Forecasting and Risk Measurement: Two Complementary Tools in Risk Management

How to Combine Forecasting and Risk Measurement to Tackle Uncertainty and Optimize Business Decisions

Published by Luigi Bidoia. .

Procurement Procurement Risk ManagementIn an increasingly dynamic and uncertain economic environment, characterized by market fluctuations, unpredictable geopolitical events, and sudden regulatory changes, companies must face numerous uncertainties, both internal and external. Strategic and operational decisions require the ability to foresee future events and manage the associated risks. Two fundamental tools to address these challenges are forecasting of key variables and the measurement of risks related to decisions.

External Uncertainties in Procurement

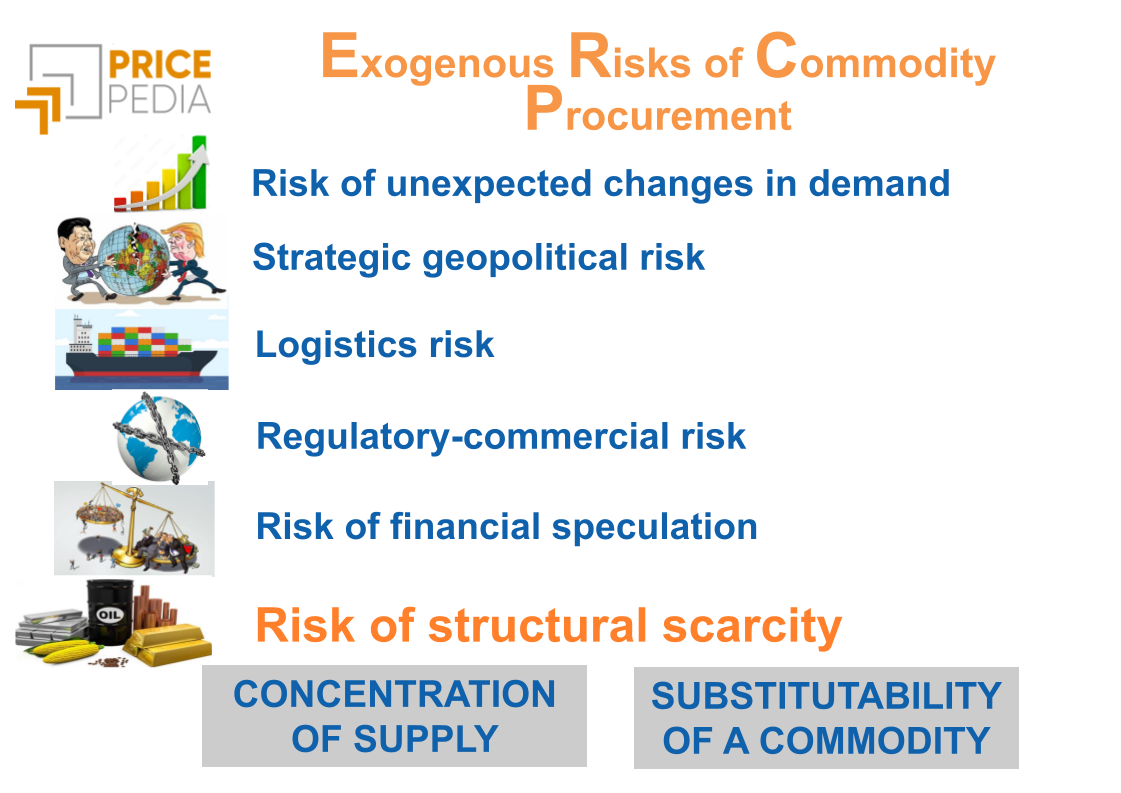

External uncertainty factors in procurement can be grouped into four macro areas:

- Market risks: related to potential price and currency fluctuations, as well as possible trade barriers between countries;

- Supplier risks: stemming from issues with quality, timely deliveries, financial difficulties, or changes in supplier management;

- Logistical risks: caused by supply chain disruptions (due to natural disasters, pandemics, strikes, or industrial accidents) or transportation and shipping issues (due to port congestion, intermodal transport problems, or sudden increases in shipping costs);

- Regulatory risks: represented by new laws and regulations that impose additional requirements (environmental, customs, safety, or ethical) or trade restrictions and sanctions that limit access to certain markets or raw materials.

In this article, we focus on market risks and the tools available to manage them: forecasting and risk measurement.

One concrete example is inventory management. The optimal inventory levels and subsequent purchasing schedules depend, on the one hand, on price forecasts for the material and, on the other hand, on the assessment of potential damages in case the risks materialize. All else being equal, expected increases (or decreases) in prices would lead to an increase (or decrease) in the average level of inventory. Similarly, the expected damages from high or low risks would influence how much inventory a company decides to hold.

The Forecasting Tool

In the past century, the development of computing has facilitated the broad collection of data related to various economic phenomena and the creation of increasingly sophisticated forecasting models. The increased availability of data and the improvement of models have enabled progressively more robust and accurate forecasts.

For a long time, the expertise and experience of forecasting teams were essential to improving the quality of predictions. However, in recent years, the advent of big data and artificial intelligence has made it possible to develop algorithms capable of producing accurate forecasts, sometimes with limited human intervention.

A fundamental limitation of forecasting, however, lies in its reliance on what we call the regular past. In other words, forecasting models work well in conditions where historical data follows recognizable and predictable patterns. However, when extraordinary events or disruptions occur — the so-called irregular past — forecasting models, by their nature, cannot anticipate them, as these events fall outside the regular dynamics observed in the past.

The great advantage of using forecasts is that, over the long term, their average tends to be accurate. Even though a single forecast may be subject to uncertainties, the systematic use of forecasts in business processes allows for more reliable results over time, maximizing benefits and minimizing costs.

Risk Measurement Tools

All business activities are subject to various risks, stemming from the possibility that unpredictable future events may occur, significantly influencing a company's performance and results. The unpredictability of such events arises from the fact that they do not follow patterns of regularity observable in historical data, making them difficult to forecast with traditional methods.

The main source of uncertainty is almost always the timing of such events. Conversely, their intensity can be estimated by analyzing the severity of extraordinary events that have occurred in the past. This allows companies to measure the potential magnitude of the damage these events could cause, providing a basis for evaluating whether to implement protective measures or mitigation strategies.

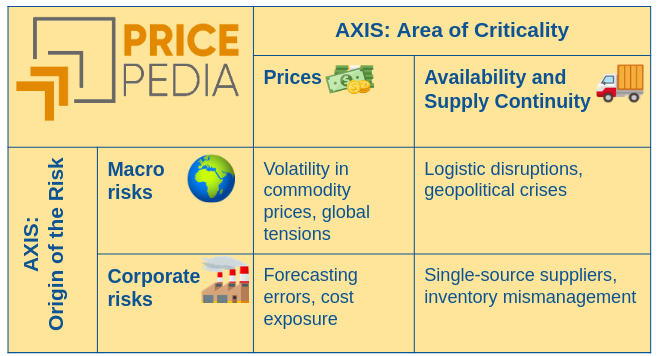

The possible risk measurement tools are divided into two broad areas:

- Qualitative analyses: Based on experience, expert judgment, and case studies, these techniques assess risks in terms of probability and impact but without rigorous quantification. They are useful when quantitative data is limited or when emerging risks have no clear historical precedent.

- Quantitative methods: Based on the analysis of historical data and the identification of past events that forecasting models failed to capture. Among the most widely used quantitative methods are Value at Risk (VaR), which estimates the maximum expected loss with a certain level of confidence, and Expected Shortfall (ES), which measures the average loss in the worst cases, beyond the VaR threshold.

Benefits of Integrating Forecasting and Risk Measurement

The example of inventory management suggests that integrating forecasting and risk measurement, when used together in a complementary way, enhances a company’s decision-making ability and allows for more effective risk management.

Forecasts provide optimal results in relatively stable contexts but do not offer the same accuracy in the face of extraordinary events or sudden disruptions. In such cases, complementary risk management tools are necessary to protect the company from these events or limit their negative impact.

The PricePedia Approach

To provide companies with comprehensive information to support procurement decision-making processes, PricePedia has launched a project to measure the market risk of commodities, adding this information to price forecasts.

This will allow companies subscribed to the platform to access both types of information: commodity price forecasts of interest and assessments of the associated market risk.

The risk will be measured through a score (ranging from 0 to 100), consistent across different commodities, indicating which are most subject to sudden price increases or potential supply chain disruptions.

Conclusions

No one can predict the future with certainty, and the only way to explore it is by learning from past events. Events that exhibit regularity are valuable because they allow for forecasts of the most probable scenarios.

However, irregular events are equally valuable, if not more so. While they do not allow us to predict exactly when a new extraordinary event might occur, they provide insights into its possible intensity. This enables companies to focus on those risks that could cause the greatest damage.

Integrating forecasting and risk measurement offers a more complete set of information, essential for companies to optimize their decision-making processes and effectively manage uncertainty.