EU: Russia's new dependency is urea

Urea has replaced natural gas as an element of dependence on Russian imports

Published by Giuseppe Pierri. .

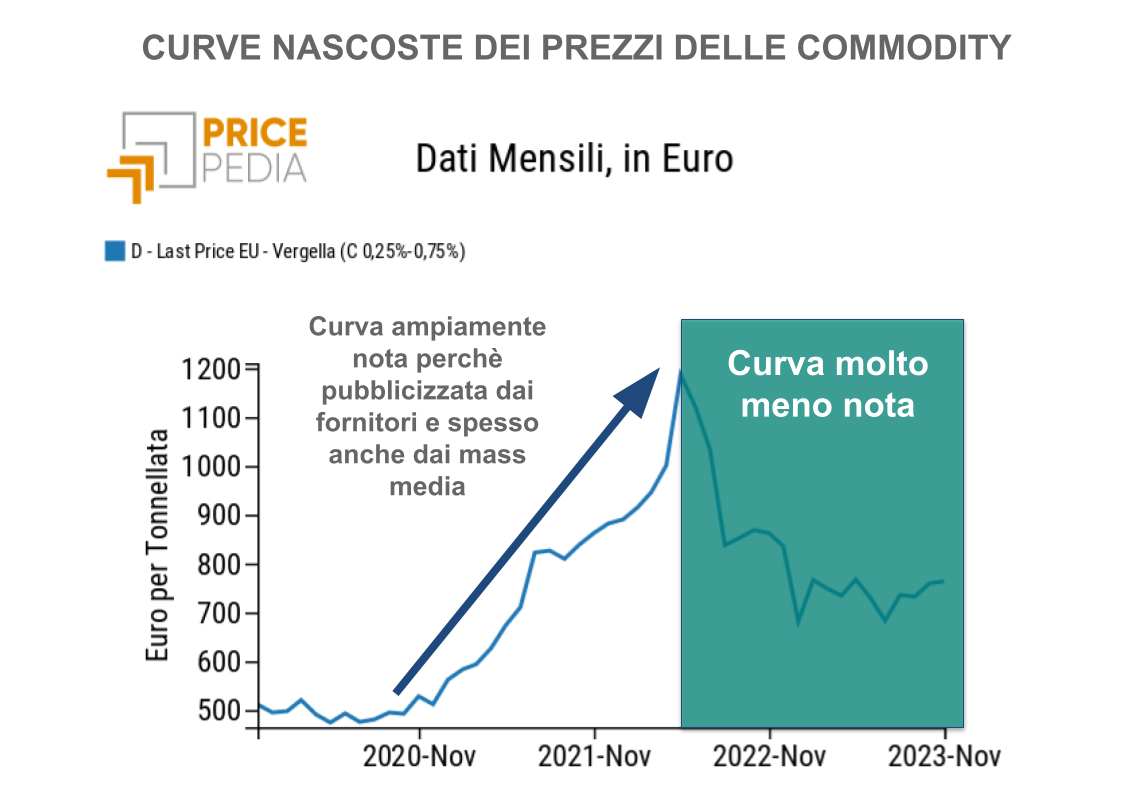

Fertilizers Commodity price cycle 2020-2023The importance of urea

Fertilizers, by ensuring food supplies for populations, are always at the center of interest for all states, particularly importing ones like those of the European Union. These states are vulnerable to price volatility and the trade policies implemented by exporting states.

In this article, we will specifically analyze one of the main fertilizers used in the EU area: urea.

Urea is an organic chemical compound with a high nitrogen concentration (46%), which is essential for plant growth and soil fertility.

This makes urea a strategic asset in ensuring adequate levels of agricultural production.

Price dynamics in the urea market

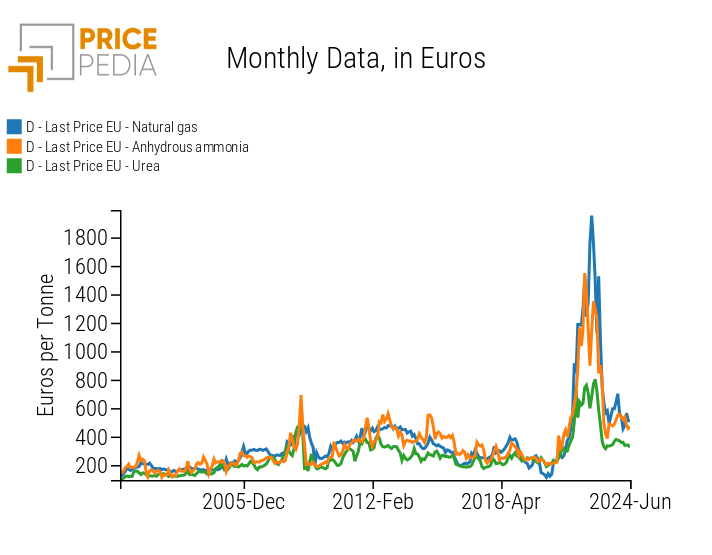

In the production process of urea, ammonia is used as an input, which in turn is produced using natural gas. As highlighted by the graph comparing the prices of these three commodities, they are closely linked to each other.

Comparison of natural gas, ammonia and urea prices

The price of urea has experienced significant increases in recent years.

Market disruptions for this commodity began in the second half of 2021 with the onset of the energy crisis.

The increase in natural gas prices in 2021 led to a rise in the prices of its derivatives, first ammonia and then urea.

This upward trend continued with the start of the Russian-Ukrainian conflict, which exacerbated the situation, until it eased in 2023.

During 2023, prices started a downward trend and then remained relatively stable to this day, though at levels still higher than in 2021, before the onset of the energy crisis.

The price of urea did not follow the same growth as the price of ammonia.[1] This situation occurred because European states, especially following the invasion of Ukraine, acted to replace ammonia supplies from Russia with those from other countries. This created immediate and significant increases in its price.

The same did not happen with urea, as we will see later in the article, resulting in a smaller excess demand in the urea market compared to the ammonia market and consequently a smaller increase in the price of urea.

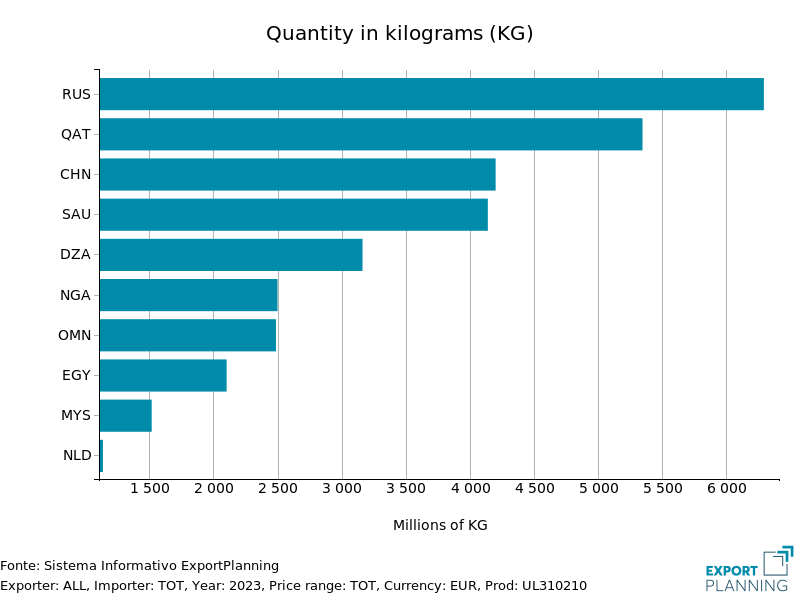

Russia's role in the world urea market

Russia is the world's largest producer and exporter of urea.

Major global exporters of urea

Almost all major exporting countries are significant gas producers, confirming the comparative advantage that gas producers have in producing urea, with the exception of China[2] and Egypt. For these two countries, urea is so strategic that the state has implemented support policies for this industry, resulting in significant increases in production capacity and exports.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

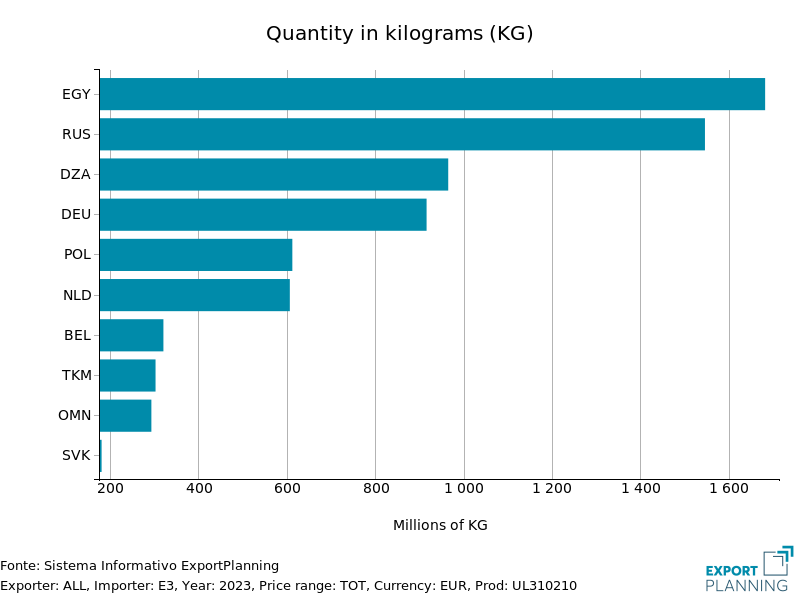

Main urea exporters to the EU and the role of Russia

Russia, along with Egypt, is the main supplier to the EU.

Major exporters of urea to the EU

Egypt is the main exporter of urea to the EU, despite its annual production being much lower than that of Russia. In 2023, Egyptian production was just over 2 million tons, while Russian production exceeded 6.5 million tons.

Before the crisis of recent years, the EU sought to limit imports from Russia, favoring those from Egypt.

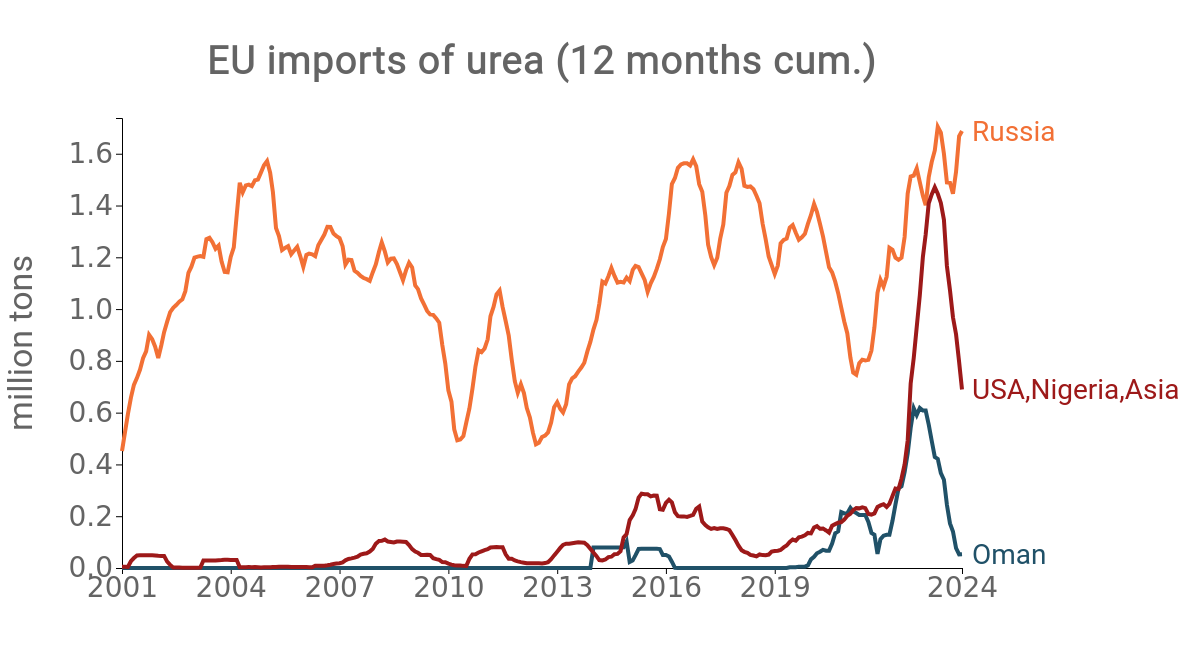

During 2022, EU imports of urea from the USA, Nigeria, Oman, and several Asian countries increased significantly.[1]

EU urea import dynamics

As previously mentioned, the process of replacing Russian ammonia has not been accompanied by an equivalent process of replacing urea.

Although urea supplies from other countries have increased, those from Russia have not followed an opposite trend; instead, they have actually increased during the same period, creating a surge in supply on the EU market.

The main determinant has been the increase in European demand, most likely for precautionary purposes, given the fear that Russia might use urea as a bargaining tool after the invasion of Ukraine.

This rush to stockpile urea has driven the price of this fertilizer to record levels, as demand has significantly exceeded supply.

In light of subsequent dynamics, what could have seemed, and been, a process of replacing Russian urea with that from other countries has followed an opposite path: supplies from Russia have continued and increased, while those from other countries, being more expensive, have decreased.

Dependence on Russian Urea: Reasons and Risks

Reasons

Russia manages to guarantee lower prices compared to other global suppliers because it has a strong cost advantage in urea production for several reasons:

- It holds the necessary raw materials (gas and ammonia) in abundant quantities, making Russia the largest producer and exporter of urea in the world;

- Fewer environmental constraints on producers. Conversely, the production of fertilizers in the EU is subject to stringent environmental protection regulations (European Fertilizer Regulation)

Risks

The EU's dependence on Russian urea, from a country with which the EU is in conflict on multiple fronts, entails a significant risk of a possible reduction or even cessation of imports from Russia.

The experience of 2022 highlighted the existence of many producing countries that could potentially replace imports from Russia. However, a potential substitution process could take time, opening the possibility of a prolonged period of urea scarcity in the EU market and a consequent sharp increase in prices.

Recent Requests from European Producers

In an EU market open to Russian competition, the cost advantage of Russian producers is putting European manufacturers at a disadvantage. As a result, these producers have requested the EU Commission to adopt protectionist measures. However, any potential intervention by the Commission might be limited to avoid harming European farmers, who are the end-users of these fertilizers.

Therefore, a balanced solution is needed to protect both farmers, who face price instability, and European producers, who struggle to compete with the prices set by Russian suppliers.

One possible approach could be to introduce incentives for purchasing fertilizers produced within the EU and, in the long term, to promote greater domestic production, while also aiming to progressively reduce the use of fossil-based fertilizers in favor of biological ones.

Conclusions

Despite Russia being a geopolitical antagonist for the European Union, the EU is heavily dependent on Russian imports of a strategic product like urea. It is likely that, given the ongoing tensions between the EU and Russia, the European Commission will initiate actions aimed at gradually reducing this dependency.

As a result, price increases are anticipated, although efforts will be made to limit this rise to prevent costs for farmers from becoming unsustainable, thereby avoiding excessive harm to this sector and reducing the risk of political and social tensions.

[1] See the article: "The price of urea between scarcity fears and high costs";

[2] For further details on urea in China, refer to the article: "Update of urea prices to June 2024";