Monthly commodity prices update for December 2024

In 2024, the lateral movement of industrial commodity prices continued

Published by Pasquale Marzano. .

EU Customs Global Economic TrendsThe monthly update of the PricePedia commodity prices for December 2024 has been released. Industrial commodity prices continue to be characterized by weak global demand, and in December as well, they moved laterally, consistent with the November 2024 update.

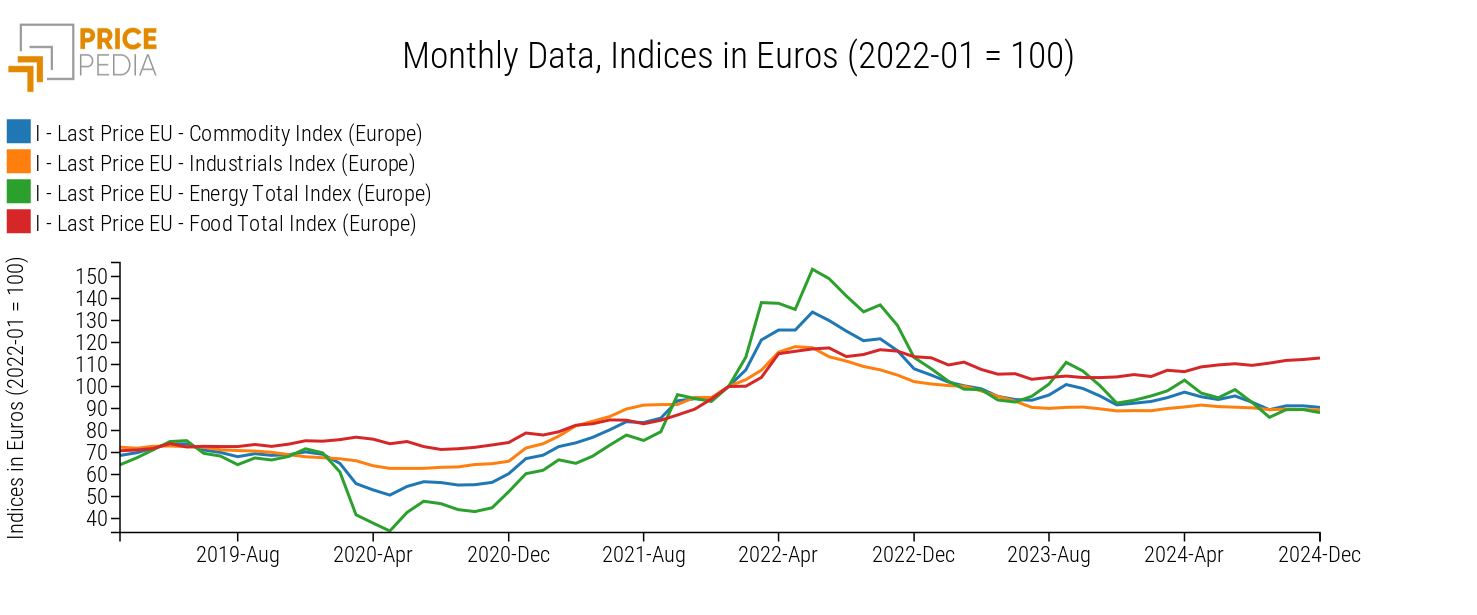

The graph below shows the price trends for raw materials in Europe for the main PricePedia aggregates: Commodity[1], Industrials[2], Energy Total, and Food Total, with January 2022 levels as the base (100).

In December 2024, price variations were modest compared to the previous month, not exceeding 1% in absolute terms. The only exception was energy, which fell by -1.6%.

Regarding food, on a monthly basis, prices rose slightly in December 2024 (+0.6%), while the overall group of industrial commodities remained essentially unchanged (-0.3%).

For this group in particular, price trends appear moderate even over a longer time frame, indicating the persistence of the current dynamics: in December 2024, the year-on-year percentage change was +0.4%.

Commodity prices by category

To understand how individual commodity categories have moved over the past 12 months, it is helpful to consider the price changes, in euros, recorded in December 2024 compared to the same month of the previous year for the main categories available in PricePedia.

Graph 2: December 2024, % variations in euros compared to December 2023

Source: PricePedia

Between December 2024 and December 2023, Precious Metals recorded the highest price increases (+20%) due to their role as a safe haven during periods of economic weakness. This increase is an anomaly compared to other commodity families, which experienced changes, both negative and positive, that never exceeded 10%.

Among the commodities that saw the largest increases were food (+8%). Non-ferrous metal prices also rose during the same period, by +6.4%, driven by expectations of stronger economic growth, particularly in China, in early 2024. These expectations were later disappointed, as China recorded lower growth rates than initially anticipated, leading to corrections in non-ferrous prices during the summer of 2024.

Price increases in these categories contrasted with declines in the chemical sector, particularly Inorganic Chemicals (-5.2%), and Pharmaceutical Chemicals (-4.6%), and Ferrous Metals (-3.8%).

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Comparison with the Chinese market prices

The comparison between European and Chinese market price trends confirms that the current weakness in commodity demand is a global phenomenon.

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|---|

| I-Last Price EU-Industrials Index (Europe) | −4.90 | −9.30 | +32.94 | +27.15 | −13.88 | −4.34 |

| I-History China FOB-Industrials Index (China) | −4.59 | −8.03 | +32.18 | +20.39 | −20.04 | −7.80 |

After being consistently aligned, the variations between the two indices diverged starting in 2022, showing a widening gap between European and Chinese prices over the past three years. Following a greater rise in European prices than in Chinese prices in 2022, the subsequent two years saw a smaller decrease in European prices compared to Chinese ones.

The energy crisis in Europe, triggered by Russia's invasion of Ukraine, led to reduced competitiveness for European industry due to higher production costs. This limited European companies' ability to lower prices as much as their Chinese counterparts during the subsequent phase of global economic weakness.

1. The PricePedia Commodity index is the aggregation of Industrials, Food and Energy indices.

2. The PricePedia Industrials index is the aggregation of indices related to the following categories: Ferrous Metals, Non-Ferrous Metals, Wood and Paper, Pharmaceutical Chemicals, Chemicals: Specialty, Organic Chemicals, Inorganic Chemicals, Plastics and Elastomers, and Textile Fibers.