Protectionist policies: the case of steel tariffs

Trump's Tariff Plan Threatens the Global Economy by Reducing International Trade

Published by Luigi Bidoia. .

Ferrous Metals HRC Import tariffsIn the United States, there is bipartisan convergence toward increasing tariffs on imports, particularly those from China. The main difference between the proposals of the Republican candidate (Donald Trump) and the Democratic candidate (Kamala Harris) lies in the scale of the intervention. Trump's plan proposes a 60% increase in tariffs on imports from China and a 10% increase on imports from all other countries. In contrast, the Democratic proposals focus on raising tariffs on specific products only, such as electric cars, solar panels, and other goods deemed strategic.

Evaluating the potential effects of Trump's proposal is complex, particularly regarding the increase to 60% on Chinese imports. While retaliation from China against U.S. imports is predictable, it is challenging to estimate how other affected countries might react.

The probability that Trump, once elected, will effectively increase tariffs on imports from China is quite high, as raising tariffs tends to produce direct positive effects within the importing country. The imposition of import tariffs increases fiscal revenue without triggering significant protests, since it is generally believed that the burden falls on foreign exporting companies rather than on domestic businesses and consumers[1]. Moreover, increasing tariffs serves as a protective barrier for less competitive local businesses, enabling them to continue production and maintain employment levels.

However, increasing tariffs also results in indirect negative internal effects, primarily due to rising domestic prices—both from the increased cost of imported goods and from the higher production costs of less efficient domestic companies. The most significant negative effects are external, stemming from both the reaction of countries affected by the tariffs and the overall reduction in global trade.

As described in the article "Advantages and Costs of international Trade Liberalization", the effects of reduced global trade have been widely studied in the literature and are well understood. There is much more uncertainty, however, around the possible reactions of the countries affected, as these depend on political decisions and on whether individual countries are willing to support the development of a multilateral international system.

The Increase of U.S. Import Tariffs on HRC and the European Response

In 2018, the Trump administration introduced a series of tariffs on various imported products, including hot-rolled coils (HRC). These tariffs were part of the protectionist trade policy under the so-called "Section 232," based on U.S. law that allows the imposition of import duties for national security reasons. The stated objective was to protect the U.S. steel industry from foreign competition and to strengthen domestic production capabilities.

The tariffs were applied to a wide range of steel and aluminum products, with rates set at 25% for steel (including HRC) and 10% for aluminum. These tariffs were not limited to imports from China but also affected many other countries, including the European Union (EU)[2].

The introduction of these tariffs led to significant trade tensions between the U.S. and its trade partners, with some countries imposing retaliatory measures on U.S. exports. The EU, in particular, responded with a series of counter-tariffs on American goods such as jeans, motorcycles, bourbon, and other symbolic items. These tariffs, totaling approximately €2.8 billion and set at a 25% rate, were designed to put pressure on the U.S., targeting products from politically significant states.

In addition, the EU adopted safeguard measures to protect its steel market. Since U.S. tariffs on steel imports pushed global producers to find new markets, there was a risk that large volumes of steel (including HRC) would flood the European market, causing harm to local producers. Consequently, the European Commission introduced import quotas based on historical volumes to prevent an oversupply in the European market, along with an additional 25% tariff on imports exceeding those limits.

Effects of U.S. and EU Tariffs

The effects of the U.S. and EU actions were twofold. On one hand, the American and European markets were protected from Chinese exports. On the other, HRC prices in both the U.S. and EU markets were significantly higher than those in China.

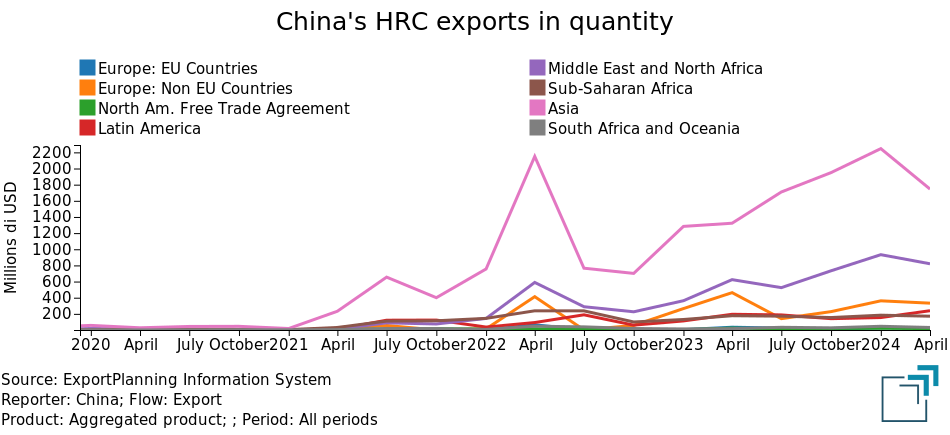

The following chart illustrates the trend of Chinese exports to different regions of the world. Until early 2021, China exported very little HRC. However, during the post-pandemic recovery, export flows from China increased significantly, particularly to Asia and the MENA region (Middle East and North Africa). Exports also rose substantially to non-EU Europe, Latin America, and Sub-Saharan Africa. In contrast, exports to North America and the EU remained low, indicating the effectiveness of the barriers that the U.S. and EU imposed on imports from China.

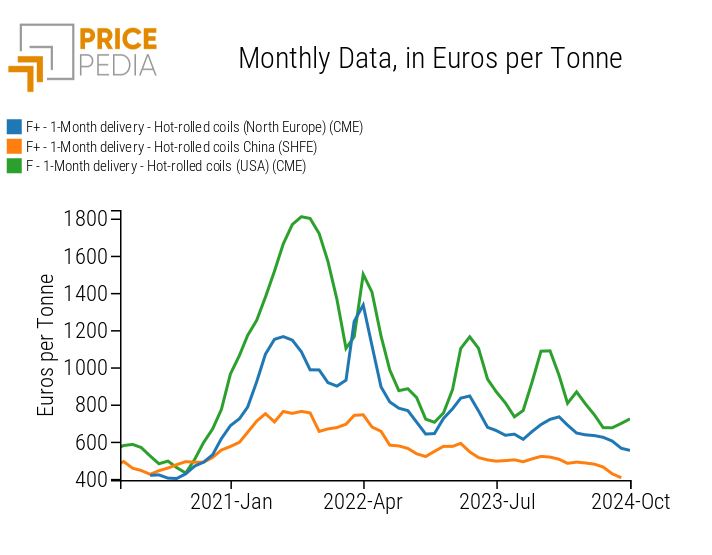

The effect of these tariffs on imports from China is also evident from the price perspective. The following chart shows the financial price levels of HRC in the North American, EU, and Chinese markets.

HRC financial price in the US, EU and China

The chart clearly indicates that while prices were quite similar in 2020, in the 2021–2022 period, prices in the Chinese market increased at a much lower rate compared to those in the EU market and, especially, the U.S. market. This divergent trend resulted in a significant price differential that persisted throughout the subsequent period, confirming the effectiveness of the trade barriers imposed by the U.S. and the EU.

Therefore, it may be useful to analyze what has happened in the steel market, specifically in hot-rolled coils (HRC), whose U.S. import tariffs in 2018 marked the beginning of the trade war between the United States and China.

The Domino Effect on Other Countries

The sharp growth of Chinese exports to markets outside the U.S. and EU has put pressure on the steel industries of the major producing countries, creating a domino effect in the introduction of trade barriers against Chinese steel and other products.

The country most "permeable" to Chinese steel has been Vietnam, partly because some Vietnamese operators viewed the U.S. and EU trade barriers on Chinese imports as a business opportunity. Following a strong increase in HRC imports from China, Vietnam has, in fact, significantly increased its exports to the EU, as described in How the greater Chinese steel supply impacts European steel prices.

However, recent plans to expand production capacity have led the Vietnamese steel industry to change its approach to Chinese imports, requesting the government to launch antidumping investigations against HRC imports from both China and India. On July 26, 2024, the Vietnamese government initiated the related investigations in response to these requests.

India's response was swift. On August 14, India launched an antidumping investigation into imports of hot-rolled flat products originating from or exported by Vietnam, following complaints that these products were being sold at low prices, damaging the interests of the national steel industry. Indian steel producers had long been reporting the effects on domestic steel prices caused by low-cost imports from China, which were being rerouted through Vietnam under the India-Asean free trade agreement.

As expected, the protectionist tariffs introduced by Trump initially led to the EU's safeguard measures and, more recently, in response to a global oversupply, to protectionist actions by other major steel-producing countries worldwide. The overall effect at the global level is a loss of efficiency in the global steel production chain, resulting in higher costs for user industries.

Conclusions

The wave of protectionism in the global HRC trade, which started in the U.S., continued in Europe, and eventually involved the major Asian producing countries, suggests that a potential implementation of Trump's plan to increase tariffs on U.S. imports from China to 60% could trigger an uncontrolled cycle of reactions and retaliations, threatening the entire international trade system, at least in the form we have known it over the last 40 years.

Since the openness to international trade is a key pillar of the EU's economy and policy, Trump's protectionist plan poses a serious threat to the economic development of the Union.

[1] The introduction of an import duty translates into a fiscal burden that can fall on foreign companies or domestic operators, depending on the pricing policies of the exporting companies. If the exporters have no market power, they will be forced to reduce their CIF prices to offset the effect of the duties on market prices. In this case, the duty represents a burden on foreign companies. Conversely, if exporters hold some power in the export market and do not lower their prices, the imposition of duties will fall on the domestic market, resulting in a burden for businesses and households.

[2] Initially, the duties were also applied to Canada and Mexico. However, temporary exemptions or bilateral agreements were later granted to certain countries, including Canada and Mexico, under the new USMCA trade agreement.