Sodium carbonate and sodium bicarbonate: production processes and price determinants

Cost models provide a complete explanation of their price dynamics, even in more recent years

Published by Emanuele Altobel. .

Inorganic Chemicals Price DriversDisodium carbonate

Sodium carbonate, also known as disodium carbonate is a key chemical compound for many industrial applications, particularly in the glass industry, which accounts for about 50% of global demand, as well as in detergent production and various chemical processes.

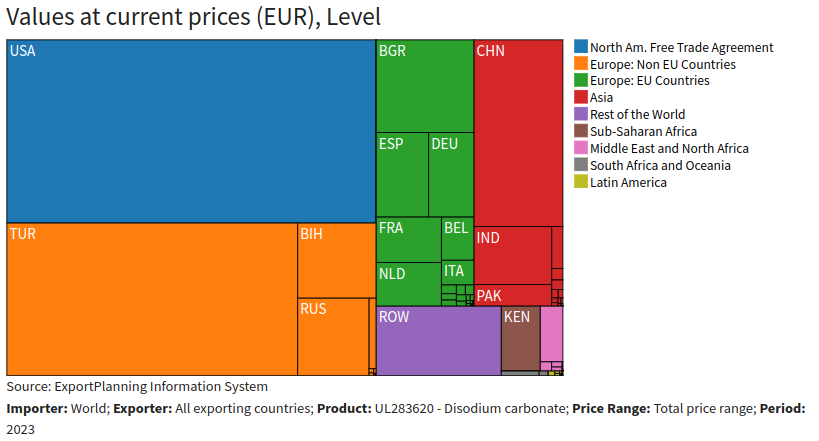

In the 2023 global landscape, the main exporters of soda ash were the U.S., Turkey and China.

World exporters of disodium carbonate 2023

Sodium carbonate is produced through two main methods:

- trona processing (mainly used in the US and Turkey);

- Solvay process (used mainly in the EU and China).

Trona processing: trona is a natural mineral consisting mainly of sodium carbonate and sodium bicarbonate. To obtain sodium carbonate, the ore is crushed, heated and purified through various stages. With abundant deposits, the U.S. and Turkey dominate the global market as major exporters.

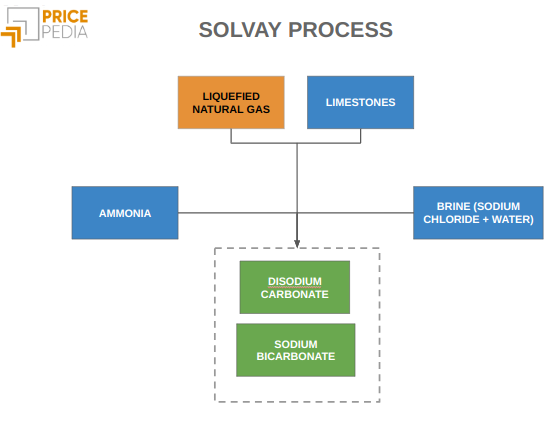

Solvay process: the Solvay process is an industrial technology to produce sodium carbonate synthetically using widely available raw materials such as sodium chloride (the common table salt), limestone (calcium carbonate) and ammonia.

In this process, limestone initially undergoes calcination, a heat treatment that removes volatile components. The material then reacts with a solution composed of water, sodium chloride and ammonia, leading to the formation of sodium bicarbonate.

Finally, the latter undergoes a second calcination to obtain sodium carbonate.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Determinants of disodium carbonate price in Europe

Within the European Union, sodium carbonate production is mainly through the Solvay process. To analyze the factors influencing the price of the finished product, we estimated a relationship between the price of soda ash and its main determinants.

The variables involved were transformed into logarithms, allowing direct interpretation of the estimated coefficients in terms of elasticity

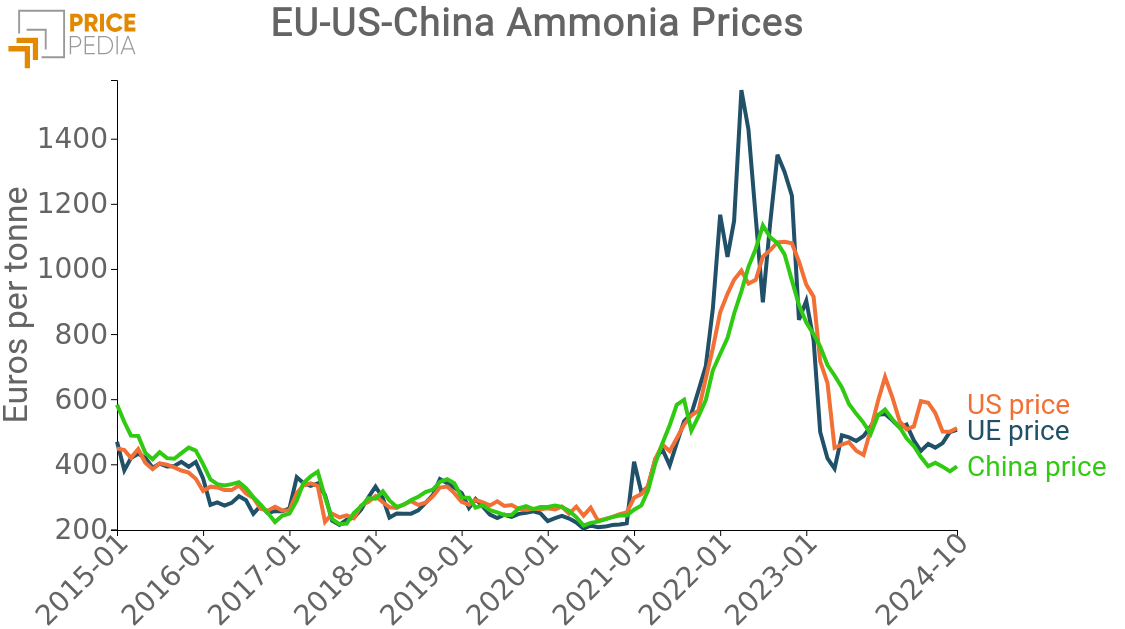

A preliminary analysis showed that the price of natural gas tends to precede the trend of disodium carbonate price. For this reason, we introduced the lagged-form variable into the estimation, achieving a significant improvement in model accuracy. Ammonia, on the other hand, was excluded from the direct analysis because its price is closely linked to that of natural gas due to the production process.

Thus, the estimated elasticity of natural gas reflects both the effect of changes in energy costs and the indirect impact, through the price of ammonia[1].

The following table shows the long-run elasticities, calculated from the coefficients estimated using the long-run equation of an Engle and Granger model. All estimated coefficients are found to be statistically significant.

Long-term elasticity among the determinants of sodium carbonate

| Limestones | Liquefied natural gas_2 | Consumer price index | R2 | |

| Disodium carbonate | 0.08 | 0.13 | 1.55 | 0.902 |

Among the inputs, natural gas appears to have the most significant impact, highlighting how the cost of energy impacts more significantly than that of the limestone-related raw material.

The analysis excluded the influence of other major exporters' prices because the sodium carbonate market appears to be highly regionalized. In Europe, the main exporters are the European Union countries and Turkey.

Regionalization can be explained by the low costs of inputs, which are readily and widely available, making long-distance exchange unprofitable, as this could significantly increase costs. In addition, the geographical proximity of a major producer such as Turkey contributes to the autonomy of the European market.

Looking at prices in the United States, a difference emerges in the impact of natural gas, i.e., the energy component, on the final cost of soda ash in the EU.

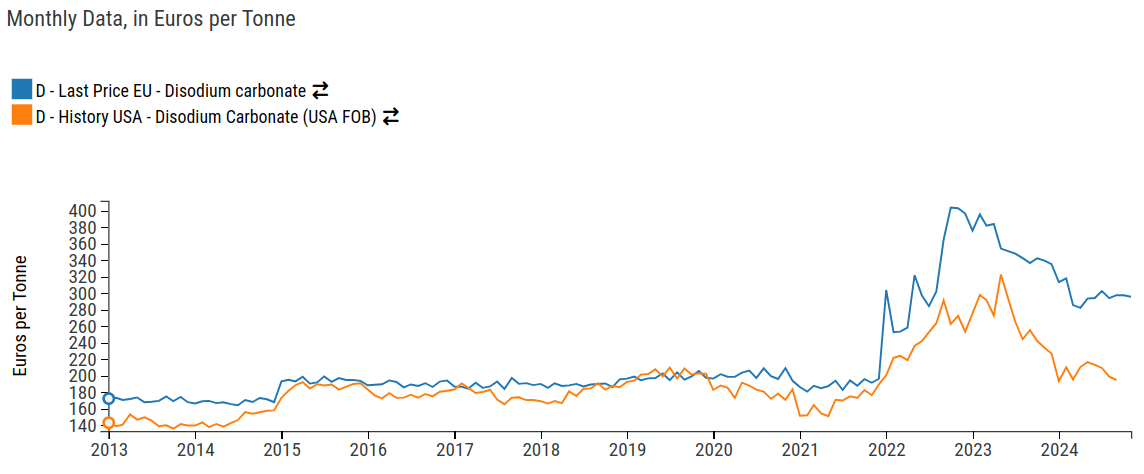

EU-US price comparison of sodium carbonate

The graph shows the different impact of the 2022 shock on prices in the two areas related to energy prices.

While starting from a similar base, the price of soda ash in the U.S. has been less affected by rising gas prices.

This is explained by the different production methods of soda ash: the Solvay process, which includes two calcination steps, is indeed more energy-intensive than the production process by trona. In addition, ammonia, which is derived from gas, has seen its prices rise, contributing to the widening gap between prices in the two countries.

Sodium bicarbonate

Sodium bicarbonate is an intermediate product in the Solvay process and is formed directly from the reaction between sodium chloride brine, carbon dioxide and ammonia. This compound has a significantly narrower market because of its use limited primarily to the food sector.

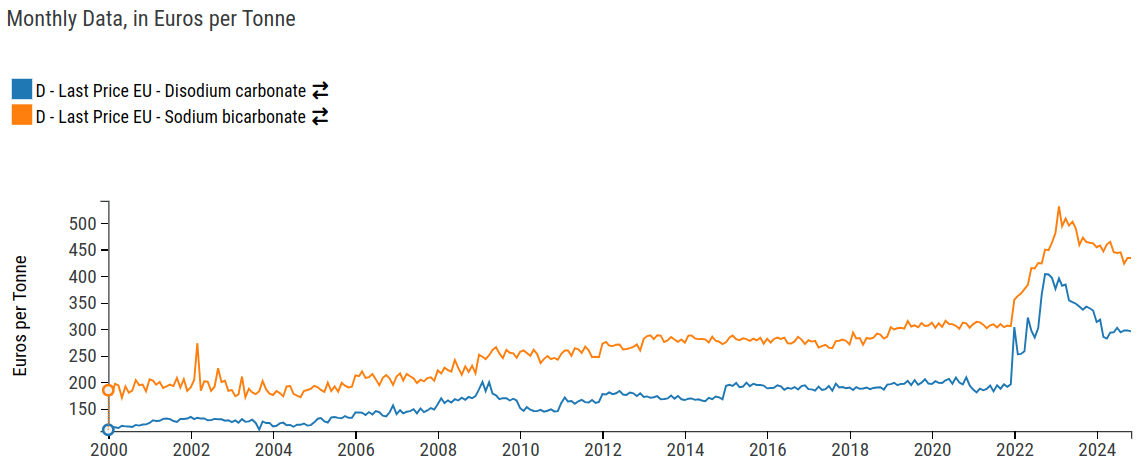

Price comparison of sodium carbonate and sodium bicarbonate

As can be seen from the graph, the prices of the two resources, produced through the same process, are closely correlated. However, sodium bicarbonate has significantly higher prices, this is explained by two factors.

The first concerns the area of use: since it is primarily intended for the food sector, sodium bicarbonate requires a higher degree of purity, resulting in purification costs that affect the final price.

The second factor is related to the production process: sodium carbonate, when reacted with water, can be reconverted into sodium bicarbonate. Therefore, it cannot be ruled out that some of the sodium bicarbonate on the market is produced by reconverting sodium carbonate.

Conclusion

Major exporters of sodium carbonate use two production methods: the trona process, which tends to be cheaper and less vulnerable to gas price shocks, and the Solvay process, which requires more energy. The latter production factor is predominant over the limestone raw material.

As for sodium bicarbonate, although it is an intermediate product in carbonate production, it has higher prices. This stems from its intended use, which requires a higher degree of purity. In addition, sodium carbonate benefits from a larger market and facilities dedicated to its production. Finally, sodium bicarbonate can also be produced by reconversion of sodium carbonate through a reaction with water.

[1] The Solvay process allows partial recycling of the ammonia used, helping to reduce its impact on production costs. Considering the way it is used, it is reasonable to assume that the impact of this resource on overall costs is limited.