First signs of recovery in commodity demand in China

Escalation of the trade war between the United States and China

Published by Luca Sazzini. .

Conjunctural Indicators Commodities Financial WeekWeekly Summary of Financial Commodity Prices

This week, financial commodity prices remained relatively stable despite rising geopolitical tensions.

The oil market experienced a predominantly bearish trend, although an additional delay in OPEC's production increase planned for January had already been anticipated. On Thursday, OPEC postponed the production increase for the third time and extended the complete cessation of production cuts by one year, until the end of 2026. This decision aligns with the fundamentals of the oil market, which remains characterized by oversupply, despite the extension of production increases.

The metals sector witnessed a further escalation of the trade war. China imposed an immediate export ban to the United States on gallium, germanium, and antimony, metals critical for various high-tech applications and strategic sectors such as defense.

These dynamics did not affect the prices of industrial metals, which remained relatively stable, except for the prices of Chinese iron ore, which showed a slight increase.

The rise in iron ore prices is attributable to favorable data from Chinese PMI indices and, above all, improvements in the real estate sector. Recently introduced fiscal stimuli by the Chinese government have positively impacted the real estate market, which is beginning to stabilize. Another factor positively influencing the price dynamics of iron ore, and other metals in general, is the expectation of further fiscal stimuli from the Chinese government during next week’s “Central Economic Work Conference.” However, recent statements from Chinese state media suggesting that economic growth below 5% would still be acceptable have moderated financial markets' expectations for aggressive short-term fiscal stimuli.

In the food sector, persistent price volatility in tropical products has been observed, alongside an increase in the prices of oils and cereals.

China PMI

Data from the two PMI indices for China’s manufacturing sector both signaled expansion in November, with the average of the two readings rising from 50.2 to 50.9.

The Purchasing Managers' Index measured by Caixin rose to 51.5, exceeding analysts' expectations (50.6) and October's figure (50.3).

The NBS PMI reached 50.3, slightly above analysts' expectations (50.2) and October’s figure (50.1).

The growth of the two indices is mainly attributed to an increase in orders due to strengthened domestic demand, the launch of new products, and the anticipation of foreign orders following Donald Trump's election. There is also growth in production, purchases, inventories, and confidence.

Contrary to analysts' expectations, the non-manufacturing PMI index declined from 50.2 to 50. The drop was due to the contraction of the construction PMI, which fell from 50.4 in October to 49.7.

Analysis of the services PMI reveals a slight slowdown in November, with the average of the two readings declining slightly from 51 to 50.8. The drop is linked to the unexpected slowdown in the Caixin PMI, which reached 51.5, down from the previous month's 52 and the 52.4 expected by analysts. The NBS services PMI remained unchanged at 50.1.

Overall, Chinese PMI publications highlighted a general improvement in the Chinese economy, especially in the manufacturing sector. Although the services PMI showed a slight slowdown, it remains above the 50-point threshold, which marks the boundary between economic growth and contraction.

The composite PMI, representing the overall performance of the Chinese economy, rose to 52.3 from October’s 51.9.

Expectations for the ECB Meeting

For the upcoming ECB Governing Council meeting on December 12, a 25-basis-point rate cut is expected.

Inflation in the euro area continues to remain above the ECB's target and is expected to rise in the last quarter of the year. However, analysts believe this inflationary pressure is temporary and not likely to persist into 2025.

The primary concern for the European economy is not inflation but rather persistent economic weakness. Official PMI data published this week, although slightly better than preliminary flash estimates, confirmed an economic contraction in the eurozone. The services sector, which had previously supported economic growth, has started to show signs of contraction. The ongoing weakness of the European industry is spilling over into the tertiary sector, leading to an overall decline in the composite PMI.

In this context, another rate cut is expected to support economic recovery in the eurozone.

Particular attention is directed to Germany, which has long been the driving force of the European economy but now shows signs of difficulty. Christine Lagarde and Joachim Nagel, president of the Bundesbank, agree on the need for greater efforts by Germany to support domestic investments. In this regard, President Nagel has urged the government to review the law limiting the annual deficit to 0.35% of GDP.

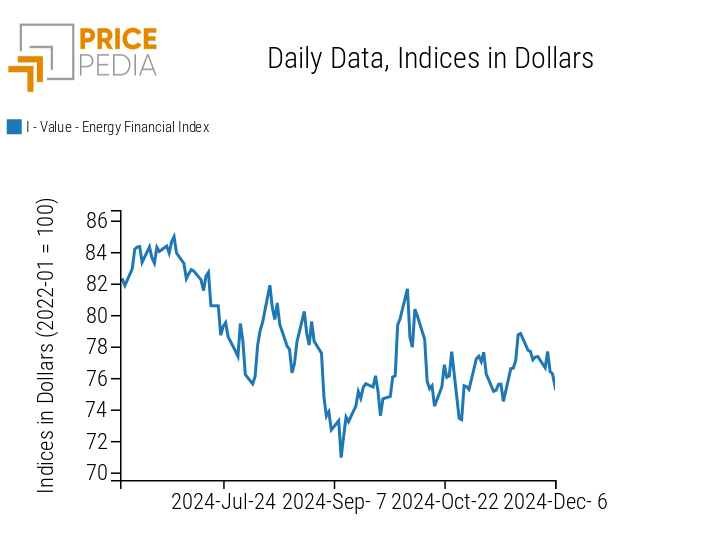

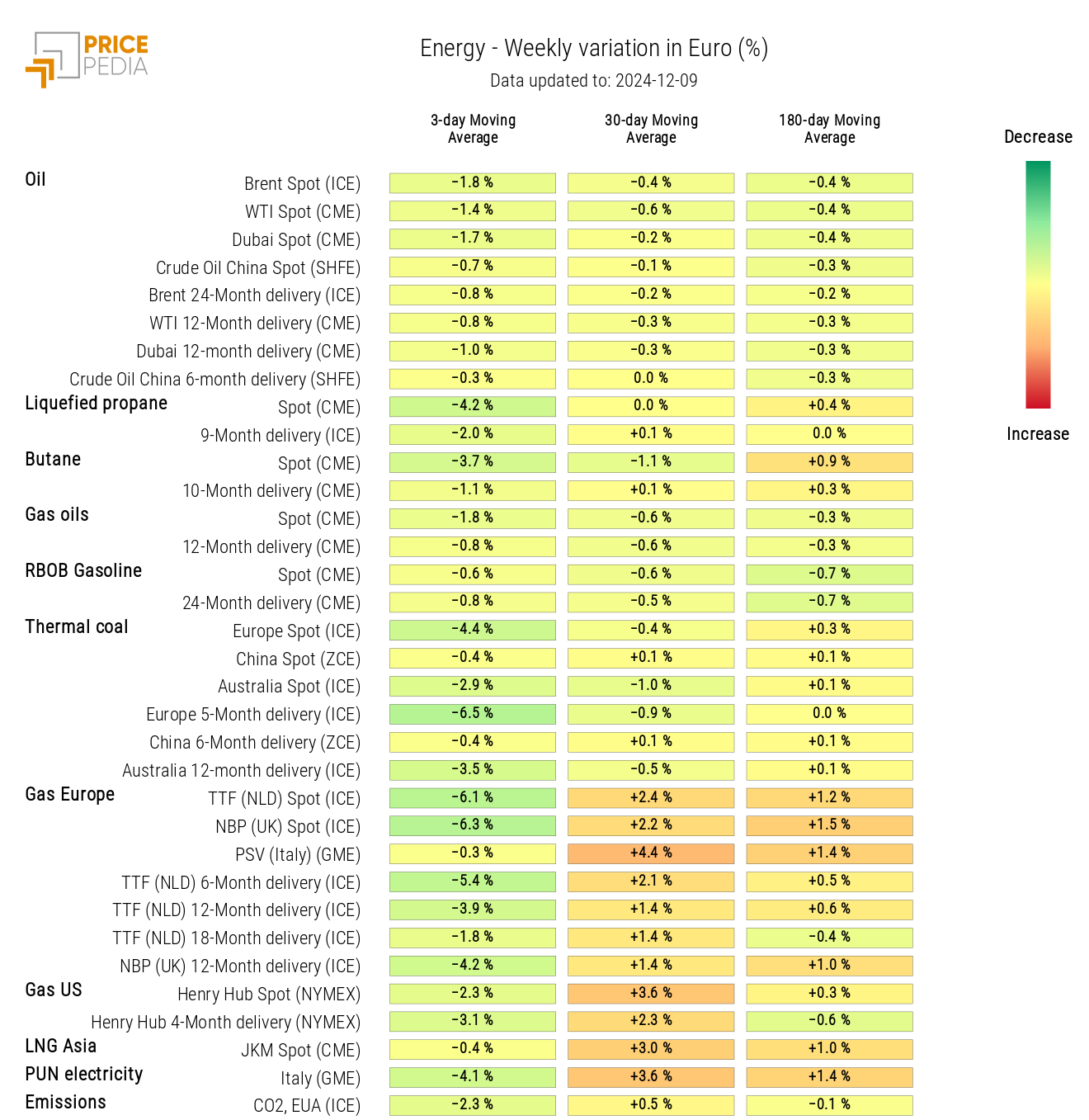

ENERGY

Except for a price rise on Tuesday, the PricePedia energy product index recorded a decline last week.

PricePedia Financial Index of Energy Prices in Dollars

The energy heatmap highlights the reduction in thermal coal and U.S. natural gas prices, driven by forecasts of milder temperatures.

HeatMap of Energy Prices in Euros

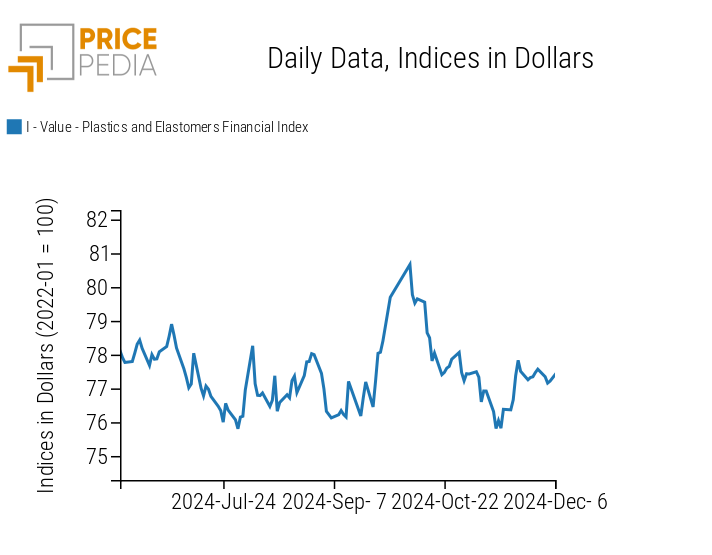

PLASTICS

The PricePedia index of financial prices for plastics and elastomers exhibited price dynamics characterized by some lateral fluctuations.

PricePedia Financial Indices of Plastics Prices in Dollars

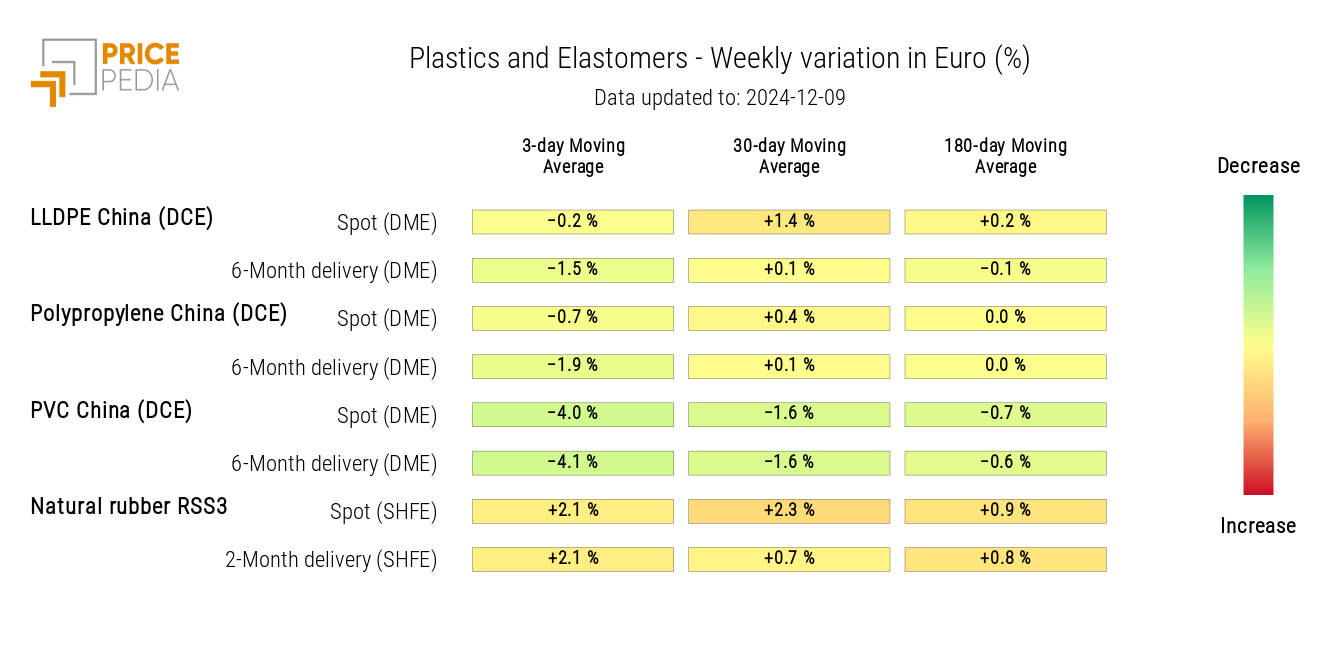

The heatmap below indicates a decrease in PVC prices and an increase in natural rubber RSS3 prices.

HeatMap of Plastics and Elastomers Prices in Euros

FERROUS METALS

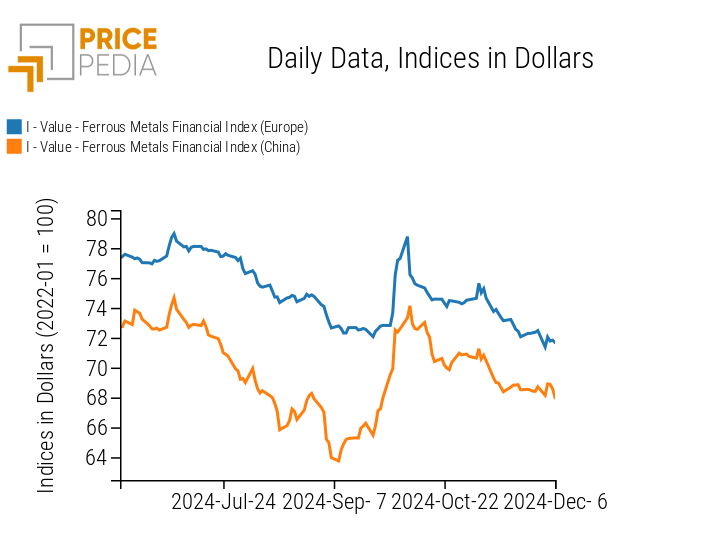

The financial indices for ferrous metals remained relatively stable over the week.

PricePedia Financial Indices of Ferrous Metal Prices in Dollars

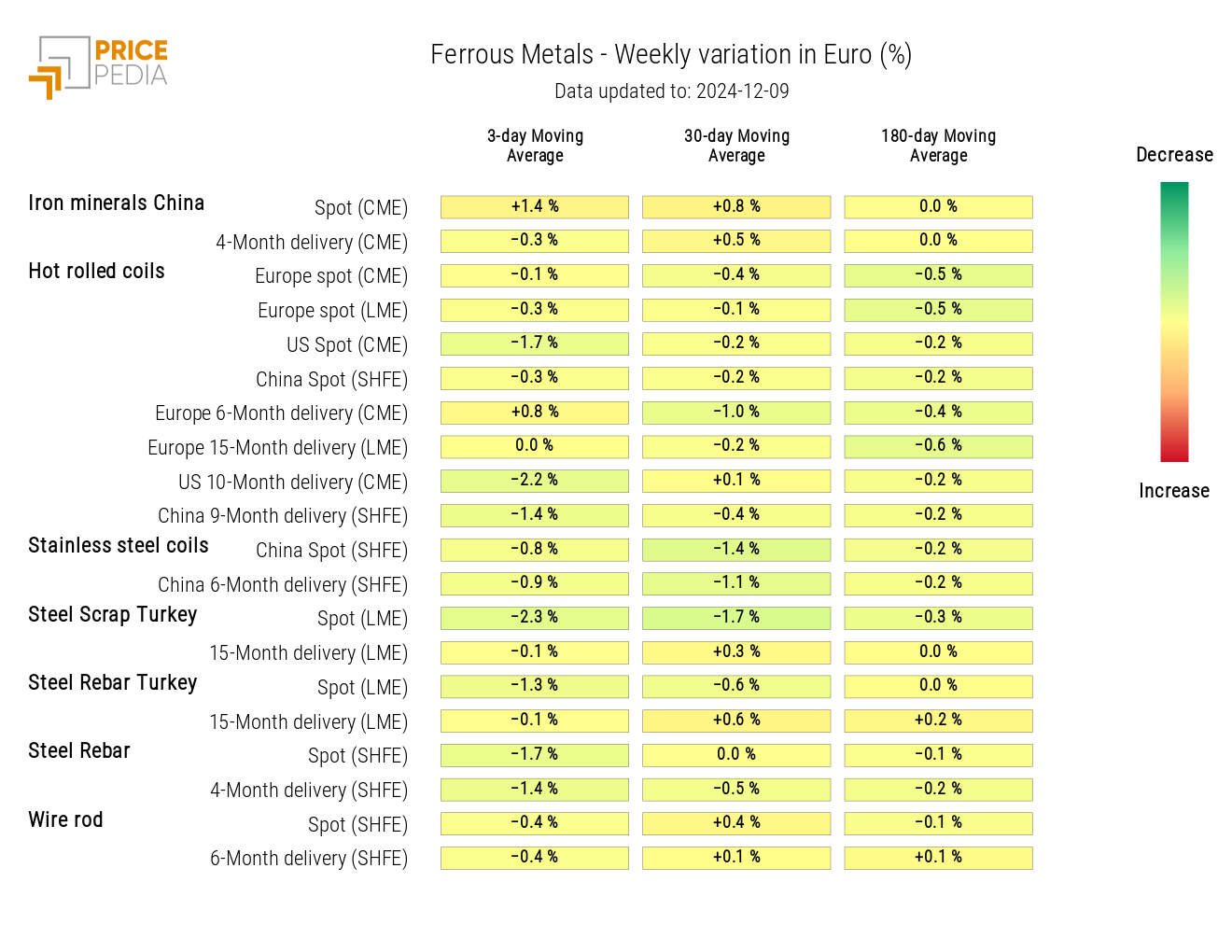

The analysis of the ferrous heatmap shows an increase in Chinese iron ore prices and a decline in Turkish steel scrap prices.

HeatMap of Ferrous Prices in Euros

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

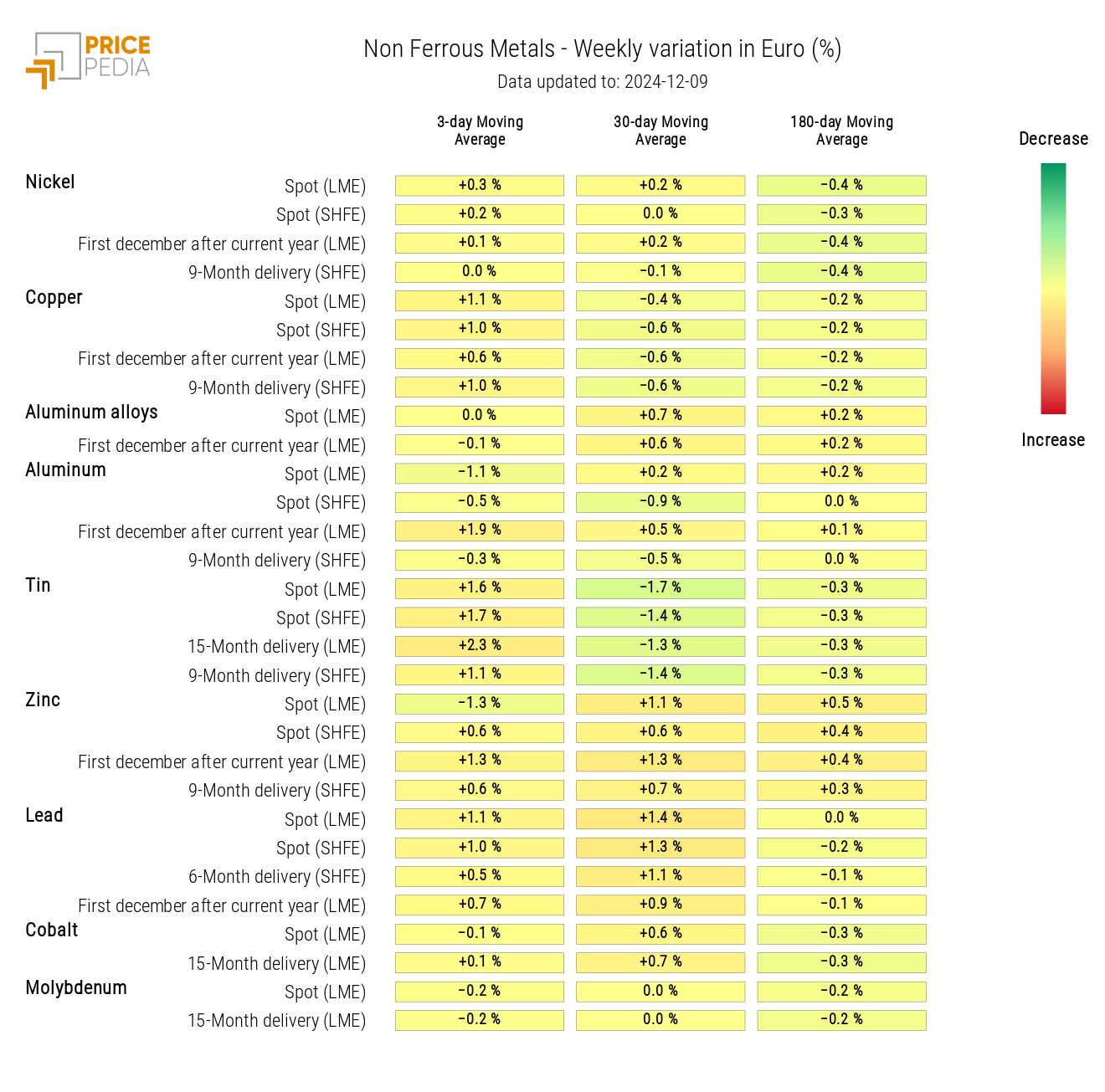

NON-FERROUS INDUSTRIALS

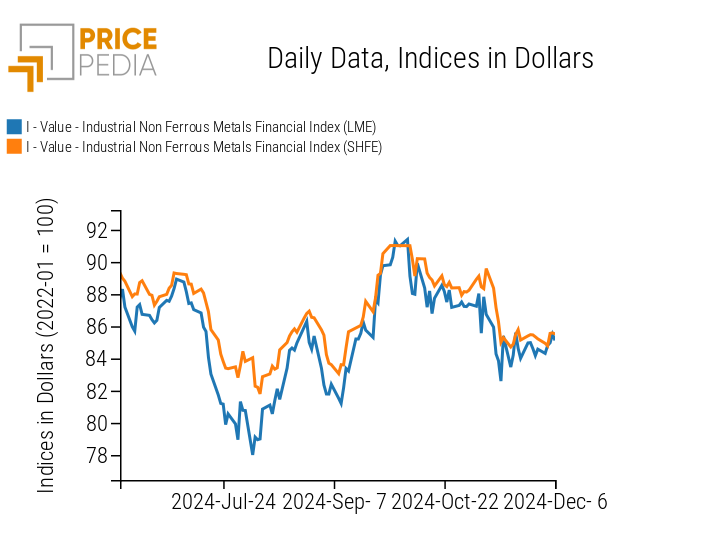

The two financial indices for non-ferrous metals record some price fluctuations, which do not alter their overall trend.

PricePedia Financial Indices of Non-Ferrous Industrial Metals Prices in USD

The heatmap below indicates a general stability in prices and a slight increase in tin prices.

HeatMap of Non-Ferrous Prices in EUR

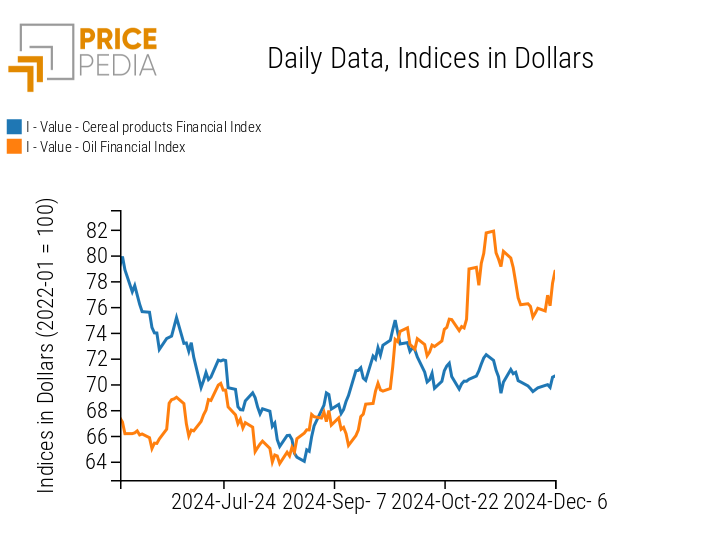

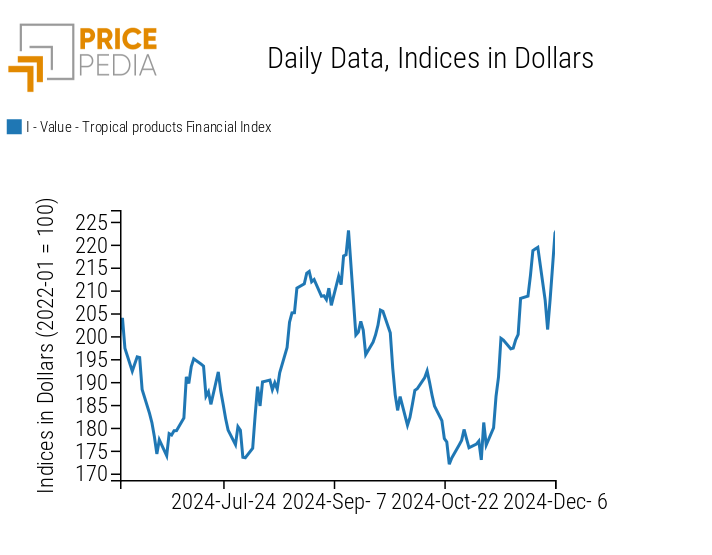

FOOD

This week, the financial indices for grains and, especially, oils show an increase in prices.

The tropicals index records a drop in prices, followed by a recovery in recent days.

| PricePedia Financial Indices of Food Prices in USD | |

| Grains and Oils | Tropicals |

|

|

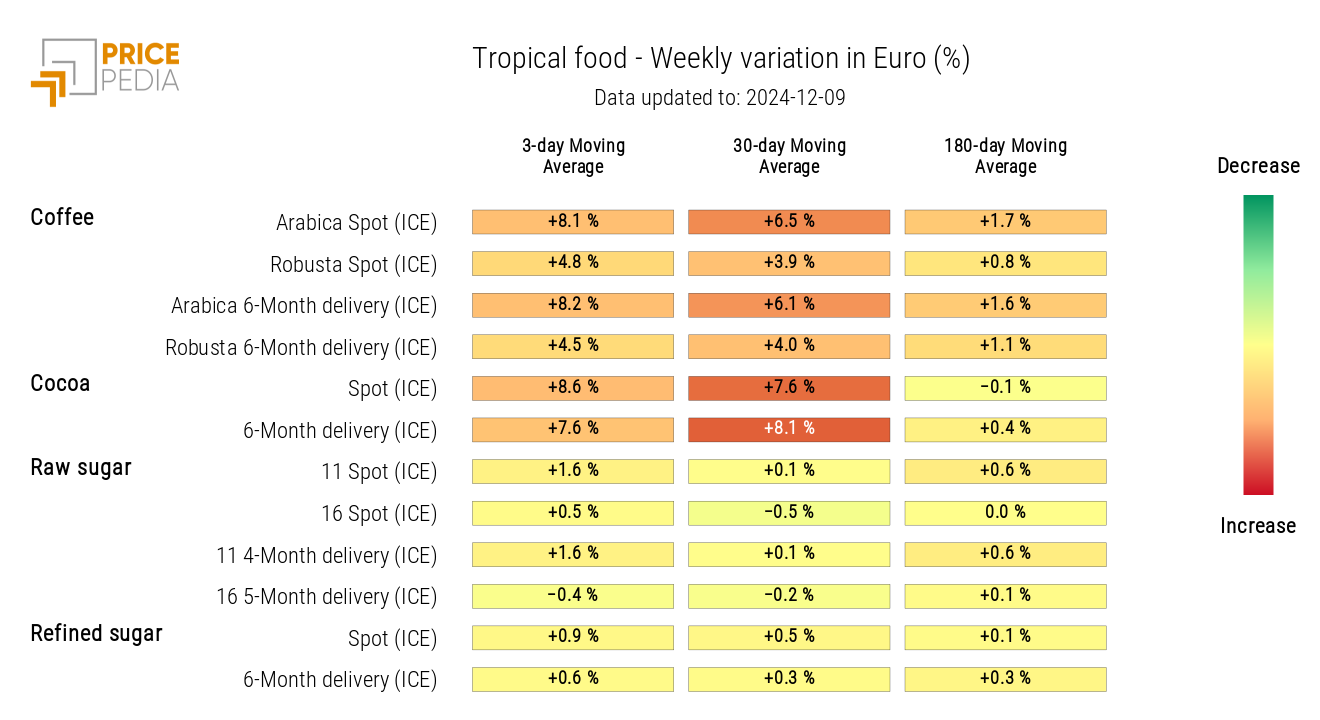

TROPICALS

The heatmap highlights an increase in coffee and cocoa prices.

HeatMap of Tropical Food Prices in EUR

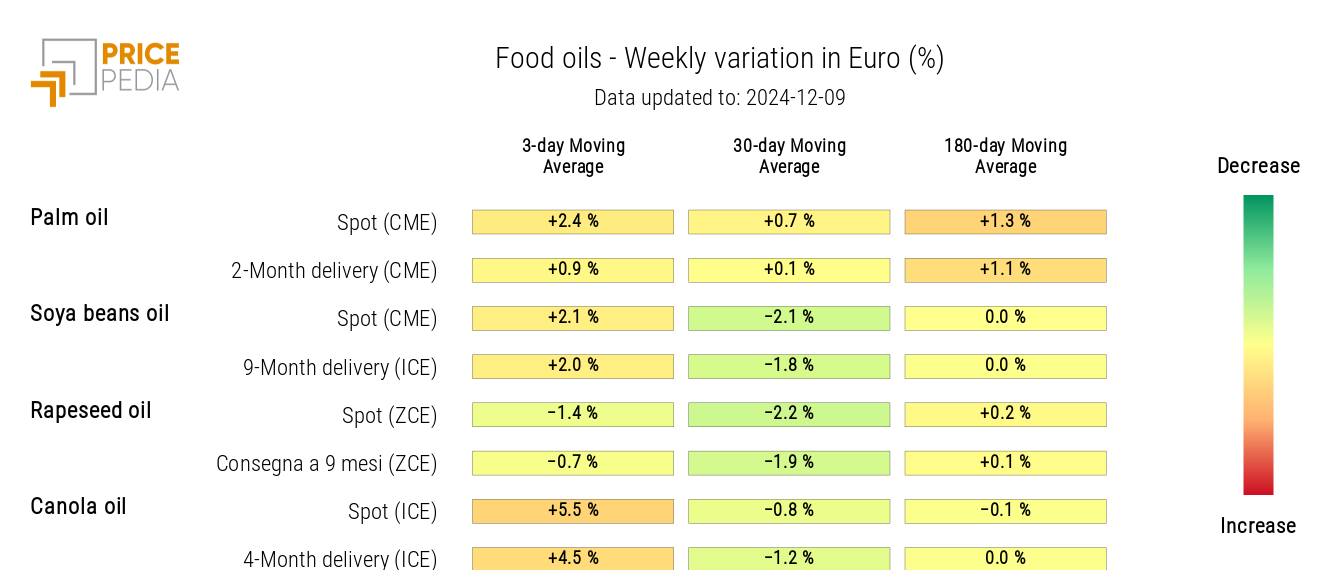

OILS

The oils heatmap shows a slight increase in oil prices, except for canola oil.

HeatMap of Oils Prices in EUR