Paper recycling: an ever-evolving industry

World trade in recycled paper pulp increases compared to relative stability of recycled paper

Published by Luca Sazzini. .

Wood and Paper Price DriversThe paper industry is a historical sector, but in recent years it has undergone several innovations in response to increased environmental pressures and growing awareness of sustainability.

This industry is indeed crucial for the ecological transition because, in addition to aiming for increased energy efficiency, as it is one of the most energy-intensive sectors,[1] it has the mission to increasingly reduce the use of virgin fibers by improving the quality and spread of recycled paper.

Currently, the recycling supply chain of paper consists essentially of three types of actors: collection companies, recycling plants, and paper mills.

The collection companies are responsible for collecting used paper from various sources such as households, offices, schools, and businesses. In addition to collecting paper, they handle the transfer to sorting centers and the selection and separation of paper from other materials.

After the selection and separation phases from other materials, the paper is first divided based on quality and then transferred to recycling plants.

The recycling plants transform used paper into new materials used by paper mills to produce new paper products. They handle the shredding of paper, de-inking, and the production of paper pulp.

The paper mills use recycled paper pulp or virgin fiber pulp to produce paper. Since the latter find it advantageous to vertically integrate, more and more paper mills are starting to buy used paper directly from collection companies and to carry out recycling and paper pulp production activities internally.

However, at the same time, the growth in global demand for recycled paper pulp has led to the emergence of new companies specializing solely in paper recycling activities.

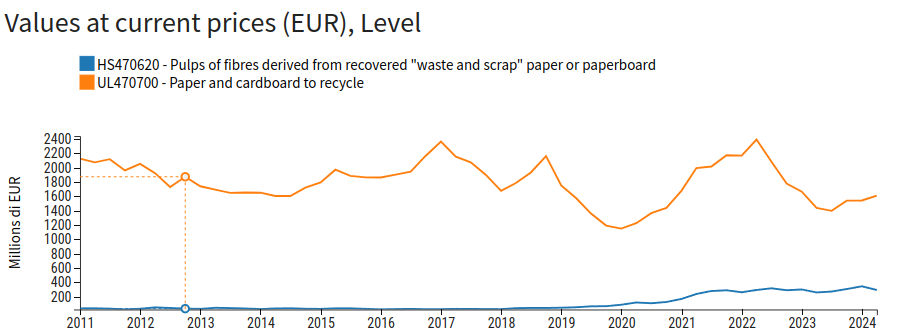

As shown in the chart below, in recent years, the total global exports of recycled paper and cardboard (the raw material for recycling plants) have decreased, while the total exports of recycled paper pulp (the output of recycling plants) have increased.

Global Exports of Recycled Paper and Recycled Paper Pulp

The increased interest in recycled paper pulp has limited the rise in paper pulp prices and, through this channel, has also mitigated the increase in final paper prices.

Indeed, if one analyzes paper prices over the past two decades, it can be observed that they have risen much less than recycled paper pulp prices.

Analysis of Paper Prices

Paper Pulp

The following table shows the descriptive statistics of paper pulp prices recorded at the customs of the 27 European countries.

Descriptive Statistics of European Customs Paper Pulp Prices

| Actual Period | Average | Minimum | Maximum | Standard Deviation | Period Variation | |

|---|---|---|---|---|---|---|

| D - Last Price EU - Softwood Chemical Pulp | 2005 - 2024 | 495 | 364 (2009) | 606 (2022) | 62.5 | +50.68% |

| D - Last Price EU - Bleached Chemical Pulp | 2005 - 2024 | 518 | 349 (2009) | 773 (2022) | 93.3 | +54.41% |

| D - Last Price EU - Bleached Softwood Chemical Pulp | 2005 - 2024 | 564 | 413 (2009) | 778 (2022) | 86.0 | +54.80% |

| D - Last Price EU - Dissolving Pulp | 2005 - 2024 | 784 | 600 (2020) | 1126 (2011) | 131 | +37.70% |

| D - Last Price EU - Chemithermomechanical Pulp | 2005 - 2024 | 425 | 330 (2009) | 563 (2022) | 54.1 | +38.80% |

The table analysis shows that in the last 20 years, paper pulp prices have increased by about 40% to 50%. The most intense variation was recorded in the price of bleached softwood chemical pulp, which grew by 55%, while the least intense was for dissolving pulp, which increased by only 38%.

Considering that consumer price inflation over the corresponding period was 50%, it turns out that, on average, paper pulp prices have recorded decreases in real terms.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Packaging Paper and Graphic Paper

The following table shows the descriptive statistics of European customs prices for packaging paper and graphic paper.

Descriptive Statistics of European Customs Prices for Packaging Paper and Graphic Paper

| Effective Period | Average | Minimum | Maximum | Standard Deviation | Period Variation | |

|---|---|---|---|---|---|---|

| D - Last Price EU - Kraftliner (weight < 150 g/m²) | 2005 - 2024 | 533 | 372 (2009) | 830 (2022) | 96.8 | +39.27% |

| D - Last Price EU - Kraftliner (weight ≥ 150 g/m² and ≤ 175 g/m²) | 2005 - 2024 | 526 | 363 (2009) | 808 (2022) | 96.5 | +45.12% |

| D - Last Price EU - Kraftliner (weight ≥ 175 g/m²) | 2005 - 2024 | 529 | 370 (2009) | 823 (2022) | 96.5 | +42.76% |

| D - Last Price EU - Testliner | 2005 - 2024 | 417 | 273 (2009) | 681 (2022) | 83.2 | +39.39% |

| D - Last Price EU - Corrugated paper and board | 2005 - 2024 | 746 | 562 (2009) | 1081 (2022) | 112 | +45.09% |

| D - Last Price EU - Graphic paper (weight 75-80g/m²) in roll | 2005 - 2024 | 719 | 585 (2009) | 1095 (2022) | 134 | +37.52% |

| D - Last Price EU - Graphic paper (weight 80-150g/m²) in roll | 2005 - 2024 | 772 | 670 (2006) | 1180 (2022) | 145 | +49.57% |

In the last 20 years, prices of packaging paper and graphic paper have increased by about 40%, 10 percentage points less than the growth of the consumer price index in the Euro area (+50%).

Since recycled pulp is cheaper than virgin fiber pulp, paper mills tend to favor the use of the former, also for its positive image returns. In fact, the use of recycled pulp has been limited by its availability.

As availability increased, thanks to the development of the recycling industry, the demand for virgin fiber pulp decreased, leading to a containment of its prices.

Recycled Paper and Recycled Pulp

The table below shows the descriptive statistics of recycled paper prices in the European market.

Descriptive Statistics of European Customs Prices for Recycled Paper and Recycled Pulp

| Effective Period | Average | Minimum | Maximum | Standard Deviation | Period Variation | |

|---|---|---|---|---|---|---|

| D - Last Price EU - Recycled Kraft paper | 2005 - 2024 | 121 | 78.1 (2005) | 181 (2021) | 29.3 | +76.43% |

| D - Last Price EU - Recycled printed paper | 2005 - 2024 | 141 | 86.4 (2005) | 232 (2022) | 34.8 | +94.50% |

| D - Last Price EU - Recycled pulp | 2005 - 2024 | 472 | 310 (2005) | 690 (2023) | 91.4 | +97.18% |

The development of the paper recycling sector and the growing demand has driven up the prices of recycled paper, which in the last 20 years have seen much larger increases compared to those of virgin fiber pulp and packaging and graphic paper.

The price of recycled Kraft paper has increased by over 75%, while that of recycled printed paper has grown by 95%. These changes, although significant, are still lower than that recorded for recycled pulp, which has nearly doubled its price levels with a variation rate of 97%.

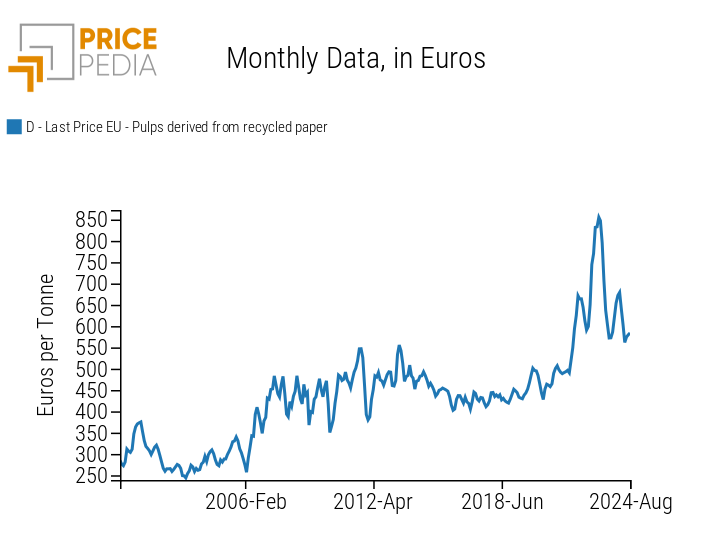

The following graph shows the historical series of customs prices for recycled pulp.

European Customs Prices for Recycled Pulp

The graph shows how the current price levels of recycled pulp (600 euros/ton) have doubled compared to those in 2005 (300 euros/ton).

Except for 2023, when there was a price reduction caused by a drop in paper demand, the last 20 years have seen a clear upward trend in recycled pulp prices.

The increased interest in the recycled paper market has caused these prices to grow at about double the rate of the price increase recorded for pulp prices reported in the first table above.

Conclusions

In recent years, the paper recycling sector has undergone significant changes due to the increasing interest in recycled paper and especially recycled pulp.

The growth in demand for recycled pulp has allowed a shift from virgin fiber pulp to recycled pulp. This has impacted various price levels of paper and the growing spread of companies specializing in paper recycling.

In the last two decades, the doubling of recycled pulp prices has mitigated the growth of pulp prices, which have undergone changes lower than those of consumer price inflation (50%).

Packaging and graphic paper prices have also recorded, in the last 20 years, a growth even lower by 10 percentage points than that of the consumer price index.

Conversely, waste paper has benefited more from the spread of the recycling market, registering price increases of between 80-90%.

[1] See the italian article: “Rising energy prices accentuate competition in the paper industry”