Criticality of nickel for European industry

Russia presents strong leadership in the nickel production chain

Published by Luca Sazzini. .

Nickel Non Ferrous Metals Critical raw materialsAmong the metals that have shaped the face of modern industry, nickel stands out for its crucial role in technological innovation and its extraordinary versatility in usage.

Below is a list of its main industrial applications, indicating in parentheses the global percentage of nickel used in each application:

- Stainless steel (72%): the predominant share of global nickel is used in the production of stainless steel, an alloy primarily composed of iron, nickel, and chromium, known for its excellent corrosion resistance;

- Other metallurgical uses (20%): in metallurgy, nickel is also used for plating and in the production of steel alloys and non-ferrous alloys, such as cupronickel;

- Batteries (7%): the use of nickel in batteries is expected to increase due to the energy transition. In particular, nickel is used in the production of lithium-ion batteries, employed in the automotive sector and electrical energy storage systems;

- Other uses (1%): nickel is utilized in a wide range of chemical processes, including the hydrogenation of vegetable oils, hydrocarbon reforming, and the production of fertilizers, pesticides, and fungicides.

Global Supply Concentration of Nickel

In the context of customs markets, nickel is traded in various forms. The two most important are nickel ores and raw nickel metal. In the European customs market, the most traded form is raw nickel metal, which is also the only type traded on the financial markets of the London Metal Exchange (LME) and the Shanghai Futures Exchange (SHFE).

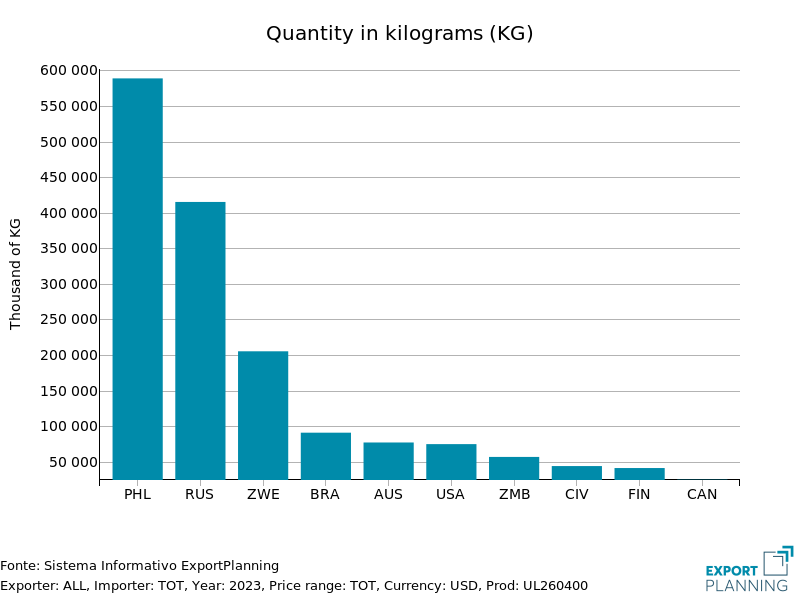

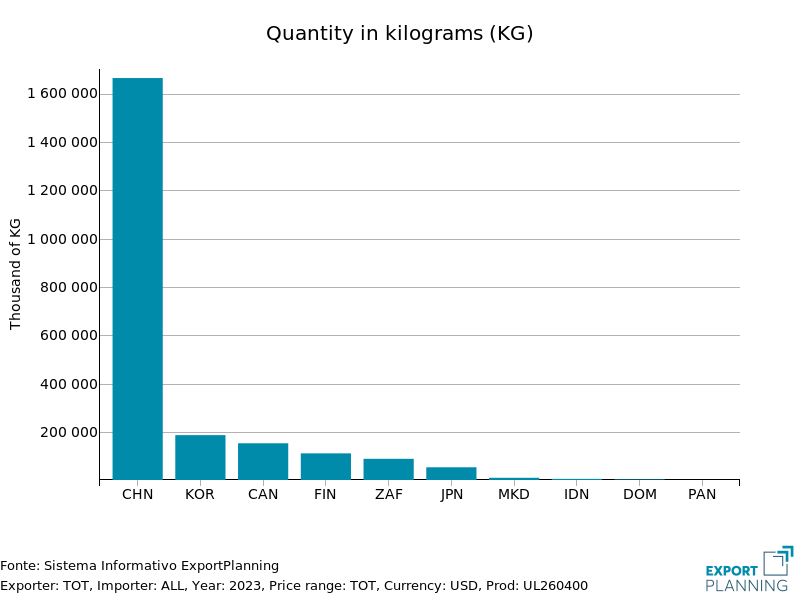

The table below presents charts showing the top 10 global exporters and importers of nickel ores in 2023.

| Nickel Ores and Concentrates | |

| Top Global Exporters | Top Global Importers |

|

|

The bar chart on the left highlights that the Philippines, Russia, and Zimbabwe are the top global exporters of nickel ores and concentrates.

The chart on the right reveals China's dominant role as the leading importer of nickel ores and concentrates.

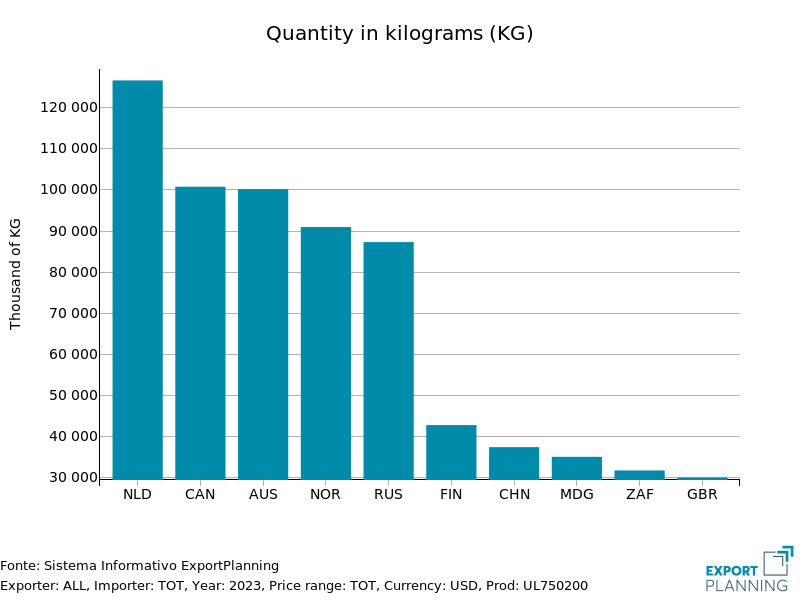

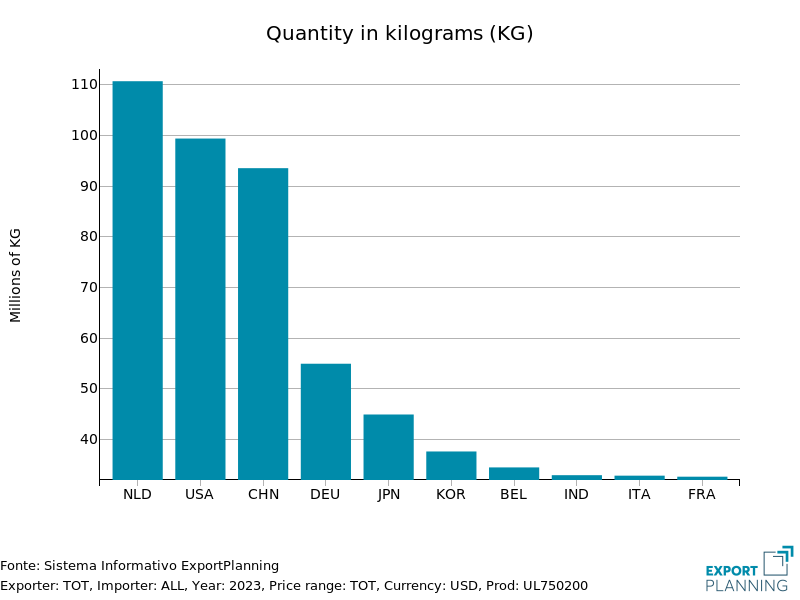

The following two charts show the top exporting and importing countries of raw nickel metal.

| Raw Nickel Metal | |

| Top Exporting Countries | Top Global Importers |

|

|

From the analysis of these two charts, it emerges that the true exporters of raw nickel metal are Canada, Australia, Norway, and Russia. The Netherlands (NLD) are so-called "false" exporters, as the vast majority of their exports involve nickel previously imported.

It is noteworthy that China ranks among the leading importers of nickel (and not among the top exporters), despite its position as an absolute leader in nickel ore imports and raw nickel metal production.

By combining the insights from this analysis of foreign trade flows, the following picture of the main players in the global nickel sector emerges:

- Competition in the global raw nickel metal market primarily involves four countries: Canada, Australia, Norway, and Russia. Among them, Russia enjoys the greatest advantages due to its high availability of ores, making it the world's second-largest exporter of nickel ores. In terms of comparative advantages, Russia is followed by Australia, which is also among the exporters of nickel ores, but with volumes much lower than those of Russia. Norway and, especially, Canada have fewer advantages, as Canada needs to import ores to sustain its production and export of raw nickel metal;

- The main importer, by far surpassing any other player, is China, which must support its high production of raw nickel metal. However, imports of nickel ores are not sufficient to meet the demand for nickel, making China also one of the top importers of raw nickel metal;

- The EU is almost exclusively an importer of raw nickel metal. Imports are carried out by the Netherlands, which subsequently re-export the metal to other EU countries. EU imports of ores almost exclusively involve imports to Finland from Brazil. These ore imports directly support steel production, as Finland is home to the Outokumpu plant, a global leader in stainless steel production specializing in nickel processing.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

The Criticality of Nickel for the EU

The economic importance of nickel, combined with its market risk derived from the concentration of its reserves and production in a limited number of countries, has made it a critical raw material not only for the European Union but also for the governments of other countries such as the United States and Canada.[1]

Another factor to consider when assessing the criticality of this metal is that, in some situations, the high volatility of its financial prices has led the London Metal Exchange (LME) to suspend and cancel transactions of futures contracts, as they did not adequately reflect the price of the underlying physical market. This issue is explored in the article: "Caos Nickel", which highlights the failure of the financial market to establish a unified price.

Comparison Between European Prices and Financial Prices

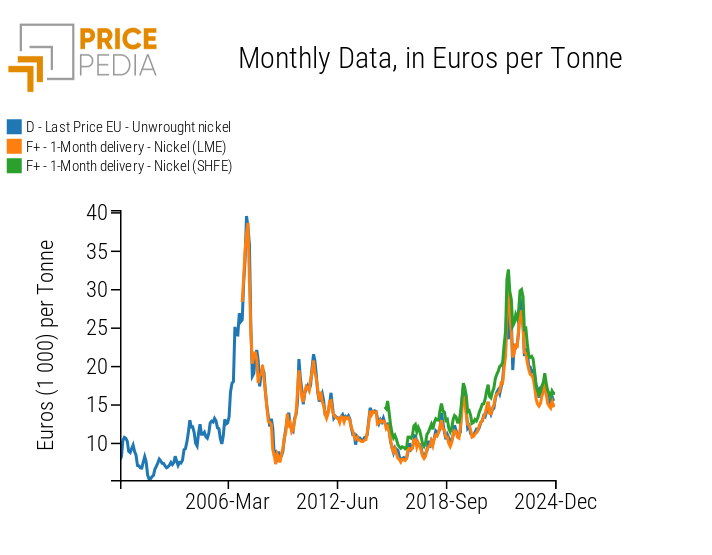

The following chart compares the financial prices of primary nickel listed on the London Metal Exchange (LME) and the Shanghai Futures Exchange (SHFE) with the customs price of unalloyed raw nickel, the benchmark for physical nickel prices in Europe.

Historical Series of Customs and Financial Prices for Raw Nickel

The chart highlights the close relationship between customs and financial prices of nickel, confirming the existence of a global price interconnected with various regional markets.

The most intense price cycle began in 2006, driven by the strong increase in demand for raw materials, including nickel, from China. Price growth peaked in April, when the European customs price reached nearly 40,000 euros/ton. Prices then collapsed following the global financial crisis, which began to manifest as early as 2007, leading to a drop in nickel demand and an enormous oversupply.

The second price peak for nickel is mainly attributable to the invasion of Ukraine by Russia, which led the London Metal Exchange to suspend the quotation of this product. This episode highlighted the significant impact on financial and physical metal prices caused by uncertainties in nickel supply, given Russia's crucial role in the global production chain, from minerals to metals.

Conclusions

This article has highlighted the main factors that make nickel a critical commodity not only for the European Union Commission but also for the governments of other countries like the United States and Canada.

Three-quarters of the nickel consumed worldwide is used in stainless steel production, while a smaller portion is currently employed in electric battery production. However, this share is expected to grow at a sustained pace, in line with the increase in battery production. The anticipated rise in global nickel demand could lead to price tensions and supply difficulties for EU companies, given the high concentration of production at a global level.

From the analysis of the main exporting countries, it has emerged that Russia ranks among the top global exporters of both nickel ores and concentrates and raw nickel. Russia's abundant mineral resources give it a strong comparative advantage over other major producing countries. This is particularly true for China, which, despite being the world's leading producer of raw nickel, has the weakness of heavily relying on foreign imports of minerals.

The EU, which directly imports raw nickel, has significantly reduced its dependence on the Russian market over the years. In 2010, the EU imported approximately 233 million kg of raw nickel from Russia, while in 2023, this figure dropped to only 29 million kg.

The importance of minimizing dependence on Russian nickel supplies has become evident in light of the events of March 2022. Following the outbreak of the war in Ukraine, nickel financial prices became so volatile that the London Metal Exchange had to suspend transactions for several days. This episode underscored the global vulnerability caused by reliance on Russian nickel supplies, triggering price spikes in both financial and physical markets.

[1] Nickel is included in the European Commission's “Critical Raw Materials” list, the United States' “Critical Minerals” list, and Canada's “Critical Minerals Strategy”.