Chinese steel prices have never been so low

Despite duty protection, low Chinese prices will also affect the European market

Published by Luigi Bidoia. .

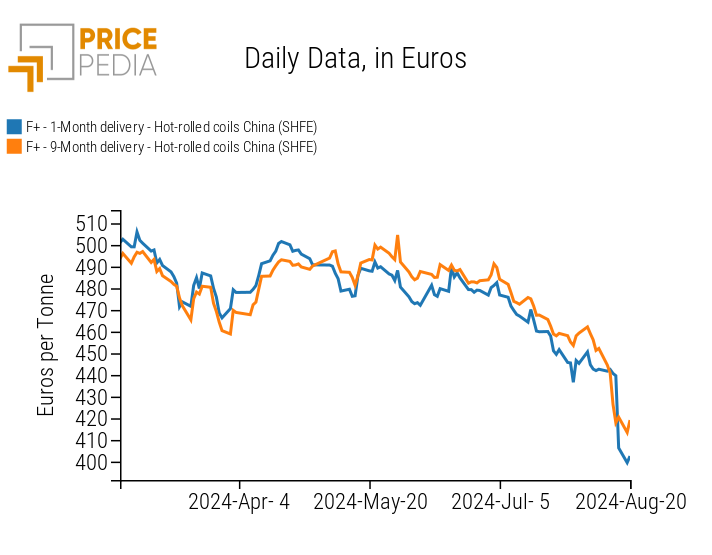

Ferrous Metals Hot-Rolled Coils HRC Import tariffsSince the beginning of June 2024, the prices of hot rolled coils (HRC) quoted on the SFHE (Shanghai Futures Exchange) have been experiencing continuous declines. In recent days, the price of futures for September deliveries has fallen below 450 dollars per ton. Futures prices with a 9-month maturity have also dropped significantly, settling at levels only slightly above 450 dollars, indicating both current and prospective weakness in steel demand in China.

HRC price quoted at SHFE

If we consider prices in real terms (that is, net of inflation[1]), we must go back to the Chinese financial crisis of 2014-2016 to find steel prices this low.

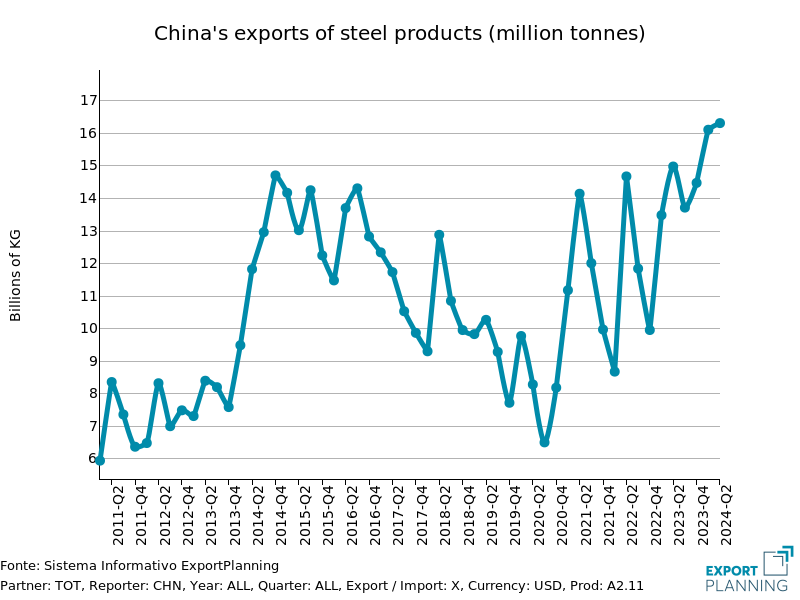

The reasons for the collapse in steel prices in China are well known. While steel production remains at 2023 levels to support the Chinese government's economic growth goals, steel demand has decreased due to the real estate crisis and the collapse in investment in new constructions. The Chinese steel industry is trying to counteract the effects of low domestic demand on activity levels and prices by increasing exports, as shown in the graph below.

In the first two quarters of 2024, Chinese steel exports reached record levels, exceeding 16 million tons per quarter. As occurred during the 2014-2016 crisis, Chinese steel exports tend to grow particularly when the domestic market is weak.

During that crisis, the pressure from increased Chinese steel exports on international markets led to a general reduction in global prices, also affecting steel prices in the European market. Between the beginning of 2015 and early 2016, steel prices in the EU dropped by an average of 20%.

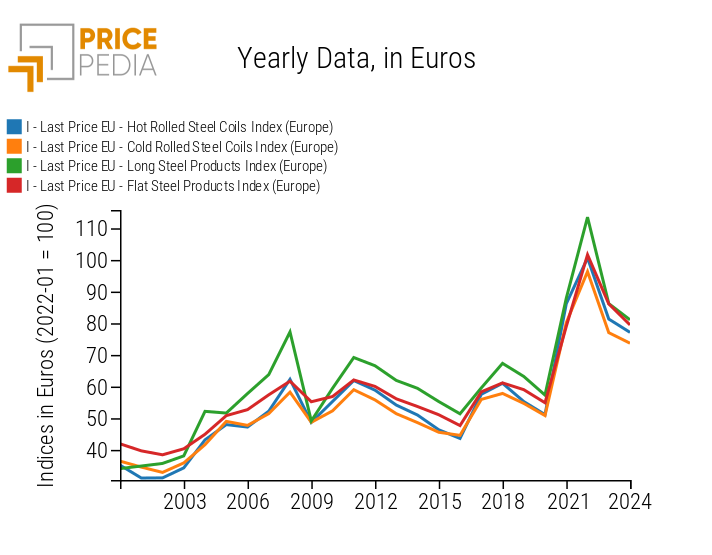

In the most recent cycle, following the collapse recorded in 2023, European steel prices further declined in 2024 by an additional 5-8%, as illustrated in the graph that follows.

Steel Price Indices in Europe

It is likely that further reductions in steel prices will be recorded in the EU market during the autumn, although to a lesser extent than what is happening in the Chinese market. This smaller decline is due to the protective policies implemented by the European Community for the EU steel market. Currently, the European steel market is "shielded" from foreign competition (particularly from China) through three main measures[2]:

- Additional duties introduced in 2019 as a safeguard measure for the European steel industry, in response to the 25% tariffs imposed by the Trump administration the previous year on steel imports to the United States.

- Antidumping duties, applied as a remedy against dumping practices, which affect imports of hot-rolled flat products of alloyed and non-alloyed steel from:

- Turkish companies, up to 7.3% of the value;

- Chinese companies, up to 31.3%;

- Russian, Iranian, and Brazilian companies, up to 96.5 euros per ton.

- Countervailing duties introduced in June 2023 on imports from China, to offset the state subsidies received by Chinese steel companies.

- CBAM (Carbon Border Adjustment Mechanism), which provides for the introduction of environmental duties on products with high greenhouse gas emissions (including steel products). Currently in a transitional phase, it is expected to come into effect no earlier than 2026.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Additional Safeguard Duties on Steel

In response to the adoption by the USA of additional ad valorem duties on imports of steel and aluminum products (at rates of 25% and 10% respectively) under Section 232 of the Trade Expansion Act, the EU introduced safeguard duties on steel imports in January 2019 through the Regulation – Reg. 2019/159. These measures apply to imports of 26 groups of steel products from third countries that exceed periodically established quota levels. The aim is to prevent exporting countries, unable to sell to the United States, from redirecting their goods to the EU market, thereby exacerbating the difficulties of the European steel industry. The measures consist of an additional 25% duty. The quota levels have been updated multiple times, with the latest update covering the period from July 1, 2024 - June 30, 2026. The 26 product groups cover almost the entire range of alloyed and non-alloyed steel goods, including coils, sheets, wire rods, profiles, bars, tubes, wires, and railway materials.

Antidumping Duties

The current antidumping duties, introduced as a remedy against dumping practices, have been implemented through three regulations: in July 2021 for Turkish companies, in June 2023 for Chinese companies, and in December 2023 for Russian, Iranian, and Brazilian companies. All these measures pertain to flat products, including rolled (coils), of alloyed and non-alloyed steel, hot-rolled.

Countervailing Duties for Public Subsidies and Support

For imports from China of flat products, including rolled (coils), of alloyed and non-alloyed steel, hot-rolled, the EU Commission Regulation No. 1123 of June 7, 2023 established a countervailing duty ranging from 4.6% to 35.9%. This duty was introduced to offset various forms of public subsidies and support enjoyed by Chinese steel companies. The EU Commission identified the existence of advantages provided to Chinese steel companies in the form of:

- Subsidized loans from state-owned banks;

- Discounted public land leases;

- Exemptions and reductions in indirect taxes;

- VAT exemptions and customs duty reductions on equipment and technology imports;

- Financial aid from public authorities to support environmental protection goals, emission reductions, R&D, innovation, and technological upgrades.

CBAM Environmental Duties

With Regulation No. 956 of 2023, the European Union introduced the CBAM (Carbon Border Adjustment Mechanism), an environmental duty that also applies to steel products. It represents a true European carbon tax, applied to imports of products with high carbon intensity, aimed at reducing “environmental dumping,” i.e., the production cost differences between the EU and non-EU countries with less stringent environmental regulations on CO2 emissions.

After a transitional period that began on October 1, 2023, and is set to end on December 31, 2025, during which importers must document the CO2 emissions associated with the production of imported goods, starting from January 1, 2026, the payment of CO2 certificates corresponding to the imports will also be required.

Conclusions

The prices of Chinese steel products have been declining for months. Specifically, the prices of hot rolled coils (HRC) quoted on the SHFE (Shanghai Futures Exchange) have recently fallen below $450/ton, equivalent to just over €400/ton. The European steel market is relatively protected from Chinese market dynamics thanks to three different types of duties: additional duties introduced in 2019, and antidumping and countervailing duties introduced in 2023. Starting in 2026, environmental duties under the CBAM will also be added.

The HRC products are particularly protected, with their prices in the European market in July 2024 standing at €625/ton (financial prices) and €650/ton (customs prices), respectively. However, the degree of protection for the European HRC market is only partial. This suggests that a further reduction in their prices in the coming months is likely.

[1] The comparison of commodity prices over time is more accurate when conducted in real terms, that is, by adjusting prices for inflation across different periods. Inflation erodes the purchasing power of money over time, potentially making a direct comparison of nominal prices (not adjusted for inflation) misleading. Real prices, on the other hand, reflect the constant value of money, allowing for an accurate comparison of the deflated price of a commodity across different periods. In PricePedia, it is possible to calculate a deflated price series using the "Transform Series" tool in the Price Data section.

[2] In the Tariffs section of PricePedia, you can access detailed sheets for each product, describing all types of duties applied to EU imports of that product.