Industrial Commodity Prices: A Year of Flat Calm

PricePedia's Monthly Update for July 2024

Published by Pasquale Marzano. .

EU Customs Global Economic TrendsThe PricePedia monthly commodity price update for July 2024 has been published. Over the past year, what stands out in aggregate is a flat trend in prices, especially concerning industrial commodities, amidst continued weak global demand. This is evident in both the European and Chinese markets (see Chinese demand drives down industrial metal prices).

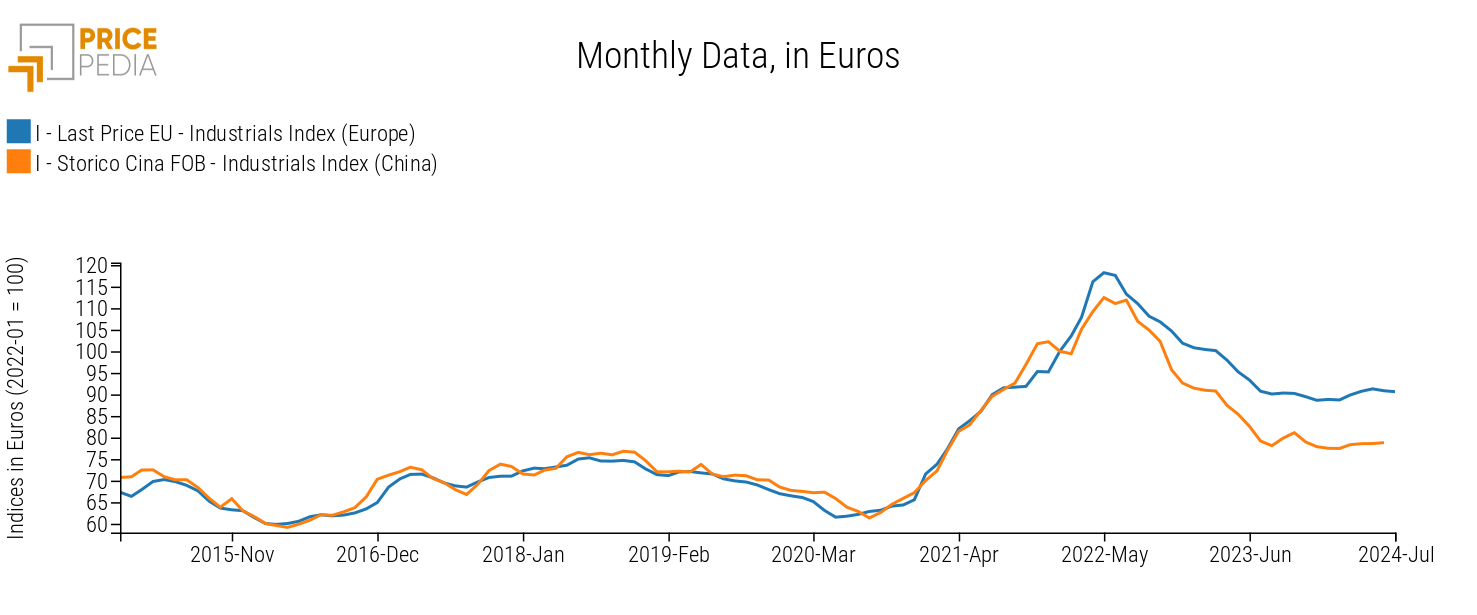

The following graph compares the price indices of Industrials commodities[1] for the two geographical areas.

Both indices remain essentially stable at their respective values from July 2023. Price levels appear relatively higher in Europe compared to China, with the latter's prices exerting a moderating effect on the European market, as indicated in the article PricePedia broadens its database: China Customs prices now available.

The flat calm characterizing the aggregated index of industrial commodities can be further explored by considering the individual commodity families available in PricePedia.

The following graph shows the percentage change for July 2024 compared to July 2023 of the indices, in euros, for each commodity family.

July 2024, cumulative % change in euros compared to July 2023

Source: PricePedia

The dynamics of non-industrial commodity families (Energy, Precious, and Food) appear differentiated compared to the Industrial category (see the article Divergences in commodity prices increase). Observing the commodities related to the latter, it is noted that the number of commodities registering positive variations (Non-Ferrous, Wood and Paper, Organic Chemicals) in the last year is equal to those registering negative variations (Textile Fibers, Inorganic Chemicals, Ferrous, and Specialty Chemicals).

Considering the price dynamics since 2021, it is possible to divide the sample of products analyzed in PricePedia into four clusters:

- Cluster 1: the largest group, comprising prices that experienced strong growth in the period 2021-2022, followed by an almost complete adjustment of prices during the second half of 2023-2024. Currently, prices in this cluster are about 10-20% higher than pre-2020 levels, showing signs of recovery in mid-2024;

- Cluster 2: prices that had a strong increase in the period 2021-2022, but only a partial adjustment. The reasons for the partial adjustment are due to three possible factors:

- links with financial prices that have remained relatively high, such as oil and copper;

- the ability of producers to differentiate prices and maintain some bargaining power that allows them to support prices;

- limited competition between the major industrialized regions (Asia, Europe, and North America) due to low price levels and high transportation costs, as well as the presence of trade barriers;

- Cluster 3: prices that did not increase in the period 2021-2022. These are limited cases;

- Cluster 4: prices that increased in the period 2021-2022 following a long-term growth trend and have not recorded a price level adjustment.

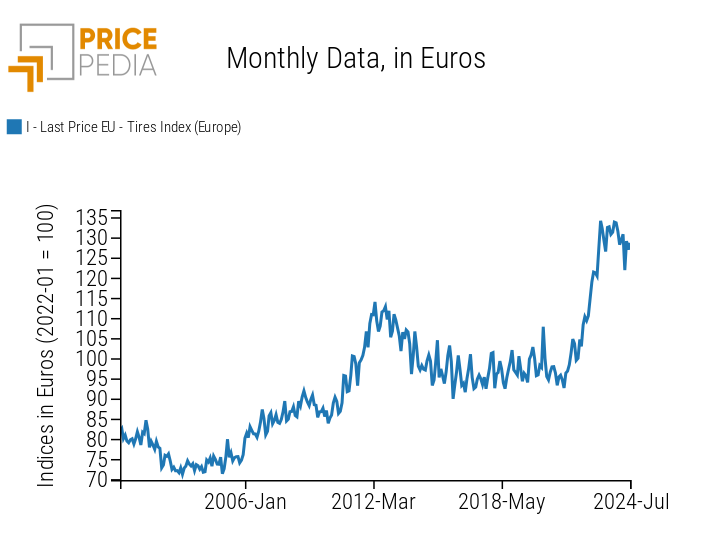

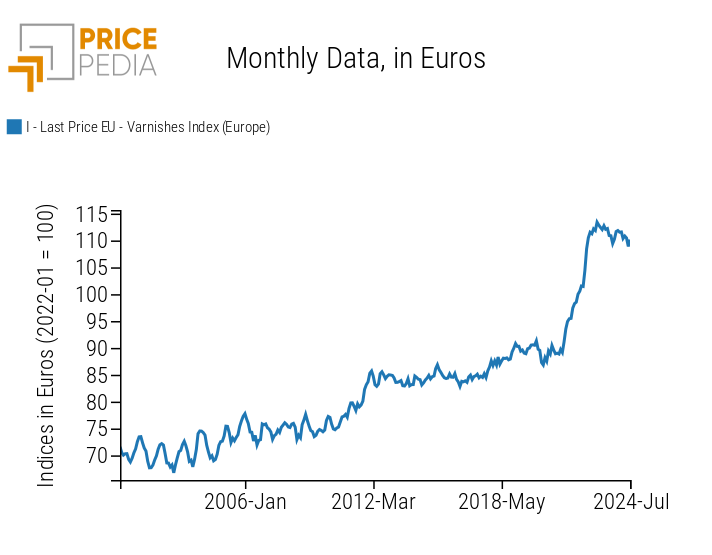

Examples related to cluster 4 are tire and paint prices, shown below.

Tires

Varnishes

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

1. The PricePedia Industrials index is the aggregation of indices related to the following categories: Ferrous Metals, Non-Ferrous Metals, Wood and Paper, Chemicals: Specialty, Organic Chemicals, Inorganic Chemicals, Plastics and Elastomers, and Textile Fibers.

Pasquale Marzano

Economist and data scientist. At PricePedia he deals with the analysis of commodity markets, forecasting models for raw material prices and management of reference databases.