How increased Chinese steel supply impacts European steel prices

Downward pressure, despite EU safeguard measures

Published by Pasquale Marzano. .

Ferrous Metals HRC Price Drivers

China is the largest steel producer in the world. Its leadership is undisputed, having produced over a billion tons of steel in 2023 alone, more than seven times the total produced by India, the second-largest producer globally (source: World Steel Association).

One of the factors supporting Chinese steel production is the lower cost of raw materials, especially compared to Europe.

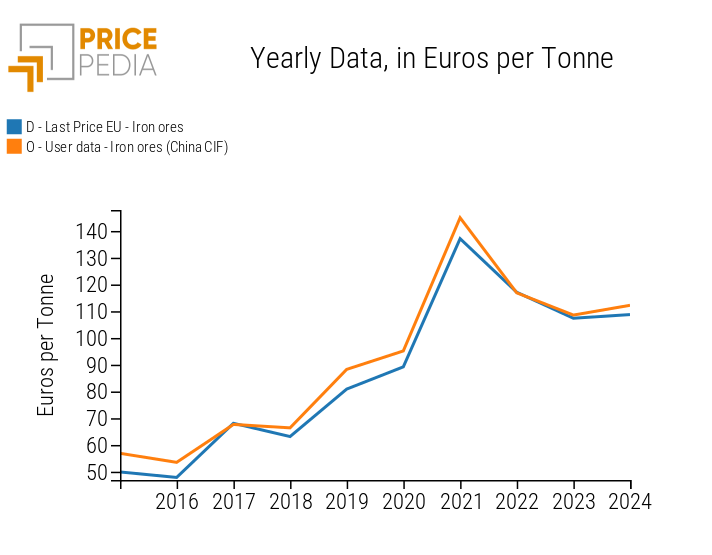

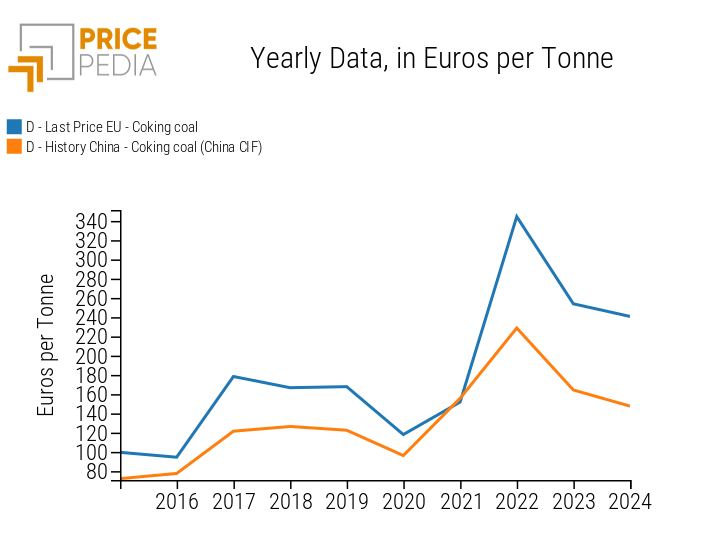

This factor is illustrated in the following charts, comparing the prices in China and Europe of the main steelmaking inputs, iron ore and coal, expressed in euros per ton.

Iron Ores, €/Ton

Coking Coal, €/Ton

The cost advantage of Chinese steel companies is mainly due to the lower price of coking coal compared to the European price. The price of iron ore[1] is essentially the same between the two markets, although commodity differences make the comparison less certain.

In addition to lower raw material costs, China’s competitive advantage is supported by significant government subsidies[2] that have boosted Chinese steel production. This production satisfies both high domestic demand (China is also the world's largest steel consumer) and leads to an oversupply of low-cost steel products in global markets.

Since 2018, this has prompted several trading partners, primarily the United States and Europe, to implement various protectionist measures to safeguard their respective steel industries.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

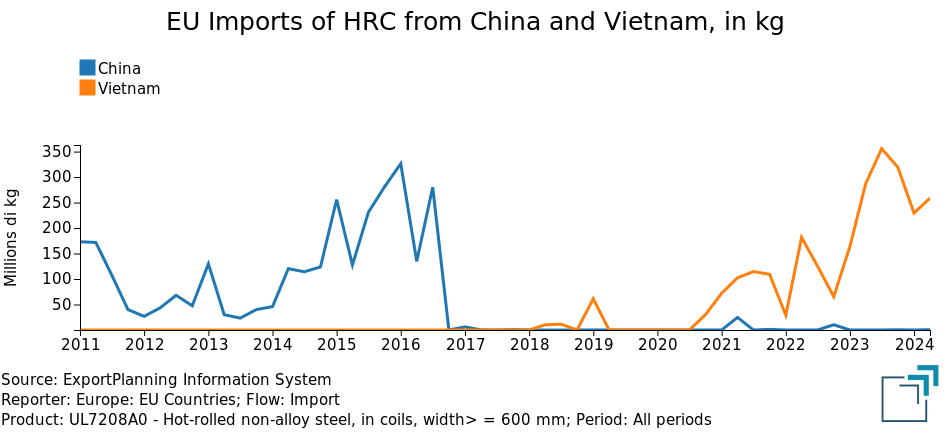

Despite safeguard measures, Chinese steel products still manage to reach the European market by circumventing customs duties imposed on China, often through triangulation with other countries, putting pressure on the Union’s steel industry.

An example of this is shown in the following chart, which illustrates the quarterly European imports of hot-rolled steel coils (HRC) from China and Vietnam, expressed in kg (source: ExportPlanning).

EU Imports of HRC from China and Vietnam, in kg

Since 2017, Chinese exports of HRC to the EU have essentially stopped. However, starting from Q3 2020, Europe began importing HRC from Vietnam, reaching a historical high in Q3 2023.

This coincided with a rise in Vietnamese imports of HRC from China during the same period.

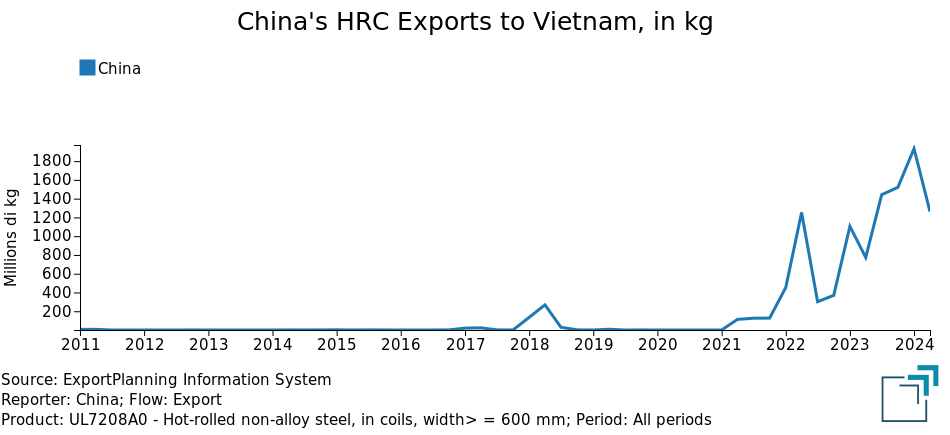

China's HRC Exports to Vietnam, in kg

Starting in 2021, Chinese HRC exports to Vietnam have shown a growing trend similar to the rise in European HRC imports from Vietnam.

At a time when Chinese steel demand is weak, the Asian giant’s production surplus is exerting additional downward pressure, via imports from third countries, on European steel prices, as can be seen by comparing the changes in EU customs price with the ones in Chinese export prices of hot-rolled coils.

Table: Year-on-year variations (%) of prices, in euros, of European and Chinese Hot-Rolled Steel Coils

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| I-Last Price EU-Hot Rolled Steel Coils Index (Europe) | −7.45 | +68.47 | +16.77 | −19.18 | −4.64 |

| I-Storico Cina FOB-Hot Rolled Steel Coils Index (China) | −2.14 | +35.81 | −3.13 | −22.70 | −6.23 |

As shown in the table, Chinese prices rose at a significantly lower rate than European prices in 2021. In subsequent years, they consistently recorded more intense negative variations than European prices.

1. The price of Iron ores (China CIF) is calculated as the arithmetic average between the prices of Iron ores (gran 0.8-6.3mm) (China CIF), Iron ores (gran < 0.8mm) (China CIF) and Iron ores (gran > 6.3mm) (China CIF).

2. In the section Countervailing Duties for Public Subsidies and Support of the article Chinese steel prices have never been so low, the various forms of public subsidies implemented by Beijing in favor of Chinese steel companies are listed. Pasquale Marzano

Economist and data scientist. At PricePedia he deals with the analysis of commodity markets, forecasting models for raw material prices and management of reference databases.