PricePedia Scenario for October 2024

Conflicting factors driving the price Dynamics of purchasing materials over the next 24 months

Published by Pasquale Marzano. .

Forecast ForecastThe PricePedia Scenario has been updated with the information available as of October 7, 2024. Compared to the previous publication, the price dynamics of core industrial commodities have been slightly revised upward, due to the combined effect of phenomena exerting opposing pressures: on the one hand, there is a worsening of the manufacturing sector; on the other hand, there is a price growth effect linked to:

- financial market expectations, especially for non-ferrous metals, which are anticipating future increases tied to demand-supporting measures recently announced by the Chinese government, although with some uncertainties highlighted in the article Uncertainty over Chinese recovery interrupts rise in financial commodity prices;

- greater certainty of the implementation of an expansionary monetary policy by central banks, thanks to ongoing disinflation (especially in Europe).

The deterioration of the manufacturing sector can be observed in the global industrial production dynamics, which shows lower growth rates than the previously published scenario: in 2024, an annual increase of +1.2% is expected, down from +1.7% in the September scenario.

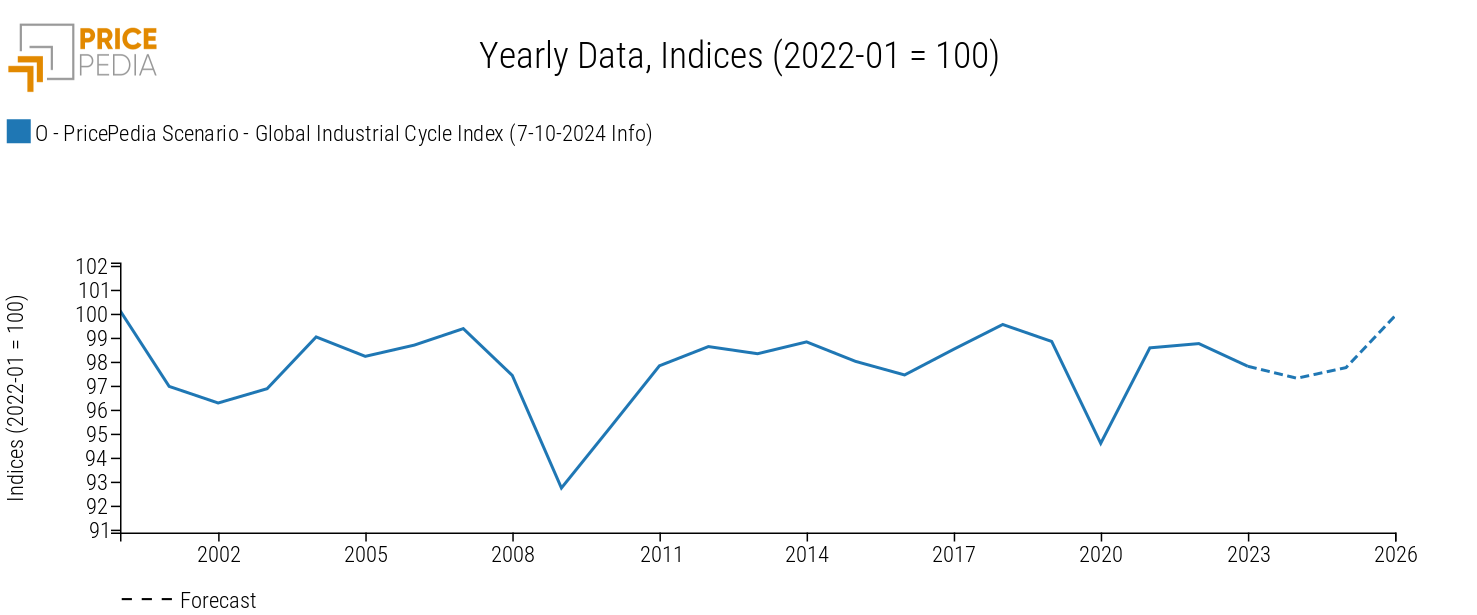

This trend impacts the dynamics of the global industrial cycle[1], for which the following graph is provided.

In the annual average for 2024, the industrial cycle is expected to register a decrease of -0.5% compared to the 2023 average values. As for 2025, the expected growth of the industrial cycle is +0.45%, down from the +1.1% of the previous scenario.

A stronger growth, linked to the transfer of the effects of expansionary monetary policies to the real economy, is postponed to 2026, when the index is expected to register a variation of more than +2% compared to the 2025 average values.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

The Price Forecast for Purchasing Materials

Regarding the prices of purchasing materials, the combined effects of the phenomena described above are uncertain and depend on the specific products considered.

Below is the table of annual price changes in euros in terms of main commodity aggregates (Industrial[2], Total Commodity[3], and Total Energy).

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| I-PricePedia Scenario-Commodity Index (Europe) (7-10-2024 Info) | −18.47 | −4.54 | −1.29 |

| I-PricePedia Scenario-Industrials Index (Europe) (7-10-2024 Info) | −13.86 | −3.64 | +3.95 |

| I-PricePedia Scenario-Energy Total Index (Europe) (7-10-2024 Info) | −23.91 | −6.65 | −6.43 |

In the case of Total Commodity, euro prices are expected to fall by -4.5% in 2024, in line with the previously published scenario. In 2025, the expected decline is less intense, at -1.3%.

As for the prices of energy commodities, the expected reductions are more intense than previously published and exceed -6%.

The combined effects on Industrial commodities are relatively positive: in 2024, euro prices are expected to decrease by around -3.6%, less intense than the -4% of the previous scenario. Similarly, the expected growth for 2025 is more significant, almost reaching +4%, bringing industrial commodity prices back to 2023 levels.

Conclusions

The forecast scenario described here presents the average values of the various indices with the highest probability of materializing. However, at this stage, the uncertainty related to the scenario is very high. This suggests that both a higher price growth dynamic and a more significant price decline are equally possible, although less probable. In this context, the forecasting tool has some limitations. These can be overcome by integrating the forecast scenario with measures of market risks associated with each commodity.

One factor generating high uncertainty is the outcome of the upcoming U.S. elections. The proposal by Republican candidate Donald Trump to increase tariffs on China by 60% and by 10% on other countries would lead to a progressive reduction in trade, especially between the U.S. and China. Based on what has already happened with steel[4], the lower sales in the U.S. market would result in an increase in Chinese supply to other world markets, primarily Europe. This would create further downward pressure on commodity prices, at least in the short to medium term.

1. The global industrial cycle index is constructed by purifying the actual dynamics of industrial production from its trend. Since the supply of commodities tends to vary according to long-term economic growth expectations, while the demand for commodities is more linked to actual cyclical uses, the global industrial cycle index tends to reproduce the conditions of tension between demand and supply on the commodity market: when it increases, it means that the demand for commodities increases more than the supply; vice versa when it decreases.

2. The PricePedia Industrials index results from the aggregation of the indices relating to the following product categories: Ferrous, Non-Ferrous, Wood and Paper, Chemicals: Specialty, Organic Chemicals, Inorganic Chemicals, Plastics and Elastomers and Textile Fibres.

3. The PricePedia Commodity index results from the aggregation of the indices relating to industrial, food and energy commodities. 4. For further details, see Protectionist policies: the case of steel tariffs