Ship Freight Prices: An Update

Not only a reorganisation of world logistics, but also an upswing in international trade behind the recent growth in ship freight rates

Published by Luigi Bidoia. .

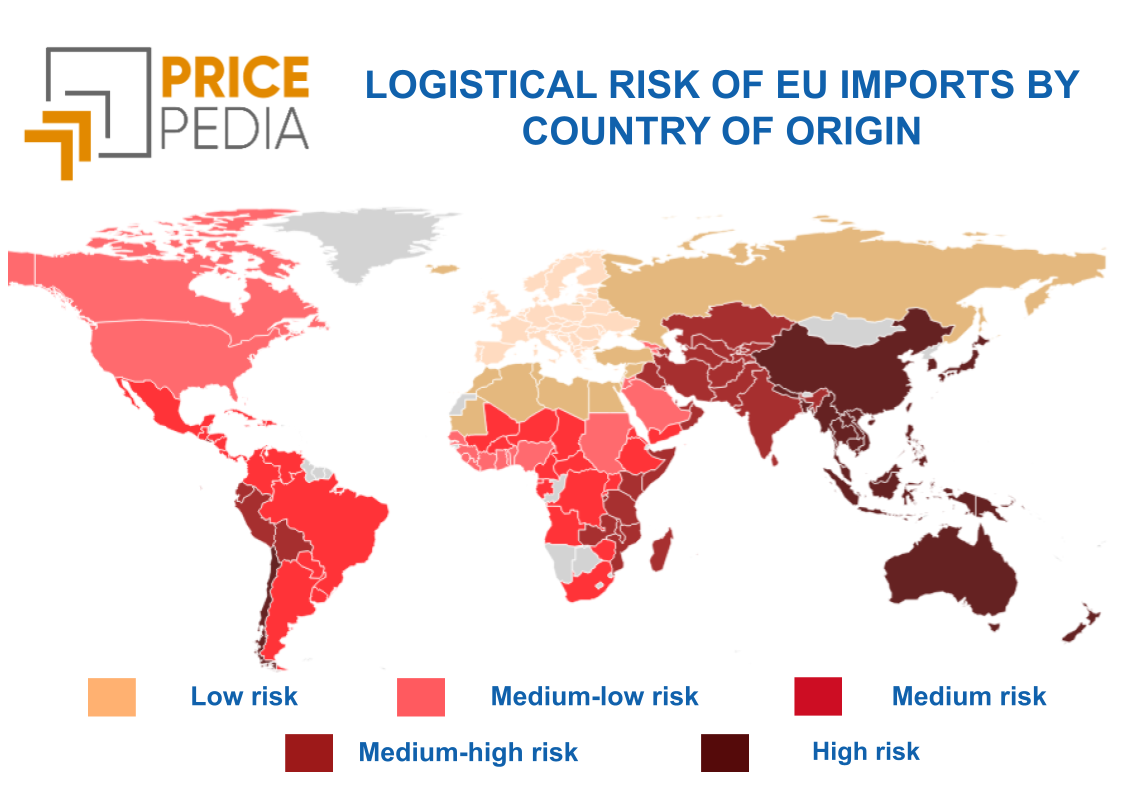

Freight Price DriversAmong the many effects of the ongoing war in the Middle East, the most evident from an economic perspective is the increase in freight rates for container and bulk cargo transportation. Due to potential Houthi attacks on ships, the Red Sea route connecting Asia to Europe has become very risky, forcing container and bulk carriers to circumnavigate Africa. The effects on maritime freight costs have been significant and multifaceted, as shown in the analysis of the charts below.

Freight rates for container ships and bulk carriers

(monthly data, in US dollars)

| Chart 1: container and bulk freights | Chart 2: container freights: Asia-Europe route |

|

|

| Chart 3: container freights: Asia-US route | Chart 4: container freights: Europe-US route |

|

|

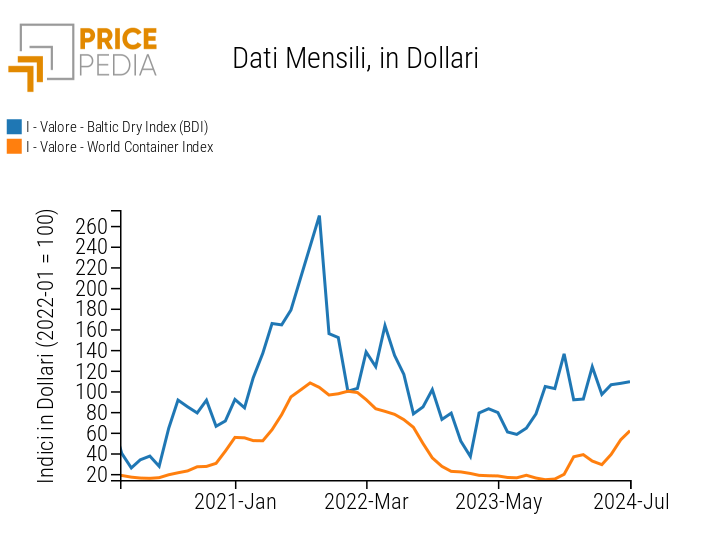

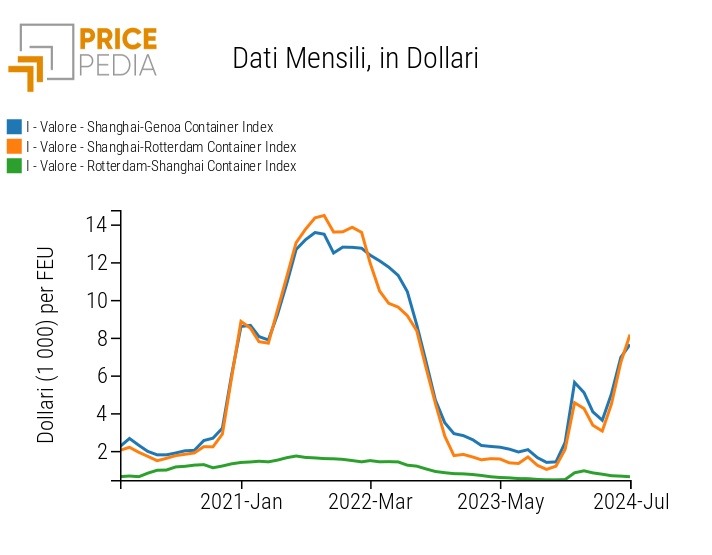

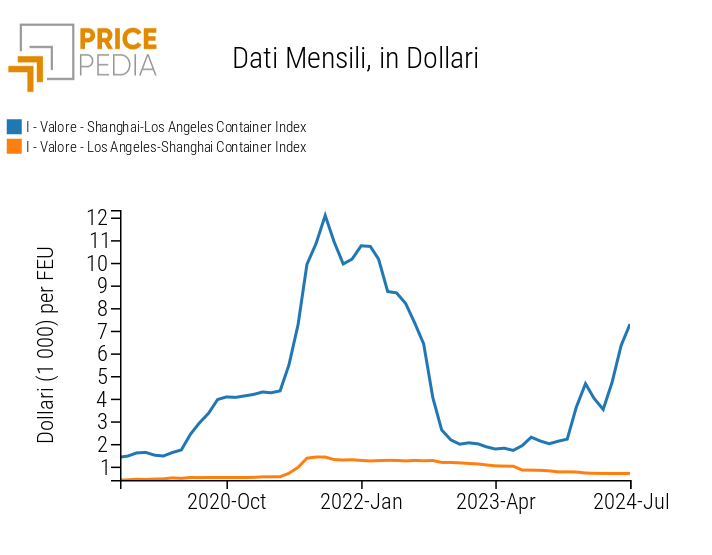

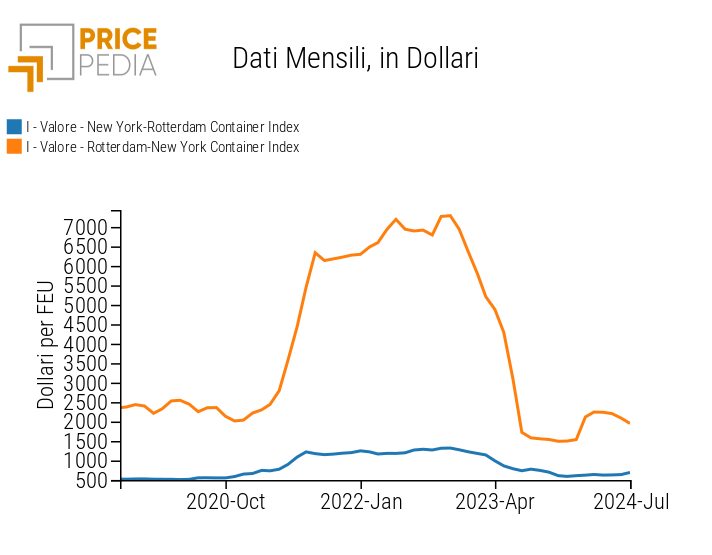

The first chart at the top shows the sharp increase in freight rates for bulk carriers and container ships during 2024. Although the increase is not comparable to that of 2021, it is still very high, on the order of 200%, for both container and bulk carriers. The phase of increasing freight rates for bulk carriers began in the early months of 2023, when difficulties emerged in the Panama Canal, where drought is limiting water availability and transit capacity[1]. The increase in freight rates for container ships occurred simultaneously with the onset of Houthi attacks on ships transiting the Red Sea. Abandoning the Red Sea route in favor of circumnavigating Africa has imposed logistical constraints not only on the Asia-Europe route (Chart 2) but also on the Asia-United States route, as evidenced by the sharp price increases for the Shanghai-Los Angeles route (Chart 3).

The opposite route, from the United States to Asia, did not experience any increase, continuing along its slow decline path that began in 2022. Conversely, the route from Europe to Asia also saw a significant increase due to the need to circumnavigate Africa.

It is interesting to note that freight rates for the Europe-USA route also increased during 2024, indicating that the recent increases are not all due to the necessity of circumnavigating Africa but also reflect a general deterioration in global logistical conditions and an increase in international trade demand.

Effect of International Trade on Freight Rates

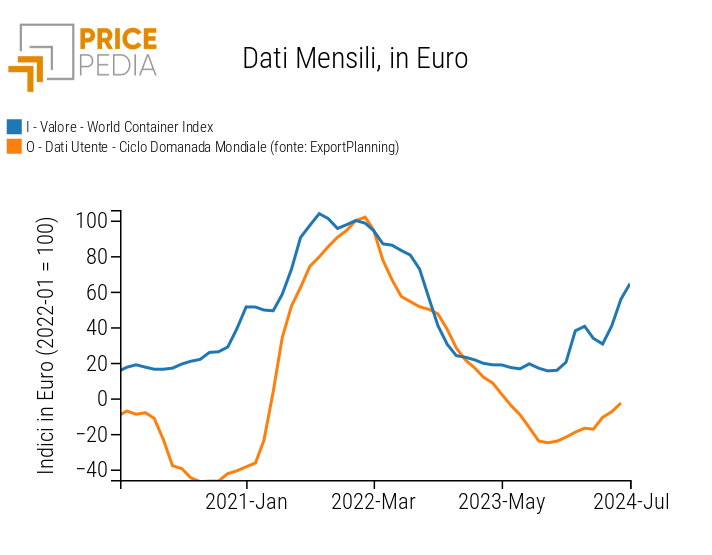

In the article The Cost of Freight as an Indicator of Global Commodity Demand: What Signals?, Pasquale Marzano analyzed the relationship between freight rates and the global cycle of industrial activity levels, highlighting that there are indications of a significant relationship, although this relationship is heavily obscured by the presence of many other determinants.

The simultaneous rise in freight rates with the recovery of trade, illustrated by the following chart, seems to confirm the existence of a direct effect of the global demand cycle on transport freight rates.

International trade cycle and shipping freights

(monthly data, in euros)

This relationship suggests that a non-marginal role in the recent increase in shipping freight rates is due to the ongoing recovery in international trade of goods.

The Most Recent Observations of Container Freight Rates

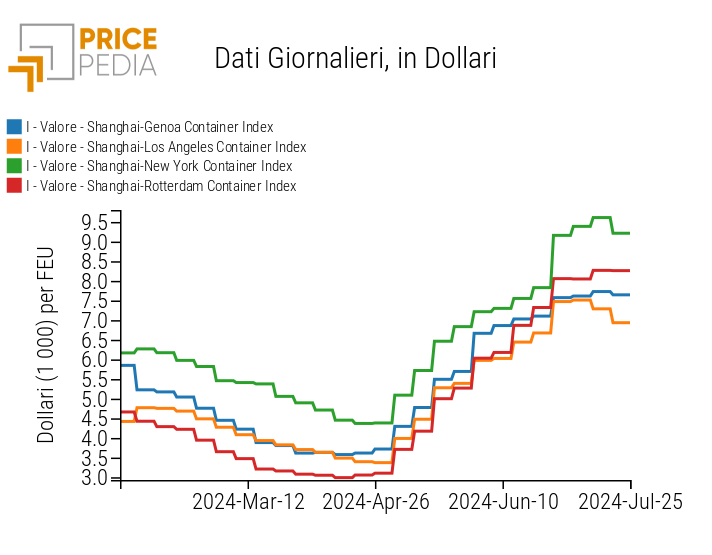

It is worth noting that in the past month, there have been reductions in freight rates on some container routes. The most significant reduction concerns the Shanghai-Los Angeles route; this confirms the hypothesis that the global maritime transport system is beginning to rebalance after the shock caused by the necessity of circumnavigating Africa.

Container freights: conjunctural data

(daily data, in US dollars)

Conclusion

The first part of 2024 has been characterized by a sharp increase in freight rates for both container ships and bulk carriers. The main determinants are the reduction in traffic through the Panama Canal, due to its water crisis, and the circumnavigation of Africa, imposed by Houthi attacks in the Red Sea. These two events have caused a supply-side shock to the global maritime transport service. Added to this is the effect of a growing demand, not intense, but gradually strengthening over the last few months.

In recent weeks, signs of the beginning of a rebalancing phase in the global maritime logistics system have emerged. If this phase continues, a progressive reduction in shipping freight rates could be observed in the coming months, even with a growing demand for maritime transport services.

[1] for more information see the article The BDI index of bulk carriers rates rose by 50 per cent in a single week