Friendshoring and market risk of purchasing materials

Commodity market risks also reflect the degree of integration of world areas

Published by Luigi Bidoia. .

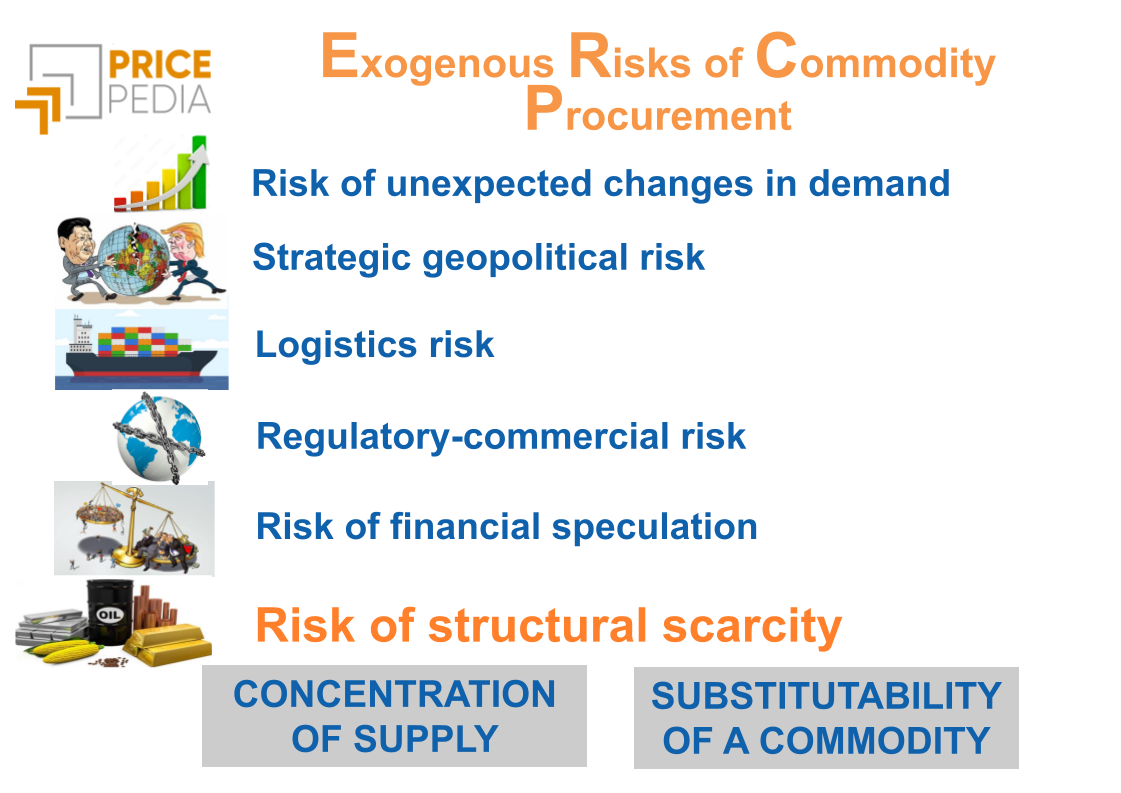

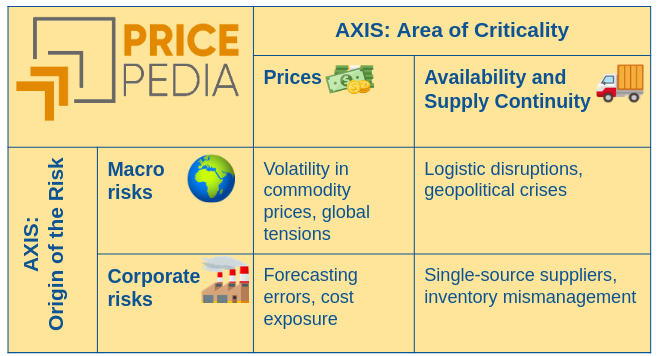

Management Procurement Procurement Risk ManagementIn the article Commodity market risk, an analysis of the factors contributing to determining the market risk of a commodity was developed. These factors have been grouped into six points, among which one of the most significant is undoubtedly the possible process of dividing global trade into friendly regions, the central theme of this article.

From the American Peace to the Division of the World into Friendly Regions

At the end of World War II, the United States emerged as the dominant superpower, establishing a global order based on the values of liberal democracy, capitalism, open markets, and the growing role of international institutions such as the United Nations, the International Monetary Fund, the World Bank, and later, the World Trade Organization (WTO). The fall of the Berlin Wall in 1989 and the disintegration of the Soviet Union seemed to have definitively consolidated this global structure. This was followed by strong global economic growth as various countries adhered to this order and opened up to international trade and capital flows. China's entry into the WTO in December 2001 can be considered the peak of success for this model.

Contrary to the expectations and hopes of many, during this century the global model based on Western economy and values has progressively weakened. This has led Niall Ferguson, from a neoliberal perspective, to speak of "the West and the Rest," and Janet Yellen, U.S. Secretary of the Treasury in the Biden administration, to advocate for the need of global value chains based on "friendshoring."

The main events that have marked this shift in the global order are:

- The 2008 financial crisis, which originated in the United States and spread to closely integrated economies, undermining confidence in the Western economic model;

- The trade war initiated by Trump in 2018 to counter China’s growing economic influence;

- The increase in EU tariffs in 2019 on steel and aluminum imports from China;

- China's strong economic growth and its significant trade surplus, especially with the United States, which have reinforced the perception of China as an economically successful nation;

- The sudden withdrawal of NATO troops from Afghanistan in 2021, led by the United States;

- Russia's invasion of Ukraine and the subsequent division of the world between countries supporting Ukraine and those neutral or aligned with Russia;

- The U.S. Inflation Reduction Act (IRA) of 2022, which introduces significant incentives for domestic production, penalizing imports of technology from countries considered hostile;

- The U.S. CHIPS and Science Act and the EU Chips Act of 2022 and 2023, aimed at revitalizing their respective semiconductor industries;

- China's responses to the protectionist measures introduced by the U.S. and the EU between 2022 and 2023;

- The initiation of an EU procedure to introduce countervailing duties on electric vehicle imports from China and the resulting Chinese reactions.

Numerous events have contributed to altering the process of globalization in the world economy, and their effects are becoming increasingly evident. In particular, a recent study by three economists from the International Monetary Fund highlights how foreign investments in strategic sectors of the most developed countries are increasingly directed toward politically aligned nations.

So far, this process has not yet led to significant changes in the structure of international trade[1]. At this time, it is therefore difficult to predict the evolution of the ongoing changes.

However, from a purely exploratory perspective, it may be useful to begin analyzing which commodity markets could be most affected by a possible division of the world into two distinct blocs, characterized by stronger internal integration and weaker external integration between the blocs.

The effects on commodity markets of a divided world

The first necessary hypothesis for measuring the possible effects of a world divided into blocs is to imagine which countries might belong to each bloc. To this end, we considered two distinct criteria, which we believe are plausible, although not inevitable.

The first criterion is based on the various votes that have taken place in the UN regarding resolutions on Ukraine. These votes have revealed a clear split between countries, with one group consistently voting in favor of the resolutions and another group voting against or abstaining[2].

The second criterion refers to the "Economic Freedom" index published by The Heritage Foundation, which measures the degree to which various countries adhere to American conservative values based on free markets, limited government, and individual liberty. In this case, the underlying assumption is that countries with an index score of 60 or higher (on a scale of 0 to 100) share these values and consider themselves politically aligned.

Using these two criteria, we divided the world's countries into two groups, which we simply refer to as West and Other. As expected, the two criteria lead to largely overlapping results. Out of 151 countries analyzed, 63 belong to the West group according to both criteria, while 60 are classified as Other. Only 28 countries have a different classification depending on the criterion used.

We then calculated, for each commodity analyzed in PricePedia, the normalized trade balance[3] of the West group. In the scenario of a world divided into two blocs where trade is facilitated within the blocs but more difficult between different blocs, the commodities that could experience the most significant market tensions in the West area are those with a negative and high absolute trade balance. For these commodities, a divided world could indeed result in a significant supply shortage.

An initial analysis of the results highlights the following commodities with significantly negative trade balances in the Western area:

- Natural graphite

- Lithium oxide

- Vanadium oxides and hydroxides

- Crude manganese

- Sebacic acid

- Stearic acid

- Diammonium phosphate (DAP)

- Pig iron in ingots

- Fluorocarbons

In all of these commodities, with the exception of stearic acid and pig iron in ingots, China holds a leading position globally.

This brief analysis suggests an initial consideration, which may seem obvious but is supported by actual trade data: the effects on various commodity markets of a potential division of the world into groups of countries with stronger intra-group integration compared to inter-group integration will vary significantly depending on which bloc China belongs to.

Conclusion

There is no doubt that, in recent years, the global economic model centered on the American economy and the globalization of trade has been increasingly challenged by numerous events. Predicting the future trajectory is difficult. Experts are sharply divided between those who see these years as a temporary interruption in the development of multilateral global relations and those who believe that a division of the world into blocs with significantly stronger economic and political integration within each bloc than between different blocs is more likely.

It is evident, however, that these possible shifts in the global economy will have significant implications for commodity markets, purchasing prices, and the availability of various materials used in industrial processes. Procurement departments must therefore prepare to manage a global scenario that will likely be characterized by long-term uncertainty and complexity. Monitoring the evolution of the global economy into two or more blocs will be crucial for assessing the market risk associated with procurement materials.

[1] For an in-depth analysis of international trade dynamics and the signs of increasing regionalization, see Regionalization of world trade: current trends.

[2] In cases where a country did not consistently vote in the same direction, we considered the most recent votes.

[3] The normalized trade balance of a country or an area comprising multiple countries is calculated as (Exports - Imports) / (Exports + Imports). The balance is negative or positive depending on whether the country's or area's exports are lower or higher than its imports, and its absolute value increases proportionally with the balance relative to the total value of its foreign trade.