Natural Gas Price Forecast

Forecasts on key global natural gas price benchmarks

Published by Luca Sazzini. .

Natural Gas ForecastThe natural gas market is a local market where price dynamics can vary significantly depending on the geographic area considered.

In financial markets, there are numerous natural gas price quotations, each tied to specific regional markets. The three main global benchmarks for natural gas prices are:

- TTF Netherlands: the representative price for the European market;

- Henry Hub: the representative price for the American market;

- Liquefied Natural Gas(LNG) JKM (Japan/Korea Marker): the representative price for the Asian market.

This article provides natural gas price forecasts from various forecasters, aiming to outline a PricePedia scenario for each of the three financial benchmarks mentioned above.

Implicit forecasts in futures

An initial source useful for forecasting scenarios comes from futures prices and the forecasts embedded in them. Futures prices measure the price today at which sellers are willing to deliver a specific good at an agreed future date.

The following table shows the monthly averages for 2024 of spot prices for the three financial benchmarks analyzed above, compared with their respective futures prices for December 2026.

Comparison Table of Spot and Futures Prices in $

| 2024-09 | 2024-10 | 2024-11 | |

|---|---|---|---|

| F+-Delivery in 1 month - TTF Natural Gas (Netherlands) (ICE), price/MWh | 40.20 | 44.06 | 45.64 |

| F+-Delivery December 2026 - TTF Natural Gas (Netherlands) (ICE), price/MWh | 36.84 | 37.50 | 36.16 |

| F+-Delivery in 1 month - Henry Hub Natural Gas (USA) (NYMEX), price/MMBtu | 2.41 | 2.58 | 2.79 |

| F+-Delivery December 2026 - Henry Hub Natural Gas (USA) (NYMEX), price/MMBtu | 4.14 | 4.20 | 4.21 |

| F+-Delivery in 1 month - JKM Liquefied Natural Gas (Asia) (CME), price/MMBtu | 13.46 | 13.31 | 13.53 |

| F+-Delivery December 2026 - JKM Liquefied Natural Gas (Asia) (CME), price/MMBtu | 12.12 | 12.35 | 11.93 |

Analysis of futures prices reveals that the European (TTF) and Asian liquefied natural gas financial markets are currently in a state of backwardation, where futures prices are lower than spot prices. This indicates that financial markets expect a future decline in spot prices for both markets by December 2026.

Conversely, the financial prices of the U.S. Henry Hub are in a state of contango, with the December 2026 futures price higher than the spot price. As is well known, contango does not necessarily imply expectations of price increases but reflects the opportunity cost of storing gas until the contract's expiration date. However, contango is consistent with expectations of future increases, although not strong enough to trigger their immediate realization.

World Bank Forecasts

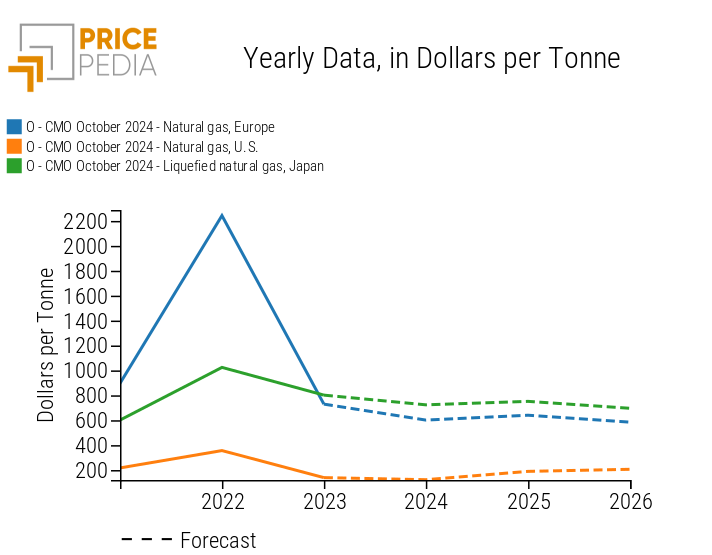

The graph below shows the World Bank’s natural gas price forecast scenario in $/ton for each of the three geographic areas analyzed.

World Bank Forecasts in $/Ton

From this forecast scenario analysis, a reduction in natural gas prices for Europe and Asia is expected in 2026, while prices in the United States are projected to increase.

Forecasted prices for 2026 are estimated at $584/ton for Europe, $206/ton for the United States, and $696/ton for Asia.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Consensus Economics

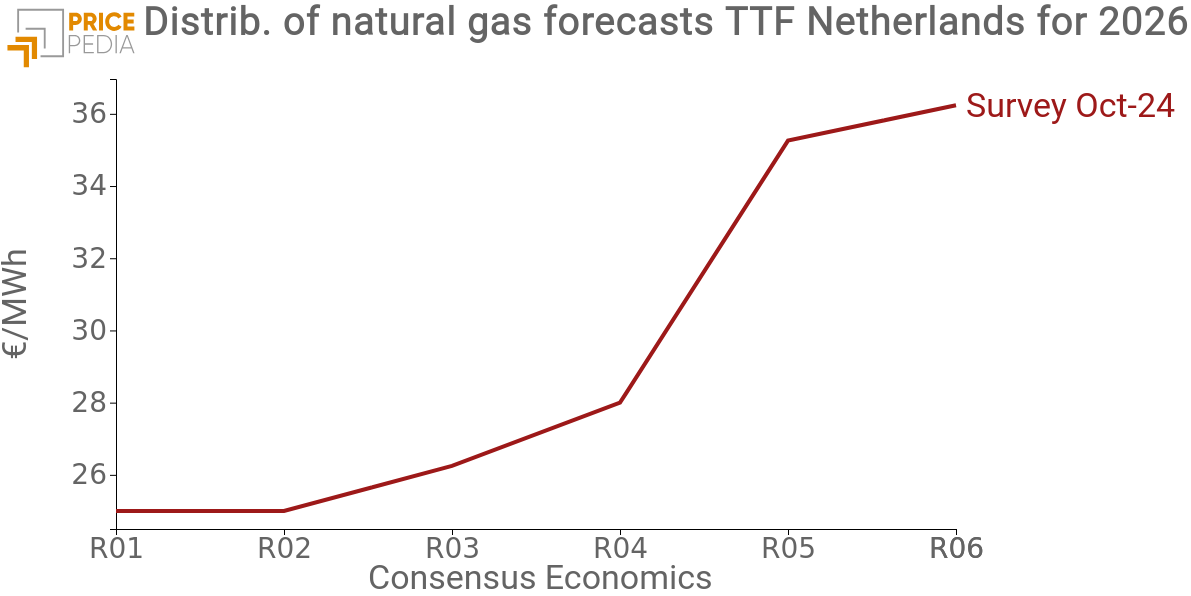

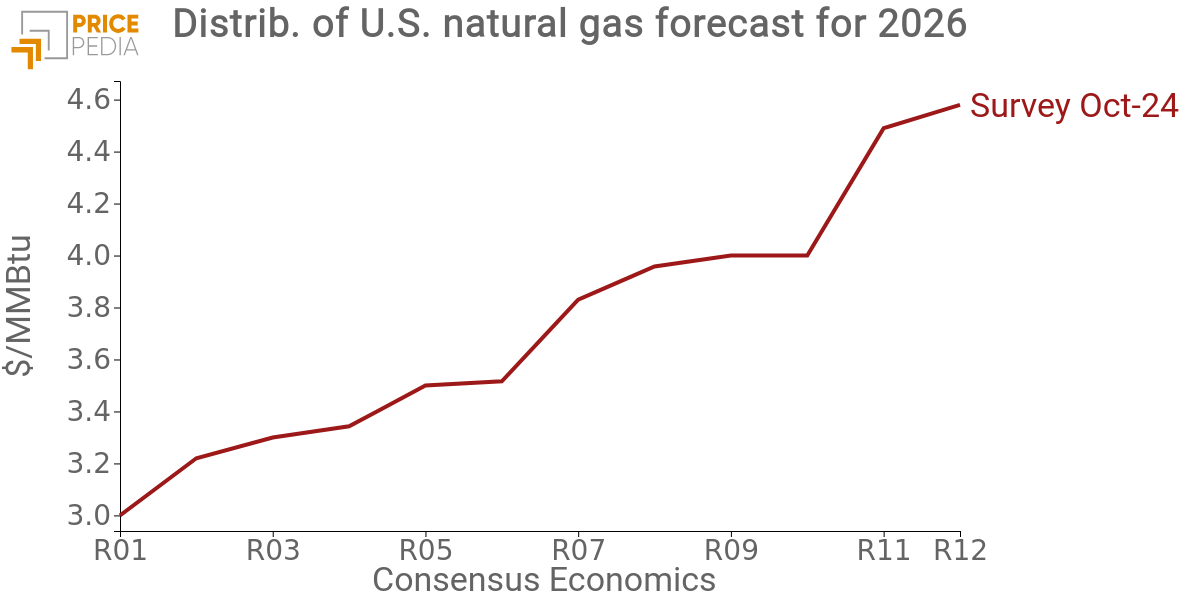

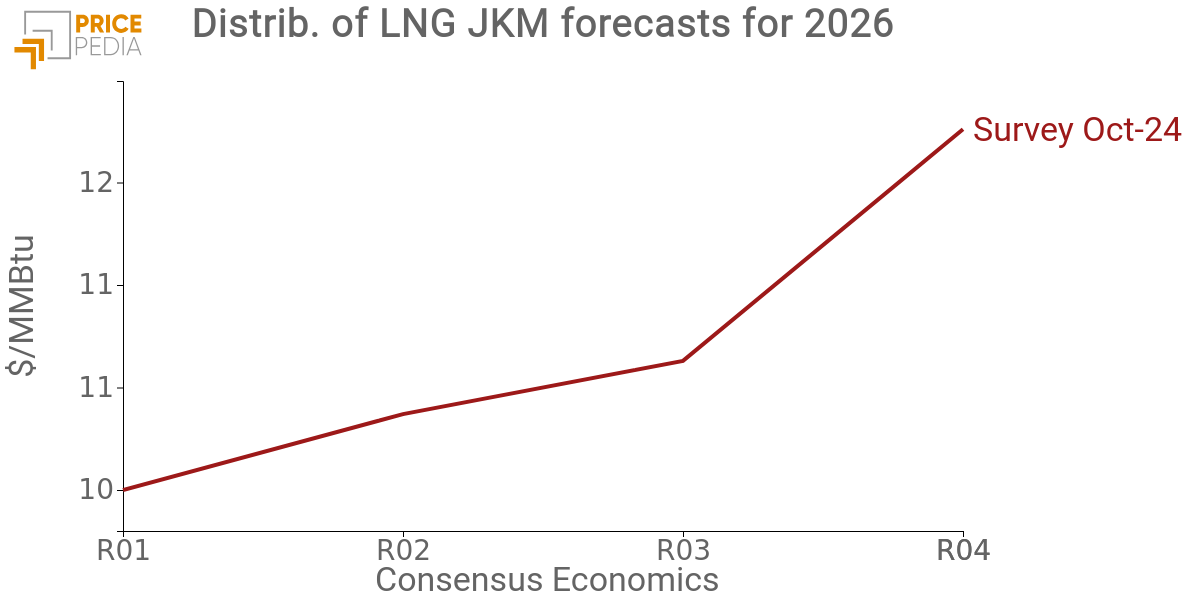

One last source of forecasts that can be useful to analyze is Consensus Economics.

The advantage of this forecasting source is that it allows building a prediction interval based on the results of a survey conducted among various expert commodity forecasters.

The prediction intervals for natural gas prices in the three analyzed geographic areas are reported below.

For the purpose of the forecast analysis, we excluded the two lowest and the two highest cases from each distribution.

| TTF 2026 Forecast Distribution | Henry Hub 2026 Forecast Distribution |

|

|

| LNG JKM 2026 Forecast Distribution |

|

From the October survey analysis, the following forecast intervals for 2026 emerged:

- Natural gas prices in Europe are expected to range between 25 and 36 euros/MWh, with an overall average of nearly 30 euros/MWh;

- Natural gas prices in the United States are projected to range between 3 and 4.6 $/MMBtu, with an overall average of approximately 3.7 $/MMBtu;

- LNG prices in Asia are expected to range between 10 and 11.8 $/MMBtu, with an overall average of 10.7 $/MMBtu.

The forecast interval analysis reveals a significantly higher risk for the U.S. market, followed by the European market, both characterized by normalized standard deviations markedly higher than those of the Asian market. The Asian LNG prices reflect a less regional context compared to gas distributed via pipelines in Europe and the U.S. In regional markets, uncertainty tends to be higher than in a global market, as the impact of specific factors is generally more pronounced in regional markets than in a global context.

PricePedia Forecast Scenario

The forecasts published in the PricePedia scenario are derived as a synthesis of the forecasts described above, prioritizing financial ones first, then Consensus, and finally World Bank forecasts. The World Bank forecasts tend not to incorporate the most recent information due to both their publication frequency and the time required for data processing. Consensus forecasts are particularly useful for evaluating the uncertainty associated with estimates but are less effective as point forecasts.

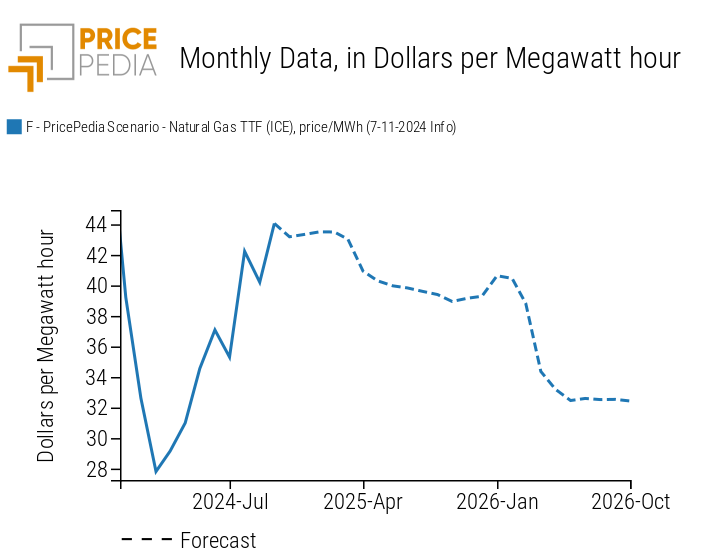

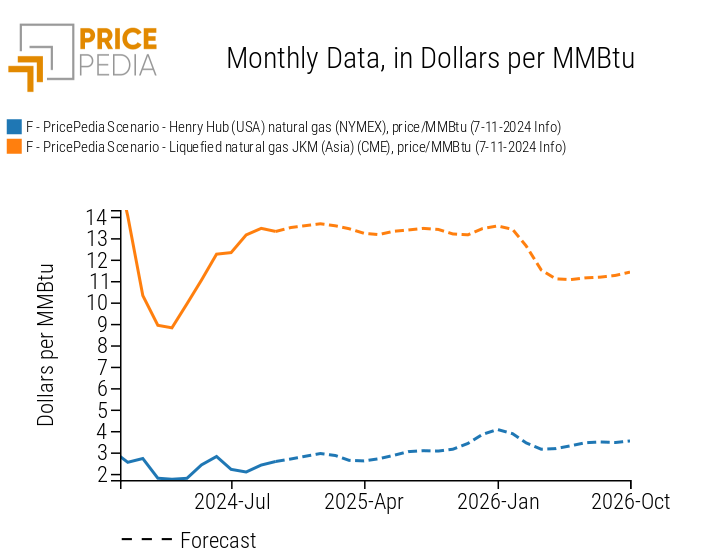

The forecasts updated to November 7 are summarized in the following two charts.

The chart on the left shows the forecast for European natural gas prices (TTF, Netherlands), quoted on the Intercontinental Exchange (ICE) in euros/MWh. The chart on the right represents the financial prices of the U.S. Henry Hub and Asian LNG (JKM - Japan/Korea Marker), both quoted on the New York Mercantile Exchange (NYMEX) and expressed in $/MMBtu.

| PricePedia Forecasts | |

| Forecast for European Natural Gas Prices (TTF) in euros/MWh | Forecast for U.S. Natural Gas Prices (Henry Hub) and Asian LNG (JKM), in $/MMBtu |

|

|

For TTF (Netherlands), after relatively high levels during the 2024-2025 winter, forecasts indicate a gradual decline in European natural gas prices, reaching 30 €/MWh by the end of 2026, a significant reduction compared to the 40.4 €/MWh recorded last month.

For Asian LNG (JKM), prices are expected to remain relatively stable in 2025, followed by a decrease of about 2 $/MMBtu compared to the October 2024 value of 13.5 $/MMBtu.

Henry Hub natural gas prices (U.S.) are the only ones among the three analyzed to show an upward forecast. After some fluctuations, prices are estimated to reach approximately 3.5 $/MMBtu by October 2026, an increase of nearly 1 $/MMBtu compared to the October 2024 monthly average (2.58 $/MMBtu).

Conclusions

Most analysts expect Europe to continue replacing Russian natural gas supplies with those from the United States in the coming years. This process will likely drive European natural gas prices down and U.S. prices up. Asian LNG prices are expected to follow the decline in the European benchmark, reflecting the competition between the European and Asian markets.

All the different forecasters agree on these dynamics, estimating very similar price levels for 2026 in each of the analyzed geographic areas. The forecasts are thus aligned in defining the described scenario as the most statistically probable future.

However, this scenario is not free of risks that could lead to dynamics different from those forecasted. In particular, regarding Europe, the potential effects of reduced natural gas supplies on the European market due to the deterioration of trade relations between Austrian company OMV and Russian company Gazprom remain uncertain.[1]

[1] See the article: “Commodity markets put under pressure by several shocks”