Procurement risk in the pharmaceutical supply chain

The EU pharmaceutical industry's dependence on Asian raw materials has grown in recent decades

Published by Luigi Bidoia. .

Pharmaceutical raw materials Procurement Risk ManagementIn the last three years, the global trade of pharmaceuticals has fluctuated around $850 billion, reaching a value double that of ten years ago. Considering that in 1995 global trade was only $45 billion, it is clear that this industry has experienced significant international growth.

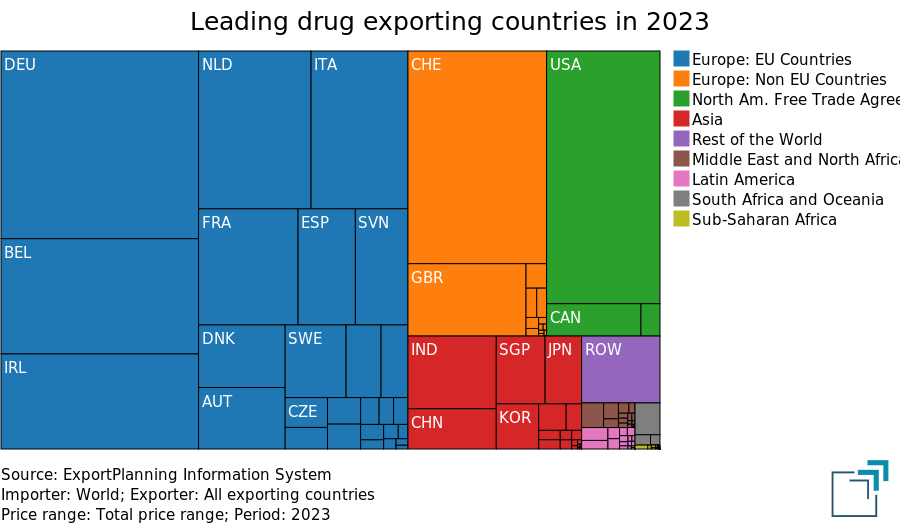

A key feature of this industry is the strong leadership of Western countries, as shown in the treemap below, which represents global exports by country.

The predominant role of the EU (blue area in the treemap) and other industrialized countries (Rest of Europe and North America) is evident. On the other hand, Asia (red area in the treemap) still plays a more marginal role, with India surpassing China in pharmaceutical exports.

The strength of the European pharmaceutical industry is based on intensive research and development in the medical and pharmaceutical field, as well as substantial public funding allocated to pharmaceutical spending. However, in recent years, a growing element of fragility has emerged: the increased risks associated with the supply chain, particularly in the procurement of pharmaceutical raw materials. While Western countries lead the global trade of finished pharmaceutical products, the same cannot be said for the production and control of the raw materials used.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Pharmaceutical Raw Materials

Pharmaceutical raw materials can be classified into three broad categories:

- Active Pharmaceutical Ingredients (API): substances that exert the therapeutic effect of a drug. These chemical or biological compounds are responsible for the pharmacological action and constitute the active ingredient of the final product.

- Reagents: substances used during the synthesis process to prepare the active ingredient or the drug itself. They are not present in the final product.

- Excipients and Other Additives: substances that do not have a direct therapeutic action but are essential for the drug's formulation. They can modulate the release of the API within the body to achieve a prolonged or controlled effect. Moreover, they may influence the solubility, taste, mode of administration, preservation, and the chemical-physical stability of the drug.

The most critical raw materials are, naturally, the active ingredients and reagents, due to their limited (if not nonexistent) possibilities for substitution.

The Growth of Developing Countries

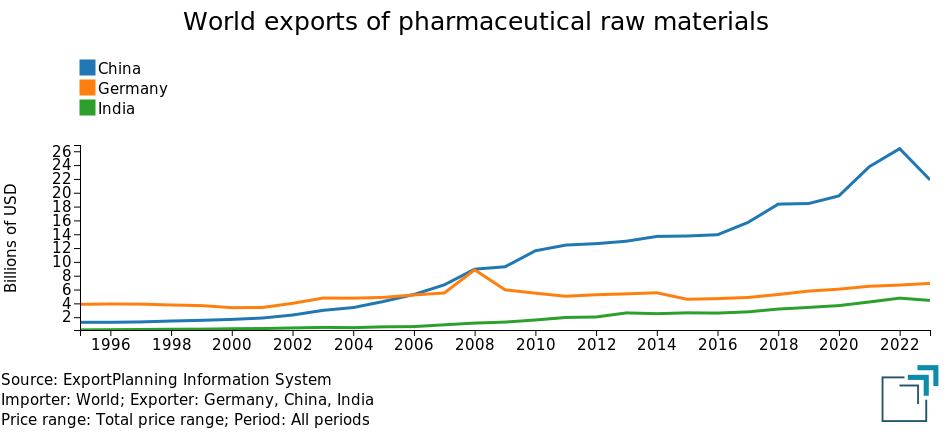

As previously noted, in the case of finished pharmaceutical products, developed countries have maintained a strong leadership position. However, the situation is different for pharmaceutical raw materials, where China initially, followed by India, have made significant progress. This trend becomes evident when comparing the pharmaceutical raw material exports of Germany, China, and India over the past 30 years.

The graph clearly shows the strong growth of Chinese exports, which surpassed those of Germany in 2007 and continued to grow significantly in the following years, widening the gap. Similarly, Indian exports of pharmaceutical raw materials have also begun to increase, reaching levels in recent years that challenge Germany's second position.

In light of these dynamics, it is clear that the EU pharmaceutical industry is becoming increasingly dependent on raw materials produced in Asia, thereby increasing the risk of supply chain disruptions for pharmaceutical companies located in the EU.

The Case of Lysine

The reshaping of global trade in pharmaceutical raw materials involves a variety of situations. In some cases, the process of substituting EU production with Asian production is just beginning, while in others it has already reached an advanced stage. A notable example of this latter case is lysine, an amino acid of great importance to the pharmaceutical industry. Here, China has taken a dominant role, accounting for nearly three-quarters of the world's lysine trade. When considering other key exporters such as South Korea and Indonesia, it becomes clear that Europe is highly dependent on Asia for its lysine supply.

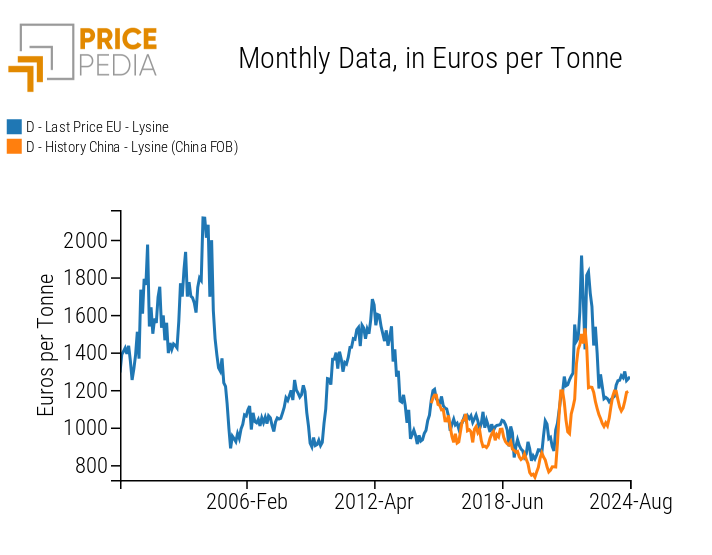

In this context, it is logical to expect that the price of Chinese exports has a significant influence on the EU customs price, as demonstrated in the graph below.

Lysine: EU prices and FOB China prices in euros per tonne

The graph clearly shows that the FOB (Free on Board) price of Chinese exports precedes the EU customs prices by one or two months. This correlation makes knowledge of Chinese prices a critical factor for anticipating trends in European prices.

Conclusions

While Europe and the United States maintain an almost unchallenged leadership in pharmaceutical production, the situation is quite different for pharmaceutical raw materials. In this sector, China and, subsequently, India have made significant progress over the last decades, leading to a growing dependency of the European pharmaceutical industry on raw materials produced in Asia. This dependency also brings with it increased risks of supply chain disruption. The situation varies across different raw materials, with extreme cases like lysine, where Chinese production holds an undisputed leadership position.