Week of generalised rise in financial commodity prices

Current conflicts, expansionary policies in China and expected rate cuts in the EU support price growth

Published by Luigi Bidoia. .

Conjunctural Indicators Commodities Financial WeekWeekly Summary of Commodity Financial Prices

The past financial week saw a widespread increase in commodity prices. Oil led the rise in energy prices. Announcements of interventions to support growth in China and increased confidence in an interest rate reduction phase in the industrialized world supported the prices of industrial metals, both ferrous and non-ferrous. Meanwhile, precious metals continued to rise, with gold reaching new records, driven by demand for protection against economic and geopolitical risks characterizing the current global economic phase.

Stimulus for the Chinese Economy

Last week, the Chinese government launched a monetary stimulus package, primarily focused on cutting mortgage rates for families affected by the housing bubble. This monetary stimulus will be complemented by fiscal measures, in line with the indications from the last Politburo meeting on September 26, during which President Xi Jinping urged to intensify efforts to implement fiscal and monetary policies aimed at supporting spending. The day before, the State Council announced 24 guidelines to support the labor market, aiming to improve job stability and incomes through employment subsidies and unemployment insurance funds.

These interventions signal the priority given by the Chinese government to employment, committing to coordinate fiscal, monetary, industrial, and pricing policies to reverse the trend of economic weakening and achieve the annual growth target.

EU Inflation

In September, inflation in the euro area fell to 1.8% year-on-year, the lowest level since April 2021. This decline is due both to the decrease in energy prices and to the moderation of prices in services, partly caused by the waning effect of the Olympics in France. This trend may continue in the coming months. With increasing signs of cyclical weakness, the decrease in inflation provides arguments for a possible new rate cut by the ECB at the next meeting on October 17.

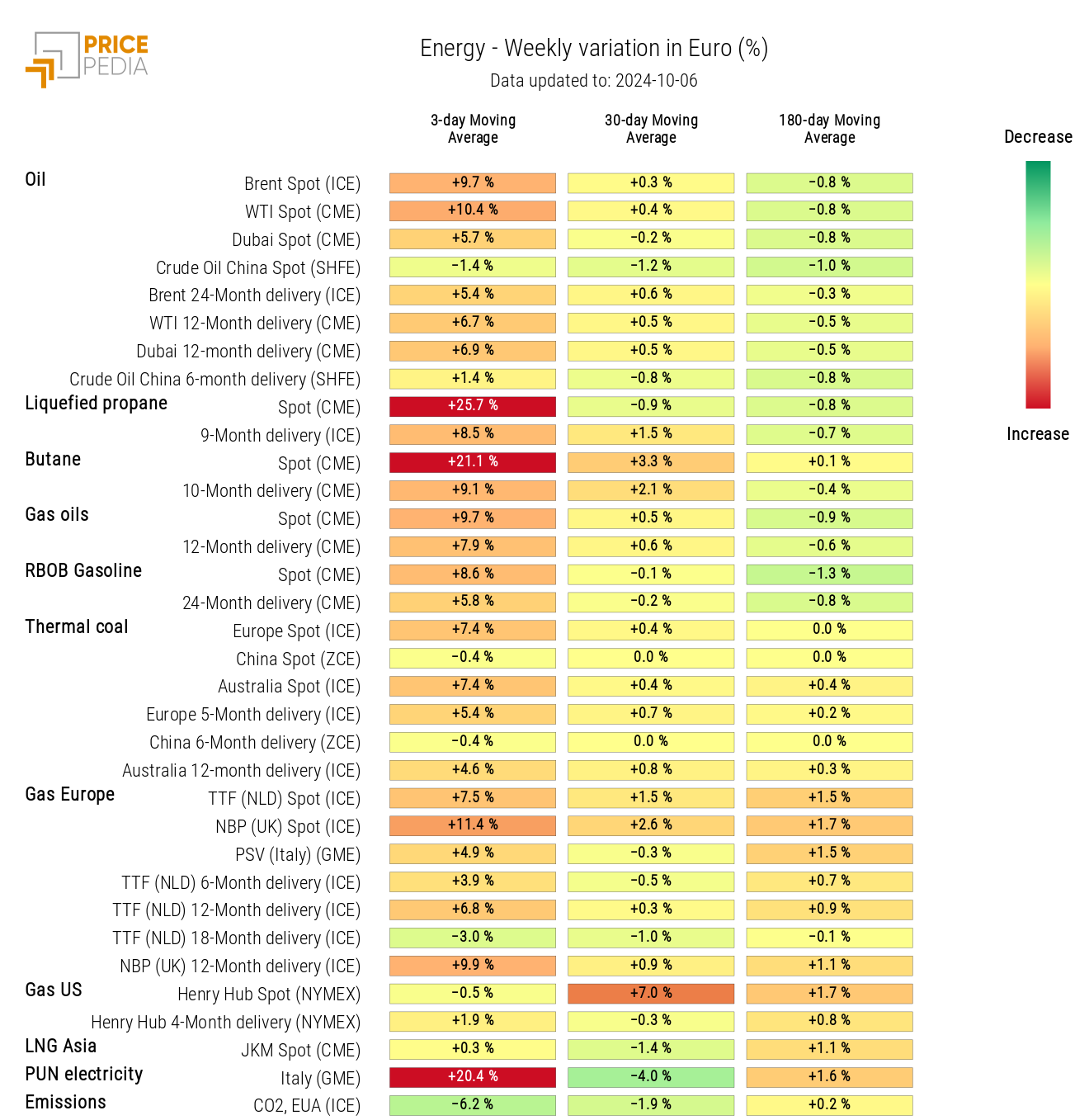

ENERGY

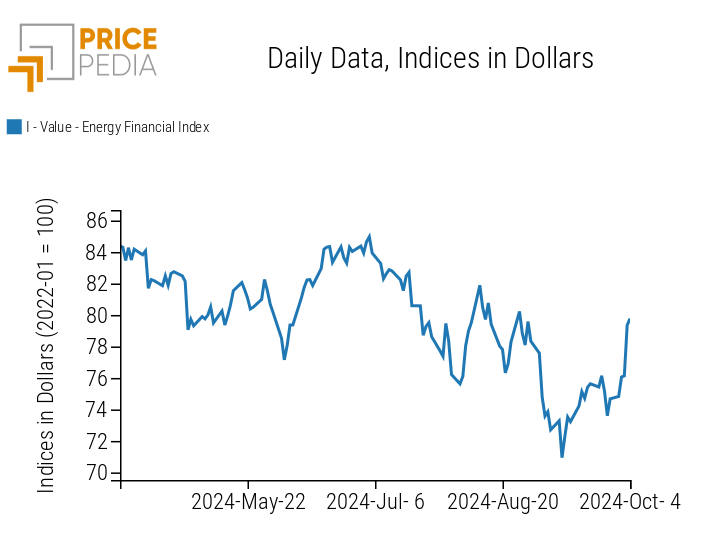

The rising tensions in the Middle East, due to the intensification of clashes along the border between Lebanon and Israel and drone and missile attacks against Israel from Iranian territory, have caused a spike in the oil market. In just a few days, the price of Brent rose from $72 to $78 a barrel. This increase has dragged all other energy prices along with it, leading to a 7% increase in this week's PricePedia aggregate energy price index.

PricePedia Financial Index of Energy Prices in Dollars

As indicated by the heatmap below, the increase in prices over the last week affected all energy prices with generally high rates of change. Exceptions include the prices of energy products quoted on Chinese financial markets, due to the closure of stock exchanges and the suspension of quotations starting Tuesday for the National Day holiday.

HeatMap of Energy Prices in Euros

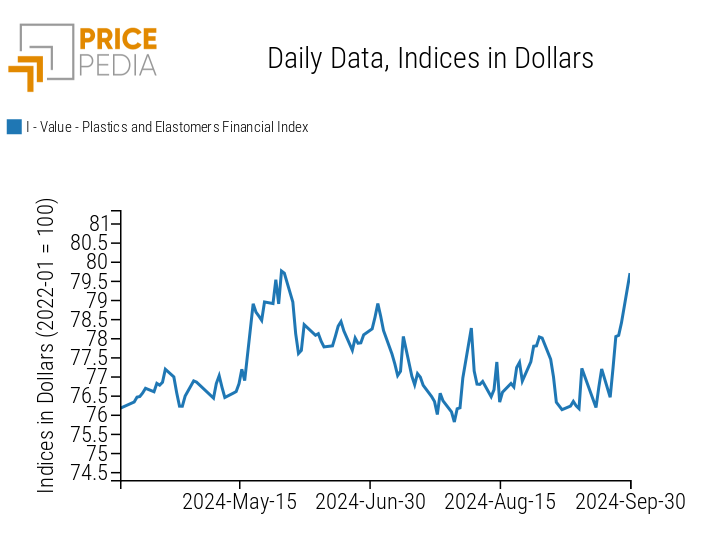

PLASTICS

The PricePedia index of plastics exclusively groups the prices of goods quoted on Chinese exchanges. The suspension of trading starting Tuesday allowed the index to be calculated only for Monday, which recorded a strong increase. It will be crucial to observe how quotations open next week to assess the impacts that both the rise in oil prices and the stimulus policies for the Chinese economy may have on the Chinese plastics market.

PricePedia Financial Indices of Plastic Prices in Dollars

FERROUS METALS

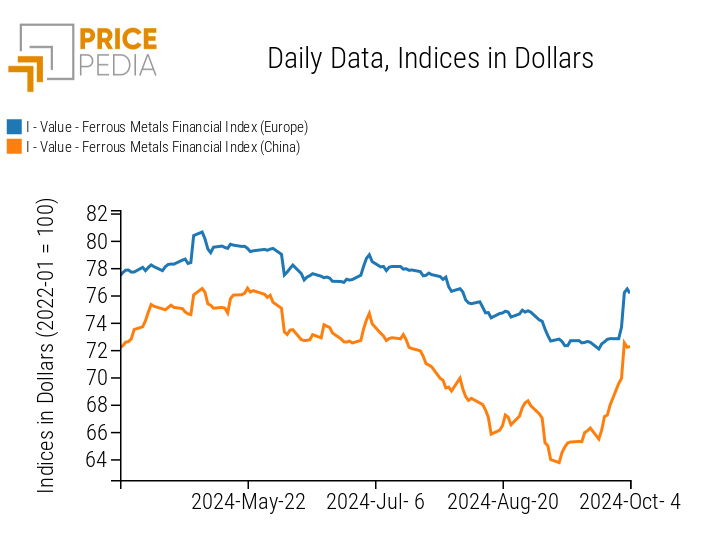

The ferrous index also recorded strong growth this week, both for products traded in Europe and those traded on the Chinese market.

PricePedia Financial Indices of Ferrous Metal Prices in Dollars

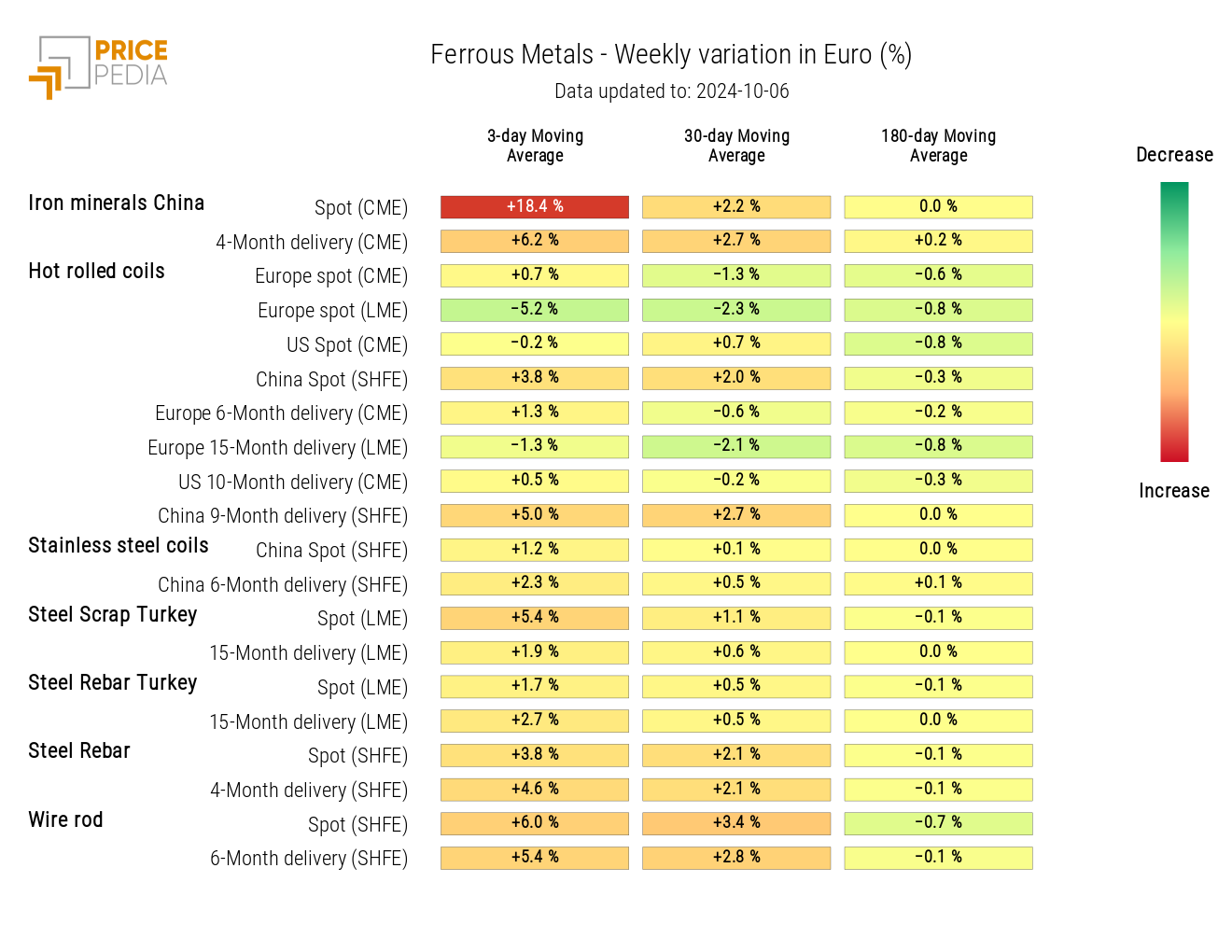

The heatmap presented here indicates a strong increase in iron ores traded in China and quoted on the Chicago Mercantile Exchange (CME).

HeatMap of Ferrous Prices in Euros

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

NON-FERROUS INDUSTRIAL METALS

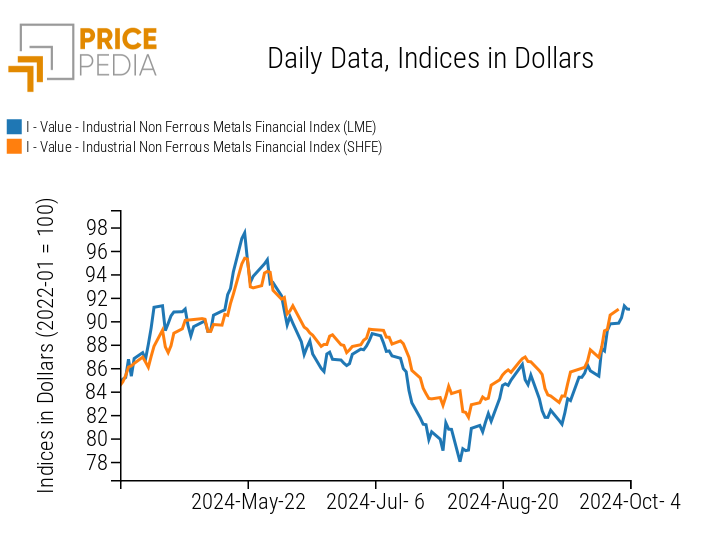

The financial index of non-ferrous industrial metals quoted on the London Metal Exchange (LME) has strengthened its upward trend this week, closely followed until Monday by the index of metals quoted on the Shanghai Futures Exchange (SHFE). This dynamic is primarily driven by new stimulus measures introduced by China to encourage the recovery of domestic demand.

PricePedia Financial Indices of Non-Ferrous Industrial Metal Prices in Dollars

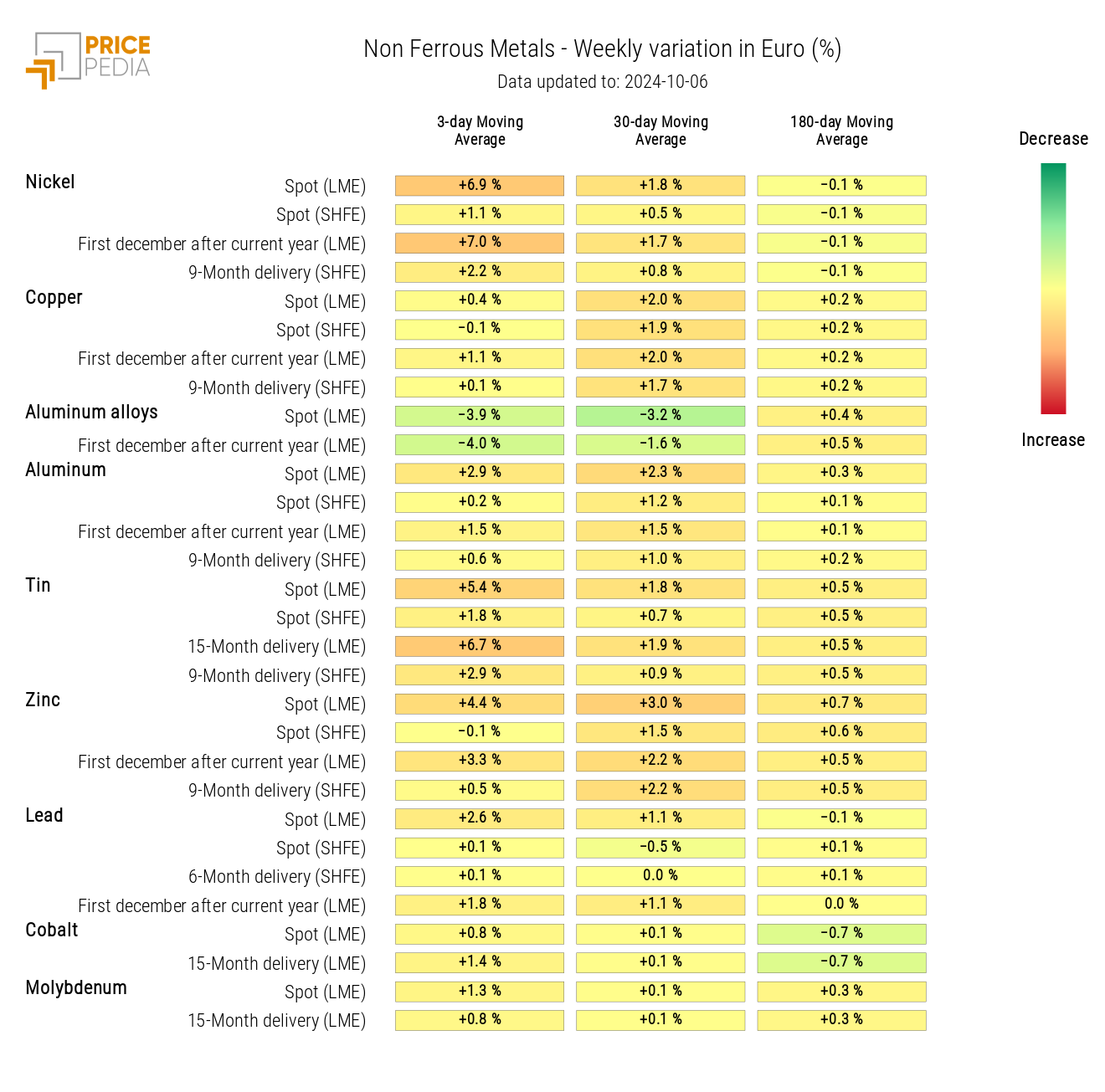

The heatmap below highlights a widespread increase in non-ferrous metal prices. The most significant increases were recorded, in order, by nickel, tin, zinc, and aluminum. In comparison, the price increase of copper remained relatively contained.

In contrast, secondary aluminum alloys continue to show a decline, reflecting a price rebalancing between the LME Aluminium Alloy and Aluminium contracts after the former unusually surpassed the latter this summer.

HeatMap of Non-Ferrous Prices in Euros

FOOD

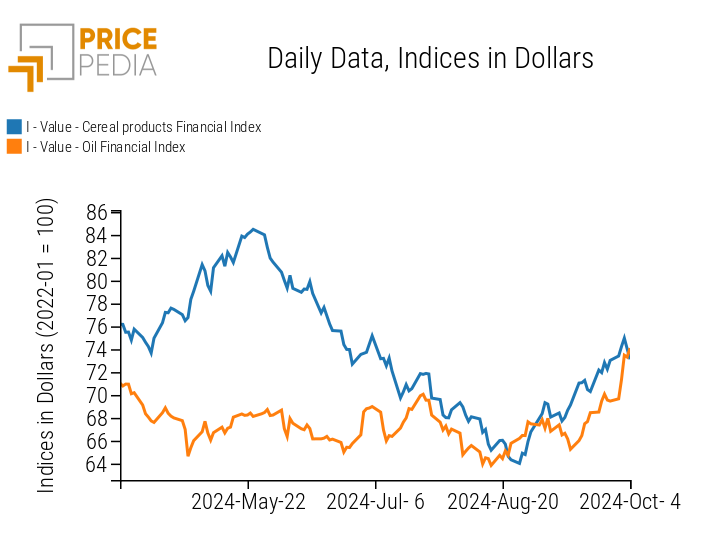

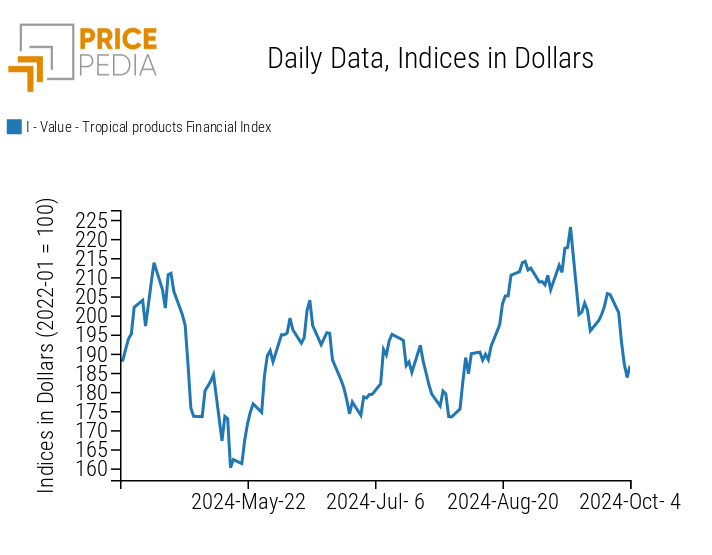

Cereals and oils have shown price growth in recent weeks. In contrast, prices for tropical products continue to be volatile, experiencing a significant reduction last week.

| PricePedia Financial Indices of Food Prices in Dollars | |

| Cereals and Oils | Tropical |

|

|

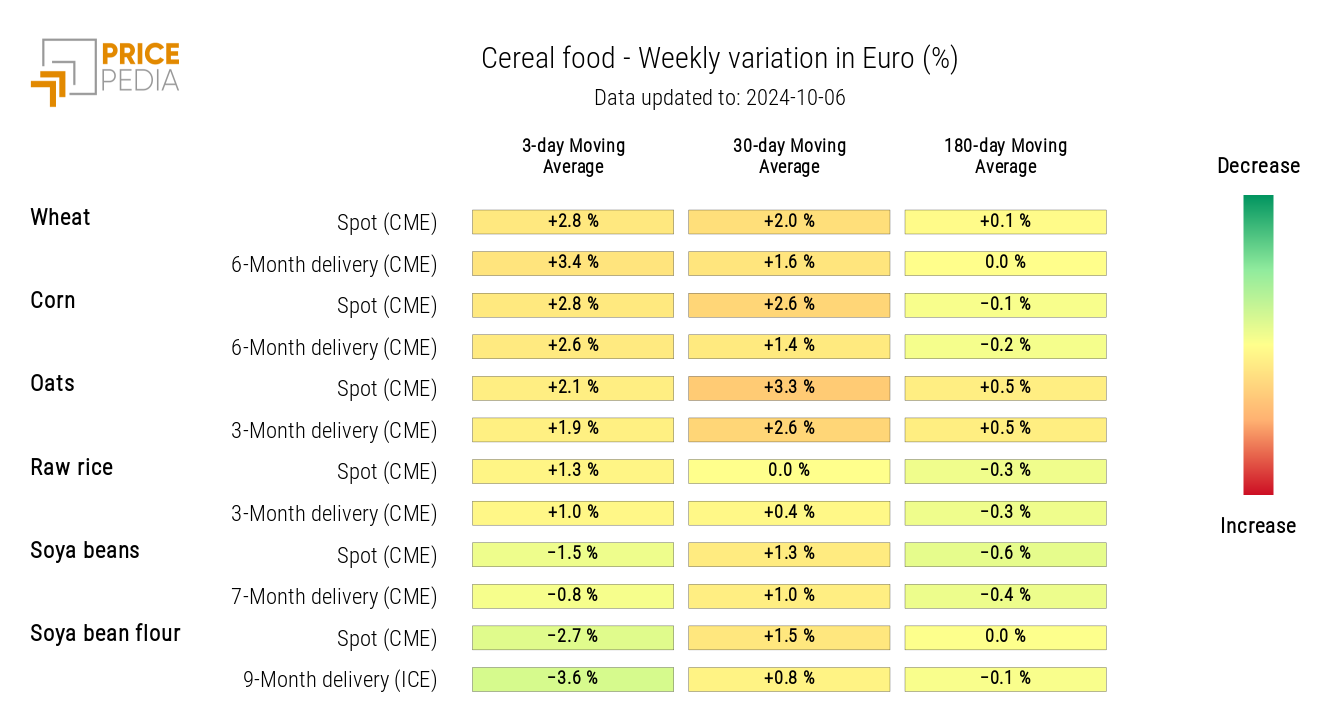

CEREALS

The heatmap for cereals highlights a generalized price increase across all products, starting from wheat.

HeatMap of cereal prices in euros

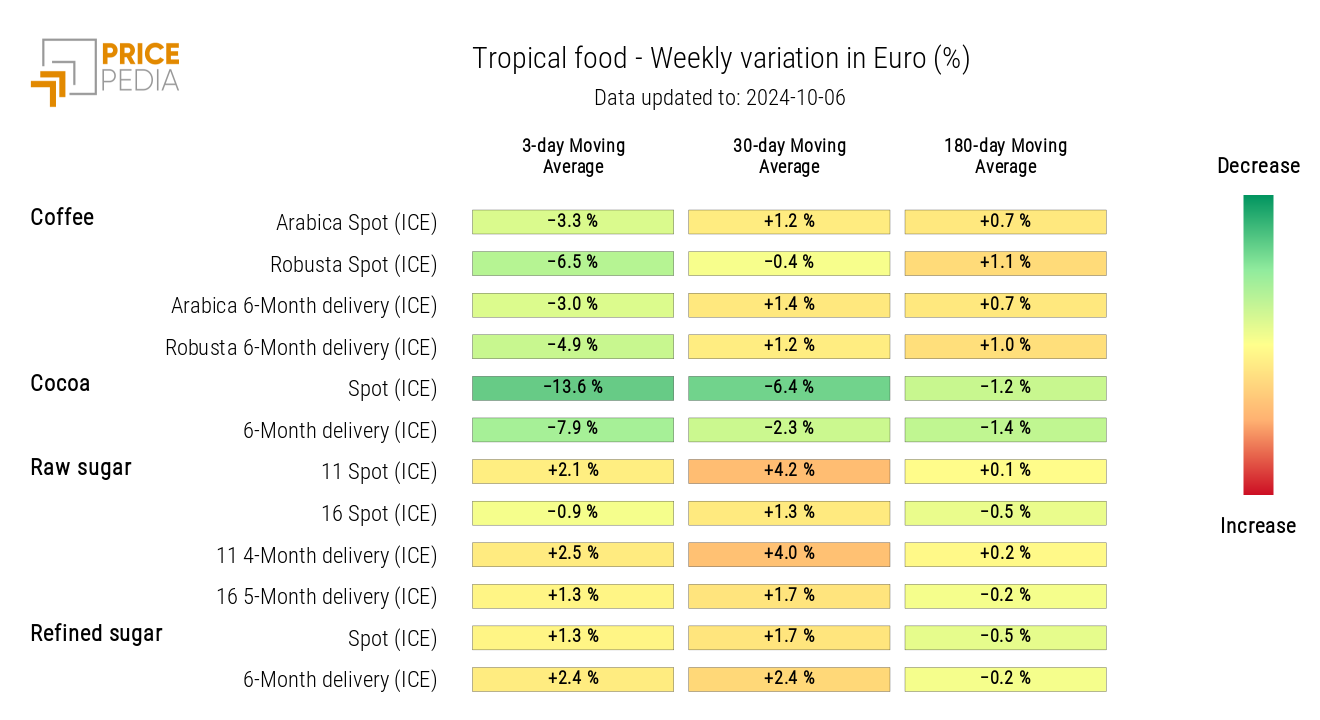

Tropical

The heatmap below highlights a significant decrease in the price of coffee and, especially, cocoa.

HeatMap of tropical food prices in euros

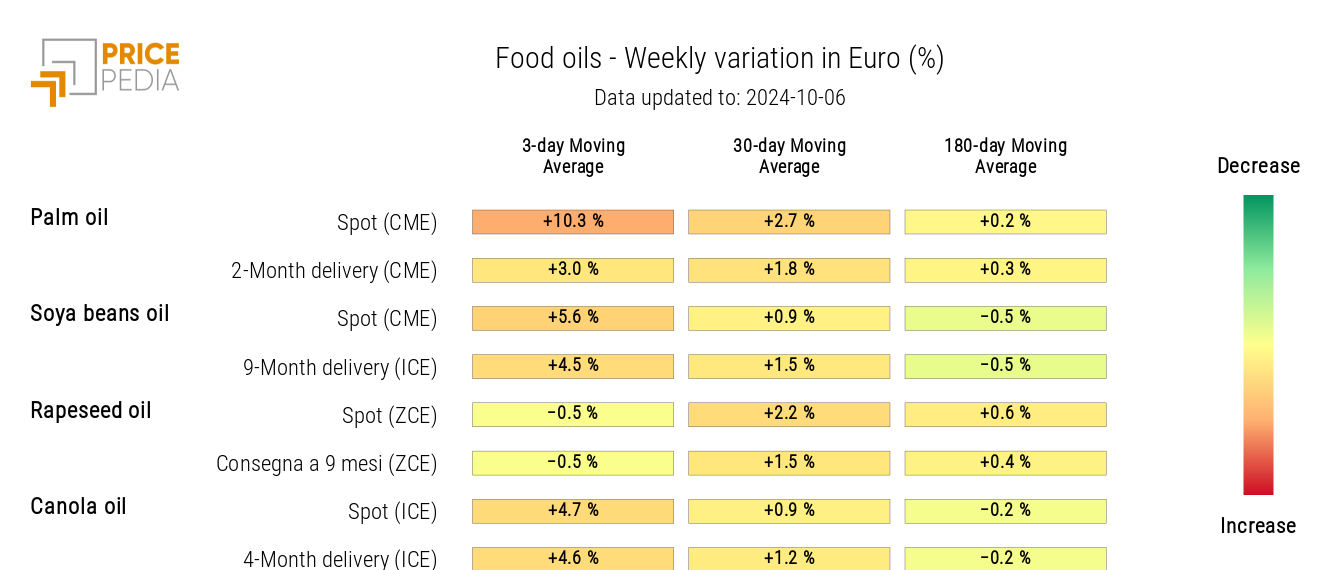

Oils

The increase in oil prices is widespread. However, the heatmap particularly highlights the significant growth of palm oil.

HeatMap of food oil prices in euros