The effect of relative scarcity on prices: the case of Anthracite

The EU failed to replace Russian supplies with those from other partners

Published by Pasquale Marzano. .

Coal EU sanctions against Russia Price DriversThe invasion of Ukraine triggered a process in Europe to replace raw materials supplied by Russia. The anticipation of EU sanctions, even before their actual implementation, led to a precautionary increase in demand for goods in which the Russian Federation is a major supplier. This was followed, depending on the goods considered, by a phase of price reduction or persistence at high levels, depending on how quickly or slowly substitution occurred.

One case where substitution occurred relatively quickly is that of anhydrous ammonia. In that instance, supplies from Russia were replaced with those from other countries, such as Trinidad and Tobago.

A contrasting case involves anthracite, a high-quality coal characterized by high carbon content and low impurities. It is considered the purest and most efficient type of coal for combustion. Although there are several substitutes for anthracite in many applications, choosing an alternative results in differences in terms of efficiency, emissions, and adaptability to plants.

Following the Russian invasion, the EU's first sanctions package also targeted coal imports, including anthracite. However, in this case, substitution with imports from other countries did not occur.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

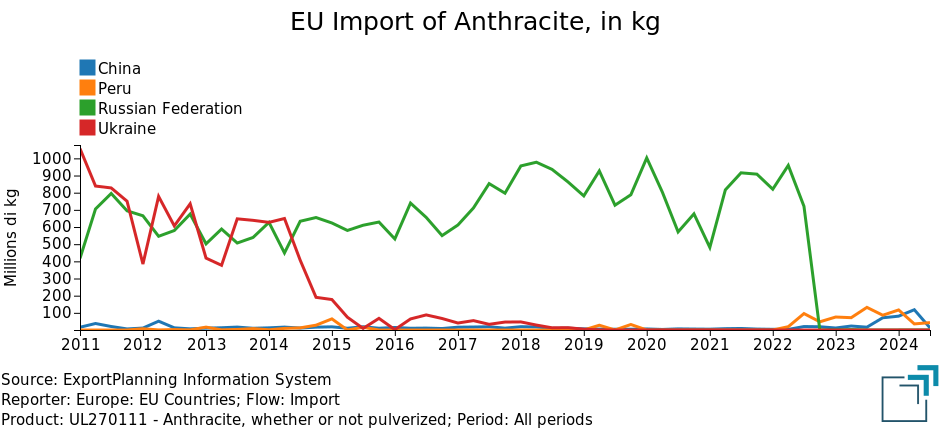

The graph below shows quarterly European imports of anthracite, expressed in kilograms, from major non-EU partners.

The EU eliminated Russian anthracite supplies starting from the final quarter of 2022, replacing them only partially with imports from Peru and China. Additionally, it should be noted that as early as 2014, European imports from Ukraine had also ceased. This coincided with the first armed conflict between Russia and Ukraine in the Crimea and Donbas regions, home to a major coal deposit. The establishment of pro-Russian separatist republics in 2014[1] effectively deprived Ukraine of a significant resource, leading to a gradual stop of Ukrainian supplies to the EU.

Overall, the availability of anthracite on the EU market decreased without being compensated by supplies from other partners or a shift in demand towards other types of coal. This led to a persistent rise in prices.

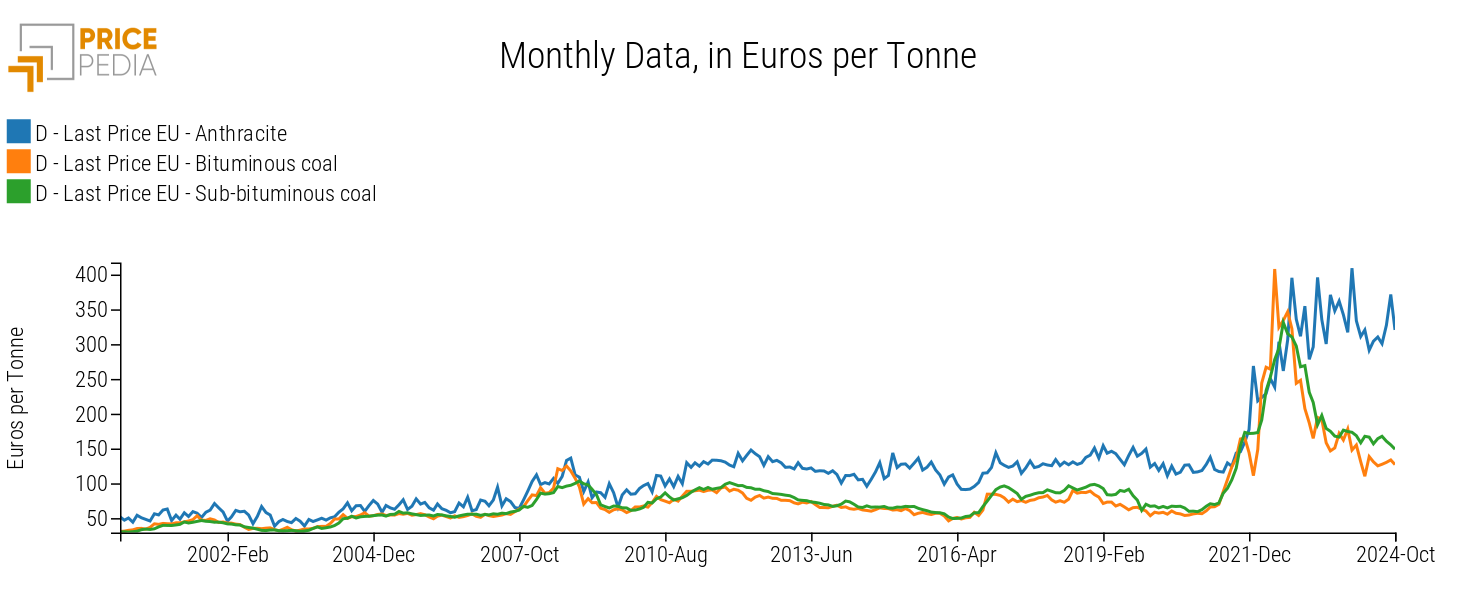

The graph below compares prices, expressed in euros per ton, of different types of coal in the EU market.

While the prices of bituminous and sub-bituminous coal, after rising in 2021 and early 2022, dropped sharply from the second half of 2022, anthracite prices remained high. Before 2022, the price dynamics of anthracite were very similar to those of the first two types of coal, with a positive price differential in favor of anthracite due to its higher grade. From June 2022, this differential first inverted, as the prices of bituminous and sub-bituminous fossil coal rose more rapidly than anthracite. Subsequently, due to the lack of replacement for Russian anthracite, the differential widened in favor of the latter.

It is also worth noting that lignite prices followed a similar trend to anthracite and are currently at historical highs.

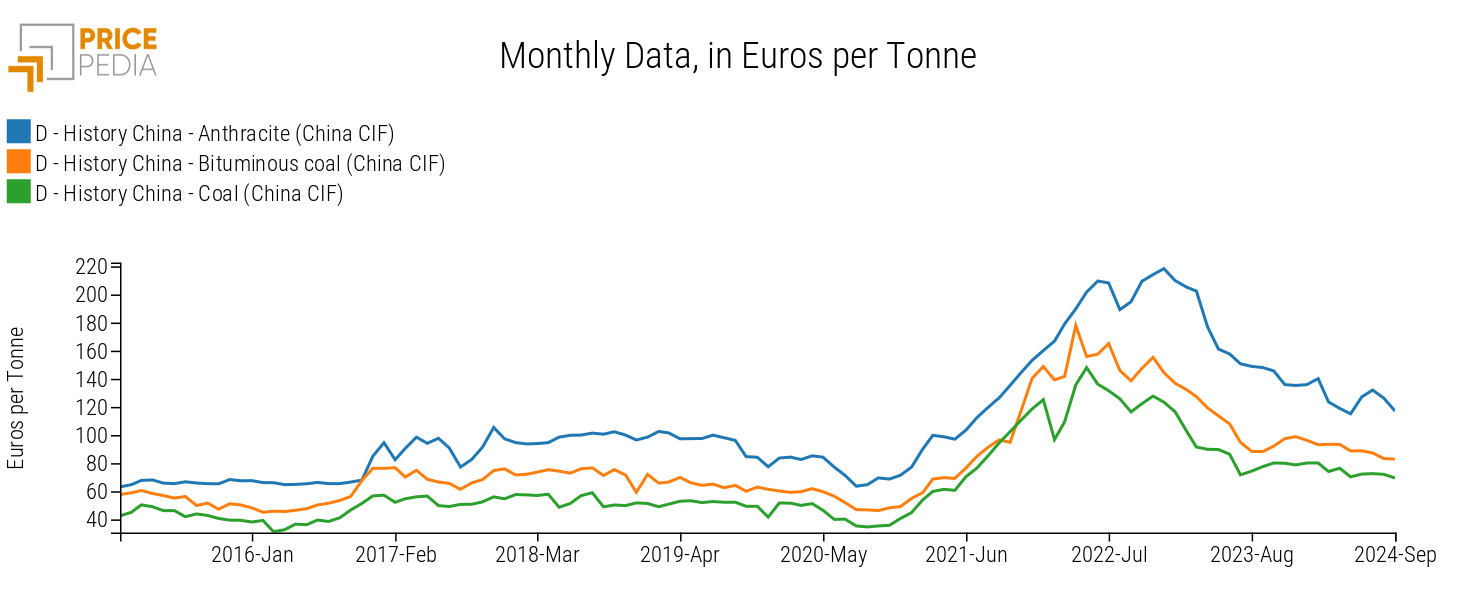

The uniqueness of what is happening in the European coal market is also highlighted by comparing coal import prices in China, as shown in the graph below.

The Chinese anthracite price follows the same trend as the import prices of other types of coal, maintaining a more or less constant price differential due to grade differences, contrary to what is observed in the European market.

1. Russo-Ukrainian War