Price determinants of unwelded steel tubes

Analysis of the impact of production costs on unwelded steel tube prices

Published by Luca Sazzini. .

Ferrous Metals Steel tubes Long steels Price Drivers

In the article "Update of steel tube prices to December 2024", it was highlighted how the different production processes of tubes, based on extrusion or welding of plates, influence the price trends in distinct ways.

In light of the differences in price dynamics between welded and unwelded steel tubes, a separate analysis was conducted for the two markets. This approach avoids generalizations that could overlook the specifics of each type. The two categories of tubes differ in both production processes and the inputs needed for their production.

In the article: "Price determinants of welded steel tubes", the determinants of welded steel tube prices, which almost entirely depend on the price trends of hot-rolled coils, have already been analyzed.

In this article, we will instead focus on the determinants influencing the prices of unwelded steel tubes, through an econometric analysis aimed at highlighting the impact of production costs on their price dynamics.

Production Costs

The first production costs considered are long products of both non-alloyed and alloyed steel, both used as key inputs in the production process of unwelded steel tubes. Non-alloyed steel is generally preferred for standard applications due to its cost-effectiveness and ease of processing. Alloyed steel, enriched with elements like chromium, molybdenum, or nickel, offers superior mechanical properties, including greater tensile strength, higher hardness, and better resistance to extreme environmental conditions.

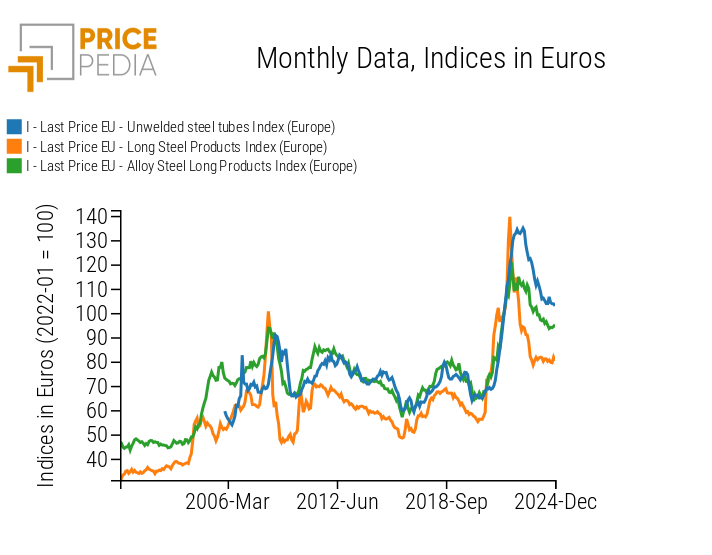

As expected, there is a strong relationship between the trend of these production inputs and that of unwelded steel tubes. This relationship can be shown through a graphical comparison between the price index of unwelded steel tubes and those of non-alloyed and alloyed long steels.

The following graph shows this comparison, using the value 100 in January 2022 as the reference base.

Comparison of Price Dynamics between Long Steel and Unwelded Steel Tubes

From the analysis of the graph, it is evident that the prices of both non-alloyed and alloyed long steels anticipate the trend of unwelded steel tubes. This suggests the need to consider potential delays for these variables in order to better understand the temporal effect of price fluctuations on the prices of unwelded steel tubes. The inclusion of delays in econometric models can optimize forecasting and price trend estimation, facilitating a more accurate understanding of the interactions between different segments of the production chain.

Other relevant costs to include in the regression model are those related to labor and services used in the production process. An indicator that summarizes these costs is the consumer price index for the euro area, assuming the hypothesis that wages and services are both indexed to inflation.

Once the determinants to include in the regression model are identified, the estimation of the long-term equation can be carried out.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Long-Term Estimation

To analyze the long-term relationship between two or more variables, the econometric model of Engle and Granger can be used, which allows the dynamic specification to be divided into two phases.

In the first phase, the long-term regression is performed to highlight the structural relationship between the variables considered.

In the second phase, the short-term equation is estimated to examine the adjustment processes of the short-term values of the variables to their long-term theoretical values.

Below is a table containing the estimation results of the long-term model between the prices of unwelded steel tubes and their respective production costs.

| Variable | Coef | Delay | P-value | Lim inf | Lim sup | |

|---|---|---|---|---|---|---|

| Intercept | -2.345 | 0.000 | -2.775 | -1.914 | ||

| Non-Alloyed Long Steel Products Index | 0.223 | 5 | 0.000 | 0.127 | 0.319 | |

| Alloyed Long Steel Products Index | 0.717 | 3 | 0.000 | 0.596 | 0.838 | |

| Euro Area Consumer Price Index | 0.582 | 0 | 0.000 | 0.477 | 0.686 | |

| Adjusted R²: 0.911 | ||||||

All long-term coefficients are consistent with theoretical expectations and are statistically significantly different from zero.

The sum of the long-term theoretical coefficients for the two main production inputs (non-alloyed and alloyed long steels) is 0.94, a value close to unity. This means that, all other conditions being equal, a 10% increase in these production inputs leads, on average, to a 9.4% increase in the price of unwelded steel tubes.

The value of the adjusted R² index, which evaluates the model's reliability considering the inclusion of new variables, is 0.91 out of a maximum of 1. This indicates that the model explains 91% of the variability in the prices of unwelded steel tubes.

Short-Term Estimation

To analyze the adjustment process of the considered variables, a short-term error correction model is estimated.

| Variable | Coef | P-value | Lim inf | Lim sup | ||

|---|---|---|---|---|---|---|

| Intercept | 0.01 | 0.440 | -0.002 | 0.005 | ||

| Shock | 0.442 | 0.000 | 0.289 | 0.596 | ||

| Adjustment Speed | -0.144 | 0.000 | -0.206 | -0.082 | ||

| Adjusted R²: 0.181 | ||||||

The coefficients estimated in the short-term equation are consistent with the theory of Error Correction Models (ECM) and are all statistically significant.

The coefficient of the shock variable indicates that 44% of the overall variations of the determinants are immediately transferred to the price of unwelded steel tubes.

The estimate of the adjustment speed is negative and in absolute value less than 1, indicating that the model gradually converges toward the long-term values. Specifically, in each period, 14% of the deviation between the observed variables and the long-term theoretical values is corrected.

Conclusions

The econometric analysis shows that production costs explain 91% of the variations in the prices of unwelded steel tubes. All the estimated coefficients are in line with economic theory and are statistically significant. The sum of the long-term estimated coefficients for non-alloy and alloy long steel products is close to unity, at 0.94. This implies that, other things being equal, a 10% increase in the prices of these two production inputs results, on average, in a 9.4% increase in the prices of unwelded steel tubes.

The short-term results show that 44% of the overall variations of the determinants are immediately transmitted to the prices of unwelded steel tubes. Subsequently, the model tends to gradually converge towards equilibrium, correcting about 14% of the deviations from the long-term theoretical values in each period.