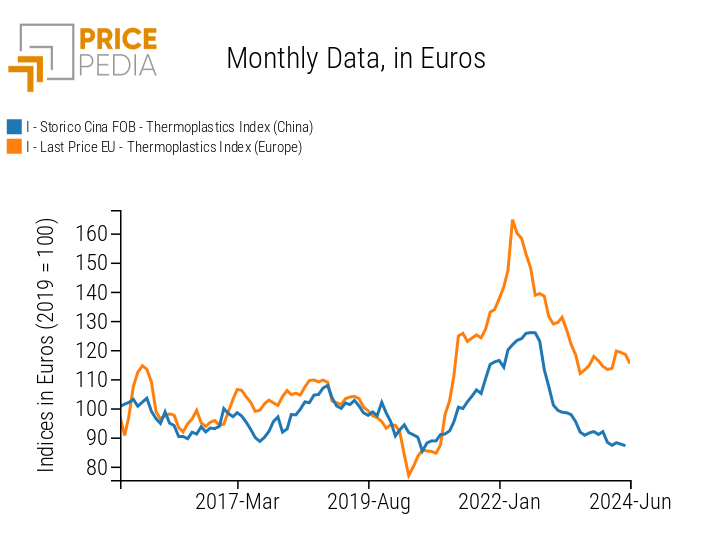

This dynamic is even more evident when considering the prices of Hot Rolled Steel Coils and Thermoplastics.

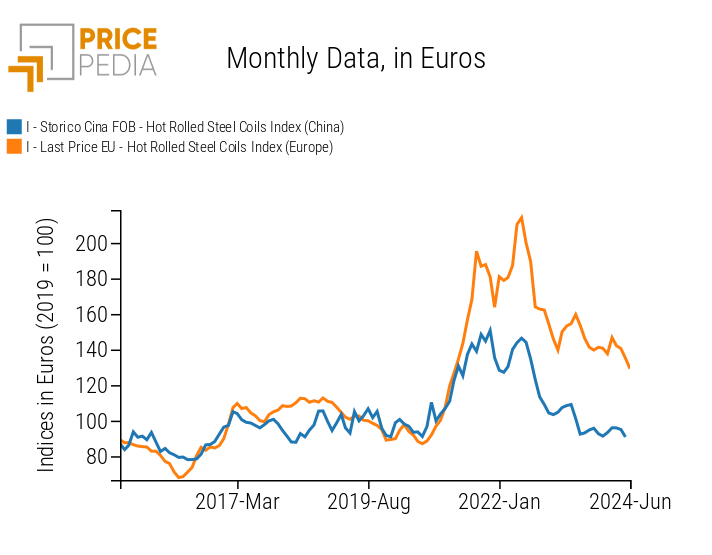

Comparison of China FOB Prices vs. European Prices (indices in €, 2019 = 100)

Hot Rolled Steel Coils

Thermoplastics

In both cases, indeed, the rise phase previously described is even more contained for Chinese FOB prices. Given the high energy costs in Europe, especially in 2022 when several peaks in natural gas and electricity prices were recorded, the Chinese supply in the European market played a role in moderating price increases. Clearly, if this role brought benefits in terms of costs for user companies, it simultaneously led to a reduction in margins for European manufacturing companies. This deterioration pushed, in some cases, European manufacturers to request the intervention of the European Commission to safeguard European industry[3], leading to the initiation of anti-dumping duty procedures against Chinese manufacturers.

China's anticipatory Role

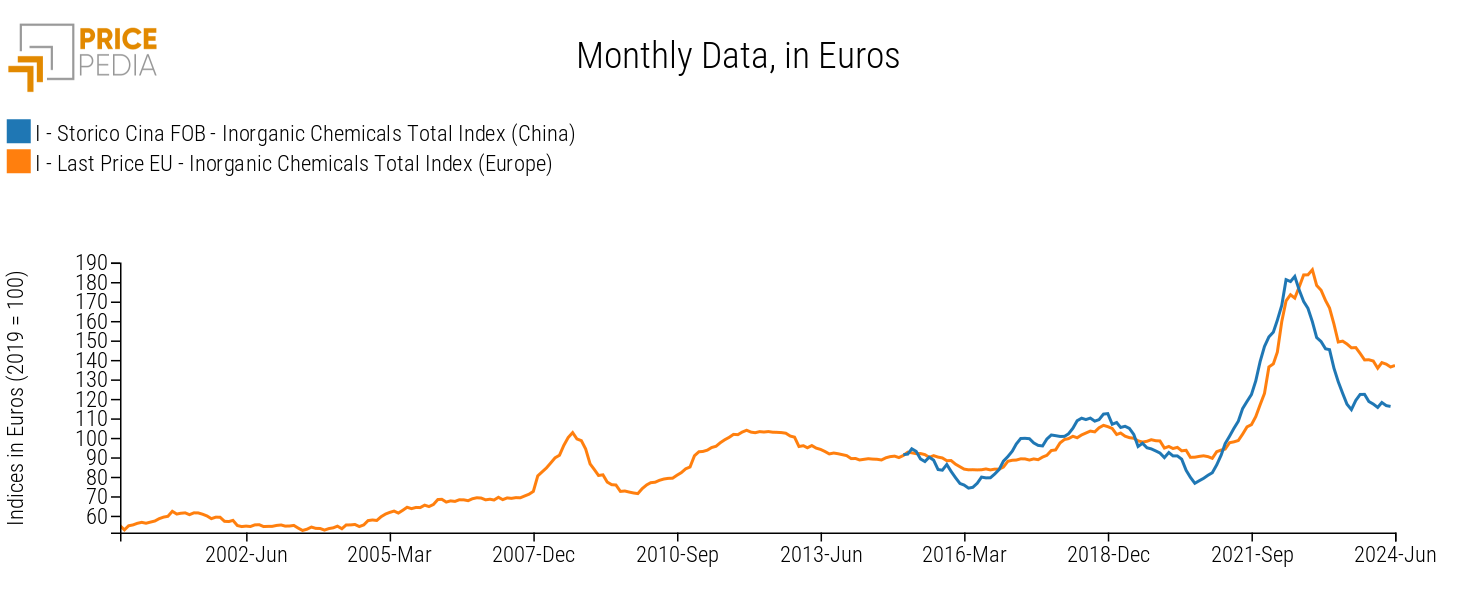

In some cases, China tends to have an anticipatory role in price dynamics. This is particularly evident when comparing the trend of Chinese and European prices of inorganic chemicals. In this case, indeed, Chinese FOB prices tend to anticipate by about one to two quarters the dynamics that occur in European markets.

Comparison of Inorganic Chemicals Prices China FOB vs. European Prices (indices in €, 2019 = 100)

Conclusions

The continuous development of the PricePedia platform aims to increasingly support the purchasing decisions of companies. The introduction of the China Customs section allows for monitoring a market where international commodity prices often tend to form, influencing prices in other markets, including the European one.

1. The section is available in the Price Data area.

2. For more insights on ongoing projects, see "PricePedia's 2024 development projects".

3. Articles: "Price of electrical steel sheets in the spotlight for EU buyers"; "Anti-dumping measures against China: the case of PET". Pasquale Marzano

Economist and data scientist. At PricePedia he deals with the analysis of commodity markets, forecasting models for raw material prices and management of reference databases.