Commodity markets put under pressure by several shocks

Behind the many sectoral shocks remain the effects of weak global demand

Published by Luca Sazzini. .

Conjunctural Indicators Commodities Financial WeekWeekly Summary of Financial Commodity Prices

In last week’s article: “Trump effect on financial markets”, it was highlighted how the result of the U.S. elections exerted downward pressure on industrial metal prices. This effect is attributed to various factors, including the appreciation of the dollar, the anticipated slowdown in the U.S. energy transition, and concerns about a potential increase in trade tariffs. However, during the same period, financial prices of industrial metals remained relatively stable, supported by positive signals from the Chinese economy and expectations of further stimulus measures announced during the National People’s Congress (NPC).

At the event, Chinese legislators approved an increase in the debt limit for local governments to stimulate economic growth and help local administrations manage debt-related risks. However, the 10 trillion yuan financing fell short of market expectations, which, after Donald Trump's victory in the U.S. presidential election, anticipated a fiscal stimulus of greater magnitude.

The disappointment in financial markets, coupled with the further strengthening of the dollar recorded this week, negatively impacted the prices of industrial metals, both ferrous and non-ferrous, which started to decline.

Currently, the support measures announced by the Chinese government, apart from being insufficient, have focused almost exclusively on liquidating unsold real estate rather than on new construction, limiting the recovery in industrial metal demand anticipated by investors.

Yesterday, China’s Ministry of Finance announced the end of the aluminum export tax rebate policy, effective December 1. This decision caused a 5.4% increase in aluminum prices on the LME. According to many analysts, the measure could have significant repercussions on the global aluminum market. However, it is not guaranteed that eliminating tax rebates will offset the effects of weak global demand. In fact, despite Friday’s rebound, the week ended without an overall increase.

During the week, the disappointing measures announced at the NPC impacted not only the financial prices of industrial metals but also those of energy products. The perception of weak Chinese demand influenced oil prices, already under pressure from the weakening of Hurricane Rafael, which was downgraded to a post-tropical cyclone. However, the overall decline in the energy index was limited by a sharp increase in European natural gas prices.

Tension in the European Gas Market

The Austrian energy company OMV won a case against Gazprom at the International Chamber of Commerce (ICC) over irregular gas supplies received in Germany in 2022. OMV intends to recover the €230 million in damages awarded by reducing its payments to the Russian company. The next payment requested by Gazprom is due on November 20, 2024, for an estimated €213 million. However, if OMV decides to withhold the entire amount, Gazprom may terminate the contract, putting Europe’s gas supplies at risk.

An additional factor putting pressure on gas prices comes from statements by the German economy minister, who has urged German ports to reject liquefied natural gas (LNG) shipments from Russia to protect the country’s "overriding public interests."

Compounding the situation, European gas storage is depleting faster than expected due to colder-than-anticipated weather and low wind power generation. This reduction has been offset by increased energy production through combined cycle gas turbine (CCGT) plants, further depleting gas reserves.

U.S. Inflation

Data on the Consumer Price Index (CPI) in the United States aligned with analysts’ expectations.

The growth in the headline index remains steady at 0.2% month-over-month, with a slight annual acceleration from 2.4% to 2.6%. The core index, which excludes energy and food, remained stable both monthly and annually, with growth rates of 0.3% m/m and 3.3% y/y, respectively, matching analysts' forecasts.

The only surprise in October’s U.S. CPI data was the reacceleration of housing services to 0.4% m/m, compared to 0.2% m/m in September.

Overall, the U.S. consumer price index data should not alter economic policy prospects. Currently, core goods inflation remains relatively high but should not hinder a moderate easing of rates by the Federal Reserve.

However, Fed Chair Powell reiterated this week that the U.S. economy remains strong and that there is no urgency to cut interest rates. This statement contributed to the strengthening of the U.S. dollar, which facilitated the decline in industrial metal prices.

Eurozone Economic Analysis

Eurostat data confirmed quarterly growth in GDP and employment of 0.4% q/q and 0.2% q/q, respectively, in Q3 2024, primarily driven by services.

On the industrial production side, there is a significant contraction both monthly and annually, falling short of analysts' expectations.

In September, eurozone industrial production fell by -2% m/m and -2.8% y/y.

This decline was mainly due to reduced production in energy and capital goods, highlighting the ongoing weakness in the European economy, which remains stagnant.

Flash estimates for next week’s Purchasing Management Index (PMI) are awaited, with expectations of further contraction in the manufacturing sector, with the PMI figure estimated at 46 points.

ENERGY

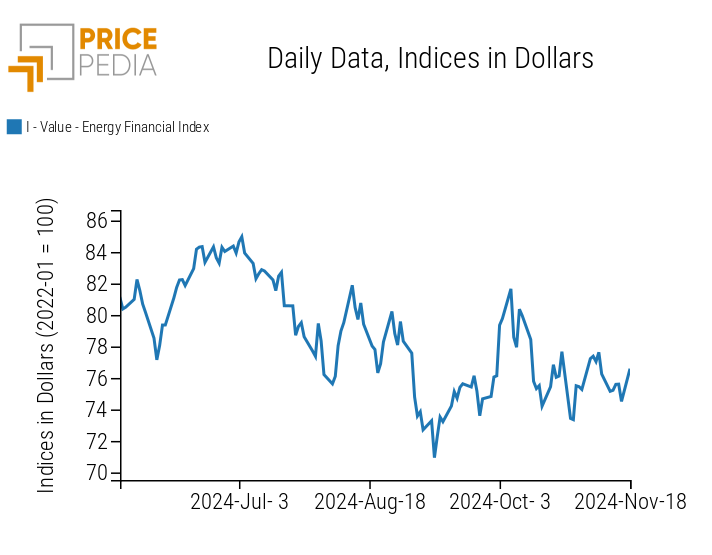

The PricePedia financial energy product index shows a continuation of the downward phase despite rising natural gas prices.

PricePedia Financial Index of Energy Prices in Dollars

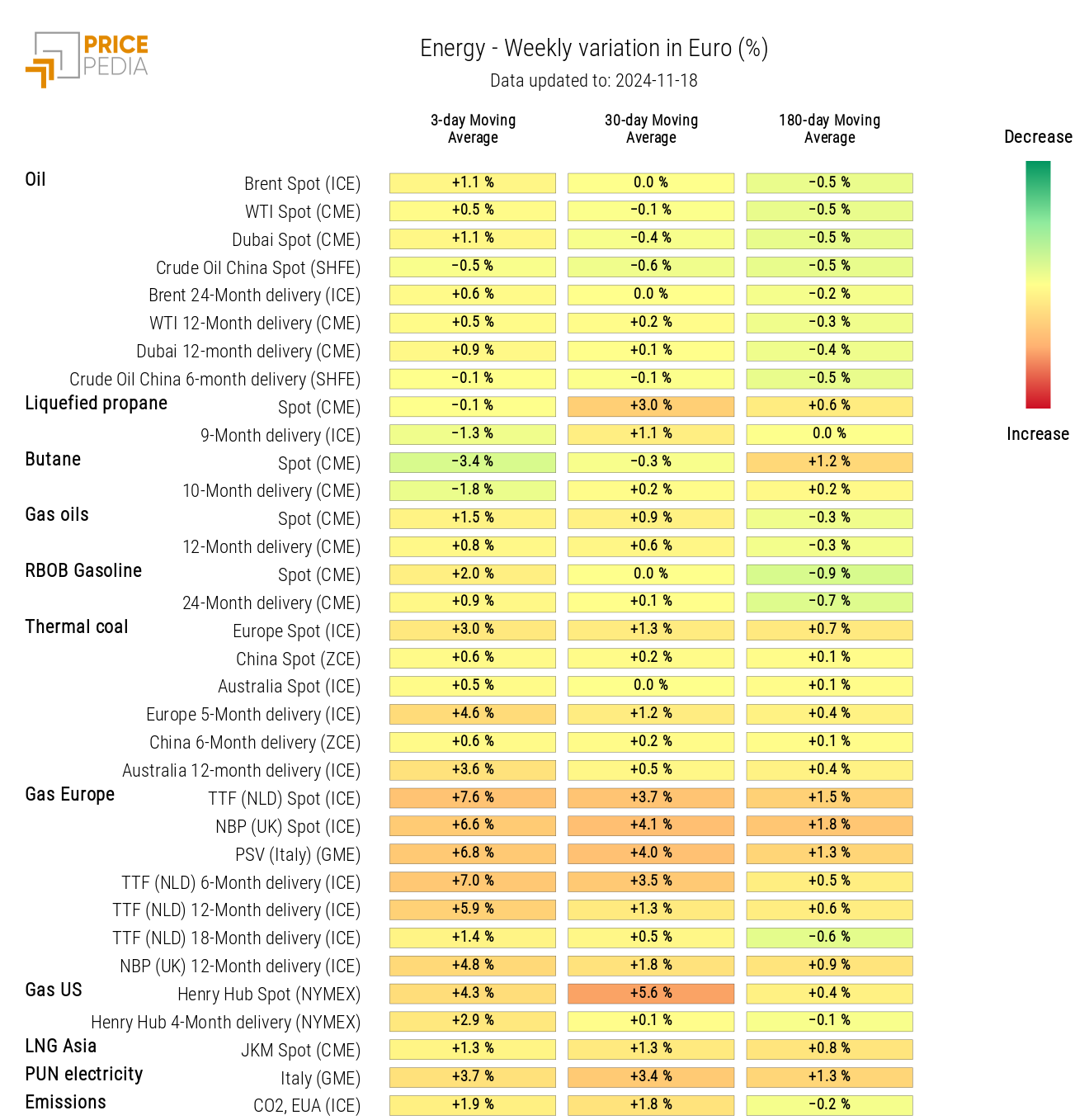

The energy heatmap highlights a sharp increase in European natural gas and Italian electricity prices, against a generalized decline in all oil-related product prices.

HeatMap of Energy Prices in Euros

PLASTICS

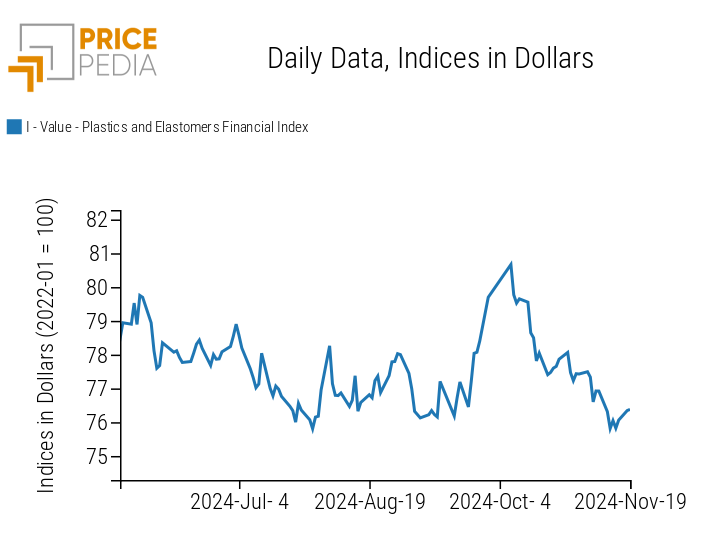

The PricePedia index of plastics and elastomers in the Chinese market interrupts its downward trend on Monday, November 18, and Tuesday, November 19.

PricePedia Financial Indices of Plastics Prices in Dollars

FERROUS METALS

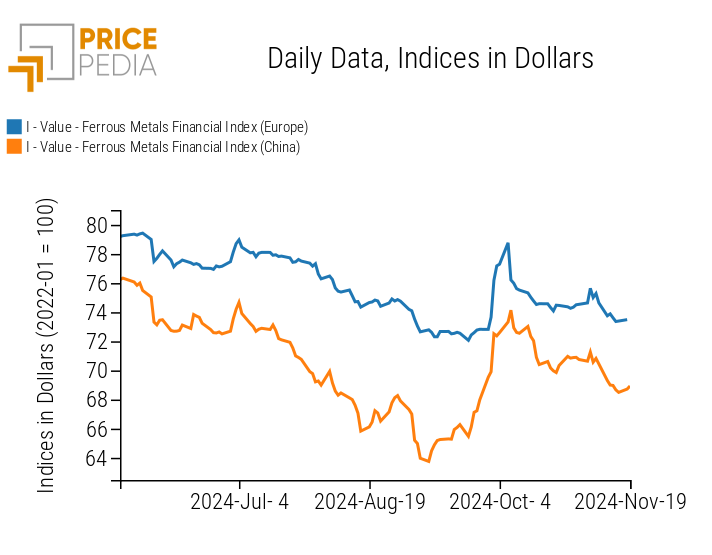

The financial indices of ferrous metals show a decline due to the disappointment over the fiscal stimulus announced by the Chinese government.

PricePedia Financial Indices of Ferrous Metal Prices in Dollars

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

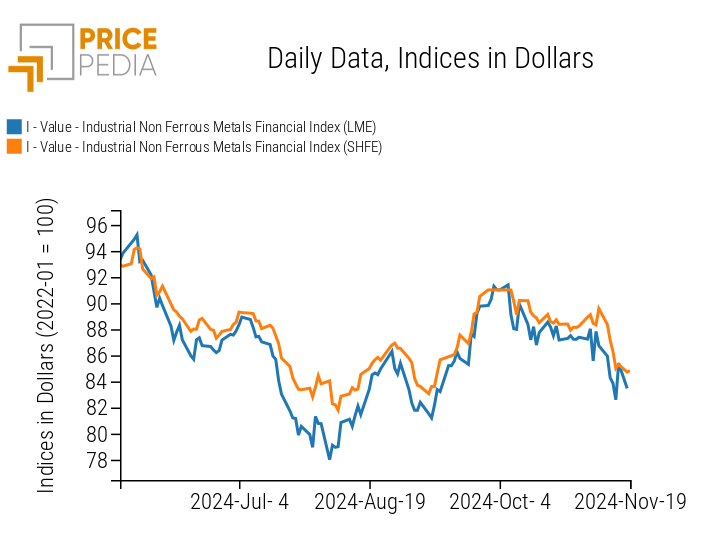

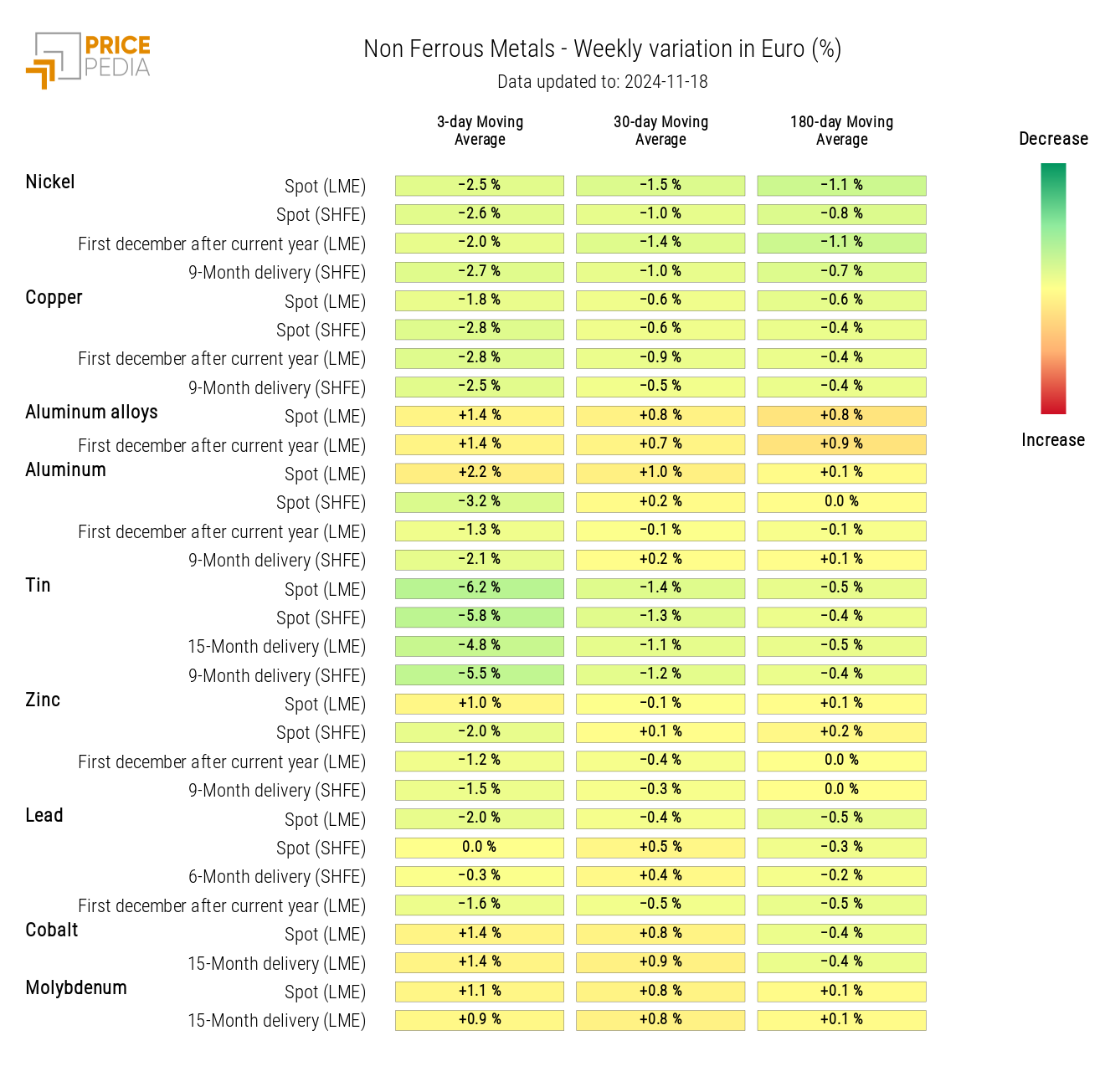

NON-FERROUS INDUSTRIAL METALS

The financial indices of non-ferrous industrial metals indicate a significant reduction in prices on the London Metal Exchange (LME) and the Shanghai Futures Exchange (SHFE). The strong increase in aluminum prices on Friday was not enough to reverse the trend of the aggregate index.

PricePedia Financial Indices of Non-Ferrous Industrial Metals Prices in Dollars

The heatmap below highlights a particularly sharp weekly price drop for copper and tin.

HeatMap of Non-Ferrous Prices in Euros

FOOD

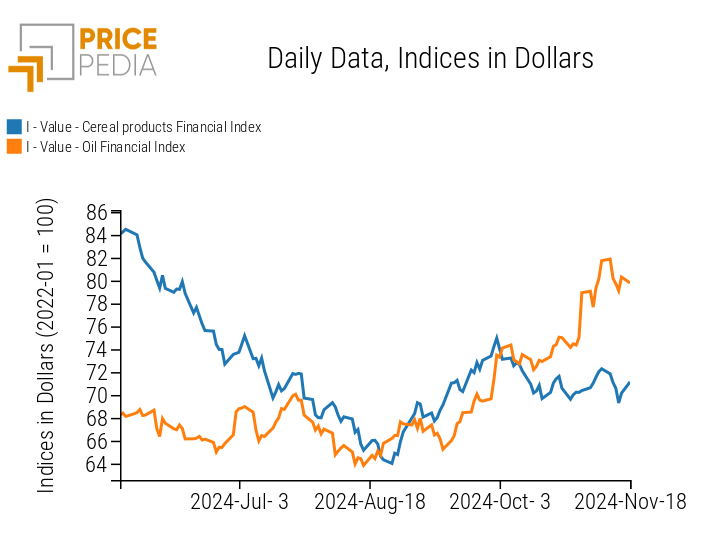

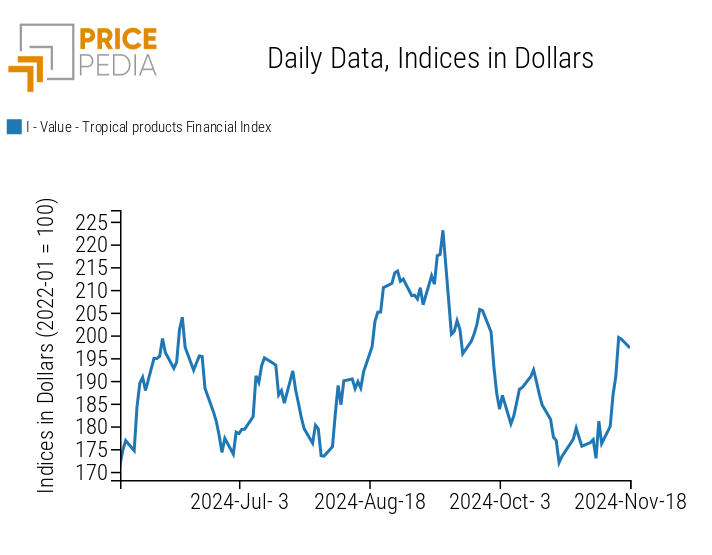

The financial indices for grains and edible oils reversed the gains from last week, while the tropical index showed a strong increase.

| PricePedia Financial Indices of Food Prices in Dollars | |

| Grains and Oils | Tropicals |

|

|

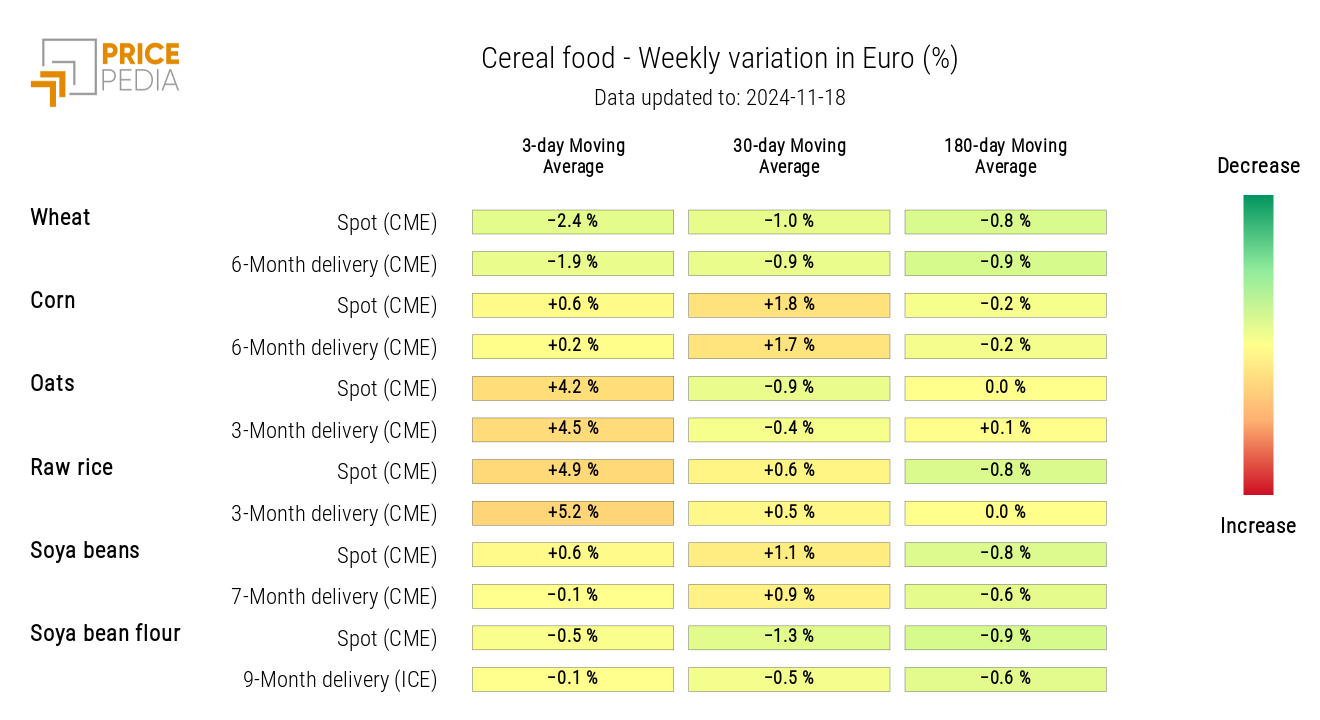

CEREALS

The cereal heatmap highlights an increase in oats and raw rice prices.

HeatMap of Cereal Prices in Euros

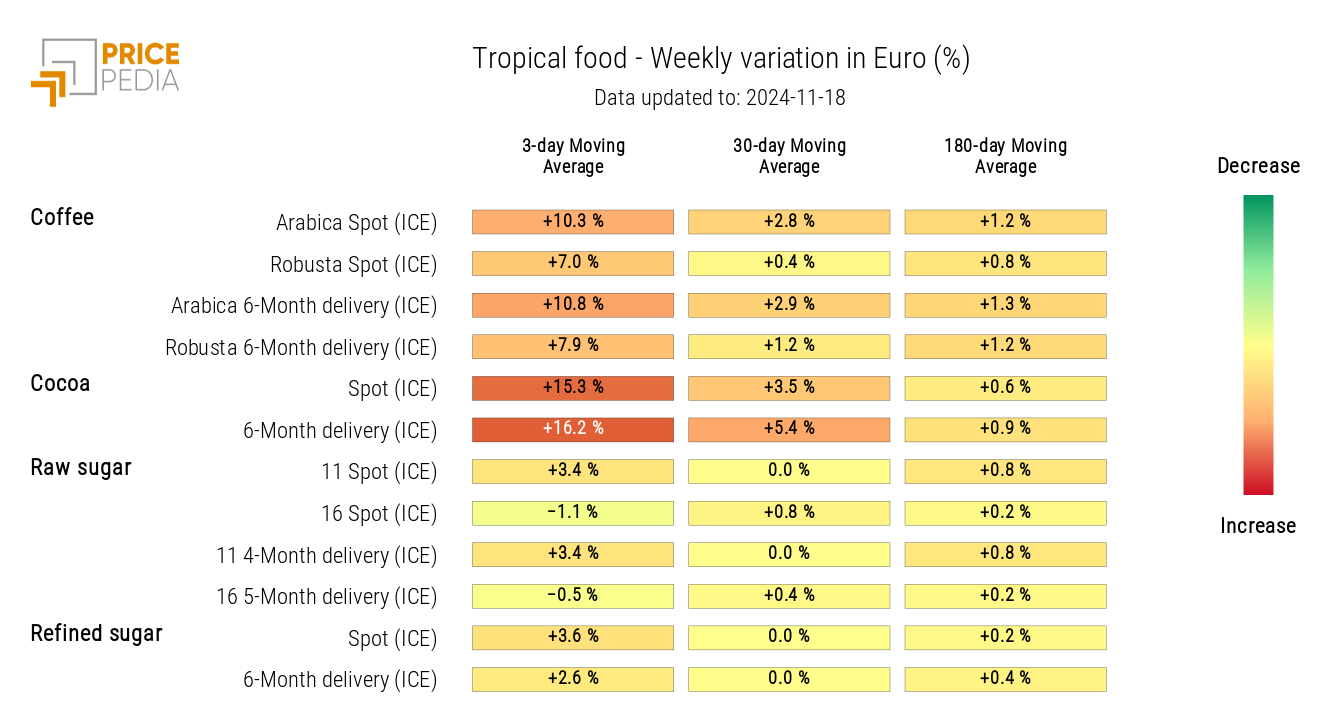

TROPICALS

The tropicals heatmap shows a significant weekly increase in the prices of cocoa and coffee.

The rise in cocoa prices is primarily linked to potential supply shortages due to concerns over the approval of European deforestation regulations.

Financial markets feared that the immediate implementation of this regulation, without modifications or delays, could have significantly restricted cocoa imports from countries with high levels of deforestation. However, Friday's vote temporarily alleviated these concerns by confirming a one-year delay in the application of these new rules.

The impact of this delay on financial markets was minimal.

HeatMap of Tropical Food Prices in Euros

OILS

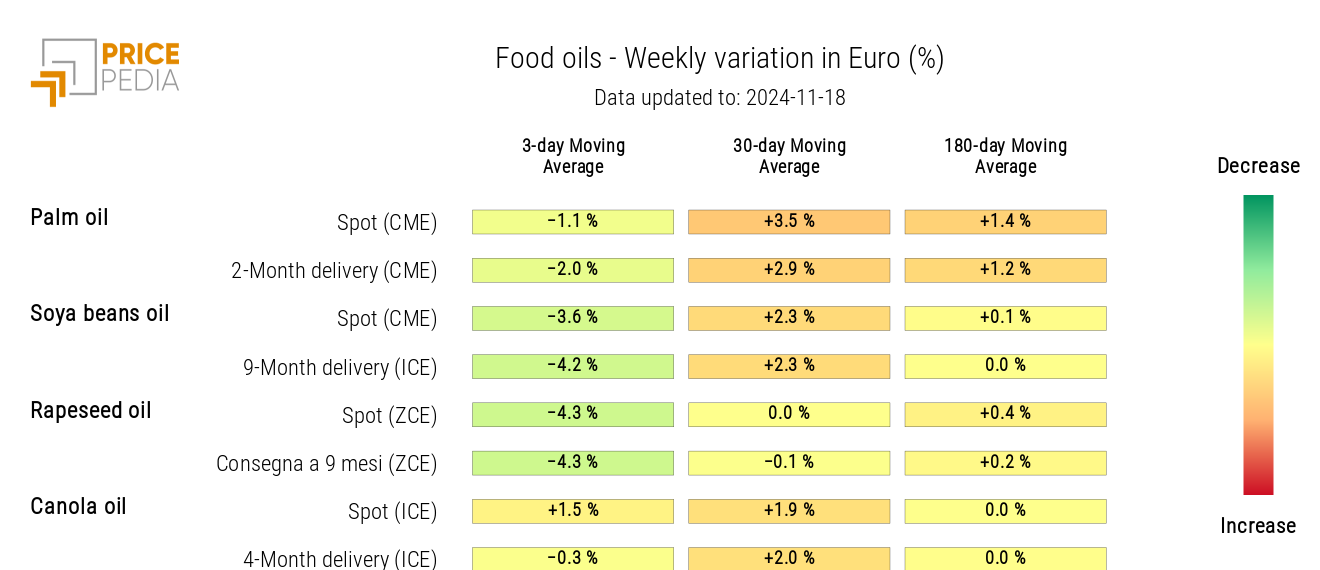

The heatmap analysis highlights a decrease in rapeseed and soybean oil prices.

HeatMap of Edible Oils Prices in Euros