Benzene price: global and determined mainly by demand

An analysis of the functioning of the world benzene market

Published by Luigi Bidoia. .

Petrolchimica Price DriversBenzene is one of the most important chemical intermediates, primarily used for the synthesis of other chemical compounds that are key elements in the global chemical industry. Its applications range from mass-consumption plastic materials to advanced and specialized chemical products.

The table below shows the main benzene derivatives, their primary uses, and related applications.

Benzene Derivatives

| Derivative | Primary Use | Applications |

|---|---|---|

| Ethylbenzene | Production of styrene | Polystyrene, ABS, styrenic rubbers |

| Chlorobenzene | Chemical intermediate, solvent | Phenol, aniline, herbicides, pharmaceuticals |

| Cumene | Production of phenol | Resins, polycarbonates |

| Nitrobenzene | Production of aniline | Polyurethanes, dyes |

| Naphthalene | Production of phthalic anhydride | Plasticizers, resins |

| Cyclohexane | Intermediate for nylon | Textile fibers, technical materials |

Production of Benzene

Benzene production mainly occurs as a by-product of industrial processes in the petrochemical sector and petroleum refining. Specifically, benzene is a by-product of the following processes:

- Steam cracking: used to produce light olefins such as ethylene and propylene.

- Catalytic reforming: a process primarily aimed at improving gasoline quality.

- Coking: used to produce coke and coking gas from coal. A by-product of coking is coal tar, which can be used to produce benzene.

- Petroleum cracking: a process that converts heavy fractions of crude oil into lighter compounds such as gasoline, diesel, and light gas oil. A by-product of this process is toluene, which can subsequently be converted into benzene.

Dependent Supply and Market Mechanism

As a by-product of these processes or derived from chemicals that are themselves by-products, benzene does not have an autonomous supply. This means its supply depends on the demand for other products, particularly:

- Gasoline (catalytic reforming)

- Olefins (steam cracking)

- Coal and coke (coking)

Benzene can be produced relatively independently by transforming coal tar or toluene, but even in these cases, its supply is tied to the demand for coke and petroleum derivatives.

Since the supply is not autonomous, there is no mechanism to adjust supply in response to prices. Consequently, the market equilibrium between supply and demand for benzene relies mainly on variations in demand, which tends to decrease with rising prices or increase with falling prices.

Global Prices and Market Dynamics

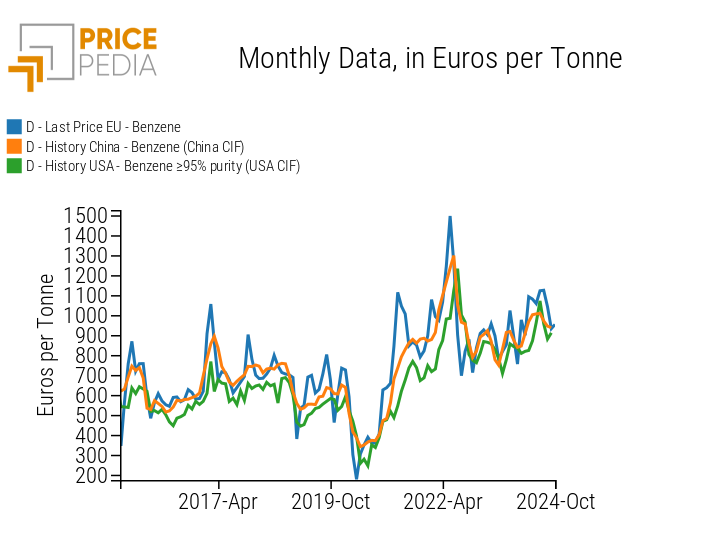

The strong alignment of benzene prices on a global scale suggests the existence of a single global market. The following graph shows:

- The EU customs price of benzene (calculated as the average of intra-EU and extra-EU trade among the 27 EU countries).

- The CIF (Cost, Insurance, and Freight) price of Chinese imports.

- The CIF price of imports to the United States.

From the analysis of the graph, there is little doubt about the alignment in price levels and dynamics of benzene in the three main economic regions of the world.

Comparison of benzene prices in the EU, China and the U.S.

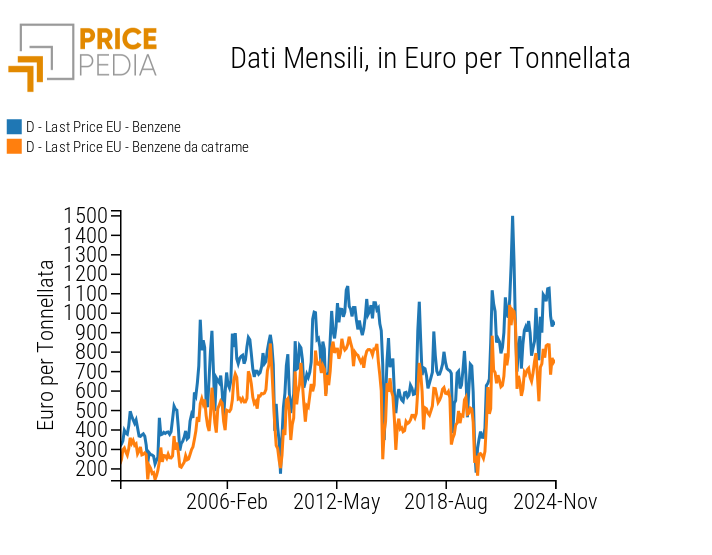

In addition to showing a high degree of alignment among prices in different regions of the world, benzene prices are also perfectly aligned based on the production process. The following graph shows the EU customs prices for petroleum-derived benzene from petrochemical processes and benzene obtained from coal tar.

Comparison of Petroleum Benzene and Coal Tar Benzene Prices

Over the past 25 years, the two prices have moved in perfect correlation, with a consistent price differential in favor of petroleum-derived benzene. This indicates the existence of a single global market, where coal tar-derived benzene is systematically priced at a discount compared to petroleum-derived benzene.

An Initial Econometric Analysis

The numerous relationships linking benzene prices globally and across production methods make it challenging to identify a statistically robust equation.

However, an initial analysis has produced results that appear consistent with previously described findings and statistically solid. In this analysis, we considered two different equations, with the dependent variables being the price of petroleum-derived benzene and coal tar-derived benzene, and the following variables as independent regressors:

- Global industrial cycle, used as a proxy for global benzene demand. Given the multiple industrial uses of benzene derivatives, it is reasonable to assume that benzene demand increases with industrial activity and decreases when it contracts.

- Oil price, recognized as a proxy for production costs by market participants.

- Toluene price, representing the actual production costs of benzene derived from it and contributing to price determination.

The dynamic specification by Engle & Granger was used. Variables were considered in logarithmic form, allowing coefficients to be interpreted as elasticities. The statistical tests show very solid results, with all coefficients highly significant. The R² of the long-term equations are 0.73 and 0.83, respectively, while the Durbin-Watson statistics for the short-term equations are 1.84 and 2.07.

The results are summarized in the table below:

Regression Results: Elasticities

| Regressors | Dependent: Petroleum Benzene | Dependent: Coal Tar Benzene |

|---|---|---|

| Global industrial cycle | 3.44 | 2.49 |

| Oil price | 0.21 | 0.43 |

| Toluene price | 0.64 | 0.55 |

The analysis highlights a total cost elasticity close to 1. This means that a 10% change in oil and toluene prices results in a similar variation in benzene prices.

Particularly notable is the elasticity of prices to the global industrial cycle. The average elasticity value is 3, indicating that benzene prices tend to vary with an intensity three times greater than changes in the cycle. This result is consistent with a market where supply does not play a moderating role in mitigating the effects of demand variations on prices.