Pig iron: the market risk due to the political risk of exporting countries

The current balance in international markets is also closely linked to free trade rules

Published by Luigi Bidoia. .

Ferrous Metals Procurement Risk ManagementThe crisis affecting multilateralism based on liberal values and openness to international trade suggests considering the potential effects that the emergence of barriers in global trade might have on commodity markets.

Indeed, if in the current situation, characterized by relative ease in international trade, the global commodity market is in equilibrium, this equilibrium could be completely compromised by changes in trade conditions between different countries. In recent years, we have seen several examples of factors that can alter trade conditions between countries. Among these, it is useful to mention:

- Changes in customs duties on products imported from specific countries and the responses adopted by the affected countries. A notable example concerns the trade of steel and aluminum products between the United States, China, and the EU during 2018-2019, with recent extensions to Canada;

- Sanctions imposed by many Western countries on imports from Russia, affecting a wide range of products following the invasion of Ukraine in February 2022;

- Export restrictions gradually introduced by China on materials considered strategic, such as graphite, gallium, germanium, and more recently, antimony.

These changes in trade conditions could lead to regional markets with precarious and opposing equilibria: some with excess demand and high prices, others with excess supply and low prices. A significant example of this situation is the price of hot-rolled steel coils (HRC), characterized by particularly high prices in the United States and much lower prices in China, with Europe in an intermediate position.

The first piece of information necessary to analyze the market risk of a commodity is the map of the main exporting and importing countries.

The case of pig iron

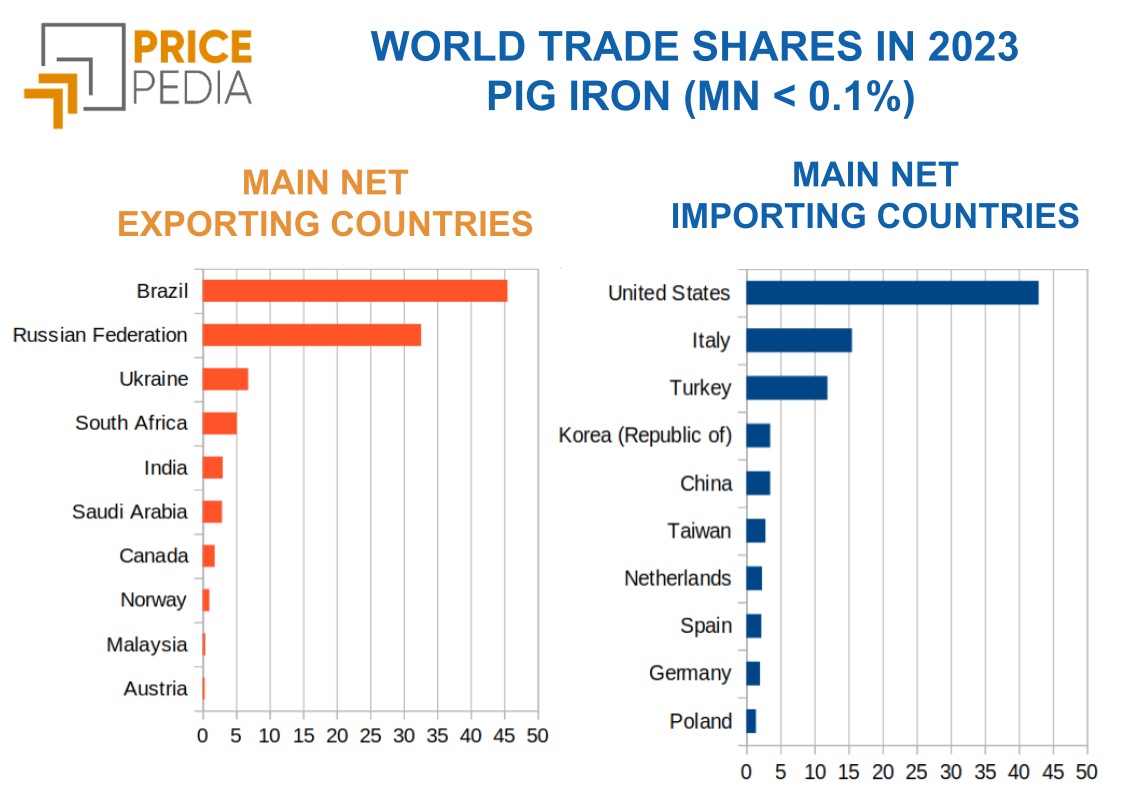

The following chart shows the list of the main net exporting and net importing countries[1] in 2023 for pig iron with low manganese content.

Among the net exporting countries, Brazil and Russia stand out. The former holds a 45% share of global exports, while the latter slightly exceeds 30%. They are followed, at a significant distance, by Ukraine and South Africa, with shares close to 5%. On the import side, however, the role of the United States stands out, accounting for over 40% of total global imports. Italy and Turkey follow, with shares between 10% and 15%. All other countries have net imports of less than 5% of the global total.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

The analysis of these two lists highlights how the current equilibrium in the global pig iron market is strongly linked to the functioning of free trade rules that govern interactions between different countries and regions of the world. Any segmentation of the market into geographic areas, even slightly separated, would likely lead to a disruption of this equilibrium, creating situations of excess demand in some areas and, conversely, excess supply in others.

For the purpose of a valuation exercise, we considered a possible differentiation of countries based on their greater or lesser proximity to the values that characterize the Western world. Following the approach described in Friendshoring and market risk of purchasing materials, we considered as a measure of distance from the Western world the Economic Freedom Index published by The Heritage Foundation, adjusted based on the positions that different countries have taken in UN votes on resolutions regarding Russia's invasion of Ukraine[2].

In the following scatter plot, the different countries, distinguished between net importers and net exporters, are positioned based on two indicators:

- The share of global trade, indicated on the x-axis[3];

- The country’s proximity index to the Western world[2].

The size of the circles varies only for exporting countries and indicates the importance of the country as an exporter to the EU. In the scatter plot, a horizontal line is drawn corresponding to the value of 60 on the proximity index to the Western world. The choice of this value is purely graphic and aimed at highlighting two areas of the graph: the first containing countries closer to the West; the second those farther away.

The chart is interactive: hover the mouse over a country and a table with related information appears

The chart clearly shows that the main exporting countries are all positioned in the area distant from the West. Conversely, the importing countries, with the exception of China, are mostly located close to the West.

It is evident how this structure of global trade could result in a market (corresponding to the Western area) with a supply deficit and in a market with a supply surplus in the hypothetical case that some barriers, even partial, were created in the trade between the two world regions. This risk is summarized in a score of 50.4 (on a scale from 0 to 100) representing the market risk due to possible reconfigurations of global trade in pig iron.

Substitute Products

However, considering the global market conditions of a single commodity in isolation may lead to distortions, given the importance of substitute goods in mitigating specific market imbalances. In the case of pig iron with a manganese content below 0.1%, highly substitutable products are those with a higher manganese content. Therefore, the previous analysis was also repeated for the trade flows of pig iron with a manganese content above 0.1%. The results are shown in the two charts that follow.

The charts are interactive: hover the mouse over a country and a table with related information appears

The trade structure of high-manganese pig iron partially differs from that of low-manganese pig iron, with Russia playing a less significant role among exporting countries and a rise in importance for India and Germany.

The importance of this type of pig iron in global trade is lower compared to low-manganese pig iron ($1.0 and $0.9 billion versus $3.2 billion).

The composite market risk score due to a possible reconfiguration of global trade stands at 51.0 and 49.2 for the two products, indicating that they too have a high average risk.

Conclusion

Pig iron is not included in the list of critical raw materials by the European Commission[5]. The analysis conducted by the Commission has broader objectives and considers more information compared to the analysis described above on the pig iron market. However, the results suggest that pig iron could become, if not "critical," at least "scarce," if the world moves towards erecting trade barriers between different regions, similar to what has already happened with hot-rolled coils and what is currently happening in the trade of electric vehicles.

Considering these possible scenarios and defining actions to take if these scenarios become more likely is one of the most strategic tasks of a purchasing department, especially if it aims to expand its scope to risk management, thereby strengthening its role as a strategic function of the company.

[1] In this analysis, we preferred to consider net exports and imports because they are more precise measures of the role a country plays in a given market. Indeed, sometimes at least part of the exports may consist of materials that were not produced in the country but imported from abroad. Considering net exports and imports allows us to eliminate the potentially distorting signal of materials imported and then re-exported.

[2] As an initial assumption, we simply multiplied the Heritage Foundation's Economic Freedom Index by 1.2 for countries that voted in favor of the various resolutions and by 0.8 for those countries that abstained or voted against. It is clear that this measure is subject to many improvements, but as an initial working hypothesis, it seemed adequate.

[3] Since the total global imports of a good match the total exports, the trade shares of exporters and importers can be represented on a single axis.

[5] For more details on the list of critical raw materials defined by the European Commission, see Critical Raw Materials: the importance of substitute goods.