Cocoa crisis and financial price spreads

Growth differences in cocoa price benchmarks

Published by Luca Sazzini. .

Food Cocoa Price DriversChocolate producers are facing what has been called the "cocoa crisis," caused by a supply reduction due to poor harvests in Ghana and Ivory Coast, two nations that provide about two-thirds of the world's cocoa bean production.

The spread of the CSSV (Cocoa Swollen Shoot Virus) has caused severe damage to plantations, leading to leaf loss, plant degradation, and reduced fruit production.

This epidemic, combined with a shortage of fertilizers, has resulted in a drop in production.

The reduced supply, exacerbated by speculative maneuvers of hedge funds, has led to a surge in financial cocoa prices, which by April 2024, at the peak of the crisis, had risen by 135% compared to January and 300% compared to early 2023 levels.

From a financial markets perspective, cocoa has the peculiarity of being traded on the same platform (the Intercontinental Exchange: ICE) with physical deliveries on two different markets: New York in the United States and London in Europe.

During the cocoa crisis, the two financial prices of cocoa fluctuated in sync until August 2024, when the dynamics of the two prices began to diverge.

Cocoa futures with delivery in the United States entered a new bullish phase, surpassing $10,000/ton, while London futures showed a more stable trend, hovering around $7,000/ton.

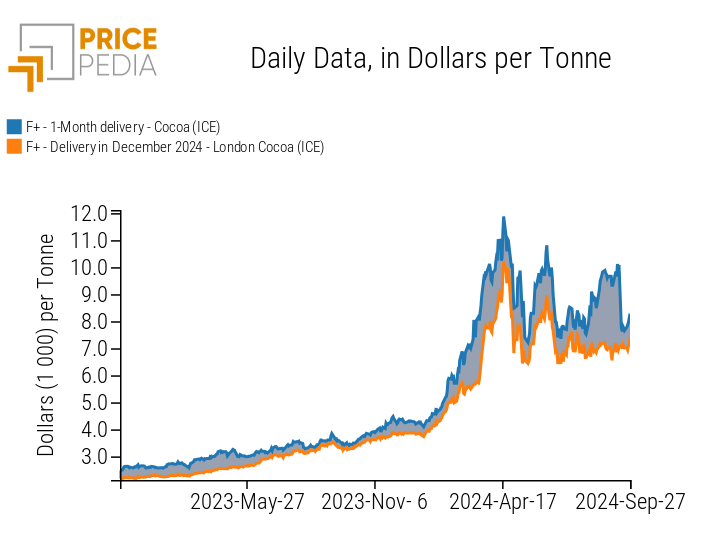

The following chart highlights the spread between U.S. and London cocoa futures prices, both quoted on the Intercontinental Exchange (ICE) financial exchange.

Spread between financial cocoa prices

The chart shows in gray the sharp increase in the spread between financial cocoa prices in August 2024 and the first weeks of September.

This difference is attributed to the varying quality of stocks in U.S. and London warehouses.

In particular, the London warehouse held cocoa beans from Cameroon, many of which were over three years old and considered lower quality for chocolate production. This qualitative difference led chocolate producers to increase their demand for the product held in the U.S., at the expense of London warehouses.

Additionally, a speculative move contributed to the growth of the spread between the two futures prices. Traders had short-sold U.S. cocoa prices, betting on a future price drop. Since this expectation did not materialize (due to increased demand from chocolate producers), traders were forced to cover their positions by demanding U.S. cocoa, further driving up the price.

On Monday, September 16, the price gap between the two financial markets suddenly narrowed, with a -23% drop in U.S. futures prices (compared to the previous Friday).

The price drop is attributed to a clarification within the European Union regarding the trade of old cocoa from Cameroon. Chocolate producers feared that the EU might block the commercialization of old cocoa with the introduction of new deforestation legislation, which will require traders and companies to prove that imported cocoa was grown on non-deforested land.

The news that the trade of existing cocoa stocks would not be affected brought U.S. financial prices back in line with those of the London market.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Relationship between financial and physical markets

Since the financial prices of the same product can diverge due to differences in the underlying quality, it can be useful to analyze customs prices to understand the relationship between them and financial prices.

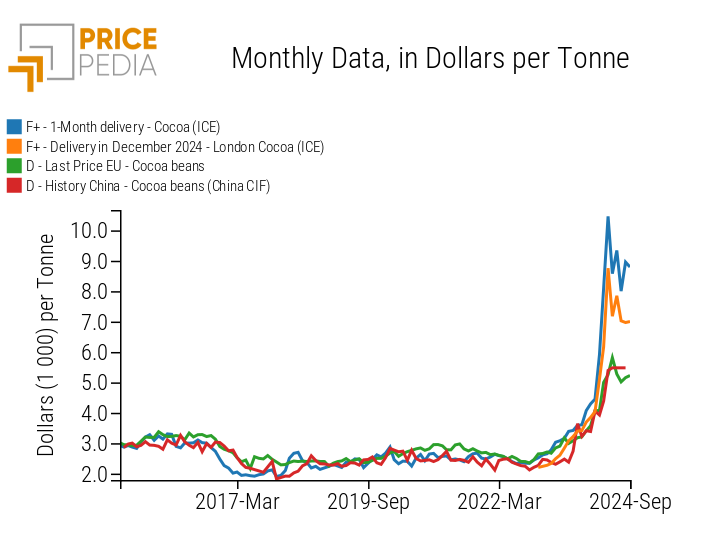

The following chart shows a comparison between financial cocoa prices and physical prices recorded at the customs in Europe and China.

Historical series of financial and customs cocoa prices

Analysis of the chart reveals that until the end of 2023, financial (U.S. and London) and customs (EU and China) markets were closely aligned in both levels and dynamics. Over the past year, however, financial markets, particularly in the U.S., have seen much sharper increases compared to those in customs markets.

To more clearly analyze these price level differences, the table below shows the monthly average prices expressed in $/ton from early 2024 to today.

Monthly Cocoa Prices Table in $/ton

| 2024-01 | 2024-02 | 2024-03 | 2024-04 | 2024-05 | 2024-06 | 2024-07 | 2024-08 | |

|---|---|---|---|---|---|---|---|---|

| F+-Delivery in 1 Month-Cocoa (ICE) | 4451 | 5910 | 8093 | 10460 | 8576 | 9339 | 8001 | 8956 |

| F+-Delivery December 2024-London Cocoa (ICE) | 4039 | 5102 | 6165 | 8756 | 7175 | 7848 | 7024 | 6968 |

| D-Last Price EU-Cocoa Beans | 4071 | 4074 | 4999 | 5254 | 5813 | 5274 | 5016 | 5155 |

| D-Historical China-Cocoa Beans (China CIF) | 4057 | 3926 | 4383 | 5393 | 5479 | 5479 | 5479 | 5479 |

The price table highlights that at the beginning of 2024, the monthly averages were around $4,000 per ton, with slightly higher values for the US financial market price. This market also recorded the fastest and most pronounced growth, reaching nearly double levels by the end of the first quarter ($8,093 per ton) and exceeding them significantly in the following month, marking an increase of 135% compared to the beginning of the year. The London financial market also saw a significant rise in the first 4 months, more than doubling its price levels.

Customs markets, while reflecting the same trend as financial markets, show a lag in adjustment and decidedly more contained variations.

In April, the customs markets in Europe and China recorded a cocoa price increase of "only" 30% compared to the beginning of the year.

In the last month, customs prices settled at $5,000 per ton in Europe and $5,500 in China, well below the levels of the financial markets in London and the United States, which reached $7,000 and $9,000 per ton, respectively.

The case of cocoa is particularly interesting as it highlights how in 2024 the difference between the prices of financial and customs markets has drastically changed. At the beginning of the year, the gap was less than $500 per ton, but in the last month, this difference has nearly quadrupled.

Customs markets, while reflecting the trend in financial prices, show slower and more contained variations, while financial markets are characterized by significantly greater volatility.

Conclusions

Financial cocoa prices have demonstrated how the difference in the quality of the underlying asset can generate divergent dynamics between prices that cannot be realigned through arbitrage operations.

Until 2023, the customs prices in Europe and China were closely correlated with the performance of financial markets.

However, in the past year, in light of the significant price increases in financial markets, the physical prices recorded at customs have seen decidedly more moderate increases.

In the first quarter of 2024, in fact, while financial prices have more than doubled, the customs markets in Europe and China recorded limited increases, around 30%.