Effects of US tariffs on global commodity prices

The lessons of the 2018 US tariffs

Published by Luigi Bidoia. .

Aluminium HRC Import tariffsFaced with the policies of the upcoming American administration, led by Trump, which planned to increase tariffs on imports from China up to 60% and 10% for other partner countries, many analysts highlighted the possible effects these policies could have on U.S. inflation, the growth of the American economy in the short and long term, and the global economy. However, few analyses have focused on the effects these policies could have on global commodity prices.

The United States is a net importer of many commodities that could be subject to the new tariffs. The impact of tariffs on the domestic prices of a commodity will also depend on any compensatory measures the administration might implement. However, most analysts believe that such compensations are unlikely to be effective and that tariffs on commodities will result in higher prices in the American market, leading to inflationary pressures.

The focus of this article is the impact that tariffs on commodities could have on prices in global markets, outside the U.S. economy. From a theoretical standpoint, these effects lead, ceteris paribus, to a reduction in prices on international markets. Tariffs reduce exports to the United States, causing an increase in supply in global markets and a consequent decrease in prices.

An analysis of what occurred during Trump’s first term, with the increase in tariffs on steel and aluminum, can provide empirical evidence of the potential effects, complementing theoretical analyses with a practical measurement of what actually happened.

The increase in U.S. tariffs during Trump’s first term

After taking office in January 2017, the Trump administration launched an investigation to determine whether imports of steel and aluminum posed a threat to the national security of the United States. After a year of investigation, the Department of Commerce concluded that these imports were threatening the domestic steel and aluminum industries, which were deemed critical to national security. This conclusion allowed the Trump administration to introduce, in March 2018, tariffs of 25% on steel and 10% on aluminum imported from various partner countries.

The Effect on Steel Prices

It is not straightforward to calculate the effect of the tariffs introduced by the Trump administration in 2018 on steel prices in the U.S. market and international markets, as tariffs are just one of several factors influencing the steel market. Other significant factors include the cost dynamics of the steel industry, as well as variations in supply and demand. However, we can derive some preliminary indications by analyzing the price variations presented in the table below. This table includes various measures of the factors that may have contributed to determining prices in the global steel industry during the 2018–2019 period. The three columns display annual changes for 2018 and 2019, as well as the cumulative change over the 2018–2019 biennium.

Effect of Tariffs on Hot-Rolled Coil Prices (Annual Variation Rates)

| Prices | 2018 | 2019 | 2018-2019 |

| Coking Coal * | 3.9 | -5.6 | -1.9 |

| Iron Ore ** | -2.3 | 30.1 | 27.1 |

| HRC Producer Price (USA) | 16.1 | 0.1 | 16.2 |

| Steel Producer Price (EU) | 12.5 | -8.7 | 2.7 |

| EU HRC Customs Price | 11 | -8.7 | 1.3 |

| HRC FOB Export Price (China) | 0.2 | -1.5 | -1.3 |

| HRC CIF Import Price (USA) | 13.5 | -12.3 | -0.5 |

If we consider the cumulative data for the 2018–2019 period, the effect of the tariffs becomes evident. Despite the relative stability of hot-rolled coil (HRC) prices in the international market, producer prices in the U.S. market increased by 16.2%. Additionally, the stability of international prices suggests a negative impact of the U.S. tariffs on these prices, given the simultaneous sharp increase in global production costs due to rising international iron ore prices.

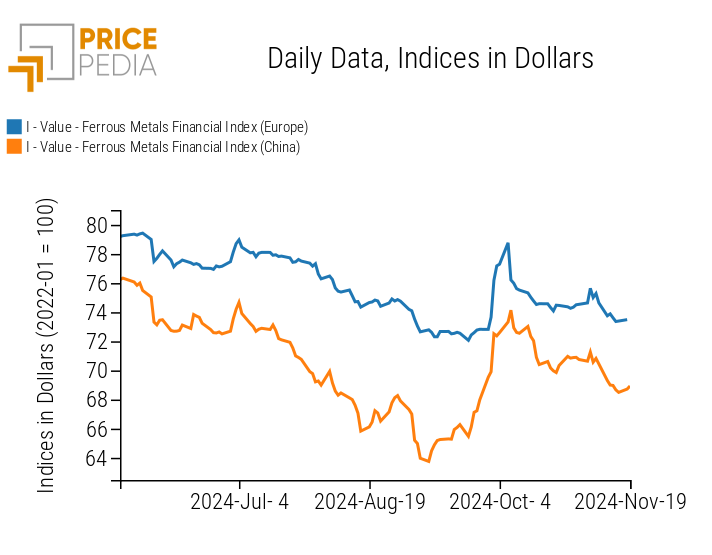

PricePedia Financial Indices of Ferrous Metal Prices in Dollars

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

The Effect on Aluminum Prices

For aluminum prices, we also analyzed changes in costs and various domestic and international prices during the 2018–2019 period. On the cost side, we considered international alumina prices and natural gas prices, used as a proxy for electricity prices. On the international price side, we examined the quotations of primary aluminum on the London Metal Exchange (LME) and the Shanghai Futures Exchange (SHFE). Unfortunately, the only price available for the U.S. domestic market is the producer price of secondary aluminum (source: U.S. Bureau of Labor Statistics), which can only serve as a proxy for the price of primary aluminum.

Effect of Tariffs on Aluminum Prices (Annual Variation Rates)

| 2018 | 2019 | 2018-2019 | |

| Prices in Europe | |||

| Customs: Alumina | 25.8 | -12.5 | 10.1 |

| Customs: Natural Gas | 30.6 | -30.3 | -8.9 |

| Financial (LME): Aluminum | 7.2 | -15.1 | -8.9 |

| Prices in China | |||

| CIF Imports: Alumina | 24.9 | -4.4 | 19.4 |

| CIF Imports: LNG | 28.2 | -4.1 | 22.9 |

| Financial (SHFE): Aluminum | 0.1 | -6.6 | -6.5 |

| Prices in USA | |||

| Producer Prices: Secondary Aluminum | 8.4 | -14.2 | -6.9 |

The data in the table clearly show the impact of tariffs, particularly in 2018, in suppressing international aluminum prices despite a sharp increase in production costs that year. This effect was more pronounced on Chinese prices, as the EU introduced a series of market protection measures in 2018, which achieved some partial results. The impact of tariffs on U.S. domestic prices is evident from the near double-digit increase in the producer price of secondary aluminum.

The analysis of data for 2019 (and therefore for the entire 2018–2019 biennium) is complicated by the differing production cost dynamics in the EU and China and by the slowdown in the U.S. industry, which affected secondary aluminum prices.

Conclusions

Protectionist trade policies, such as the tariffs on commodities introduced by the Trump administration, not only impact domestic markets but also drive changes in prices and dynamics within international markets. Analyzing the empirical effects of these measures provides valuable insights for assessing the impact of similar future policies, highlighting the importance of considering both domestic and global effects.

Theoretical and empirical evidence suggests that, all else being equal, the policy announced by the new U.S. administration to increase tariffs on imports poses a downside risk to international commodity prices.