Uncertainty over Chinese recovery interrupts rise in financial commodity prices

China's National Development and Reform Commission (NDRC) meeting disappoints financial markets

Published by Luca Sazzini. .

Conjunctural Indicators Commodities Financial WeekWeekly Summary of Financial Commodity Prices

In last week's article: “Week of General Rise in Financial Commodity Prices”, a generalized increase in the financial prices of raw materials was reported. Announcements of new stimulus measures for the Chinese economy positively impacted the prices of industrial metals, which experienced significant rises.

After the end of the Chinese Golden Week, financial markets anticipated new stimulus announcements for the meeting of the National Development and Reform Commission (NDRC) on Tuesday, October 8.

The speech by Zheng Shanjie, the head of the National Development and Reform Commission (China's main economic planning body), did not meet market expectations for further fiscal stimulus to boost domestic demand recovery.

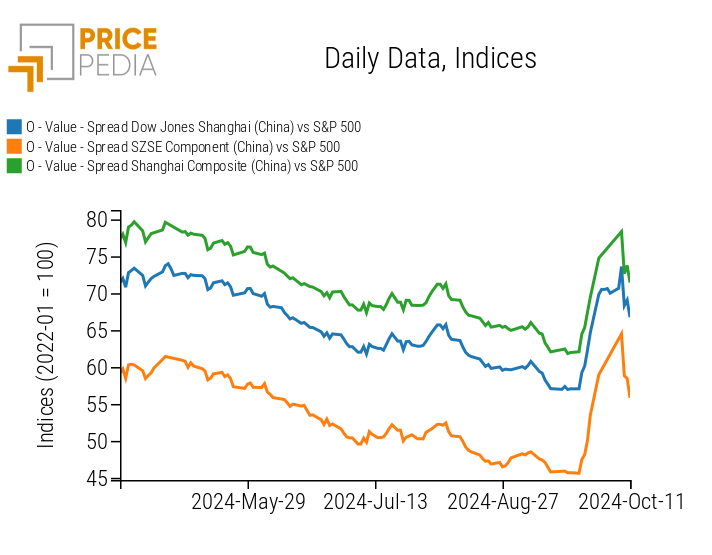

The dynamics of the three indices of Chinese stock markets clearly document the change in expectations that occurred between Tuesday, October 8, and Wednesday, October 9.

Chinese Stock Market Indices

The lack of clarity on how China can pursue its ambitious economic growth expectations has also raised concerns among speculators in the commodity financial markets, who have reduced their exposure in the metals market due to worries about weak Chinese demand.

This week, general reductions in prices were recorded for both ferrous and non-ferrous metals.

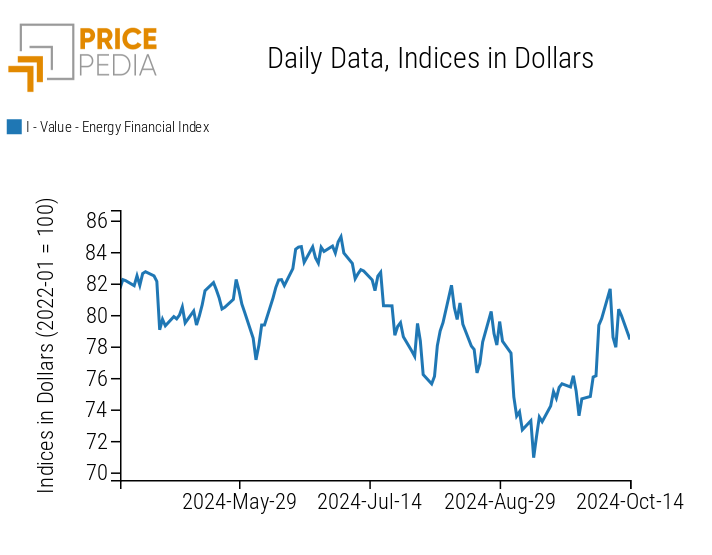

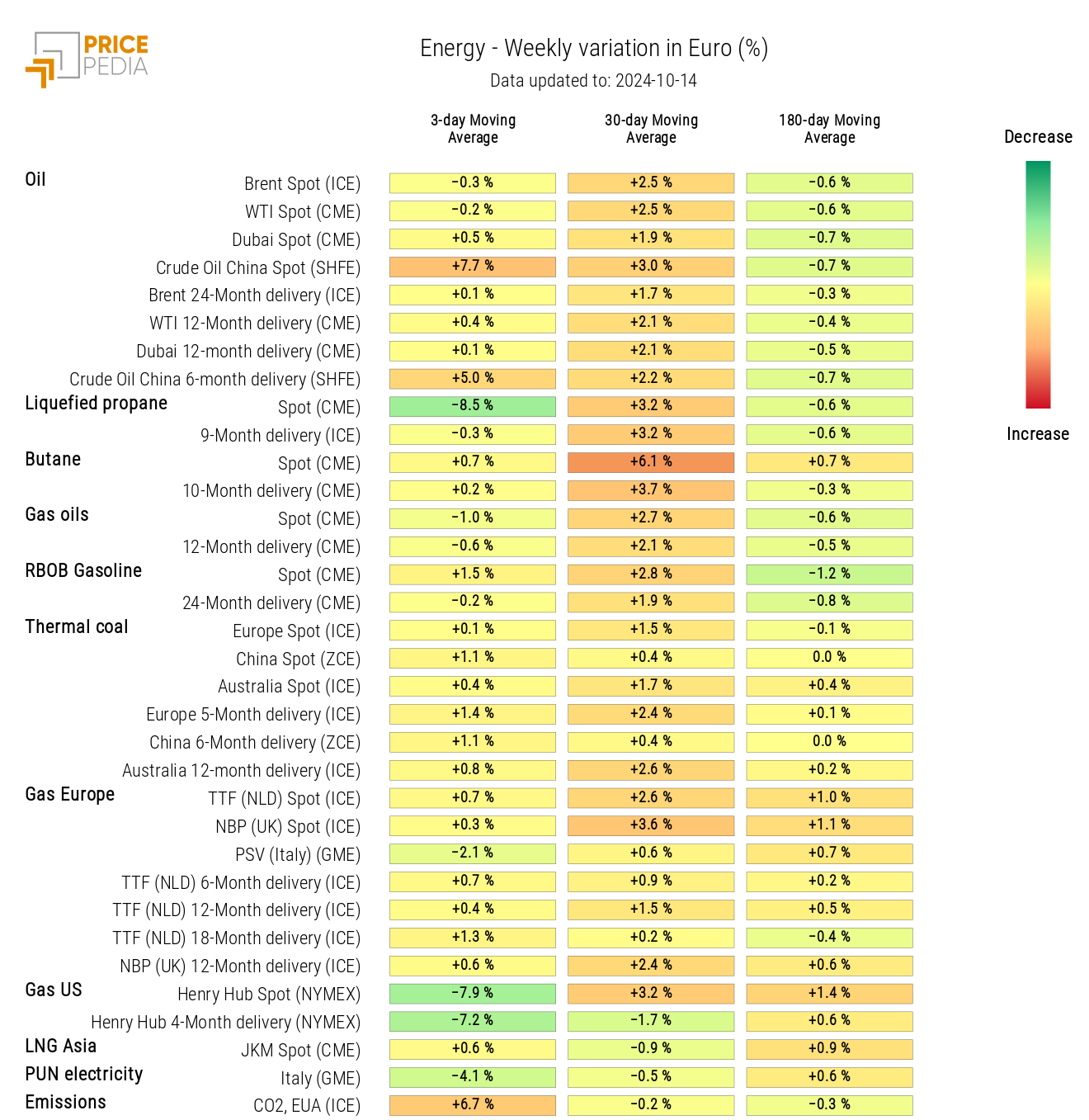

The disappointment from the NDRC meeting, in addition to negatively impacting metal prices, also affected energy commodity prices due to concerns about weak oil demand from China. However, after an initial decline in energy prices, a rebound was observed due to geopolitical tensions and the presence of Hurricane Milton, which temporarily blocked some oil platforms in the United States.

Despite President Joe Biden discouraging Israel from planning an attack on Iran's oil infrastructure, financial markets remain highly concerned about a possible Israeli retaliation following the missile attack launched by Iran against Israel last week.

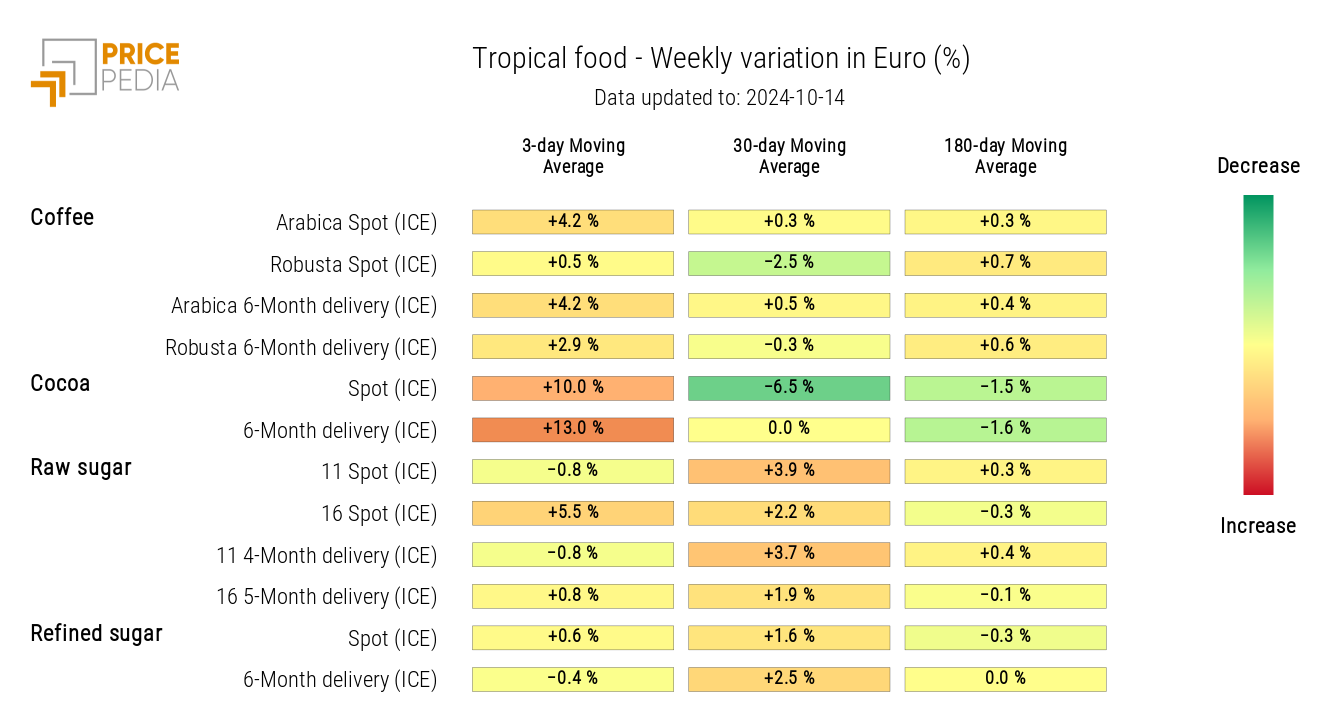

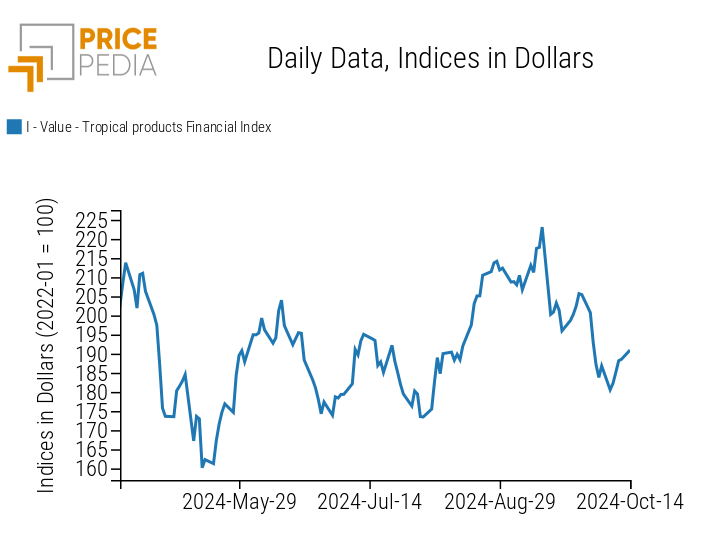

In the food market, there was a recovery in cocoa prices, driven by adverse weather conditions that compromised the harvest in Ivory Coast. In recent days, heavy rains in the western regions of Ivory Coast have hindered the harvesting, drying, and transportation of cocoa beans. Analysts anticipate a decrease in both the quantity and quality of cocoa exported.

US Inflation

The data on the Consumer Price Index (CPI) revealed that US inflation in September grew above expectations, for both the headline and core indices.

The dynamics of the US CPI remained unchanged month-on-month, recording a growth of 0.2% m/m, against expectations of a slowdown to 0.1% m/m. On a year-on-year basis, the headline CPI dropped from 2.5% to 2.4%, slightly above analysts' expectations of 2.3% y/y.

The core index's dynamics, which excludes its most volatile components (energy and food), also remained unchanged month-on-month, with a growth rate of 0.2% m/m, against expectations of 0.1% m/m. On a year-on-year basis, there was an unexpected worsening from 3.2% to 3.3% y/y.

The lack of deceleration in inflation is attributed to an unexpected increase in food prices, which registered a monthly acceleration from 0.1% m/m to 0.4% m/m. Data concerning housing services, on the other hand, pleasantly surprised analysts, registering a deceleration in inflation month-on-month from 0.5% m/m to 0.2% m/m.

Overall, the inflation data for September suggests a more contained interest rate cut by the FED compared to the one that occurred last month. For the meeting on November 6-7, analysts expect the FED to cut interest rates by 25 basis points, the same expected for the ECB meeting next week.

ENERGY

The PricePedia financial index for energy has recorded significant fluctuations throughout the week.

PricePedia Financial Index for Energy Prices in Dollars

The energy heatmap highlights a reduction in prices for liquefied propane, US natural gas, and the Italian PUN (National Single Price).

The heatmap also indicates a price increase for oil in China.

HeatMap of Energy Prices in Euros

PLASTICS

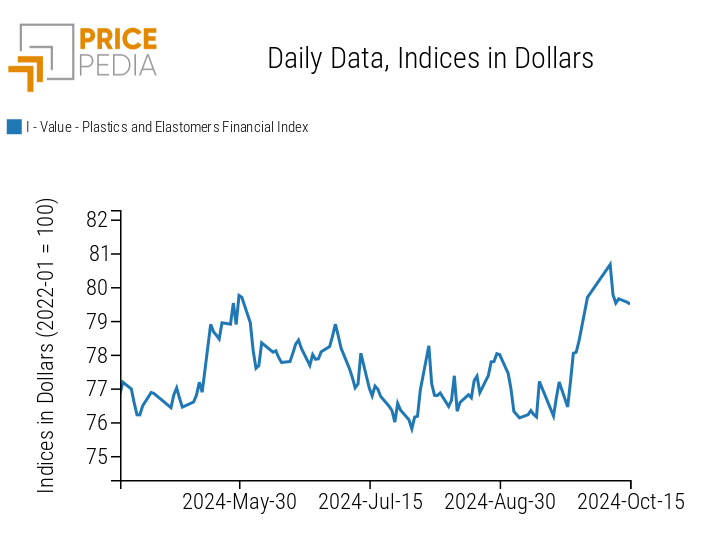

The PricePedia index for financial prices of plastics and elastomers has reversed its upward trend due to the decline in natural rubber prices.

PricePedia Financial Indices for Plastic Prices in Dollars

FERROUS

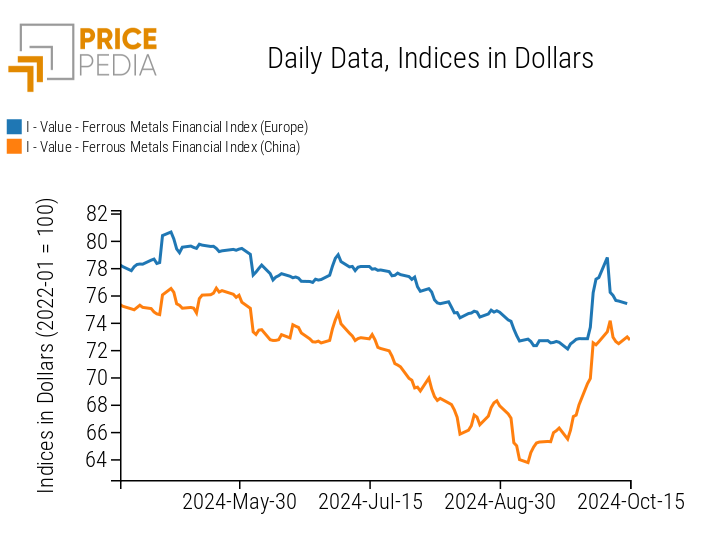

The financial indices for ferrous metals are registering a downward shift due to the disappointments of financial operators regarding the NDRC meeting.

PricePedia Financial Indices for Ferrous Metal Prices in Dollars

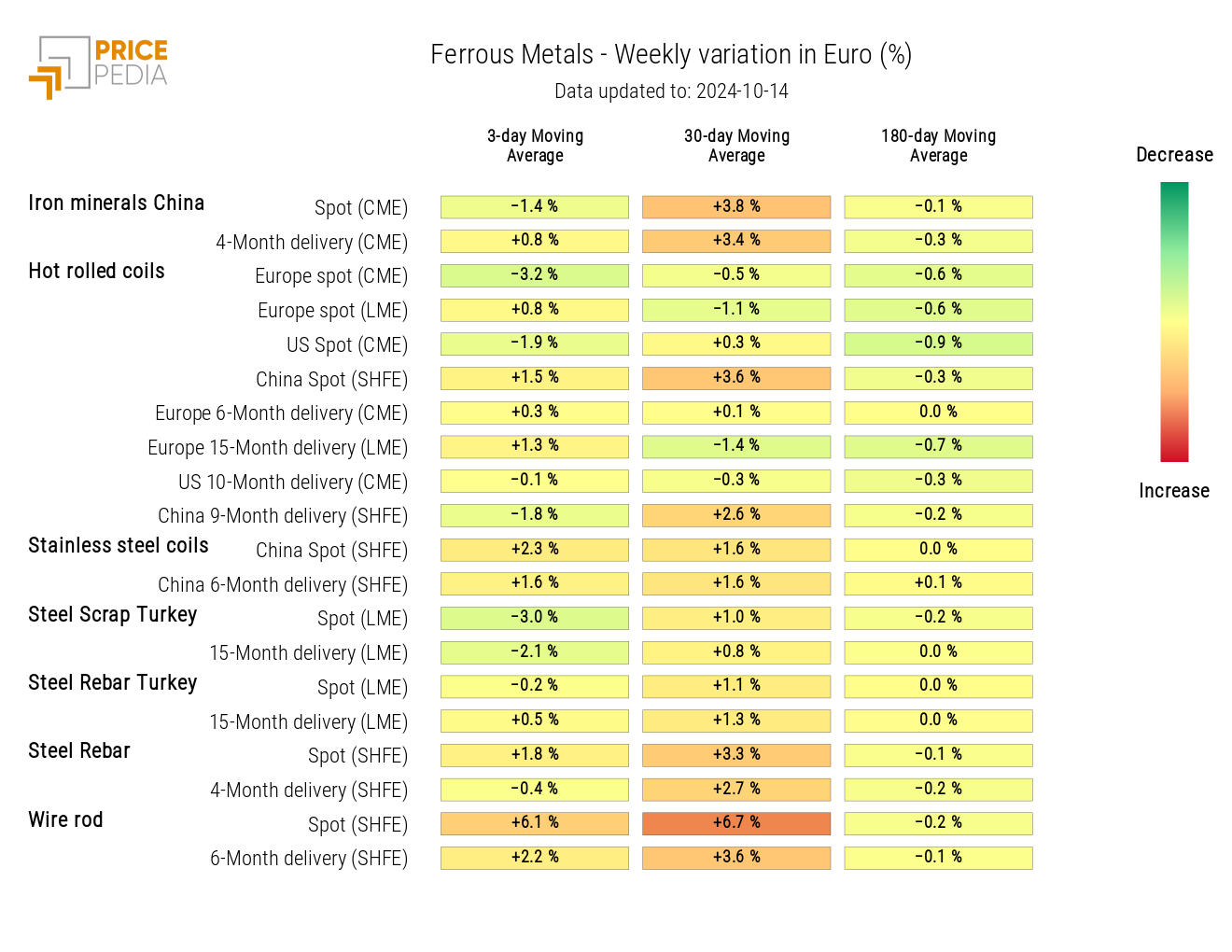

From the analysis of the ferrous heatmap, there is a reduction in prices for steel scrap from Turkey, iron ore from China, and hot coils from Europe and the United States quoted at the Chicago Mercantile Exchange (CME), against a rise in the price of rebar.

HeatMap of Ferrous Prices in Euros

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

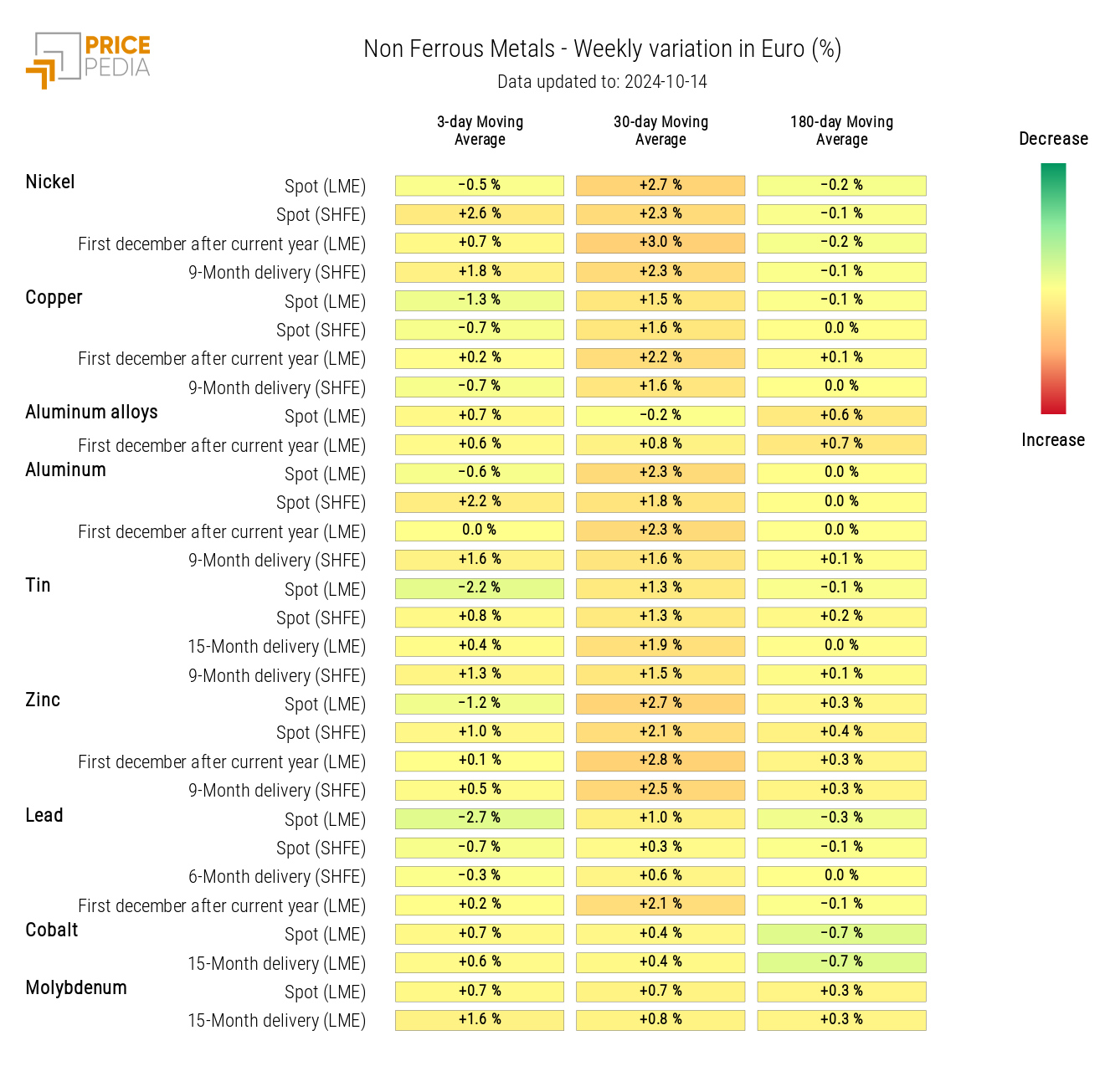

INDUSTRIAL NON-FERROUS METALS

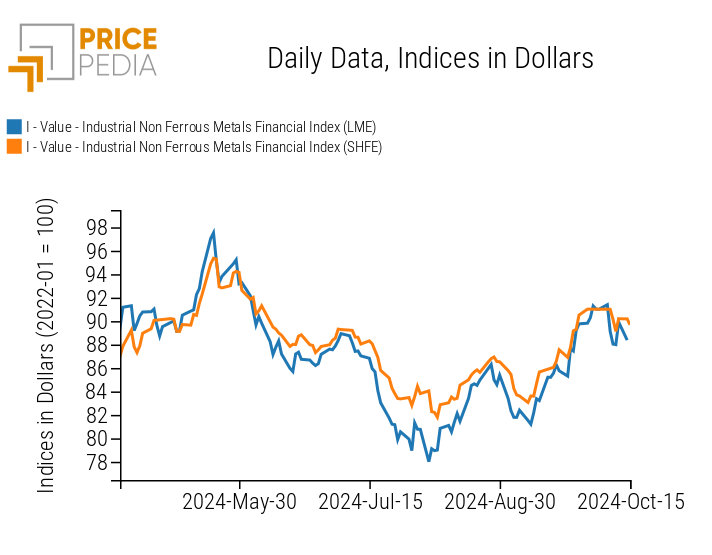

Both financial indices for non-ferrous metals indicate a decline in prices, more pronounced on the London Metal Exchange (LME).

PricePedia Financial Indices for Non-Ferrous Industrial Metals Prices in Dollars

The heatmap below indicates that this week there was a general decline in prices for the main base metals quoted on the London Metal Exchange (LME).

HeatMap of Non-Ferrous Prices in Euros

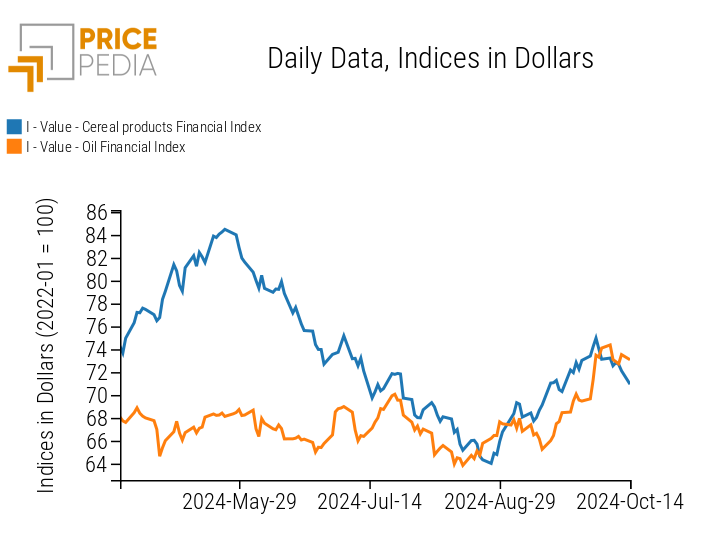

FOOD PRODUCTS

The financial indices for cereals and edible oils are getting closer together, reaching the same levels, while the index for tropical products rises due to the increase in cocoa prices.

| PricePedia Financial Indices for Food Prices in Dollars | |

| Cereals and Oils | Tropical Products |

|

|

Tropical Products

The heatmap below highlights in red the weekly growth of the three-day moving average of cocoa prices due to excessive rainfall that has damaged the harvest in Côte d'Ivoire.

HeatMap of Tropical Food Prices in Euros