Acetato di etile: prezzi europei e cinesi a confronto

La dinamica dei prezzi cinesi influenza quella europea, nonostante flussi commerciali limitati

Published by Luigi Bidoia. .

Organic Chemicals Price DriversEthyl acetate is one of the most versatile and useful chemical substances, thanks to its unique balance between technical performance and sustainability. It is widely used in various sectors, making it an interesting case study to analyze changes in the European chemical industry, competition with the Chinese market, and the effects on price dynamics.

Structure of the global market

The two charts below show the top 10 exporting and importing countries of ethyl acetate in 2023.

Cross-analysis of these data highlights some peculiarities:

- Belgium: stands out as the second-largest exporter and the largest importer, with similar import and export volumes. This role is linked to the presence of major chemical distribution companies in the country, which import ethyl acetate (mainly from the United Kingdom) and then re-export it to other European Union countries.

- Indonesia: plays a similar role, acting as a logistical hub between the Asia-Pacific region and, in part, Singapore.

Excluding these exceptions, the main exporters are also major producers. Among them, the following stand out:

- China: the undisputed leader, with a strong focus on Asian markets.

- United Kingdom and Saudi Arabia: primarily oriented toward the European market.

Trade flows and destination markets

A more detailed analysis of export markets highlights some relevant dynamics:

- United Kingdom and Saudi Arabia: their main destination is Belgium, which serves as the gateway to Europe.

- Europe: Europe's largest importing and consuming countries are Italy, Germany and Turkey.

- Asia major Asian importing and consuming countries are Japan, Thailand, Vietnam and Taiwan .

The existence of two distinct regional markets – Europe and China – suggests the need to analyze price formation separately in each area.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Price Formation in Europe and China

Ethyl acetate is typically produced through an esterification reaction between acetic acidand ethanol, in the presence of an acid catalyst, generally sulfuric acid.

The cost of acetic acid and ethanol usually accounts for 30% to 40% of the total cost of ethyl acetate. Other costs include sulfuric acid, energy, and service and labor expenses. Each of these costs, however, has a relatively minor impact, never significantly exceeding 10%.

Therefore, by analyzing the price dynamics of acetic acid and ethanol, it is possible to gain a good understanding of the cost trends of ethyl acetate.

The table below shows the price levels of the three products between 2019 and 2024 in the European and Chinese markets.

Input and Output Prices of Ethyl Acetate Production (€/ton)

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|---|

| EUROPE | ||||||

| Acetic Acid | 424 | 421 | 624 | 840 | 693 | 598 |

| Undenatured Ethanol | 742 | 819 | 903 | 1247 | 1100 | 921 |

| Ethyl Acetate | 883 | 812 | 1302 | 1433 | 1093 | 1078 |

| CHINA (FOB): | ||||||

| Acetic Acid | 362 | 333 | 535 | 572 | 445 | 319 |

| Undenatured Ethanol | 635 | 610 | 850 | 1035 | 863 | 835 |

| Ethyl Acetate | 675 | 626 | 993 | 985 | 780 | 696 |

The price trends are aligned between Europe and China. However, price levels in China are on average 20% lower than those in Europe, indicating greater competitiveness in Chinese production. For acetic acid and ethyl acetate, this price differential favoring China has progressively widened over the past four years.

In 2024, the average export price in China and the customs price in Europe for acetic acid were €319 and €598 per ton, respectively. In the production of acetic acid, China has maintained a significant advantage over European production and, especially, over the U.S., which dominated the market at the beginning of this century.

For ethyl acetate, the 2024 prices for China and Europe were €969 and €1,078 per ton, respectively. Here too, the price differential favoring China increased, moving from a -24% difference in 2019 to a -35% difference in 2024.

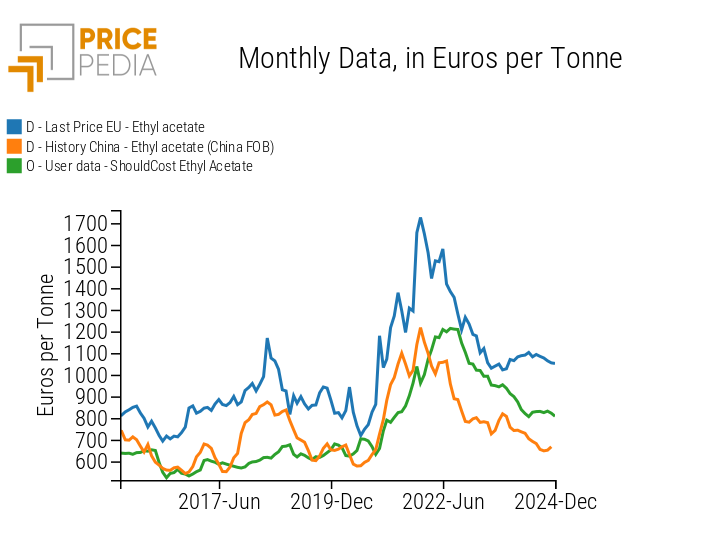

This competitive advantage of China, however, has not translated into increased Chinese exports to the European market. Nonetheless, although the Chinese and European markets have remained "isolated" in terms of trade flows, this has not prevented the price dynamics in China from influencing European prices. This becomes evident when comparing the European price of ethyl acetate with the cost trends (calculated as the average input prices) and prices in China, as illustrated in the following chart.

Comparison of cost and price dynamics of ethyl acetate

In fact, during the period 2017-2019, the European price of ethyl acetate (blue line) follows the same cycle as the Chinese price (orange line), despite relative stability in production costs (Shouldcost of ethyl acetate: green line). In addition, the price increase of ethyl acetate in the first half of 2021, both in China and Europe, occurred more intensely and earlier than the rise in costs. The most plausible hypothesis is that, even in the absence of trade between the two regions, the European market "tuned in" to the Chinese market, attributing it a leading role.

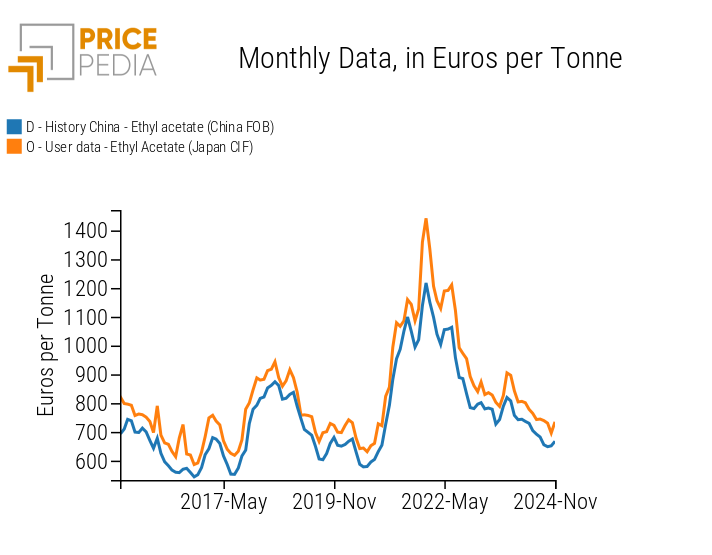

A confirmation of this hypothesis comes from the comparison between Chinese export prices of ethyl acetate and Japanese import prices. As shown in the following chart, the two prices are perfectly aligned, with a consistent differential ranging between 5% and 15%.

Comparison of Chinese and Japanese prices of ethyl acetate

This evidence reflects the trade flows of ethyl acetate between the two economies, with China as a net exporter and Japan as a net importer. However, it allows us to exclude the possibility that the alignment of price dynamics between Europe and China can be attributed to a global market structure where European prices lead Chinese prices.

Conclusions

The global ethyl acetate market is divided into three regions: Europe, Asia, and North America. China is the undisputed leader in the Asian market, thanks to more competitive costs and lower prices compared to other global producers. The largest producer in Europe is the United Kingdom, whose exports enter the EU primarily through Belgium. Belgium imports ethyl acetate from the United Kingdom and Saudi Arabia, then re-exports it to other EU countries.

Although trade flows of ethyl acetate between Asia and Europe are limited, European price dynamics only marginally follow cost trends and are instead closely aligned with Chinese prices. The Chinese price acts as a benchmark across different markets, as confirmed by the strong alignment between the Chinese FOB export price and the Japanese CIF import price.

Since 2019, however, the gap between European and Chinese prices has progressively widened, increasing the cost advantage for companies sourcing from Chinese suppliers.