Concerns about weak commodity demand and falling prices

Financial market uncertainty pushes gold prices to new highs

Published by Luca Sazzini. .

Conjunctural Indicators Commodities Financial WeekWeekly Summary of Commodity Financial Prices

In last week’s article: “Uncertainty over Chinese recovery interrupts rise in financial commodity prices” the focus was on the financial markets’ disappointment due to the absence of new stimuli announced by China during the National Development and Reform Commission (NDRC) meeting.

Last weekend, the Chinese Ministry of Finance promised further support for the real estate market and struggling private companies. However, once again, the expected new stimulus measures were not presented to investors. Despite the government's efforts to reassure markets, the lack of clarity regarding any provisions fueled the downward trend in industrial metal prices.

The financial markets' disappointment with the lack of new economic stimuli also contributed to the recent decline in oil prices and its derivatives. There remains strong concern about the weakness of oil demand from China. This week, both the International Energy Agency (IEA) and OPEC+ revised down their forecasts for future oil demand. Growing pessimism about demand prospects further pushed down oil financial prices, which were also influenced by the recent statement from the Israeli government. Israel reassured the United States, declaring that it would not attack Iranian oil and nuclear infrastructures. This announcement reassured, at least in the very short term, the oil financial markets, which continued their downward trend.

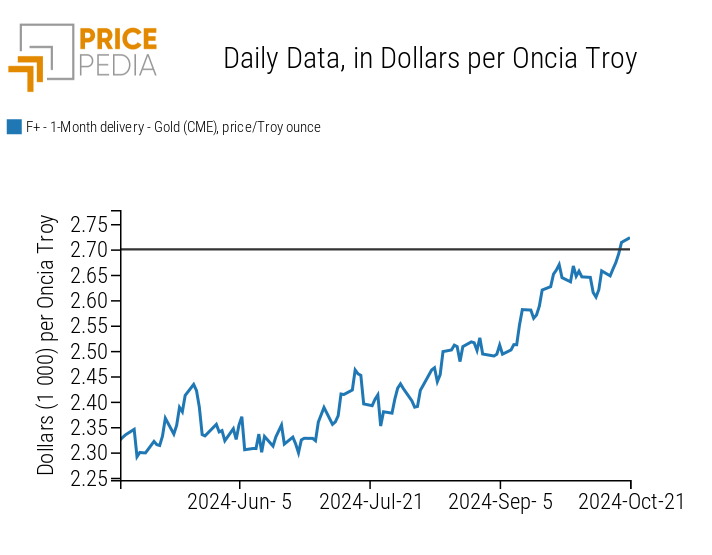

A product that continues to stand out from the general commodity trend is gold, which, as a safe-haven asset, is demanded for entirely different reasons compared to other commodities.

Below is the trend of spot gold prices quoted on the Chicago Mercantile Exchange (CME).

CME Gold Financial Prices, expressed in $/Troy Ounce

The analysis of the chart shows the strong upward trend in gold prices, which have exceeded the level of $2,700 per ounce. This growth is primarily attributable to the increase in geopolitical risks, with Israel continuing its war and, this week, declaring that it has killed Hamas leader Yahya Sinwar.

ECB Rate Cut

In the October 17 meeting, the European Central Bank (ECB) cut interest rates by 25 basis points, as widely anticipated by analysts. The decision was unanimous and made to support the European economy.

The deposit rate is now set at 3.25%, the refinancing operations rate at 3.4%, and the marginal refinancing rate at 3.65%.

For the December meeting, the ECB will continue to maintain a data-driven approach, although the market and analysts have already begun pricing in a further rate cut.

The new forecasts expect inflation to sustainably return to target during 2025, rather than by the end of this year as previously announced.

Decline in Eurozone Inflation

The new Consumer Price Index (CPI) data signaled a slowdown in inflation growth in September.

The September figure stands at 1.7%, against analysts’ forecasts of 1.8%. This is down from the previous month's 2.2% and a sharp decline compared to the same period last year (4.3%).

China GDP

The Chinese GDP data for the third quarter of 2024 recorded growth of 0.9% q/q, compared to 0.5% q/q in the previous quarter. September data signaled an improvement in production, consumption, and investment.

On a year-over-year basis, the economy slowed from 4.7% y/y to 4.6% y/y due to an unfavorable comparison, with deceleration in the industrial sector (from 5.6% y/y to 4.6%) and the agricultural sector (from 3.6% y/y to 3.2%).

The real estate sector remains a very weak sector for China, but a reduction in the contraction of investments is expected.

The new support measures announced by the Chinese government will support a recovery next year, but they are unlikely to have a significant impact starting from the last quarter of this year.

At the moment, there is still considerable uncertainty about the new fiscal stimuli promised by China, and recent interest rate cuts alone are not enough to drive a rapid recovery in domestic demand.

ENERGY

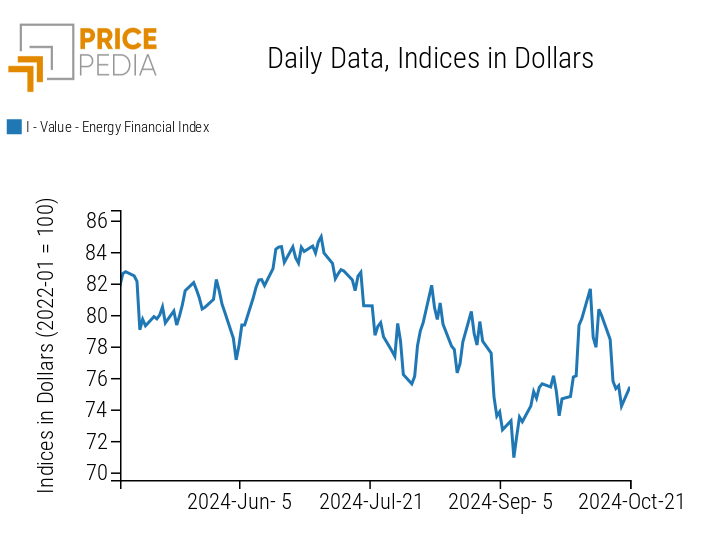

The PricePedia energy financial index registers a strong weekly decline in energy prices.

PricePedia Financial Index of Energy Prices in Dollars

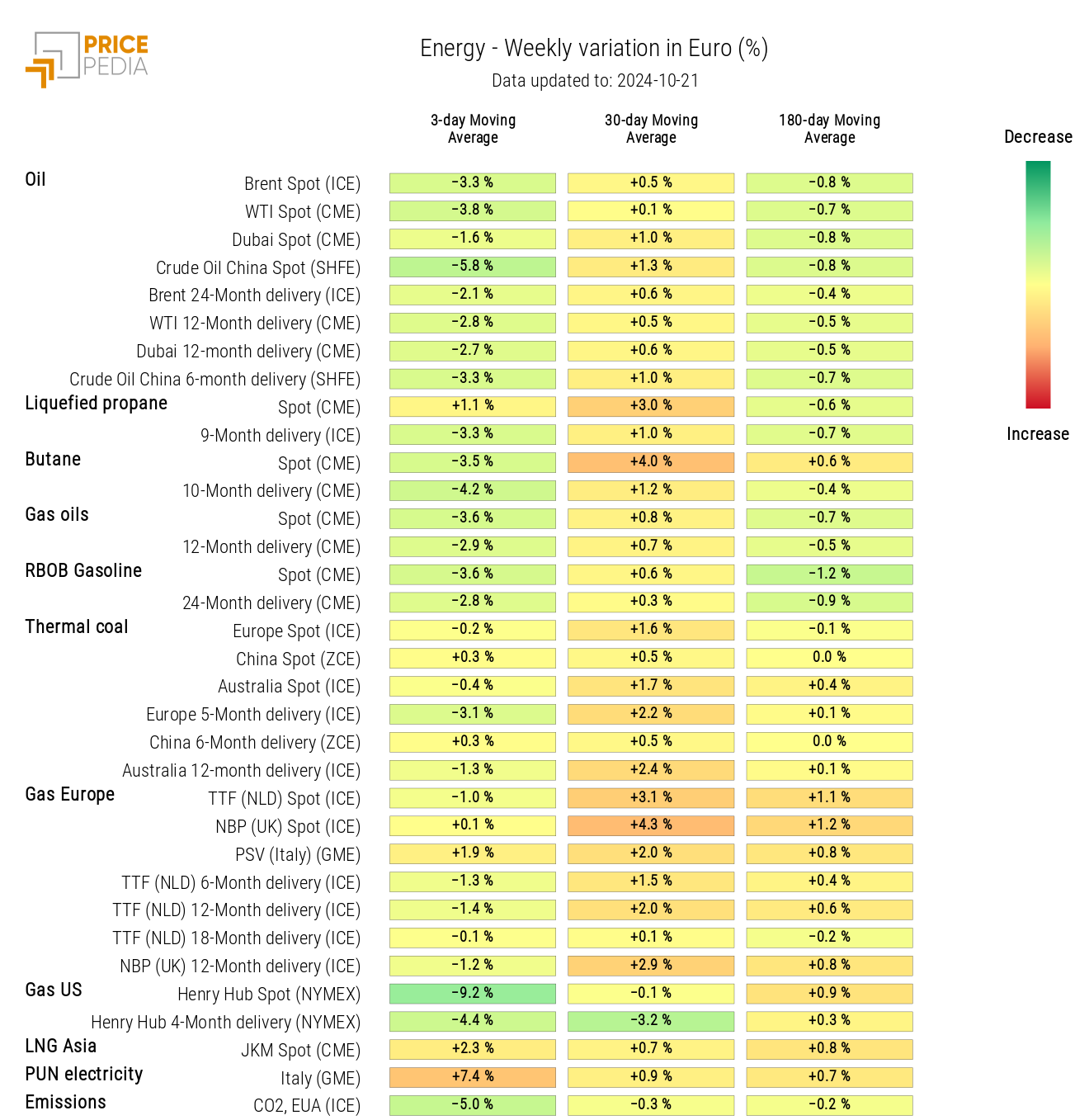

The energy heatmap highlights a generalized decline in oil and its derivatives prices, alongside a rise in the PUN price, due to the different levels of midweek prices.

Energy Price HeatMap in Euros

PLASTICS

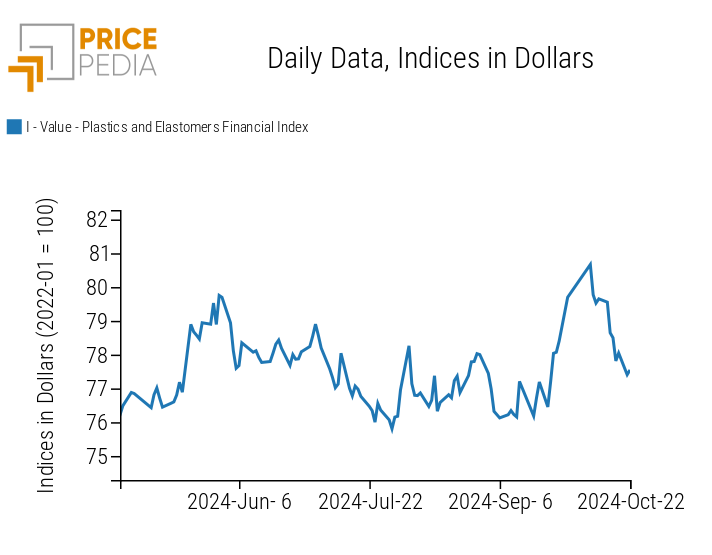

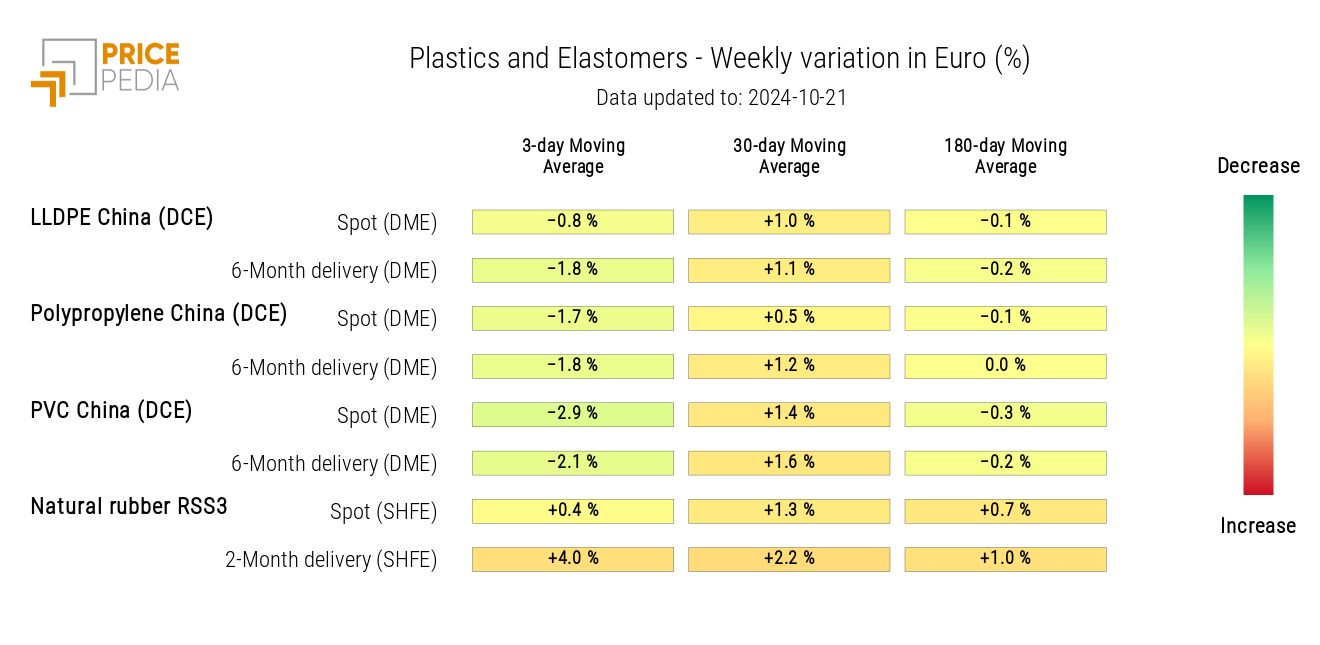

The PricePedia index of financial prices for plastics and elastomers continues its downward trend, almost completely erasing previous increases.

PricePedia Financial Indices of Plastics Prices in Dollars

The heatmap below indicates a weekly reduction in the three-day moving average of financial prices for thermoplastics.

Plastics and Elastomers Price HeatMap in Euros

FERROUS METALS

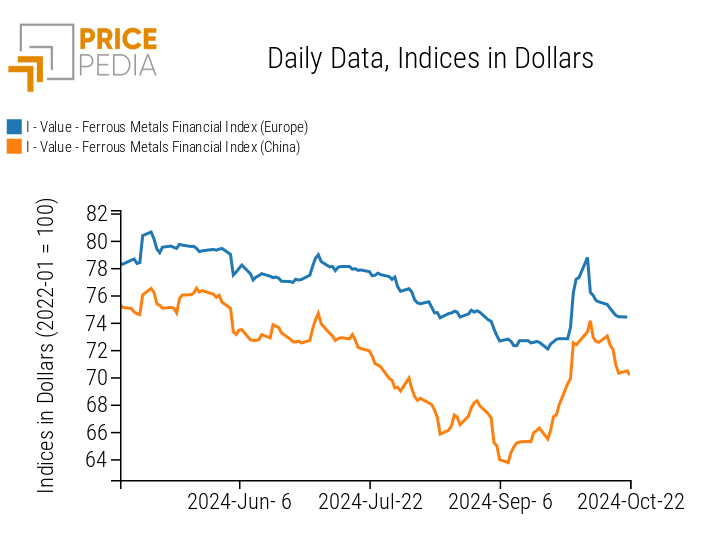

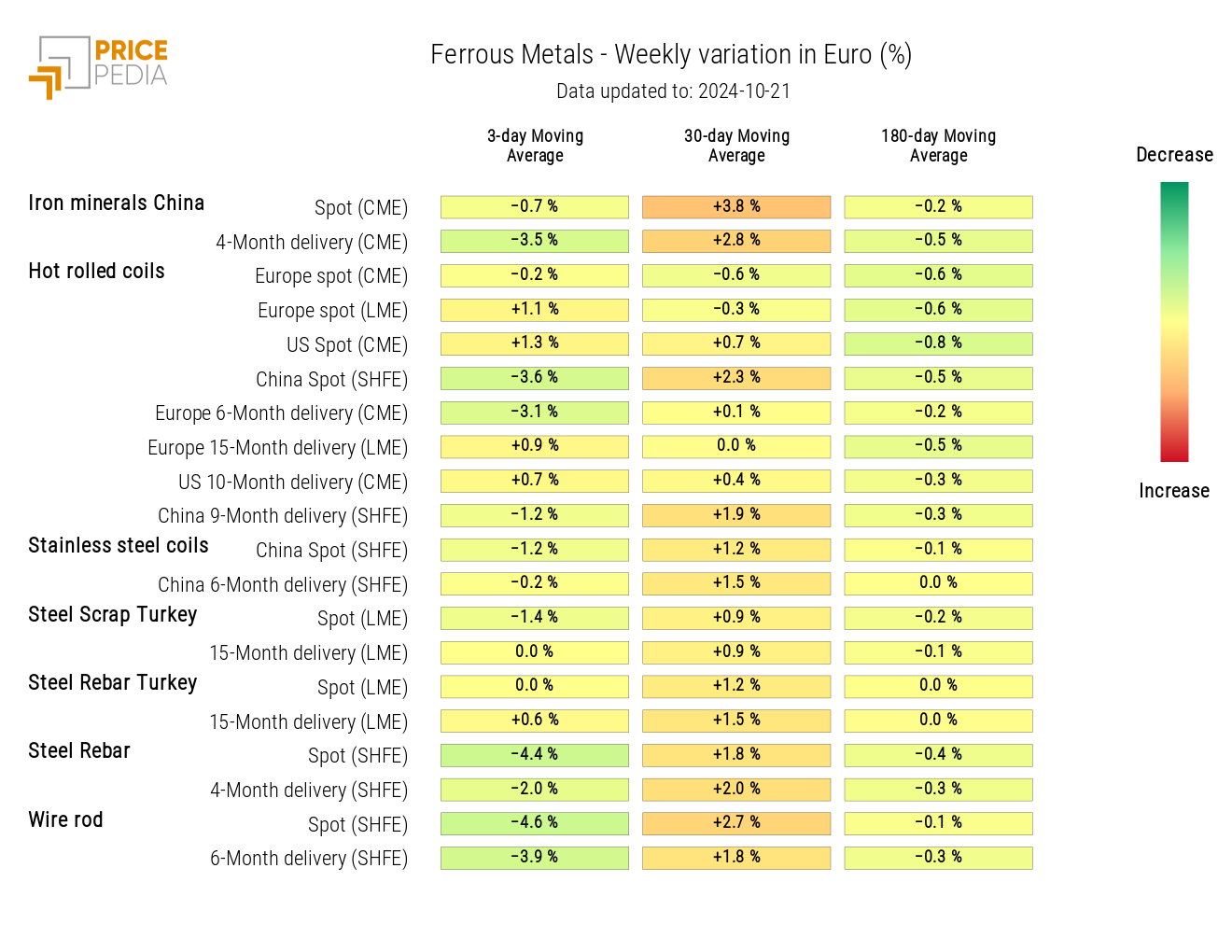

The reduction in ferrous metal prices continues, more pronounced for the China index compared to Europe.

PricePedia Financial Indices of Ferrous Metal Prices in Dollars

The analysis of the ferrous heatmap shows a decline in the prices of China hot-rolled coils and Shanghai wire rod.

Ferrous Metals Price HeatMap in Euros

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

INDUSTRIAL NON-FERROUS METALS

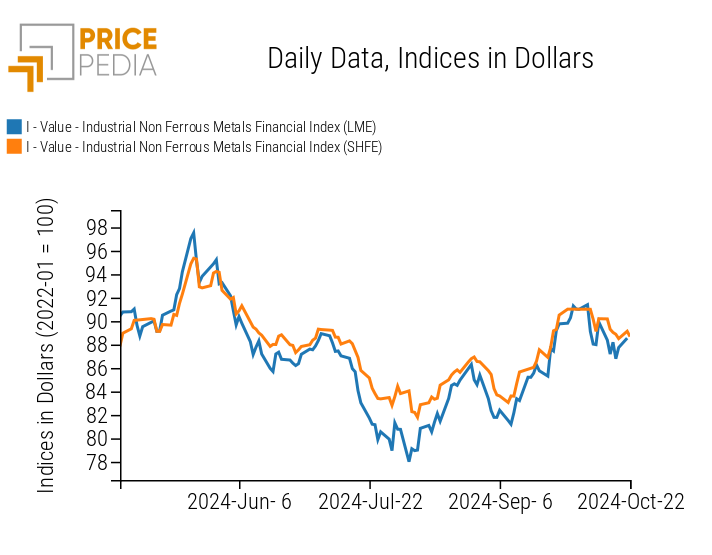

Over the past few days, the PricePedia indexes for the two major financial markets for nonferrous metals are showing a slight upward swing, but this does not still change the downward dynamic.

PricePedia Financial Indices of Industrial Non-Ferrous Metals Prices in USD

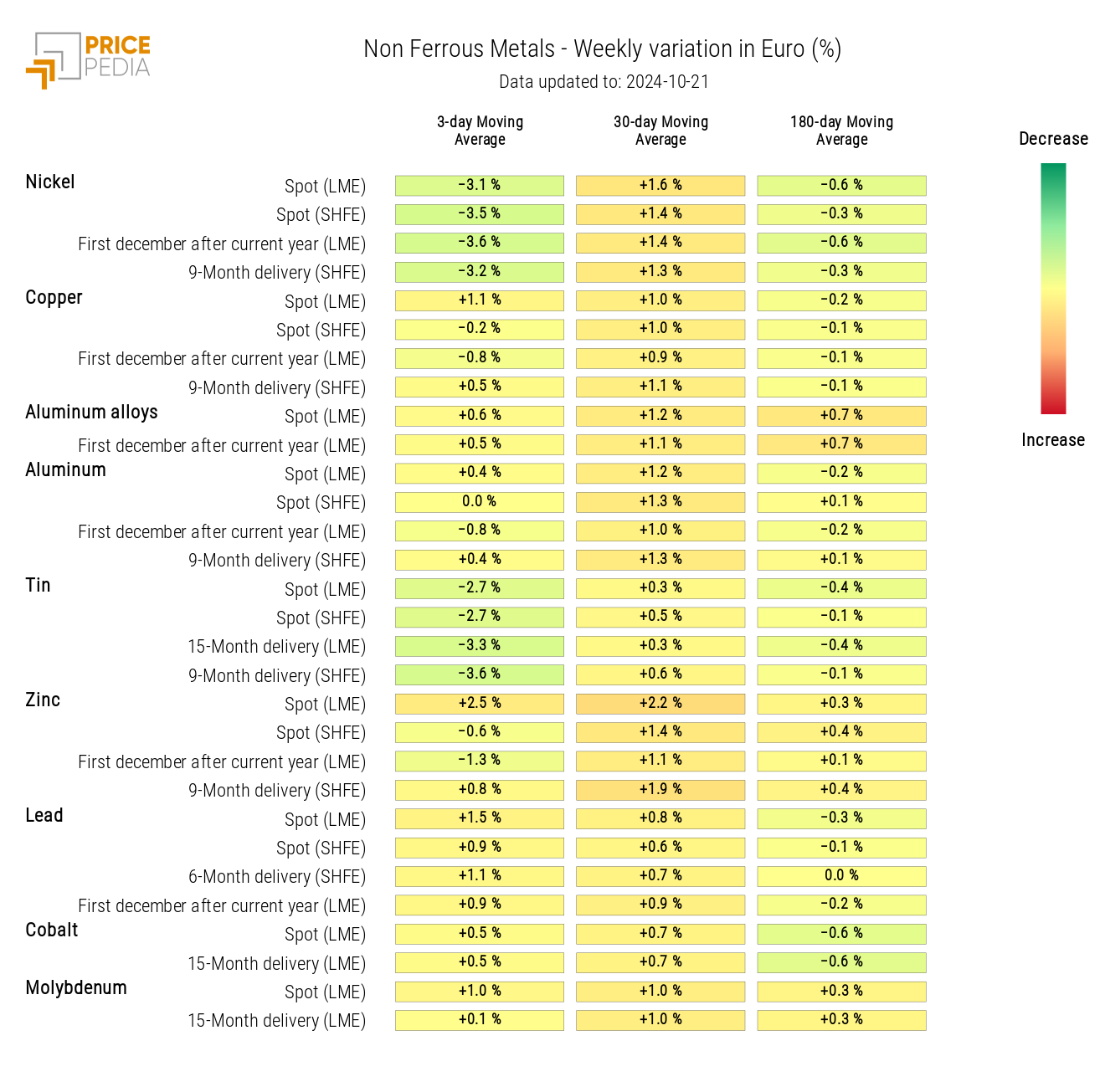

The heatmap below shows a more significant reduction in nickel and tin prices.

HeatMap of Non-Ferrous Metals Prices in EUR

FOOD PRODUCTS

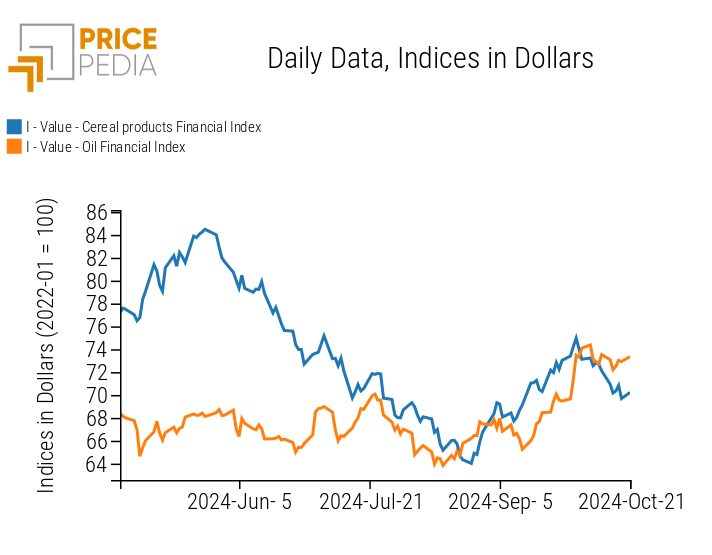

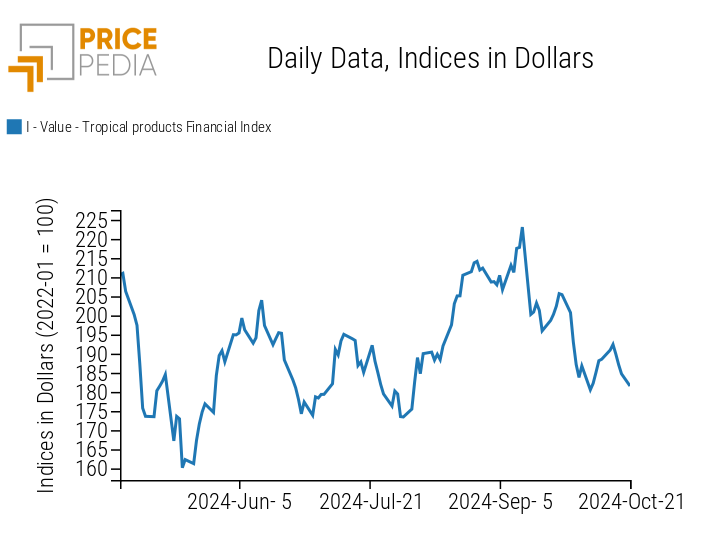

This week, financial indices for food products showed brief price fluctuations, with a sharper decline for tropical products.

| PricePedia Financial Indices of Food Products Prices in USD | |

| Grains and Oils | Tropical Products |

|

|

CEREALS

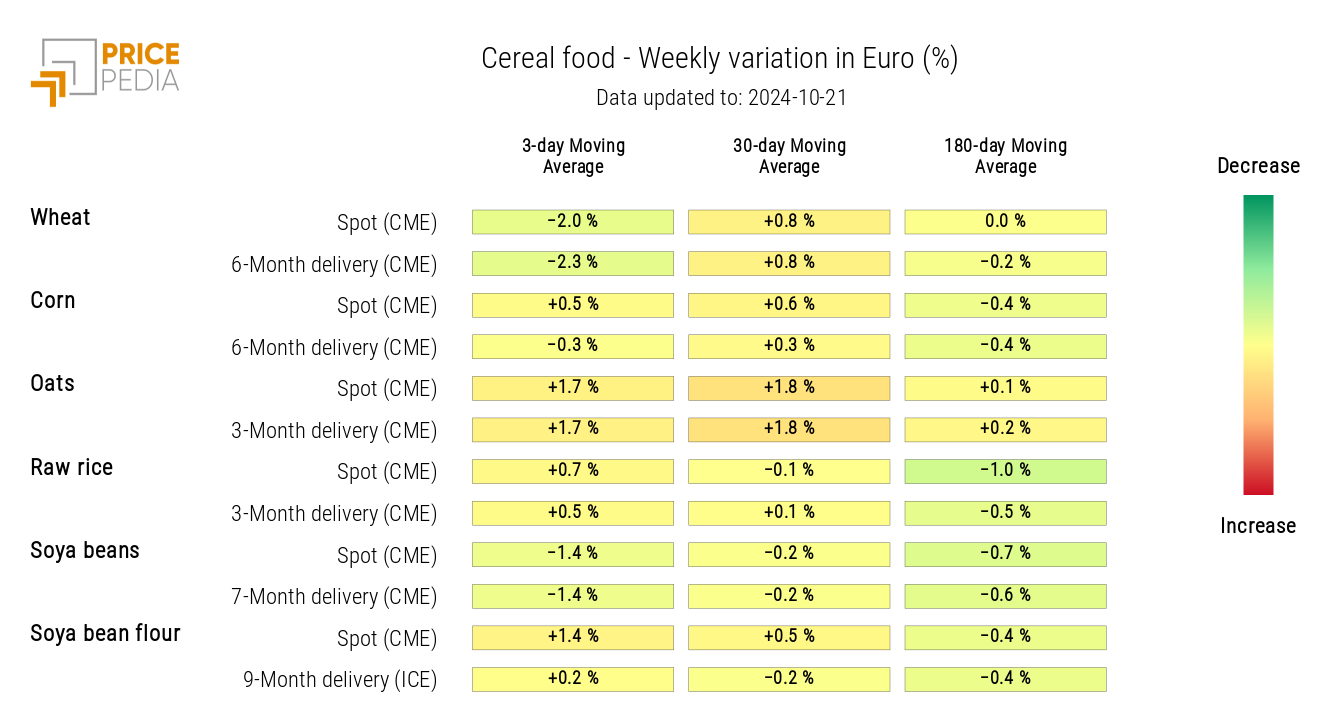

The heatmap for cereals highlights a reduction in the price of wheat.

HeatMap of Grains Prices in EUR