Middle East: the effects of detente on global commodity markets

Truce between Israel and Hezbollah drives decline in oil, gold and dollar

Published by Luca Sazzini. .

Conjunctural Indicators Commodities Financial WeekWeekly Summary of Financial Commodity Prices

In last week’s article: "Effect of Russia-Ukraine escalation on commodity prices", the impact of the escalation of the Russia-Ukraine conflict on financial commodity prices was highlighted.

The escalation of the crisis mainly influenced the energy and gold markets, which saw upward trends that week.

This week, the opposite movement was observed, attributed to the truce between Israel and Hezbollah. The most significant drop in gold and oil prices occurred on Monday, the 25th, when rumors spread about the acceptance of a ceasefire proposal by Israeli Prime Minister Benjamin Netanyahu during a security meeting on Sunday evening. The truce was later approved by the Israeli government on Tuesday evening and officially came into effect on Wednesday morning, November 27.

Despite the suspension of the conflict temporarily easing geopolitical tensions in the Middle East, there are strong concerns about potential violations of the truce agreement. The Israeli military has accused Hezbollah of repeatedly violating the ceasefire agreement. Additionally, Israeli President Netanyahu officially stated that while he supports a temporary pause in the conflict in Gaza, he would not accept a permanent cessation of hostilities as demanded by Hamas.

These recent statements contributed to the slight recovery of gold and oil prices on Thursday.

At the upcoming OPEC+ meeting, an announcement of a further delay in the planned oil production increase for January is expected. A premature increase could generate an excessive oversupply, considering the persistent weakness in demand.

According to the U.S. Energy Information Administration (EIA) weekly stock analysis, the decrease in natural gas reserves was lower than expected. This favored a reduction in Henry Hub prices, which had risen due to severe weather in the United States. Despite the persistent cold, U.S. gas demand did not grow as the market had anticipated, temporarily halting the rise in Henry Hub natural gas prices.

In the industrial metals market, prices for ferrous and non-ferrous metals showed relative stability.

During the week, President Donald Trump announced via a post his intention to impose new tariffs on imports from China, Canada, and Mexico. The announcement caused a drop in base metal prices, despite the weakening of the dollar this week. However, no significant price changes have been observed so far, as industrial metal indices continue to record levels similar to those of the previous week.

Inflation

Euro Area

In November, the headline Consumer Price Index (CPI) of the euro area recorded a monthly decline of 0.3% m/m, as expected by analysts. This decrease is mainly attributed to the seasonal drop in services prices, which fell by 0.9% m/m.

Year-on-year, the CPI rose by 2.3% y/y, in line with analysts' expectations but up from October's figure of 2% y/y. The CPI excluding energy and food, the ECB's preferred measure, grew by 2.8%, one-tenth of a point higher than the year-on-year growth recorded in October.

These data highlight persistent inflation in the eurozone, with values exceeding the ECB's 2% target. However, it is unlikely to hinder the anticipated rate cuts by the ECB, especially given the weakness of the European economy.

United States

This week, the Personal Consumption Expenditures (PCE) data, the Federal Reserve's (FED) preferred inflation measure, were released.

As expected by analysts, the October inflation growth measured by the PCE index was 2.3% y/y, up from 2% y/y the previous month.

The PCE core index, excluding energy and food, rose to 2.8% y/y, up from September's figure of 2.7% y/y and in line with analysts' expectations. On a monthly basis, however, the core index remained unchanged, with a growth rate of 0.3% m/m.

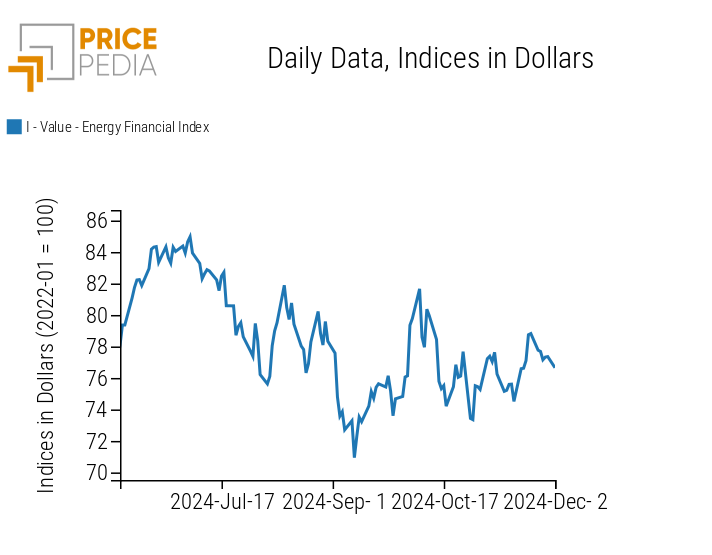

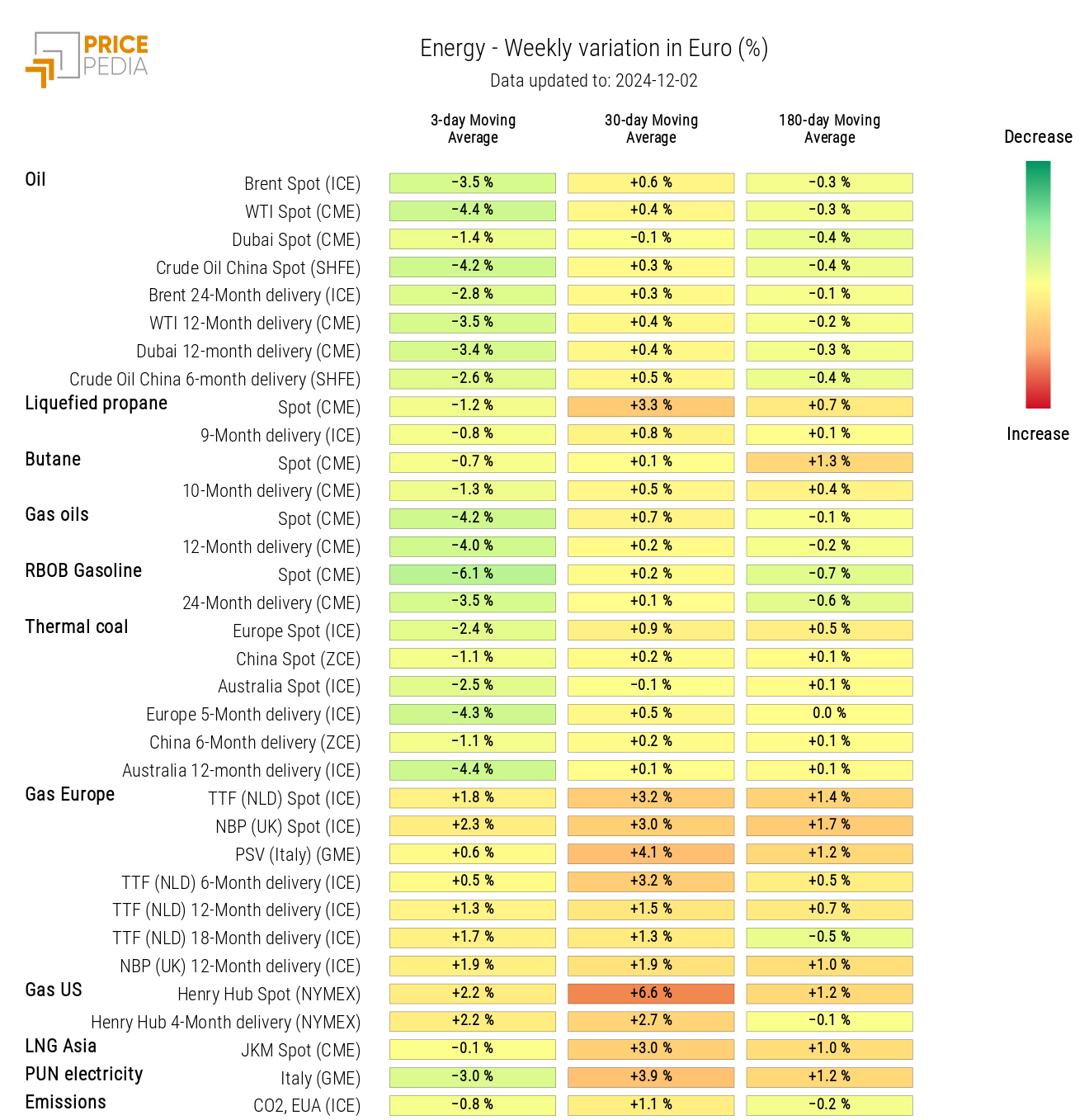

ENERGY

The PricePedia financial index for energy products follows a downward trend due to the truce in the Middle East.

PricePedia Financial Index of Energy Prices in USD

The energy heatmap highlights a reduction in oil prices and its derivatives.

Energy Price HeatMap in EUR

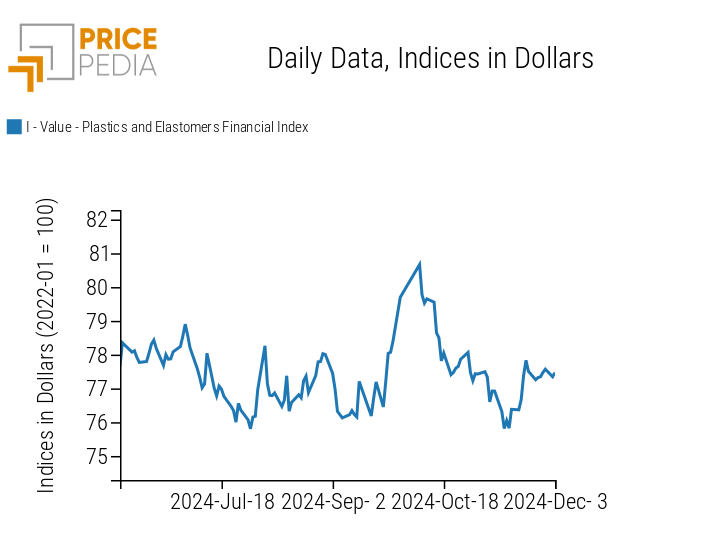

PLASTICS

The PricePedia index for plastics and elastomers shows slight weekly fluctuations, which do not alter its price levels.

PricePedia Financial Indices of Plastics Prices in USD

FERROUS METALS

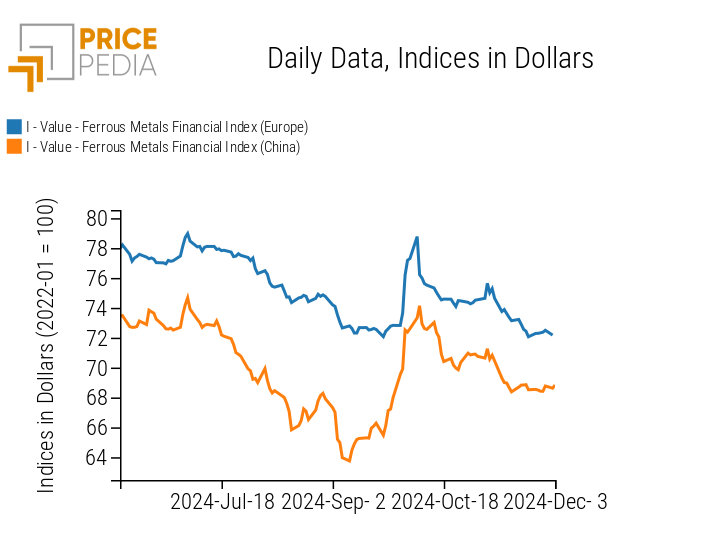

The European financial index for ferrous metals slightly recovers, while the Chinese ferrous metals index remains stable.

The slight recovery of the European index is mainly attributed to the weakening of the dollar recorded this week.

PricePedia Financial Indices of Ferrous Metal Prices in USD

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

INDUSTRIAL NON-FERROUS METALS

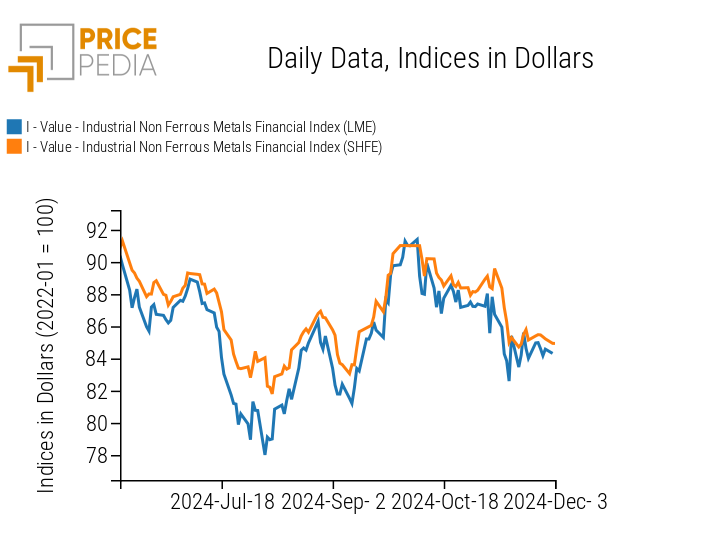

The LME non-ferrous index shows a slight fluctuation in prices, while the SHFE index remains more stable.

PricePedia Financial Indices of Dollar Prices for Industrial Non-Ferrous Metals

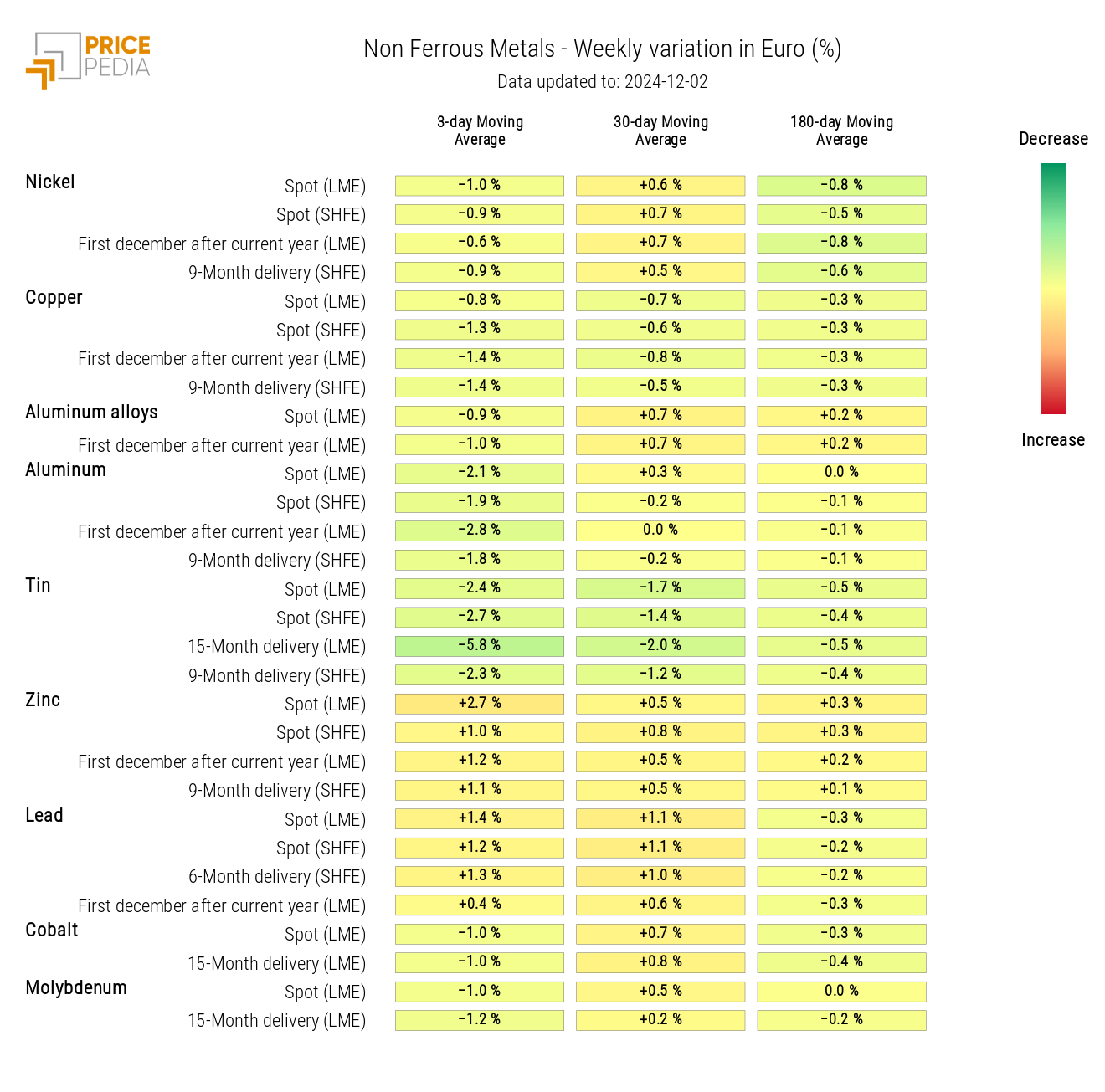

The heatmap below highlights a drop in tin prices, alongside an increase in zinc prices.

HeatMap of Non-Ferrous Prices in Euro

FOOD

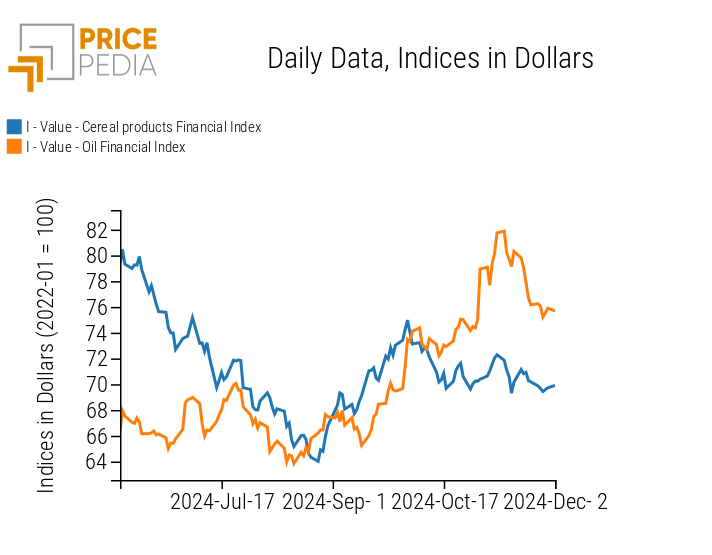

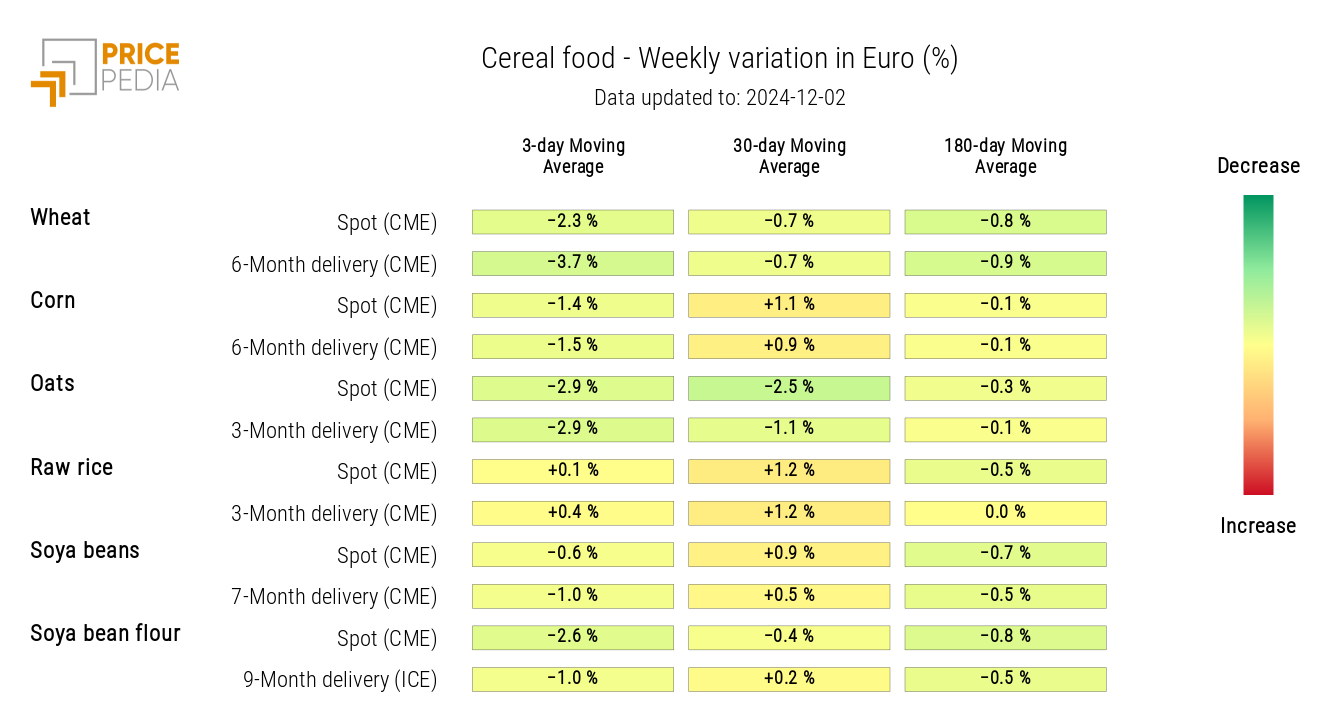

The cereals index continues its slow price decline through Wednesday, the 27th.

The index interruption is due to the closure of the financial market at the Chicago Mercantile Exchange, for the United States' Thanksgiving holiday.

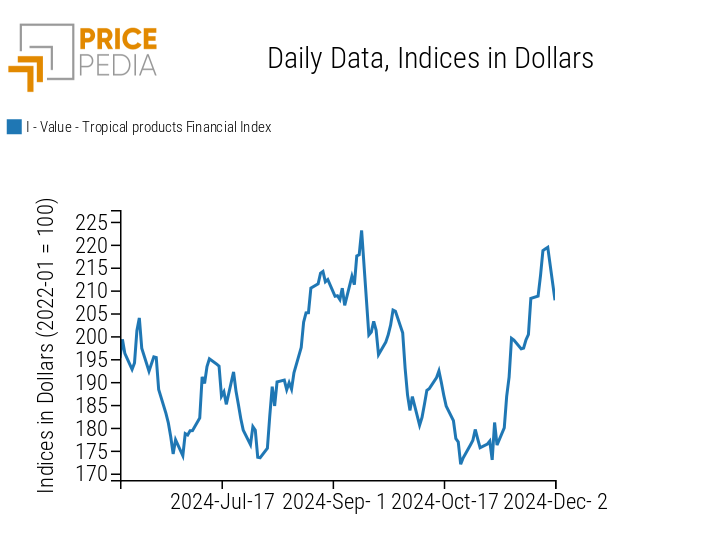

The tropicals index experienced a sharp decline on Monday, December 2, which erased the gains made earlier in the week. The oils index, on the other hand, continues its downward trajectory, despite a slight positive fluctuation in recent days.

| PricePedia Financial Indices of Dollar Prices for Food | |

| Cereals and Oils | Tropicals |

|

|

CEREALS

The cereals heatmap highlights a decrease in the prices of wheat, corn, oats and soya bean flour.

HeatMap of Cereals Prices in Euro

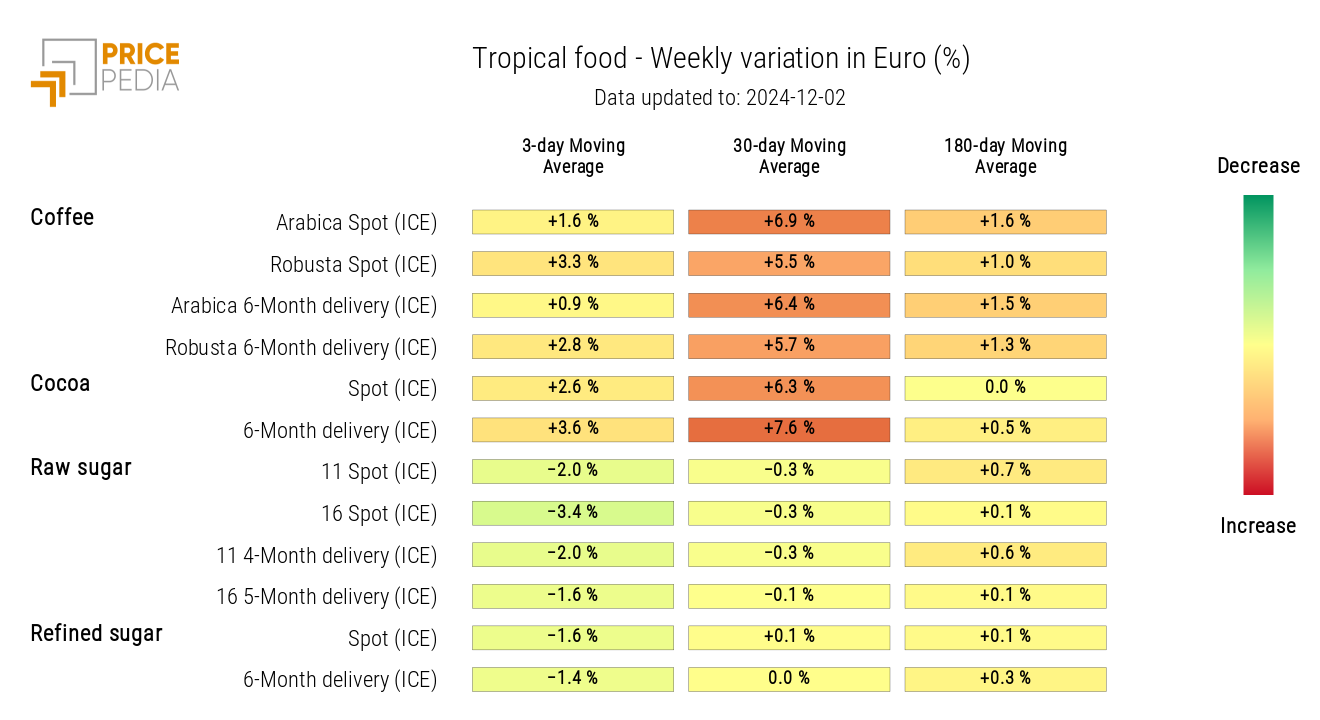

TROPICALS

From the analysis of the 30-day moving average variation, a strong increase in coffee prices is recorded.

HeatMap of Tropical Food Prices in Euro

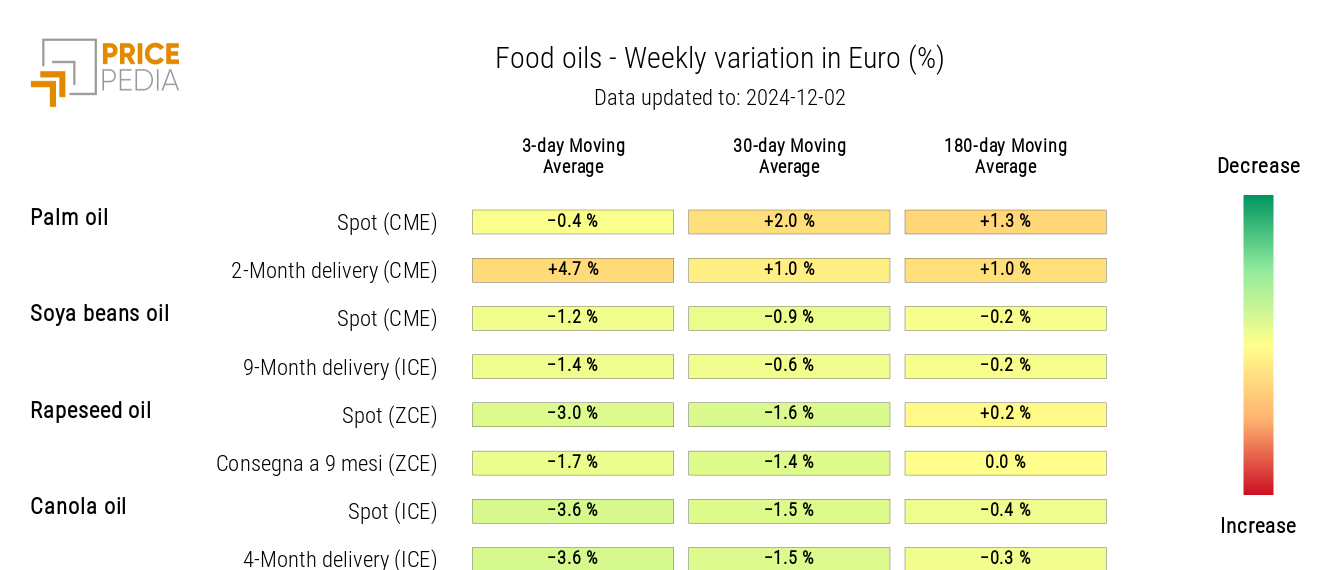

OILS

Analysis of the heatmap reveals a drop in the weekly moving average prices for all oils, specially for rapeseed oil and canola oil.

HeatMap of Food Oil Prices in Euro