Critical raw materials: tellurium market risk analysis

Tellurium has the highest market risk among the more than 700 commodities monitored by PricePedia

Published by Luca Sazzini. .

Strumenti Critical raw materialsIn the article “PricePedia commodity market risk”, it was noted that tellurium is the commodity with the highest market risk score among the more than 700 commodities monitored and analyzed by PricePedia.

This extremely rare metal is considered "critical" by the European Commission, the U.S. government, and the Canadian government[1].

Its production is closely linked to that of copper, as tellurium is mainly recovered as a byproduct of the electrolytic refining of this metal rather than through the mining of ores. In recent years, the tellurium market has seen significant growth, and analysts predict that future supply may not keep up with the continuously expanding demand.

In modern industry, tellurium is used:

- for the production of solar panels (40%): the main application of tellurium is in the production of thin-film cadmium telluride (CdTe) solar panels;

- for the production of thermoelectric devices (30%): for power generation, as a heat pump, or for cooling;

- as a metallurgical alloy additive (15%): it improves the machinability of steel or copper alloys and enhances the strength, hardness, and vibration resistance of lead alloys;

- for the vulcanization of rubber (15%): as a vulcanizing agent and accelerator in rubber processing.

World Trade Analysis

To assess the criticality of tellurium, it can be useful to analyze the world trade shares of various countries to identify potential supply risks associated with the concentration of global exports of this metal.

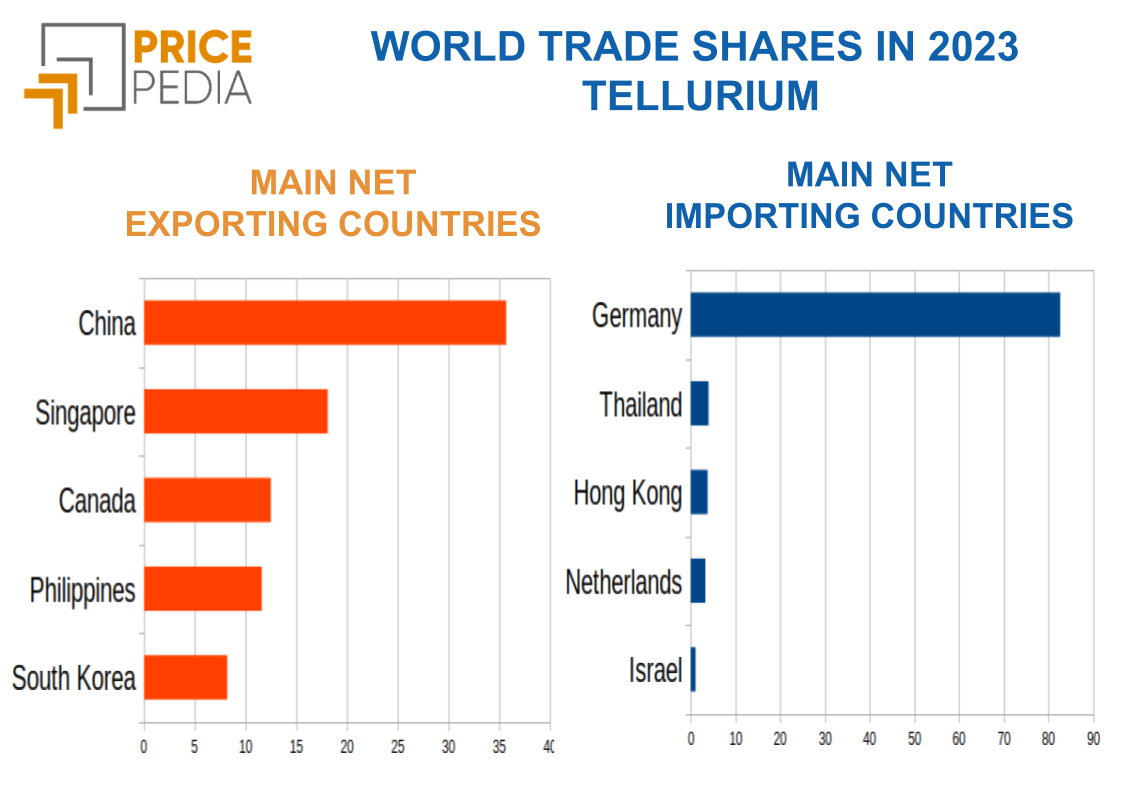

The table below shows the top 5 net exporting and importing countries[2] of tellurium worldwide.

The main net exporting countries of tellurium globally are: China, Singapore, Canada, the Philippines, and South Korea, which together represent over 85% of the world’s net tellurium exports.

Notably, China, the world’s largest producer, holds over 35% of total net exports alone.

The analysis of the major net importers shows the predominance of Germany, which alone imports more than 80% of the world's total net tellurium imports.

These data highlight a strong concentration of global tellurium trade, with few countries controlling the majority of net exports.

In the case of the European Union, 90% of tellurium supply depends exclusively on Canada (56%) and China (34%). A supply disruption from either of these countries would be enough to jeopardize the availability of tellurium in the European market.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Market Risk Score Analysis

PricePedia is developing risk indices to quantitatively assess market risks for commodities, expressed through scores ranging from 0 to 100, with 100 indicating the highest level of risk.

Based on the initial analyses conducted, a risk score of 60 has been estimated for tellurium, positioning it at the top of the ranking of commodities with the highest market risk.

This high level is the result of several factors:

- the strong and unexpected demand accelerations that have characterized this market, especially at the beginning of this century;

- the absence of autonomous European production;

- the high concentration of supply globally;

- the high average distance from the EU of the world's major producers.

Price Analysis

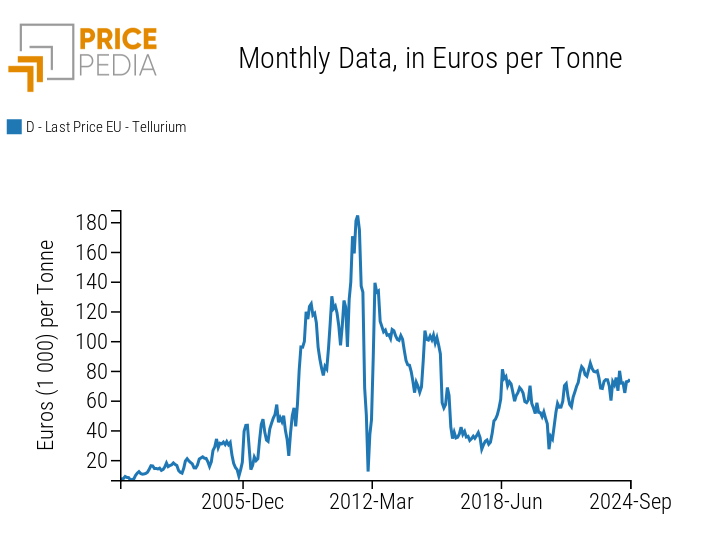

The chart below shows the dynamics of European customs prices for tellurium, as recorded by the customs offices of the 27 European Union member states.

Historical Series of European Customs Prices for Tellurium, in EUR/ton

The analysis of the chart reveals the high volatility of tellurium prices.

The spread of cadmium telluride (CdTe) photovoltaic cells led to a strong price increase, peaking in the first half of 2011 when tellurium reached a high of 180 thousand euros per ton, over 100 times higher than the levels recorded in the early 2000s. In the following years, there was a price decline due to multiple factors, including:

- slower-than-expected adoption of solar technologies, including CdTe photovoltaic cells;

- some significant technological improvements that reduced the amount of tellurium required for the production of CdTe solar panels;

- the development of alternative solar technologies, such as silicon and perovskite cells.

Since 2020, the increased production of cadmium telluride (CdTe) solar panels has led to a recovery in tellurium prices, which have stabilized around 75 thousand euros per ton. Although the volatility of tellurium prices has significantly decreased in the last two years, the high market risk could lead to new significant price shocks.

Conclusions

The data analysis has revealed the high market risk of tellurium, a metal classified as critical by both the European Commission and the governments of the United States and Canada.

According to PricePedia's market risk score, tellurium has an overall score of 60 out of a maximum of 100, the highest among the more than 700 commodities analyzed by PricePedia.

This high risk level is largely attributed to the strong concentration of global trade and the absence of production within the European Union.

The price analysis has shown a significant reduction in volatility over the past two years, with tellurium prices stabilizing around 75 thousand euros per ton. However, the concentration of supply has historically led to market tensions, causing severe material shortages and sharp price increases. The recurrence of such tensions cannot be ruled out in the future if there are unexpected demand accelerations.

[1] Tellurium is included in the “Critical Raw Materials” list of the European Commission, the “Critical Minerals” list of the United States, and the “Canadian Critical Minerals Strategy” of Canada.

[2] In this analysis, we preferred to consider net exports and imports as they are more precise measures of a country’s role in a given market. Indeed, sometimes at least part of the exports may consist of materials not produced in the country but imported from abroad. Considering net exports and imports eliminates the potentially distorting signal of materials imported and then re-exported.