Criticality of coking coal for European industry

Analysis of the issues that have made coking coal a critical raw material

Published by Luca Sazzini. .

Coal Critical raw materialsCoke, derived from coking coal, is one of the main production inputs for the steel industry, which absorbs about 90% of its total production. During the blast furnace process, coke plays crucial roles such as:

- reducing agent: the carbon in coke reacts with the oxygen in iron ore (iron oxide), reducing it to metallic iron, essential for steel production;

- heat source: the combustion of coke generates the necessary heat for iron melting;

- structural support: within the blast furnace, coke forms a porous and solid structure that supports the upper layers of iron ore and limestone, facilitating the passage of combustion gases and the circulation of heat for chemical reactions.

Due to the economic importance of coke, and thus its raw material coking coal within the steel industry, the European Union has included coking coal in its list of Critical Raw Materials.[1] Although the supply risk of coking coal is not among the highest in the list of critical raw materials, it should not be underestimated due to the high concentration of global exports in a few supplier countries.

This article explores the European Union's supply risk concerning coking coal, analyzing exports and their prices, including the pulverized but non-agglomerated variety (customs code: CN270112.10), which represents the most traded type within EU countries.

World Trade of Coking Coal

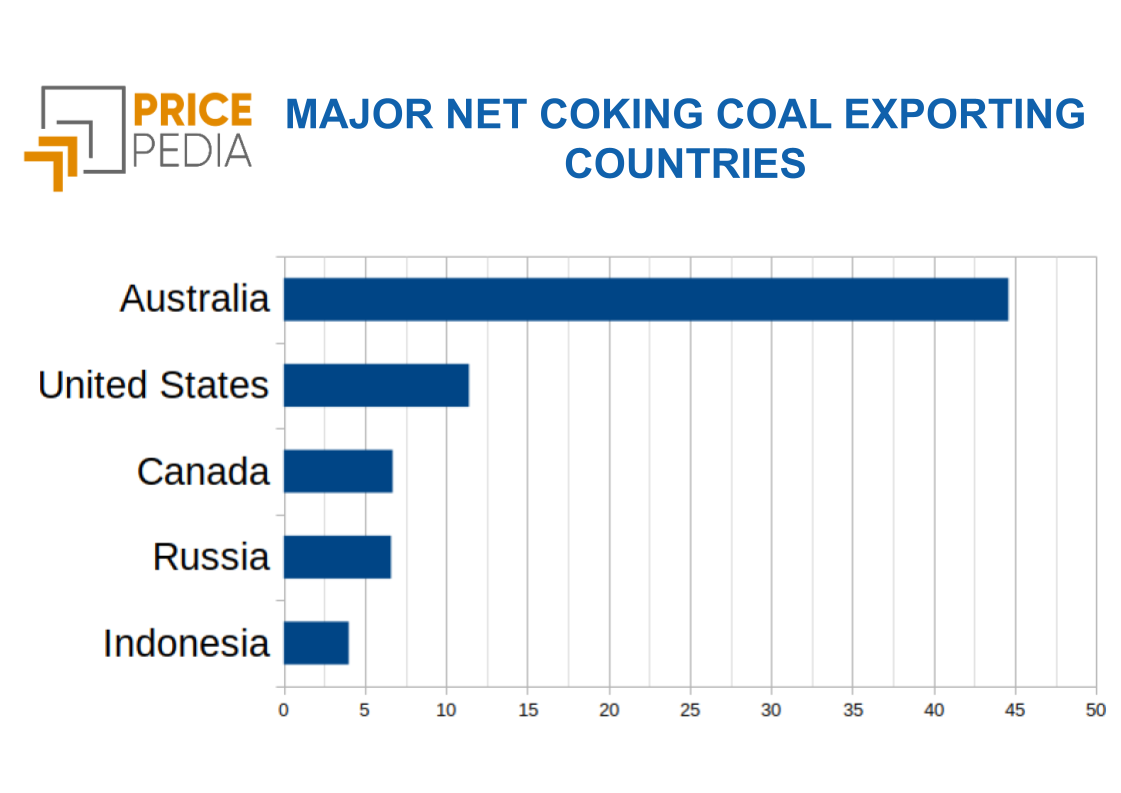

The following chart shows the top 5 net exporting countries of coking coal in 2023.

The chart analysis reveals that Australia alone accounts for nearly half of global coking coal exports. The United States follows as the second-largest net exporter, controlling a share slightly over 10%. Interestingly, although China is the world's largest producer of coking coal, it is not among the top net exporters; in fact, it is a net importer, representing over 10% of global imports due to its high consumption levels. Specifically, China ranks as the fourth largest net importer globally, after Japan, South Korea, and India.

The European Union is among the net importers of coking coal and is highly dependent on imports from Australia and the United States. In 2023, these two countries accounted for 80% of the EU's total coking coal imports.

The high concentration of supply in a few exporting countries poses a risk to the global supply of coking coal.

An abrupt change in coking coal exports by Australia would be enough to cause price turbulence in coking coal markets.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Analysis of Coking Coal Prices

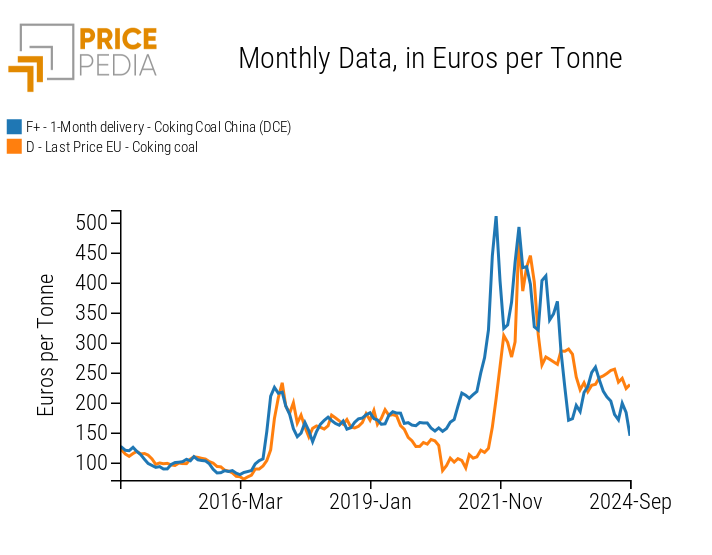

The following chart presents a comparison between the financial and physical prices of coking coal.

The financial price refers to the coking coal quoted on the Dalian Commodity Exchange (DCE), while the physical price refers to the customs price observed at the customs of the 27 EU countries.

Comparison between financial and physical prices of coking coal

The financial prices of coking coal seem to anticipate the price dynamics observed at European customs, showing a strong interconnection between the financial market and the European regional market. The correlation between the two time series from July 2013 to December 2023 is 0.79 out of a maximum of 1. Recently, however, coking coal prices have started to diverge, with financial prices showing a decrease and European customs prices remaining relatively stable. This has significantly lowered the correlation between the two prices, which has dropped to 0.43 from the beginning of the year to date.

Strategies to Reduce Coking Coal Usage

To reduce its dependence on imports from Australia and the United States, the European Union is adopting various strategies to decrease the consumption of coking coal, including:

- Powdered Coal Injection (PCI): which significantly reduces production costs by cutting coal use in steel production by 30%;

- use of natural gas and hydrogen: through innovative techniques like the Hisarna process, which limit the use of coking coal;

- increasing the use of scrap metal: to reduce the demand for primary steel and, through this channel, the use of coking coal in the primary supply chain;

- use of shredded recycled plastics in coking coal blends: to partially replace coking coal use.

The PCI technique is already widely used within the EU, and the European industry has already reached the technical limits for coking coal replacement. This method presents the disadvantage of compromising the quality standards required for steel production, limiting its application beyond a certain threshold.

Another technique already employed, with little room for further improvement, is the use of shredded recycled plastics in coking coal blends.

Their use should be limited to 1-2% of the overall product mix to avoid compromising quality.

In the coming years, the main improvement margins for the European steel industry will focus on adopting natural gas and hydrogen technologies as alternative reducing agents to coking coal and strengthening the recycling market for steel products. However, implementing these new technologies will require reducing production costs within the EU for both raw materials.

Conclusions

The criticality of coking coal for the European Union stems from its economic importance as an essential production input for the metallurgical industry.

This criticality is also linked to the concentration of global supply in a few exporting countries, with Australia alone holding nearly 50% of global coking coal exports.

The physical prices observed at European customs have shown a similar trend to financial prices, although they have not followed the same downward trend recently.

The EU is currently adopting various strategies to limit the use of coking coal, but significant improvements are still possible in boosting the recycling market and replacing coking coal with natural gas and hydrogen as reducing agents.

[1] See the article: Critical Raw Materials: the importance of substitutes.

In international trade, the "critical" product is coking coal and not coke, as transforming coking coal into coke is more economical near steel plants, given the higher transportation challenges and costs of the latter.