The Price of Pulp at the End of 2024

Are NOREXECO Quotations a Representative Benchmark for the Price in Europe?

Published by Luigi Bidoia. .

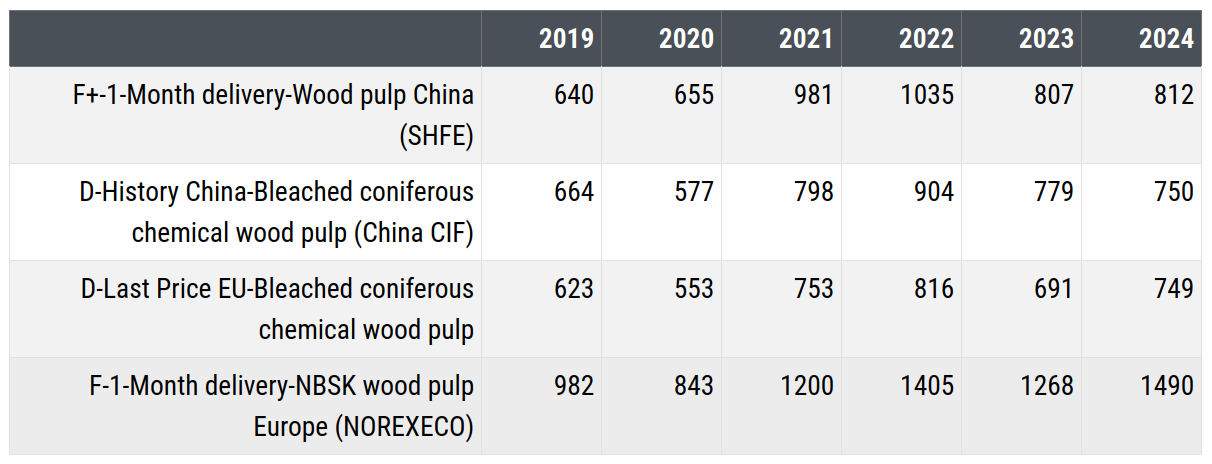

NBSK Woodpulp Price DriversThe magazine PricePedia has repeatedly highlighted the challenges encountered in effectively using the price information for pulp published by NOREXECO. NOREXECO is a regulated commodity exchange specializing in the pulp and paper sector, founded in 2012 and operational since the end of 2015. The contracts listed on NOREXECO are financially settled. In July 2024, NOREXECO quotations for Northern Bleached Softwood Kraft (NBSK) pulp with delivery in Northern Europe rose above 1,600 USD/ton, surpassing the previous peak reached in the summer of 2022. In the following months, the price decreased slightly, but as of October 2024, it remains at a historically high level, above 1500 USD/ton.

In Pulp Quotations, Shanghai Joins NOREXECO

In the industrial raw materials sector, pulp holds a significant role. In 2023, the global trade of pulp exceeded 70 million tons, continuing the rapid growth trend that has characterized this century.

The large number of players interested in trading pulp has led multiple exchanges to attempt to create an official pulp market, though with no successful results[1], at least until a few years ago.

In 2015, NOREXECO began operations. A few years later, at the end of 2018, the Shanghai Futures Exchange (SHFE) also introduced futures contracts on NBSK pulp. These contracts are physically settled through certified warehouses and facilities approved by SHFE. Deliveries come from Canada, Finland, Russia, Chile, Sweden, and other countries. Physical settlement ensures that contract prices are more aligned with physical market prices, making the NBSK contract in Shanghai a global benchmark for pulp pricing.

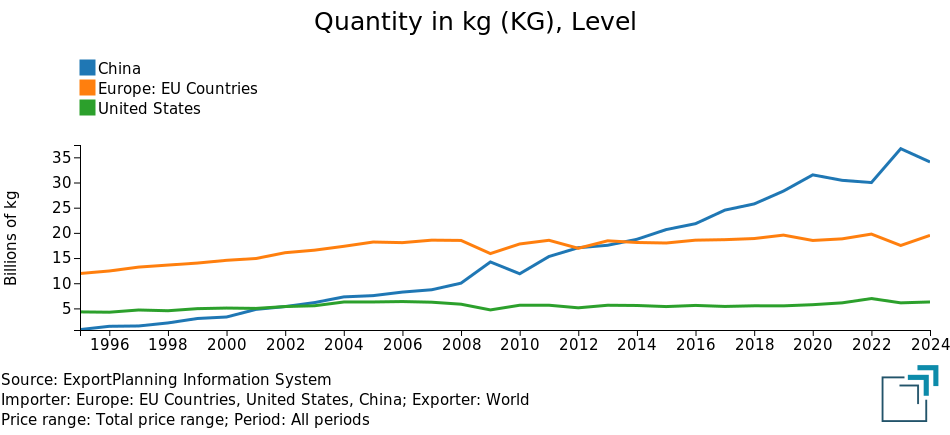

The launch of pulp futures quotations on SHFE was driven by the importance the Chinese market has gained in the global pulp market. The following chart compares pulp imports of the 27 EU countries, the United States, and China.

Pulp imports of major countries

The analysis of the chart clearly shows the shift in the hierarchy of the main importing countries over the past decade. Chinese imports, which were practically non-existent in the last century, began a significant growth phase at the end of the century, surpassing U.S. imports in 2003 and EU imports in 2014. By 2023, with almost 35 million tons, Chinese imports accounted for more than half of the world’s pulp imports.

A Comparison of Financial Pulp Prices

With the listing of NBSK pulp futures on the SHFE, it is now possible to access a daily public financial price that can be compared with the monthly NBSK Europe price published by NOREXECO[2].

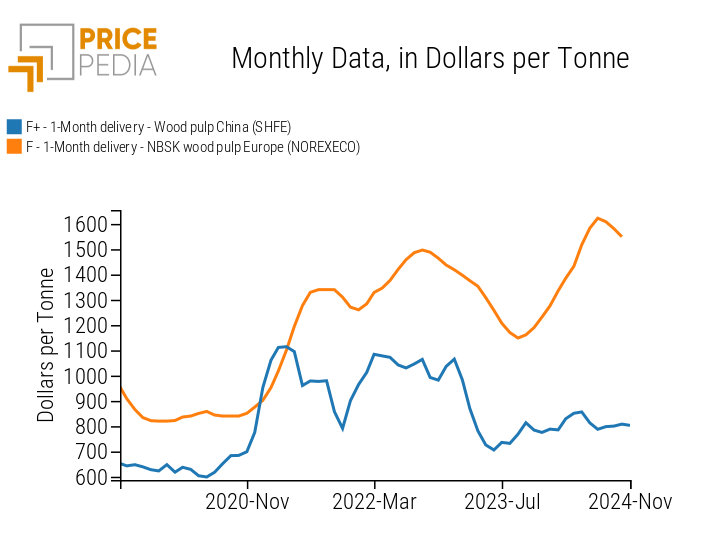

The following chart shows the monthly comparison between the two prices.

NOREXECO AND SHFE financial prices of NBSK pulp

The levels and trends of the prices on the two exchanges appear very different. The price of NBSK pulp quoted by NOREXECO is generally much higher than the SHFE price, with few exceptions. Over the 2019-2024 five-year average, the prices on the two exchanges are 1195 and 837 USD per ton, respectively. The difference is even more marked when considering that the Shanghai price is inclusive of VAT. Long-term trends also show significant differences: while the price on the Shanghai exchange rose by 29% during the period, the NOREXECO price increased by 58%. In the short-term trends, SHFE price variations tend to precede those of NOREXECO, with similar intensity, except during the increase in 2024, when the price growth on NOREXECO was significantly higher than that on Shanghai.

Comparison Between Financial and Physical Prices

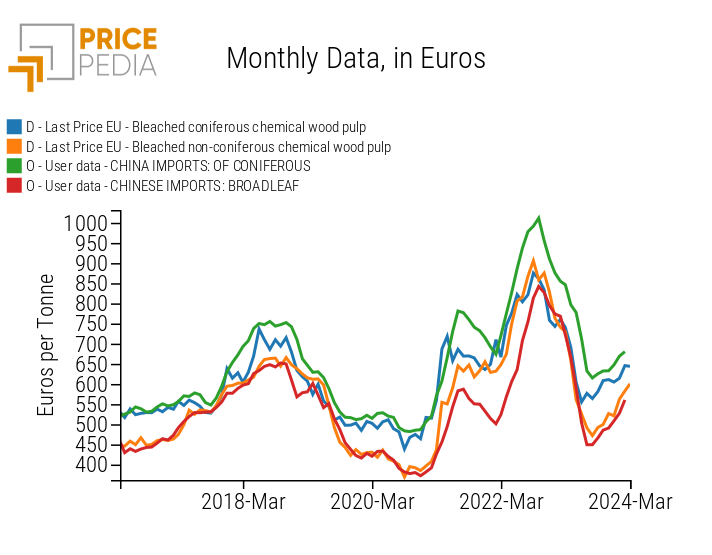

A useful comparison is that between financial and physical prices across the two geographical areas. The following table shows the financial prices of NBSK pulp recorded on the NOREXECO and Shanghai exchanges, along with the EU and China physical prices for bleached softwood kraft pulp, either soda or sulfate-processed[3], based on customs flow data.

Financial and physical pulp prices (euros/tons)

The comparison reveals a strong alignment, both in levels and trends, between Chinese financial prices and EU and Chinese customs prices. In contrast, the price of pulp quoted on NOREXECO is significantly higher and shows a much more marked growth trend over the five-year period compared to other price records.

Conclusions

The pulp quotations on NOREXECO, which have been above 1500 USD per ton for several months, raise some questions about their validity as a benchmark for standard pulp prices. The specificity of the "eco-friendly" product (produced with bleaching methods, Elemental Chlorine-Free (ECF) and Totally Chlorine-Free (TCF), free from elemental chlorine or totally chlorine-free) alone does not seem sufficient to justify such a high price differential, nearly double that of the NBSK pulp price quoted on SHFE and EU and Chinese physical customs prices.

The information currently available does not allow us to identify a physical market justification for this differential, suggesting that the explanation may lie in other areas.

[1] The failures of various exchanges in creating an official market for pulp are described in Prezzi della pasta per carta kraft in forte aumento

[2] The monthly NBSK Europe price, published by NOREXECO on the day following the expiration of a given month's futures contract, represents the settlement price of that futures contract. This settlement price is calculated as the monthly average of the weekly PIX Pulp NBSK indices for that month, published by Fastmarkets FOEX.

[3] Bleached softwood chemical pulps, either soda or sulfate-processed, include not only NBSK pulp but also lower-quality pulps, which reduces the aggregate price.