PricePedia Scenario for December 2024

Diversified trends in commodity prices over the next two years

Published by Pasquale Marzano. .

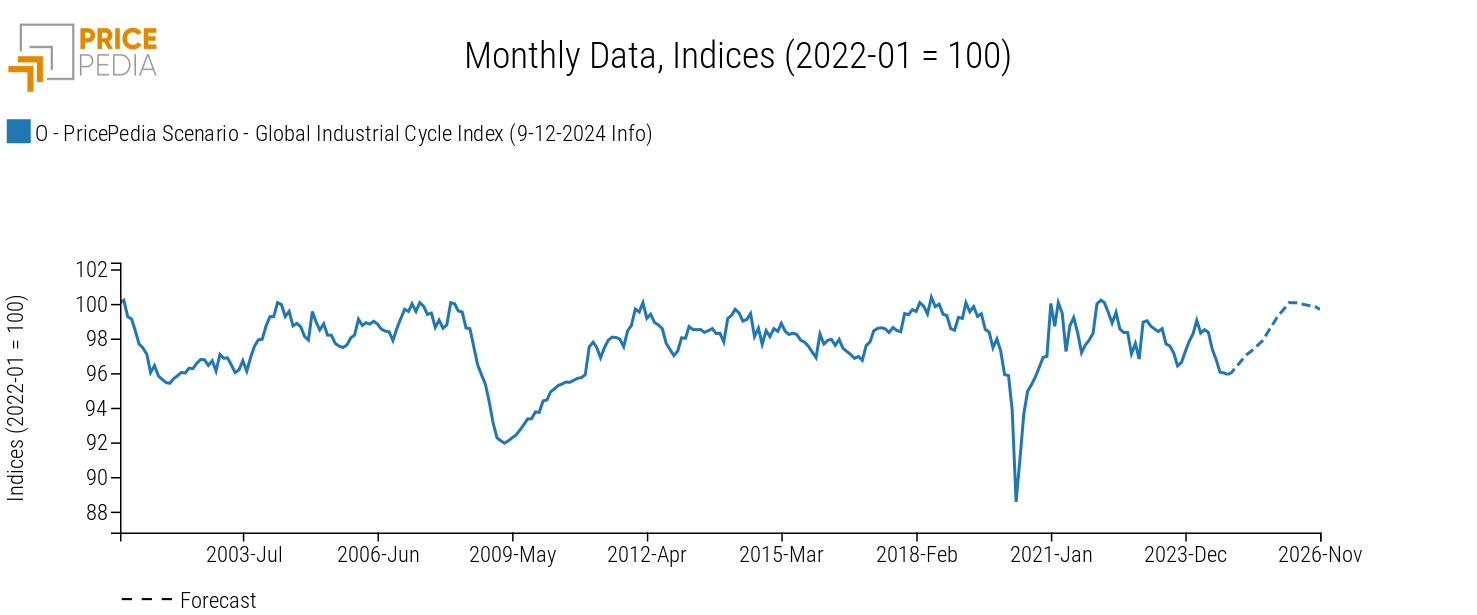

Forecast ForecastThe PricePedia Scenario has been updated with information available as of December 9, 2024. The dynamics of global industrial production, representative of commodity demand, confirm a phase of weakness. In 2024, it shows modest growth of +1.1% compared to 2023. Expectations for an improvement in the economic outlook are projected for 2025, with growth slightly exceeding +2%, and especially in 2026, when the annual growth rate is expected to exceed +4.8%. This trend aligns with the broader effects of the monetary policy easing implemented by, among others, the European Central Bank (which further reduced interest rates by 25 basis points last week) and the U.S. Federal Reserve (see the weekly update on financial commodities Russian sanctions: from metals to energy?).

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

The following graph shows the dynamics of the global industrial cycle index[1], which reflects the trends in industrial production.

Global Industrial Cycle, December 2024 Scenario

On average, the index is expected to show a contained negative variation of -0.5% in 2024, consistent with the previous scenario (see PricePedia Scenario for November 2024). In 2025, the cycle is characterized by a growth trend, although the annual average index is expected to remain stable compared to the previous year's values. A generally positive trend is forecast starting in 2026.

Forecast for Procurement Material Prices

The reversal of the global industrial cycle trend in 2025 primarily impacts the price trends of industrial commodities over the next two years.

The table below illustrates the annual price changes in euros for the main commodity aggregates (Industrial[2], Total Commodities[3], Total Energy, and Total Food).

Table 1: Annual Growth Rates (%) of PricePedia Aggregates Indices, in Euros

| 2023 | 2024 | 2025 | 2026* | |

|---|---|---|---|---|

| I-PricePedia Scenario-Commodity Index (Europe) (9-12-2024 Info) | −18.47 | −4.10 | +0.34 | −1.13 |

| I-PricePedia Scenario-Industrials Index (Europe) (9-12-2024 Info) | −14.11 | −3.91 | +3.29 | +1.36 |

| I-PricePedia Scenario-Energy Total Index (Europe) (9-12-2024 Info) | −23.91 | −5.46 | −3.45 | −3.05 |

| I-PricePedia Scenario-Food Total Index (Europe) (9-12-2024 Info) | −4.95 | +2.66 | +8.05 | −0.27 |

Overall, the Commodity index is expected to close 2024 with a reduction of -4.1%. The downward trend is expected to lose intensity during the 2025-2026 biennium.

However, when considering the individual components of the Commodity index, a distinction can be made between a slightly upward trend for industrial commodities prices and a downward trend for energy commodities prices.

Industrial commodities are projected to decline by nearly -4% in 2024, with growth of +3.3% anticipated in 2025. Conversely, energy commodity prices are expected to decrease by approximately -3% over the next two years.

A somewhat different trend characterizes food commodities. The average annual euro prices for 2024 are projected to increase by +2.7%. This dynamic will intensify in 2025 due to rising prices of tropical food commodities observed at the end of 2024, as shown in the table below.

Table 2: Annual Growth Rates (%) of PricePedia Food Aggregates, in Euros

| 2023 | 2024 | 2025 | 2026* | |

|---|---|---|---|---|

| I-PricePedia Scenario-Food Total Index (Europe) (9-12-2024 Info) | −4.95 | +2.66 | +8.05 | −0.27 |

| I-PricePedia Scenario-Wheat Index (Europe) (9-12-2024 Info) | −20.79 | −14.72 | +1.27 | +6.64 |

| I-PricePedia Scenario-Other Cereals Index (Europe) (9-12-2024 Info) | −21.49 | −17.53 | +2.55 | +1.08 |

| I-PricePedia Scenario-Soy Index (Europe) (9-12-2024 Info) | −12.23 | −15.33 | −6.87 | −7.11 |

| I-PricePedia Scenario-Glucose Index (Europe) (9-12-2024 Info) | +64.01 | −22.07 | −4.51 | −4.08 |

| I-PricePedia Scenario-Tropical Products Index (Europe) (9-12-2024 Info) | −2.86 | +37.54 | +28.54 | −0.64 |

| I-PricePedia Scenario-Oils and Fats Index (Europe) (9-12-2024 Info) | −4.08 | +11.88 | −7.99 | −1.24 |

In 2024, price increases are expected for the tropical and oils and fats families, with annual growth rates of +37.5% and +11.9%, respectively. A similarly strong increase is expected for tropical commodities in 2025 due to supply deficit concerns related to cocoa and coffee. Conversely, the oils and fats family is projected to decline by -8% in 2025.

As for other food commodity families in euros, 2024 is expected to close with a double-digit rate of reduction. In 2025, price differentiation is forecast: cereal prices will rise, while soybean and glucose prices are expected to decline.

1. The global industrial cycle index is constructed by purifying the actual dynamics of industrial production from its trend. Since the supply of commodities tends to vary according to long-term economic growth expectations, while the demand for commodities is more linked to actual cyclical uses, the global industrial cycle index tends to reproduce the conditions of tension between demand and supply on the commodity market: when it increases, it means that the demand for commodities increases more than the supply; vice versa when it decreases.

2. The PricePedia Industrials index results from the aggregation of the indices relating to the following product categories: Ferrous, Non-Ferrous, Wood and Paper, Chemicals: Specialty, Organic Chemicals, Inorganic Chemicals, Plastics and Elastomers and Textile Fibres.

3. The PricePedia Commodity index results from the aggregation of the indices relating to industrial, food and energy commodities.