Monthly commodity prices update for August 2024

The prolonged weakness of the global economy weighs on commodity prices

Published by Pasquale Marzano. .

EU Customs Global Economic Trends

The PricePedia monthly commodity prices update for August 2024 has been released. Industrial commodities continue to move sideways, following the trend that began over 12 months ago.

On the other hand, energy commodity prices are generally following a downward trend, heavily influenced by the performance of oil prices. Brent crude oil prices in dollars, for example, recorded a month-on-month decrease of -6% in August, corresponding to the prolonged weakness of the global economy, particularly in China, the main importer of oil and consumer of raw materials, which is not growing as expected by analysts.

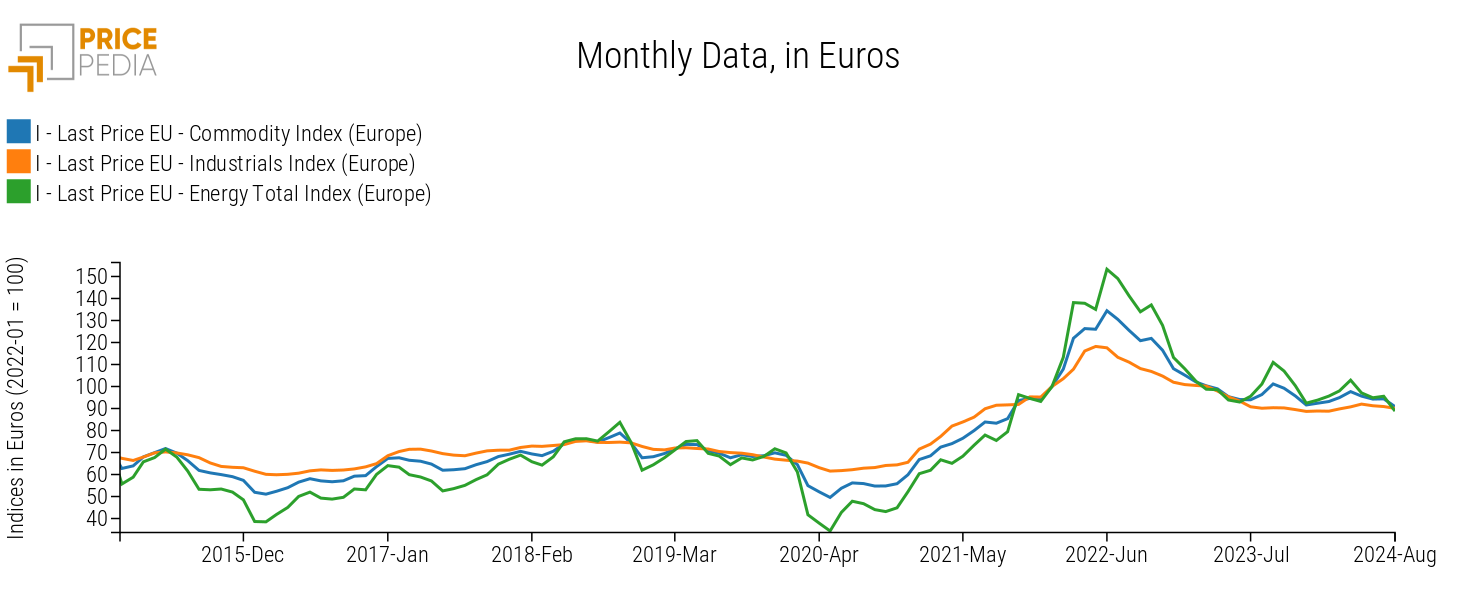

The chart below shows the price evolution of raw materials in Europe for the main PricePedia aggregates: Total Commodities[1], Industrials[2], and Total Energy, with January 2022 levels set to 100.

Over the past twelve months, the prices of Energy have experienced a generally downward trend, interrupted by often significant monthly increases, such as the +9.8% increase in September 2023, following OPEC+'s decision to reduce supply for the following year, or those related to the Red Sea crisis. However, these increases did not lead to sustained price support, as subsequent decreases of almost equal magnitude occurred. Currently, average monthly prices are about -7% lower than those recorded in July 2023.

As for the Industrial index, the growth that occurred at the beginning of the year did not continue during the summer months of 2024, and the current levels are practically identical to those of the previous year (-0.1% annual variation in August 2024).

Commodity Prices by Category

At this stage, the relative stability of commodity prices is illustrated by the monthly variations recorded in August 2024 compared to the previous month, of the euro prices of individual categories available in PricePedia.

Graph 2: August 2024, variations (%) in euro with respect to July 2024

Source: PricePedia

With the exception of Energy, which saw a decrease of -7% compared to last July, all categories showed particularly limited variations.

In fact, only three categories experienced a decrease greater than -1%: Non-Ferrous Metals (-1.9%), Organic Chemicals (-1.6%), and Inorganic Chemicals (-1.1%). For all other categories, the intensity of the variations remained, in absolute value, within 1%.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Medium-Term Trend

Considering the medium-term trend, the price variations recorded by the different categories appear more pronounced.

The following chart shows the year-on-year variations in euros recorded in August 2024 compared to the same month of the previous year.

Graph 3: August 2024, variations (%) in euro with respect to August 2023

Source: PricePedia

The year-on-year increases recorded by the different indices remain within +5%. Exceptions are Precious Metals, which have grown by more than +20% since August 2023, given their function as safe-haven assets. This can be considered representative of the level of uncertainty that has weighed on economic growth for several months.

As for commodities that have recorded declines compared to last year, Inorganic Chemicals stand out. The latter reached a peak in late 2022, unlike other categories, and in August 2024, they saw a reduction of -8% compared to the same month of the previous year.

1. The PricePedia Total Commodity index is the aggregation of Industrials, Food and Energy indices.

2. The PricePedia Industrials index is the aggregation of indices related to the following categories: Ferrous Metals, Non-Ferrous Metals, Wood and Paper, Chemicals: Specialty, Organic Chemicals, Inorganic Chemicals, Plastics and Elastomers, and Textile Fibers.

Pasquale Marzano

Economist and data scientist. At PricePedia he deals with the analysis of commodity markets, forecasting models for raw material prices and management of reference databases.