Russian sanctions: from metals to energy?

Biden administration considers sanctions on Russian oil imports

Published by Luca Sazzini. .

Conjunctural Indicators Commodities Financial WeekWeekly Summary of Financial Commodity Prices

While the European Union begins discussions on the fifteenth package of sanctions against Russia, the Biden administration is considering introducing new sanctions on imports of Russian-origin oil.

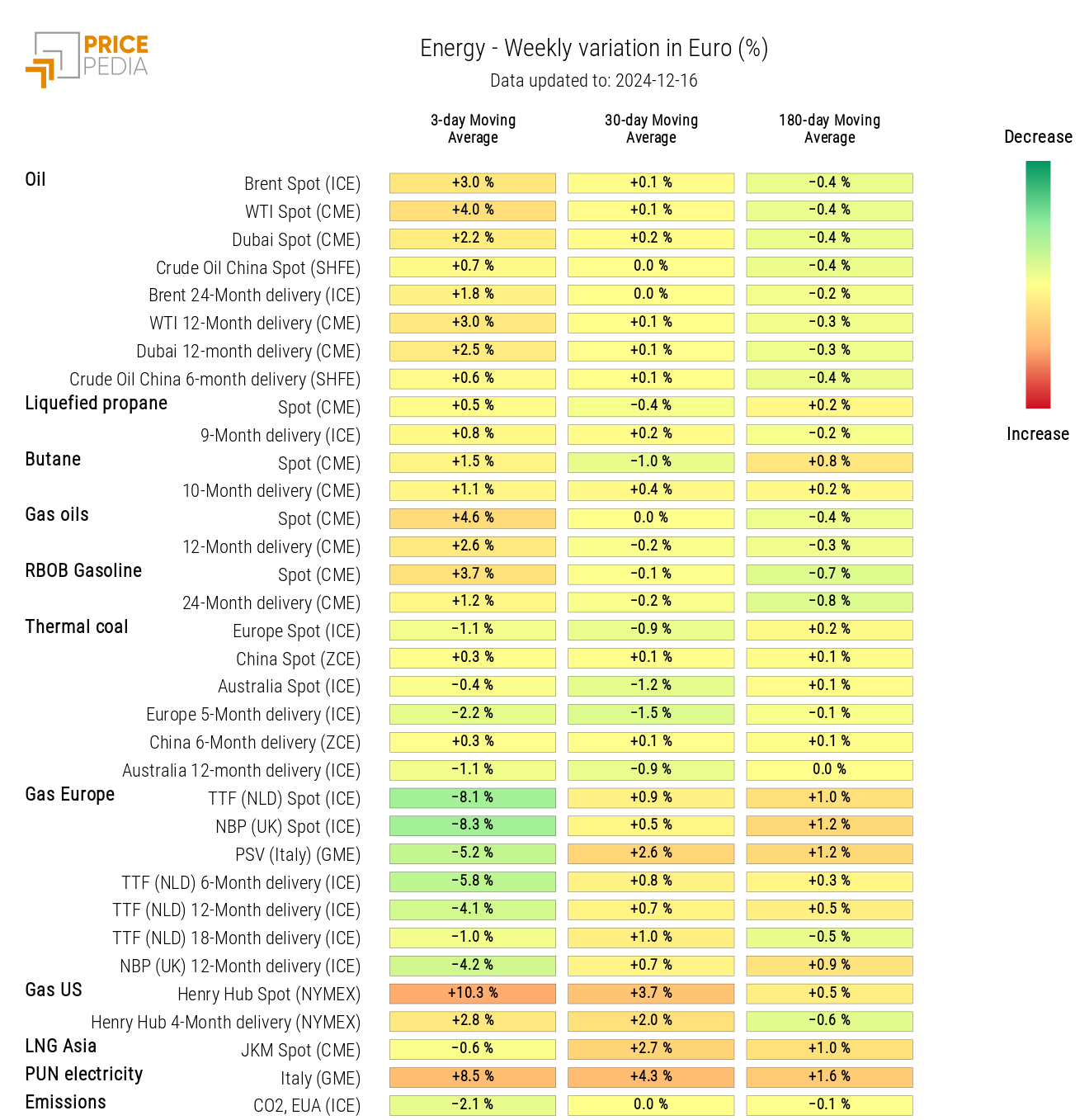

The spread of this news has increased uncertainty over oil and its derivatives' financial prices, which recorded gains this week.

Besides oil prices, other weekly increases in the energy sector involved the Italian PUN price of electricity and the U.S. Henry Hub natural gas price. The rise in the Italian Single National Price (PUN) is linked to a strike by workers in nuclear and hydroelectric facilities of the French giant EDF, which caused a reduction of approximately 2.5 gigawatts in electricity production on Tuesday and a decrease in exports to Italy. The increase in spot prices for Henry Hub is instead attributed to a reduction in gas storage due to rising consumption following the recent cold weather in the United States.

A price that moved against the common dynamics of its sector was the European natural gas TTF Netherlands, which saw a decline due to milder-than-expected weather in Europe.

During the Central Economic Work Conference, the Chinese government confirmed its intention to increase the fiscal deficit and adopt a more accommodative monetary policy to stimulate the country’s economic recovery. These statements had a positive impact on financial prices, pushing up major Chinese stock market indices. However, financial prices for industrial metals remained largely stable, with no significant changes following this news.

The only sector, aside from energy, to record a substantial weekly price increase was tropicals, driven this week by a rise in cocoa prices.

ECB Monetary Policy

On Wednesday, the European Central Bank (ECB) opted for a 25 basis point interest rate cut, bringing the deposit rate to 3%. The rates on main refinancing operations and marginal operations were set at 3.15% and 3.40%, respectively. This decision aligns with market and analyst expectations already discussed in last week's article: "First signs of recovery in commodity demand in China".

As usual, the ECB provided no forward guidance on future monetary policy decisions, reiterating that its approach will remain data-driven and that future decisions will be made on a meeting-by-meeting basis.

According to ECB projections, headline inflation is expected to drop to 1.9% in 2026, while core inflation would reach the same level in 2026-2027.

The Central Bank's GDP forecasts appear particularly optimistic, predicting growth of 1.1% in 2025 and 1.4% in 2026. However, these scenarios do not account for potential trade restrictions that could be introduced by the Trump administration.

Despite the ECB's optimism, analysts remain more cautious, warning that the risk of stagflation in Europe has increased over the past month. The eurozone economy still faces an inflation rate above the ECB target, and, most notably, recent data from the Purchasing Management Index (PMI) revealed signs of economic contraction. Particularly concerning is the weakness in the manufacturing sector, which now seems to be negatively impacting the services sector, so far the only pillar supporting economic growth in the eurozone.

In light of these factors, many analysts expect further interest rate cuts in the near future.

US CPI

This week, new data on U.S. inflation, as measured by the Consumer Price Index (CPI), was released.

Headline inflation increased on a monthly basis by 0.3% m/m, accelerating from 0.2% m/m recorded in October. On an annual basis, the CPI index rose by 2.7% y/y, up from 2.6% y/y the previous month.

The core CPI index, as in previous months, increased by 0.3% m/m and remained unchanged on an annual basis at 3.3% y/y.

The data met analyst expectations but confirmed a pause in the disinflationary process in the second half of 2024. This should not prevent a potential interest rate cut by the FED at next week’s meeting. Currently, the market anticipates, with relative certainty, a 25 basis point rate cut. While this scenario is the most likely and widely shared among analysts, the Federal Reserve’s rate cut is not as certain as the ECB’s. The U.S. economy, in fact, shows much stronger growth than Europe’s, and Chairman Powell has previously stated that there is no urgency to cut interest rates.

ENERGY

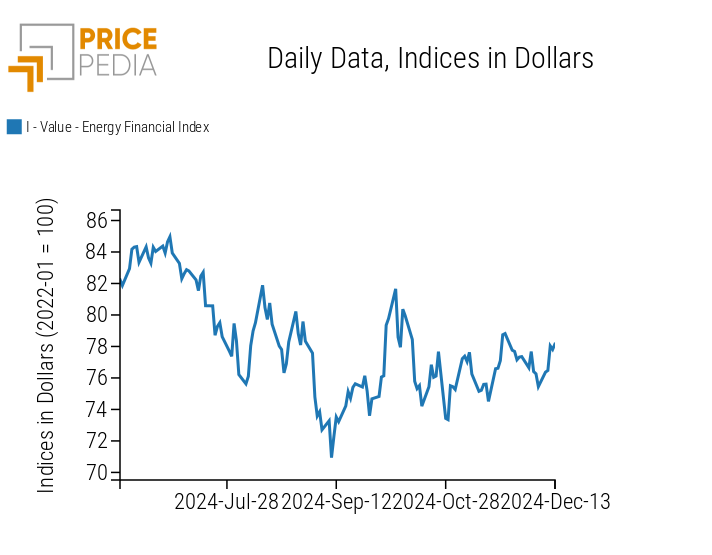

The PricePedia financial index for energy products recorded a rise in prices over the course of this week.

PricePedia Financial Index of Energy Prices in Dollars

From the energy heatmap, the growth in Italian PUN electricity prices, U.S. natural gas, and oil prices is evident, alongside a reduction in Dutch TTF gas prices.

Energy Prices HeatMap in Euro

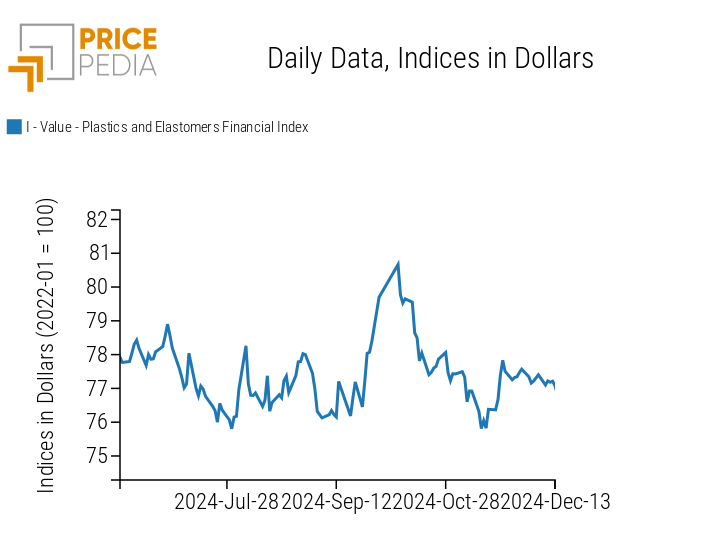

PLASTICS

The PricePedia index of financial prices for plastics and elastomers followed a mostly sideways price trend.

PricePedia Financial Indices of Plastics Prices in Dollars

FERROUS METALS

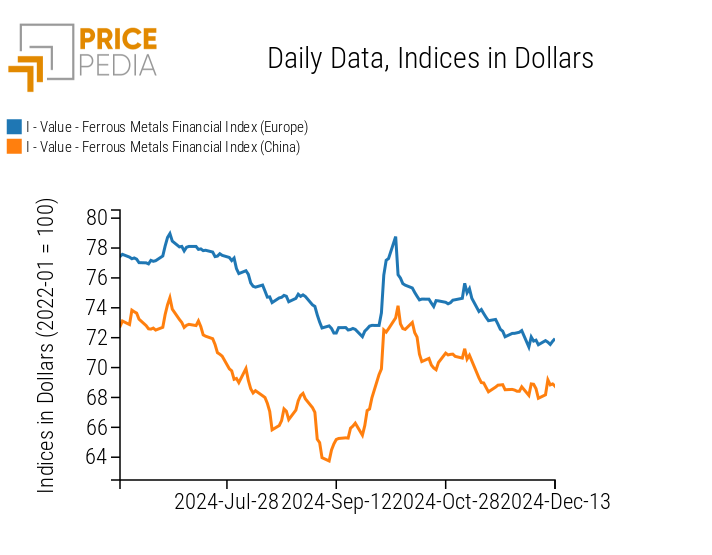

The financial index for ferrous metals (Europe) remained relatively stable, while the Chinese index showed an increase on Tuesday, followed by a slight decline in the following days. The rise in the index is mainly attributable to the increase in prices for hot-rolled coils and steel rebar, both traded on the Shanghai Futures Exchange (SHFE).

PricePedia Financial Indices of Ferrous Metal Prices in Dollars

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

NON-FERROUS

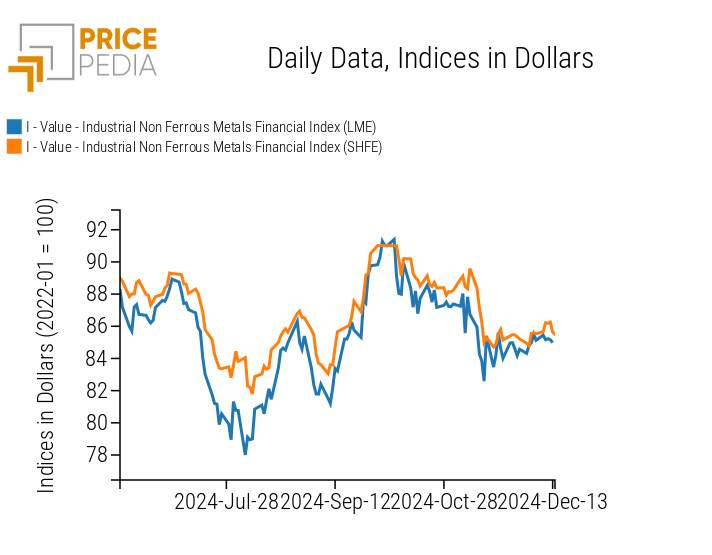

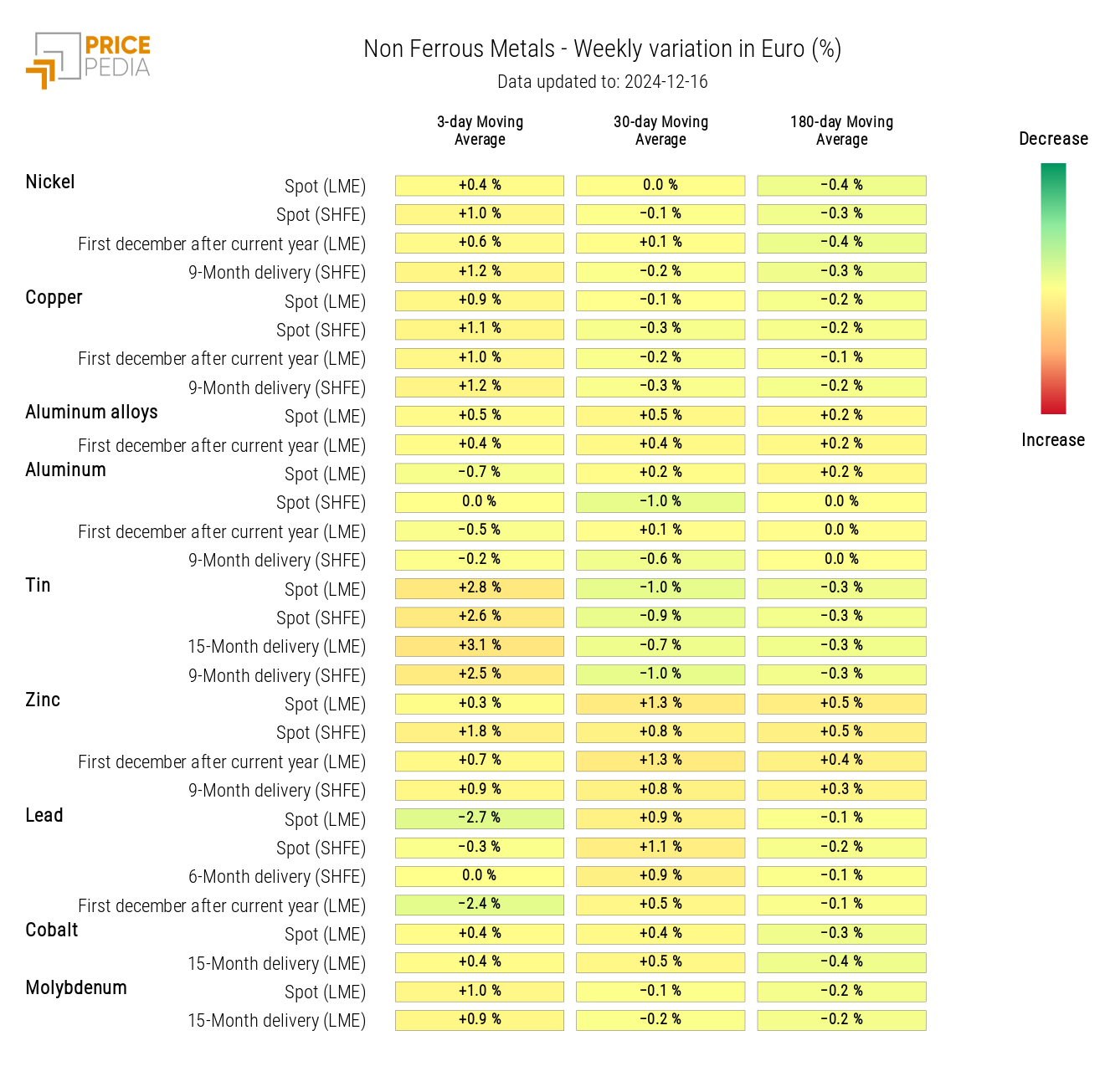

Net of some fluctuations observed during the week, the price levels of non-ferrous metals remained substantially unchanged.

PricePedia Financial Indices of Industrial Non-Ferrous Metals Prices in Dollars

The heatmap below shows an increase in tin prices, alongside a decrease in lead prices.

HeatMap of Non-Ferrous Prices in Euros

FOOD PRODUCTS

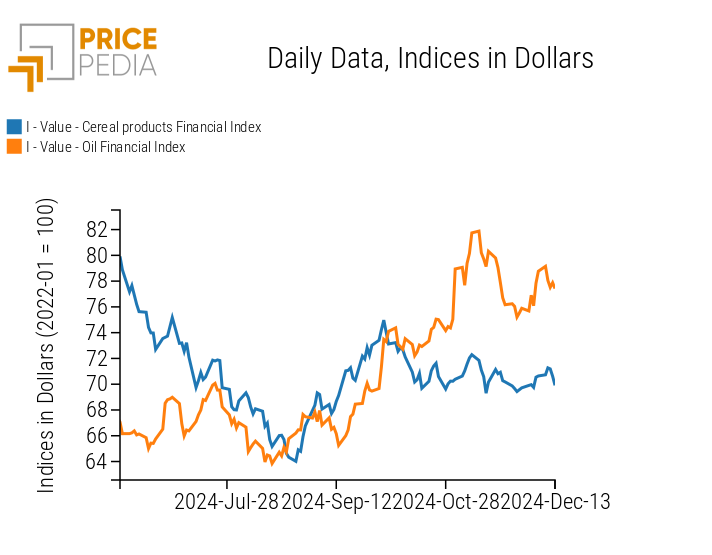

The financial indices of cereals and oils experienced uncertain trends during the week, with growth phases alternating with declines.

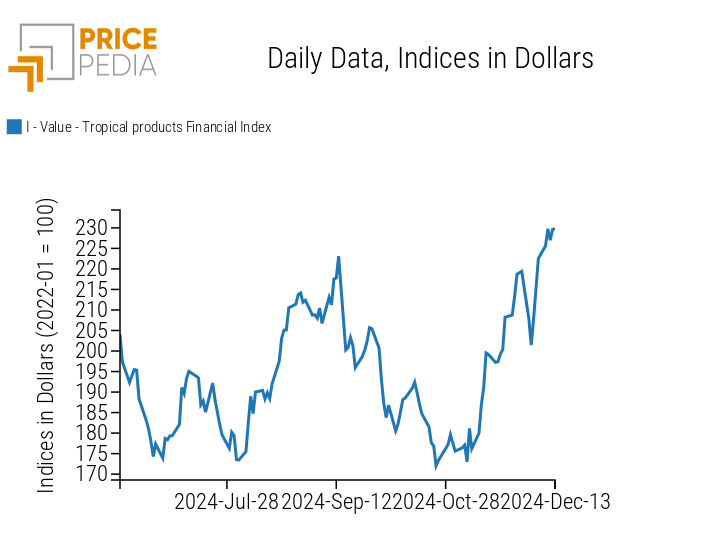

The tropicals index continues to stand out from the other two indices due to its upward trend, driven by rising cocoa prices.

| PricePedia Financial Indices of Food Prices in Dollars | |

| Cereals and Oils | Tropicals |

|

|

TROPICALS

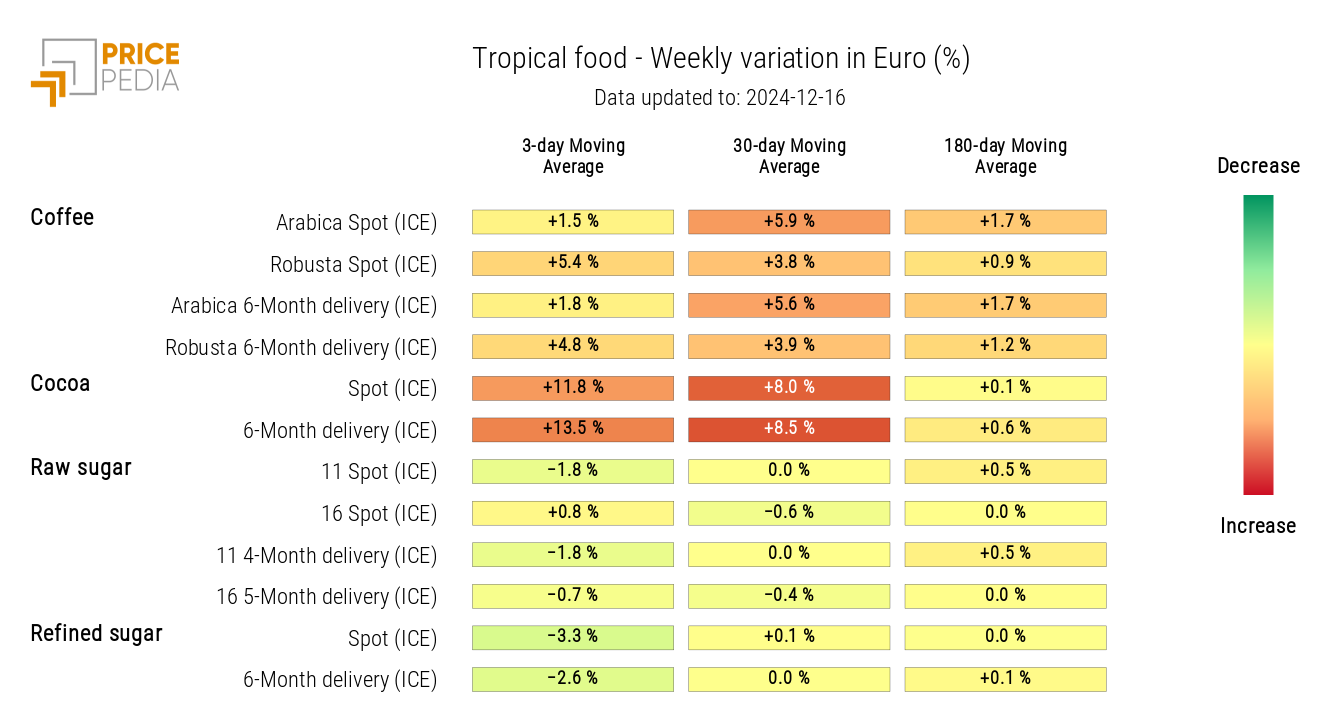

The heatmap below highlights the increase in robusta coffee prices and, particularly, in cocoa prices.

The rise in cocoa prices is due to a further worsening of weather conditions and a decline in global stocks.

HeatMap of Tropical Food Prices in Euros

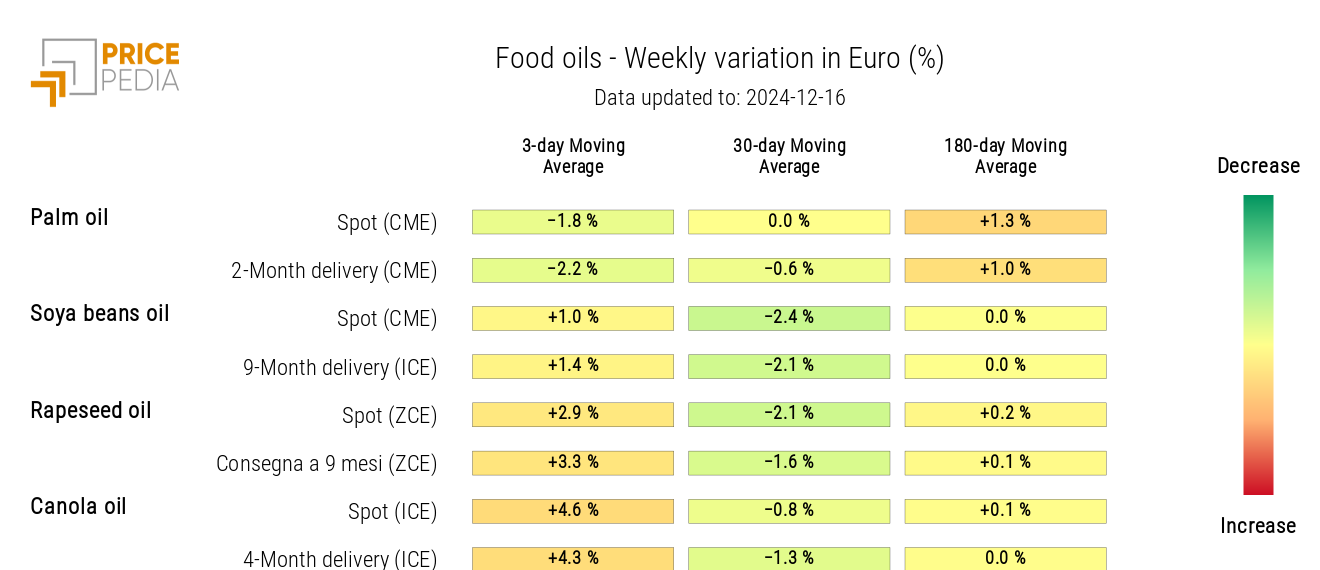

OILS

The oils heatmap shows a weekly increase in the three-day moving average of canola oil and rapeseed oil prices.

HeatMap of Food Oil Prices in Euros