Waiting for Trump

Latest moves by Biden administration as fears grow over protectionist policies by Trump administration

Published by Luca Sazzini. .

Conjunctural Indicators Commodities Financial WeekWeekly Summary of Financial Commodity Prices

This week was marked by a significant divergence in oil and gas prices.

The price of Brent crude recorded a strong increase, closing the week near the $80-per-barrel mark. This surge was triggered by the U.S. Treasury Department’s announcement of new sanctions against Russia’s oil industry. The sanctions specifically target tankers of the so-called "shadow fleet," which have enabled Russia to export crude oil to refineries in China and India, financing the invasion of Ukraine.

Asian demand for Middle Eastern oil is expected to rise in the coming months.

However, it remains to be seen what approach the future Trump administration will take toward Russia, which could differ significantly from Biden’s policies. This uncertainty has been reflected in oil futures prices, with progressively smaller increases for long-term contracts.

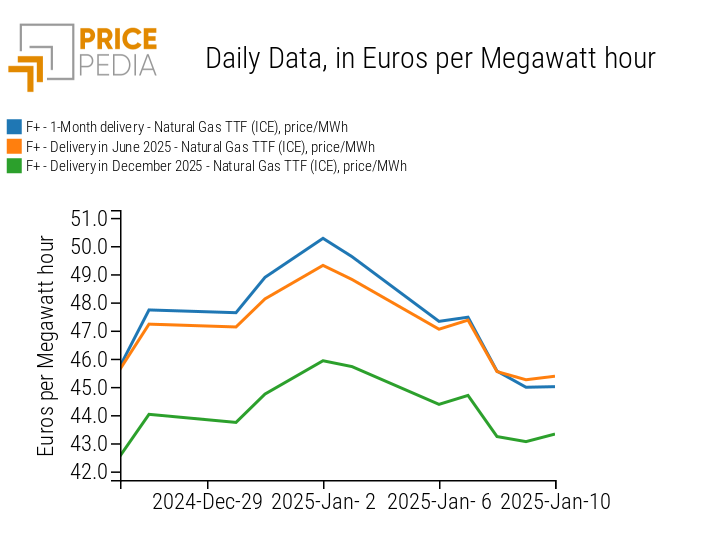

Conversely, this week saw a decline in TTF gas spot prices, thanks to forecasts of a milder-than-expected winter in the coming weeks, following the price surge seen in the last two weeks of 2024. On January 3, the spot price of Dutch TTF natural gas exceeded 50 euros/MWh due to the disruption of gas flows from Russia via Ukraine, caused by the non-renewal of the transit contract between Kyiv and Gazprom. Since Ukraine’s intentions not to renew the agreement were already evident, the price hikes had been anticipated by financial markets toward the end of 2024.

Despite this week's price drop, strong concerns persist about Europe’s gas storage levels, which are currently well below the average of previous years. The concerns are less about the ongoing winter, which Europe seems capable of weathering without major issues, and more about the ability to rebuild reserves for the next season. This fear is already reflected in futures contracts for June 2025, whose prices have slightly surpassed those of the current winter season. In contrast, futures prices for next winter remain in steep backwardation.

Historical Series of Dutch TTF Futures Prices in Euro/MWh

In the industrial metals market, dynamics were mixed, influenced by various factors. Prices of some non-ferrous metals, such as copper, experienced slight increases due to recent economic stimuli introduced by the Chinese government. However, this growth may prove temporary, especially with the imminent protectionist policies set to be implemented by the Trump administration.

Prices of European ferrous metals remain relatively stable, while Chinese prices are declining due to the ongoing weakness in the real estate market and increased supply from exporters such as Australia and Brazil.

Major global producers are looking to sell off reserves in anticipation of the Simandou iron ore project in Guinea, which is expected to start production by the end of the year.

In the food market, significant price dispersion was observed among edible oils, relative stability in cereals, and fluctuations in tropical products.

Trump Administration Protectionism

The president, Donald Trump, officially denied a report by the Washington Post regarding a potential softening of the tariff policies announced during the campaign. According to the newspaper, "anonymous sources" claimed that the new government’s tariffs would be applied selectively, targeting only sectors where imports are deemed critical.

Shortly after refuting these claims, a new concern emerged: the possibility that the new president might declare a national economic emergency. Such a declaration would allow him to adopt universal tariffs under the International Economic Emergency Powers Act (IEEPA), which grants the president unilateral authority to regulate imports in the event of a national emergency.

These protectionist measures would not only target U.S. trade rivals but also involve partner countries, amplifying global economic tensions.

The introduction of such tariffs could significantly impact global demand, reducing U.S. imports and consequently the rest of the world’s exports to the U.S. This scenario could exert strong downward pressure on commodity markets, leading to significant drops in financial commodity prices.

Euro Area Inflation

In December, inflation in the euro area increased in line with analysts’ expectations.

The Consumer Price Index (CPI) rose year-over-year from 2.2% in November to 2.4% y/y, while monthly growth climbed by 0.4% m/m.

The core index, excluding food, energy, alcohol, and tobacco, remained stable at 2.7% as forecast, while the ECB’s core measure, which excludes only energy and food, increased by one-tenth of a point to reach 2.8%.

The general index increase was mainly driven by the services sector, which grew by 0.8% month-over-month and 4% year-over-year, with a one-tenth percentage point increase from the previous month.

The second-largest contribution came from the energy sector, which grew by 0.6% m/m on a monthly basis, while recovering from -2% to +0.1% y/y annually.

The energy sector’s growth was widely anticipated by analysts, who believe base effects on energy will fade early in 2025. As for the services sector, a slowdown is expected in the first quarter of the new year, reflecting the persistent weakness of European demand.

Considering these factors, the December inflation increase should not hinder the ECB’s gradual interest rate reduction, especially given the evident fragility of European industry.

ENERGY

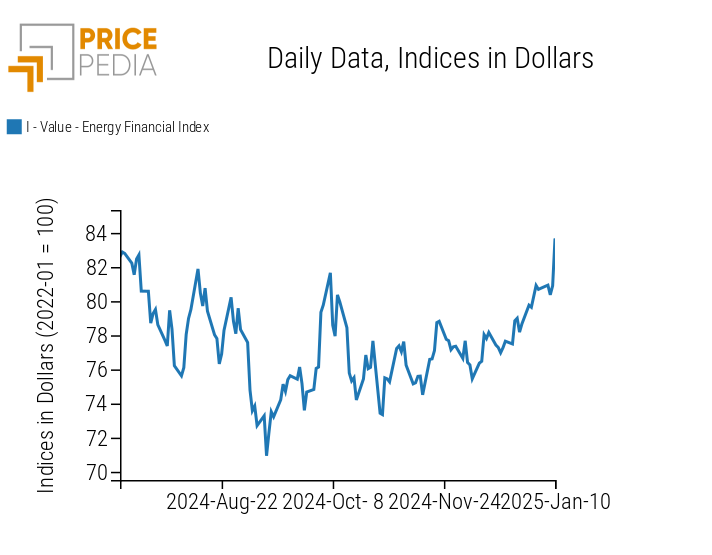

The PricePedia energy product index closed the week with strong growth.

PricePedia Financial Index of Energy Prices in USD

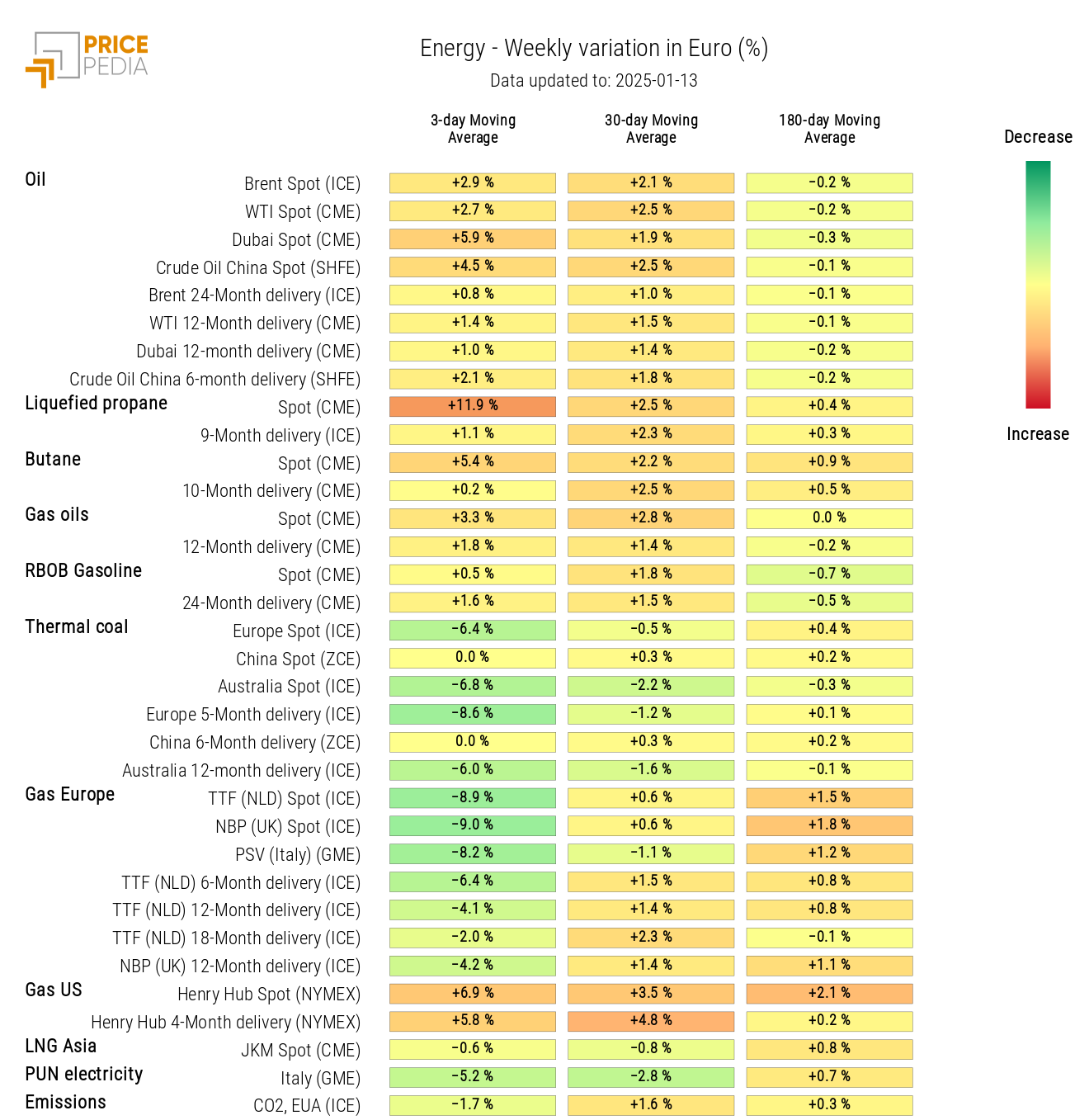

The energy heatmap shows a wide dispersion of energy prices.

Natural gas TTF (Netherlands), thermal coal, and PUN (Italy’s Single National Price) saw price declines. Conversely, prices for crude oil, liquefied propane, butane, and gas traded at the Henry Hub in the U.S. recorded significant weekly gains in the 3-day moving average.

Energy Prices HeatMap in EUR

PLASTICS

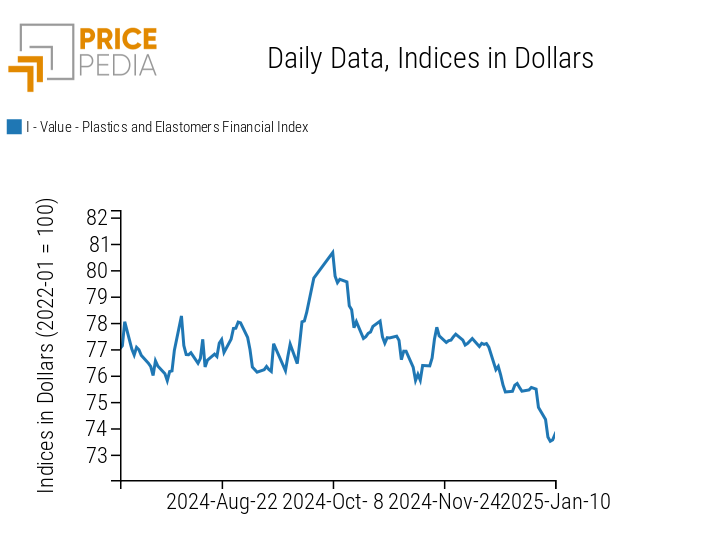

The PricePedia index of financial prices for plastics and elastomers continued its price decline trend but ended the week with a positive fluctuation.

PricePedia Financial Indices of Plastics and Elsatomers Prices in USD

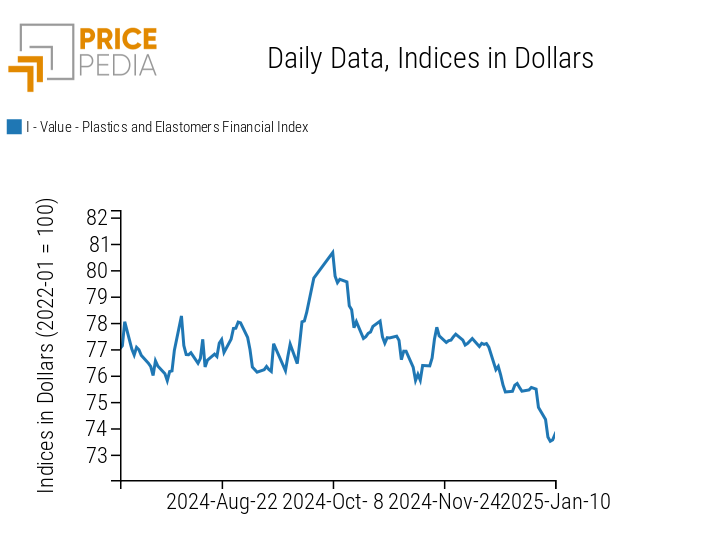

The heatmap for plastics and elastomers highlights that all products in the index recorded a weekly price drop.

PricePedia Financial Indices of Plastics Prices in USD

HeatMap of Plastics and Elastomers Prices in EUR

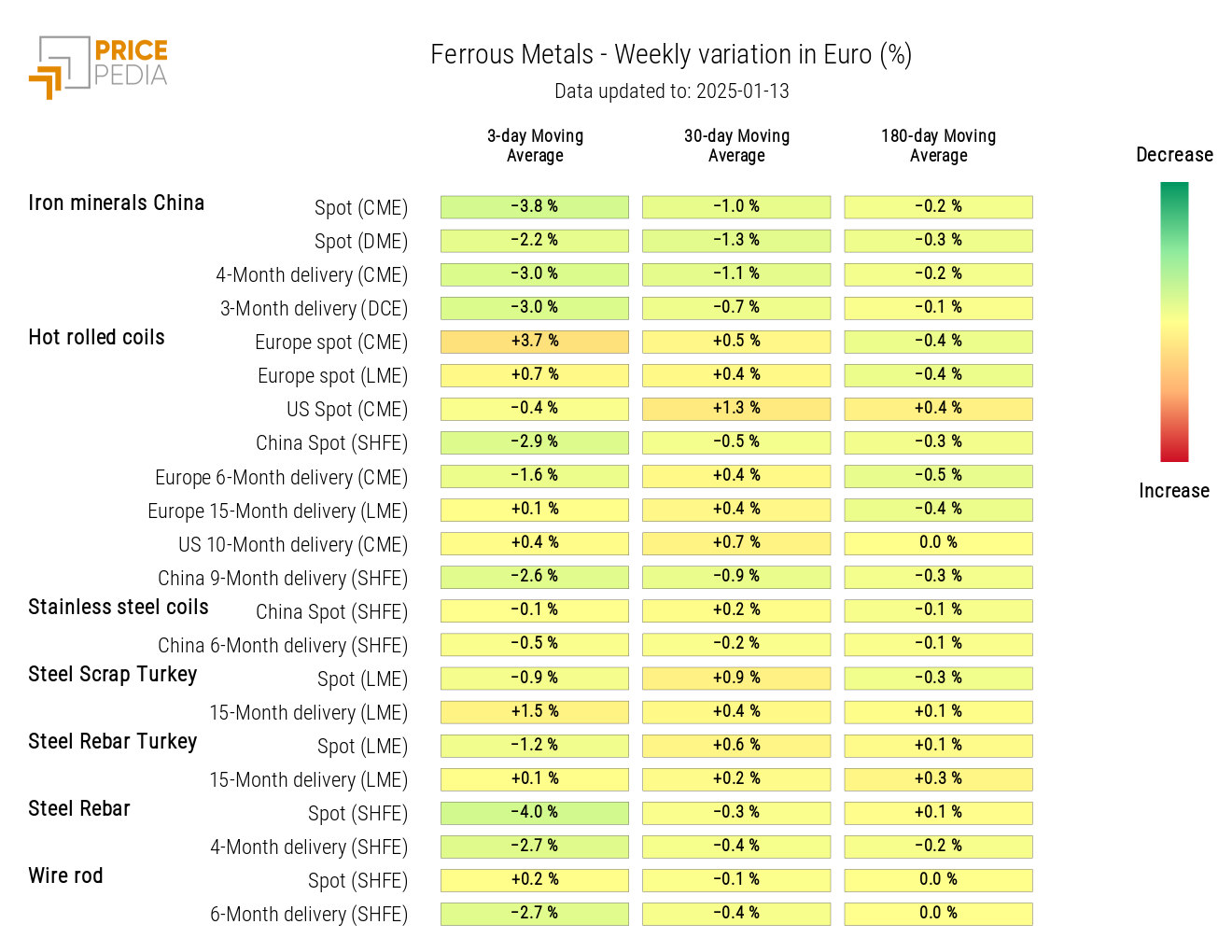

FERROUS METALS

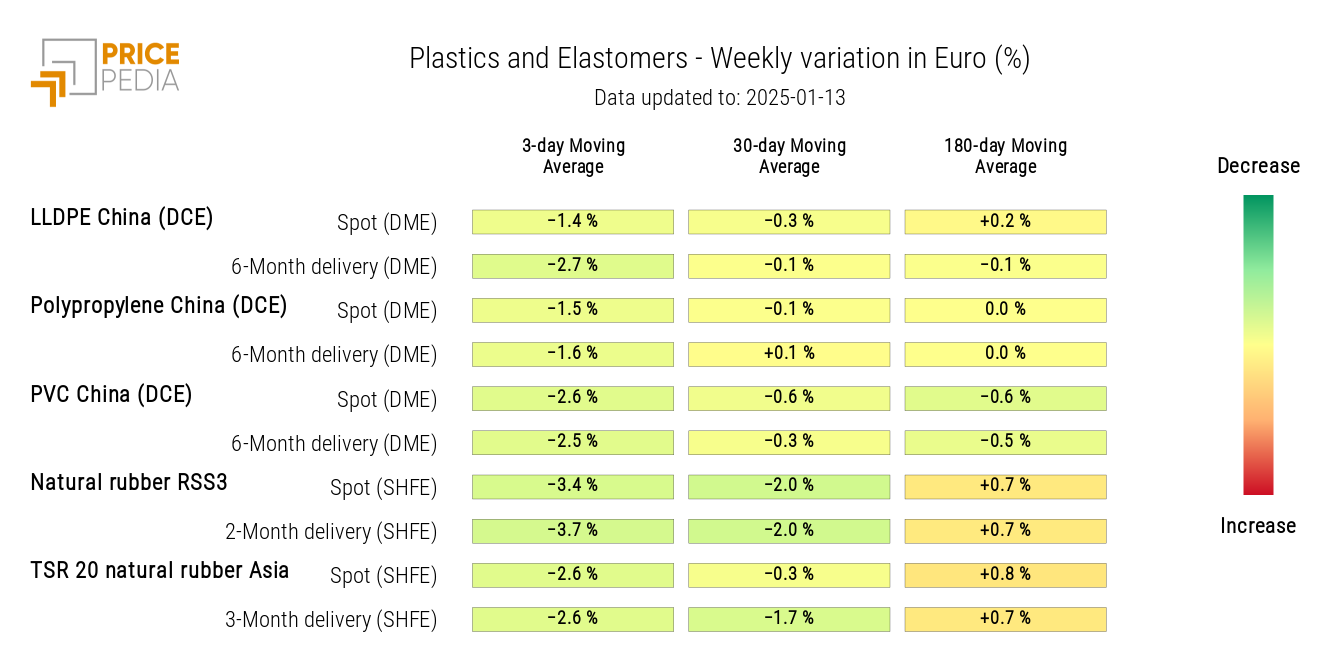

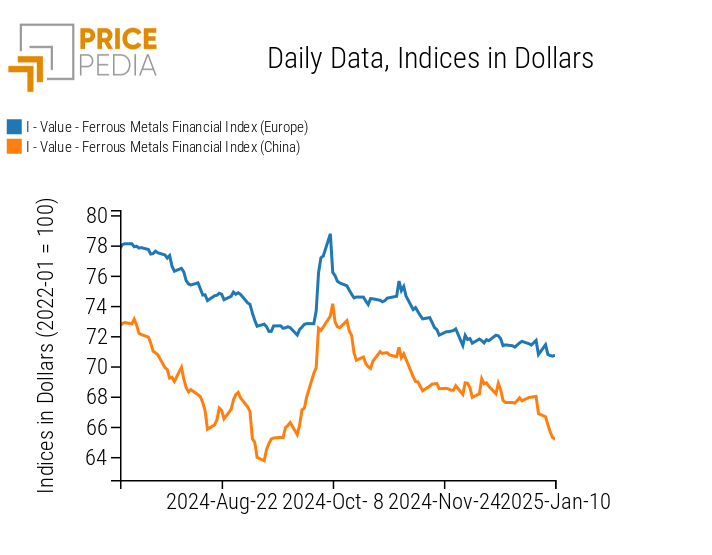

The ferrous metals index of the European market remains relatively stable, while the Chinese index continues its phase of price reduction.

PricePedia Financial Indices of Ferrous Metals Prices in USD

The heatmap analysis highlights the price decrease of Chinese iron ore and steel rebar.

HeatMap of Ferrous Metals Prices in EUR

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

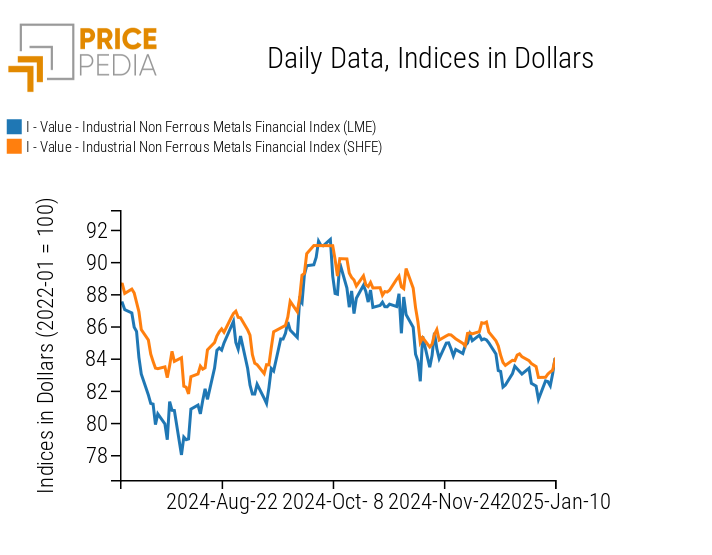

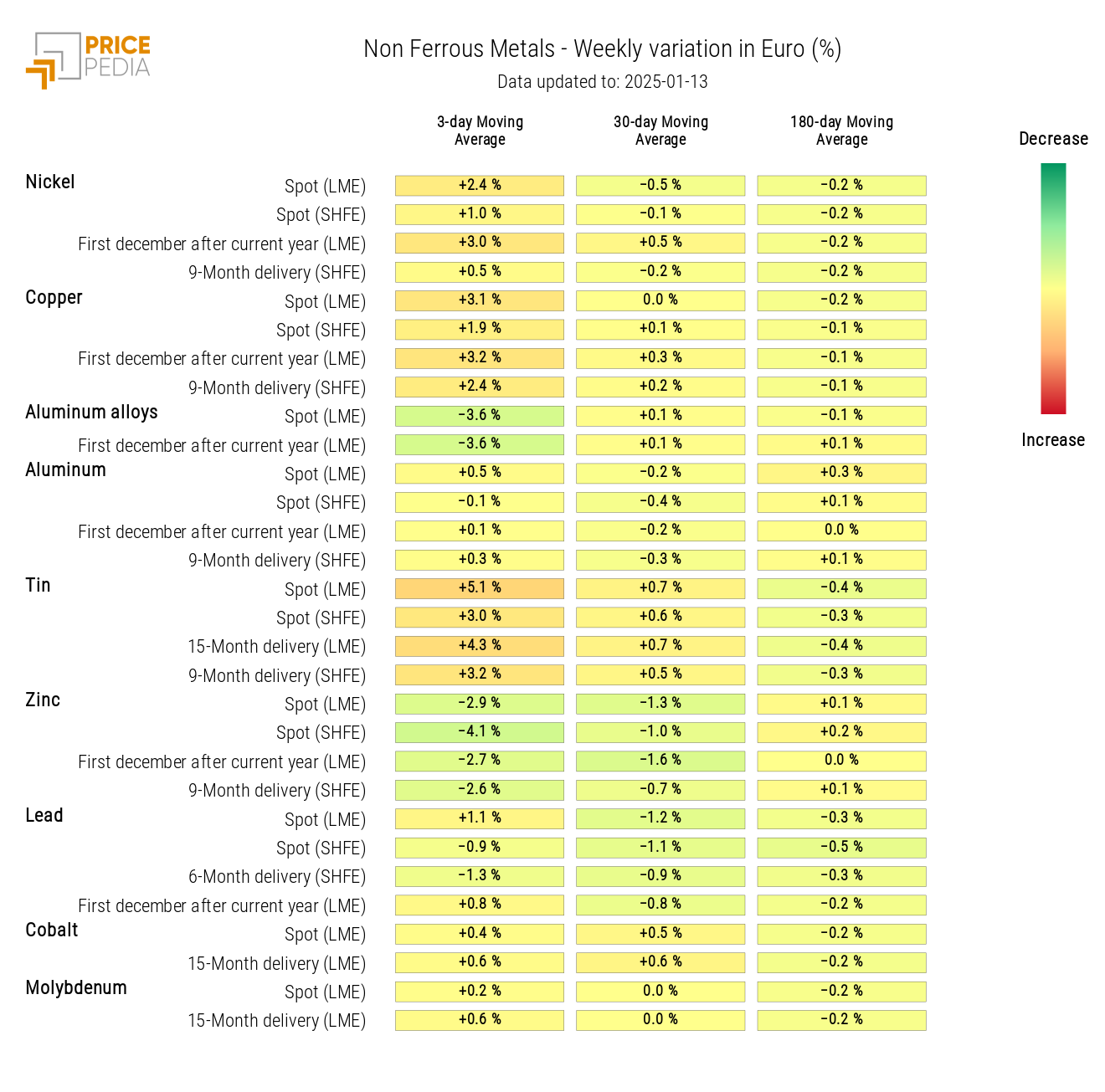

NON-FERROUS INDUSTRIAL METALS

The financial indices of non-ferrous metals quoted on the London Metal Exchange (LME) and the Shanghai Futures Exchange (SHFE) show a price increase.

PricePedia Financial Indices of Non-Ferrous Industrial Metals Prices in USD

The non-ferrous heatmap shows a weekly price increase for copper, tin, and nickel, while prices for aluminum alloys and zinc decreased.

HeatMap of Non-Ferrous Metals Prices in EUR

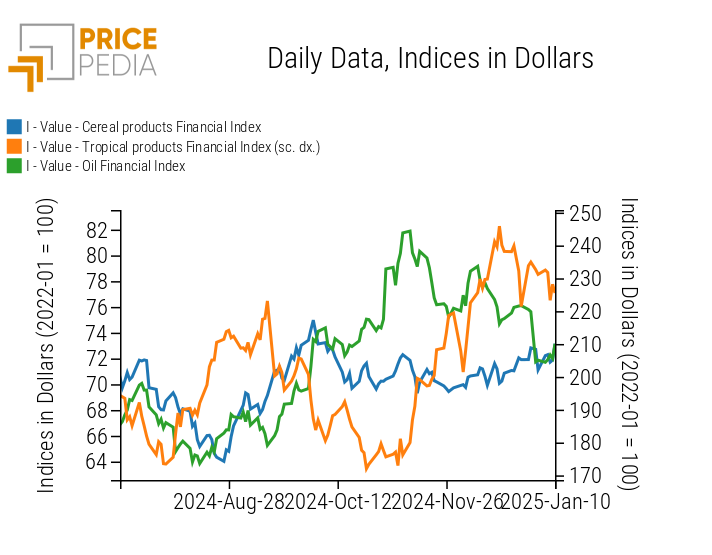

FOOD

The food indices for grains and edible oils mostly show sideways movements, while the tropicals index shows a downward trend.

PricePedia Financial Indices of Food Prices in USD

TROPICALS

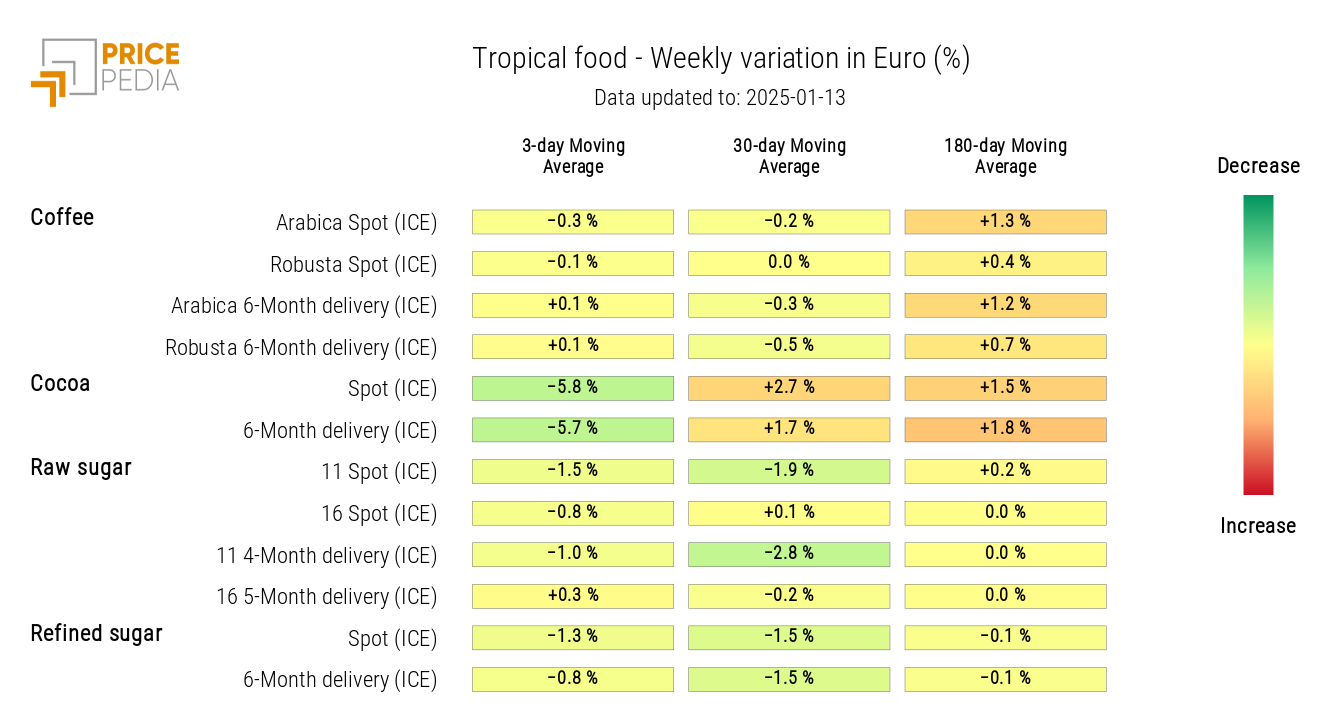

The tropicals heatmap reveals a weekly decrease in the 3-day moving average of cocoa prices.

HeatMap of Tropical Food Prices in EUR

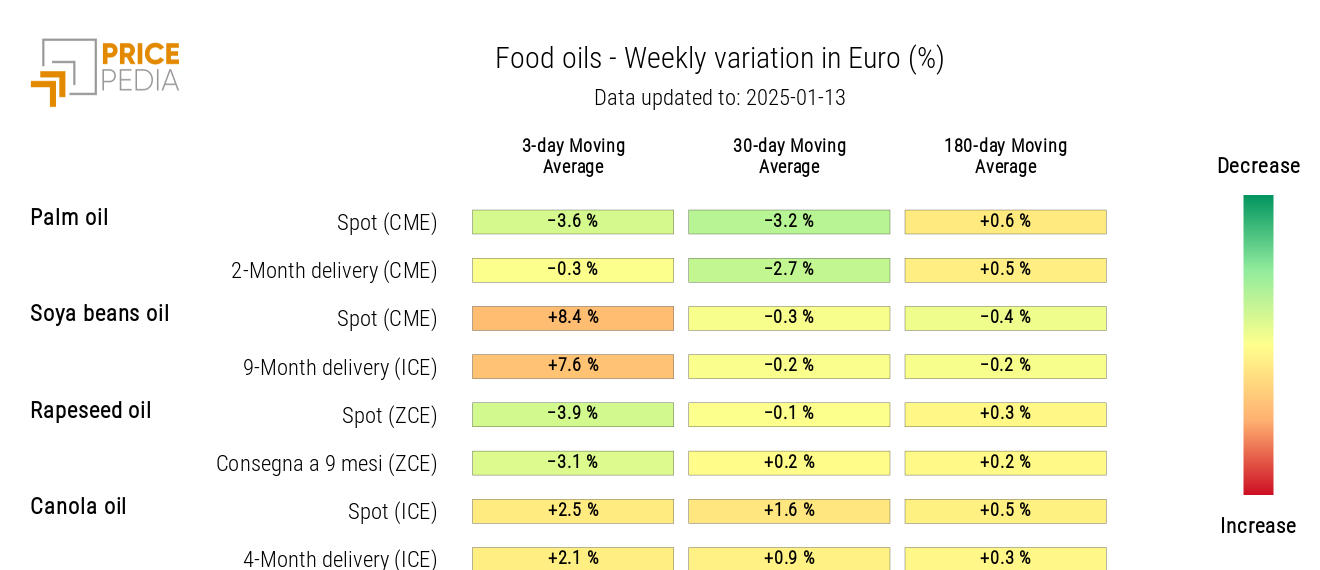

OILS

The oils heatmap shows a wide dispersion in prices, with increases for soybean and canola oils and decreases for palm and rapeseed oils.

HeatMap of Edible Oil Prices in EUR