Commodity: uncertain supply prevails over weak demand

PricePedia price indexes are realigning toward rising

Published by Luca Sazzini. .

Conjunctural Indicators Commodities Financial Week In last week's article ("Waiting for Trump"), the rise in oil prices was highlighted, triggered by the U.S. Treasury Department's announcement of new sanctions against the Russian oil industry.

The new restrictive measures include sanctions on:

- the main Russian oil companies, including Gazprom Neft and Surgutneftegas, already subject to sanctions by the United Kingdom;

- over 180 vessels, mainly tankers belonging to Russia's shadow fleet;

- traders involved in facilitating the trade of Russian oil;

- the insurance companies Ingosstrakh and Alfastrakhovanie Group, accused of supporting economic operations tied to the Russian energy industry by financing the war in Ukraine;

- oil service providers and Russian energy officials.

The U.S. Treasury has also imposed a ban on U.S. oil service companies, prohibiting them from operating in Russia starting February 27, 2025. These sanctions could have a significant impact on oil supply, already reduced due to production cuts decided by OPEC+. However, estimating the precise effect of these sanctions on oil supply is challenging, given the activities of Russia's shadow fleet.

Analysts believe that Russia will adapt and redirect trade flows toward the West, minimizing the impact of the new restrictions. According to an estimate by S&P Global, Russia has a fleet of about 600 tankers flying the flags of various countries, employing opaque practices to conceal the origin of shipments.

Even though a portion of these vessels has already been identified, Russia is expected to increase shipments using those yet to be detected. Consequently, the actual decline in Russian oil exports remains highly uncertain.

Weekly Summary of Financial Commodity Prices

The uncertainty surrounding the future supply of oil has impacted financial prices, which this week exhibited high volatility with continuous fluctuations. While prices are pressured by weak demand, they are supported by concerns over potential supply-side risks.

Another price characterized by high volatility is that of natural gas, also influenced by U.S. sanctions on Russia. In particular, concerns have emerged about potential measures against Russia's LNG projects in Portovaya and Vysotsk.

In European markets, worries increased further after Ukraine's attack on the TurkStream pipeline, the only operational route for transporting Russian gas to Europe following the interruption of flows through Ukraine. This news caused a sharp rise in TTF Netherlands prices on Monday, which subsequently declined as the pipeline's continued operation was confirmed.

In the United States, however, natural gas prices followed a different trend, with significant increases, especially over the weekend. These hikes were driven by concerns over a sharp weekly decline in gas inventories and weather forecasts predicting colder-than-expected conditions.

The ferrous metals market, particularly in China, saw a recovery in prices, driven by positive Chinese trade balance data and Beijing's statements aimed at promoting further increases in domestic consumption.

Among ferrous metals, iron ore stood out with significant gains, fueled by increased imports by China. This growth was mainly due to recent price drops combined with resilient demand to support high steel export levels.

Prices of non-ferrous metals also recorded gains, supported by news that the Trump administration might opt for a more gradual approach to raising trade tariffs rather than introducing them all at once. This development helped sustain the rise in copper prices, already boosted by increased Chinese imports reported in December.

Another non-ferrous metal experiencing significant gains this week was aluminum. Price growth was driven by declining inventories linked to increased Chinese demand and growing concerns over potential European Union sanctions on Russian aluminum.

U.S. Inflation

This week, the Bureau of Labor Statistics released U.S. inflation data for December, measured through the Consumer Price Index (CPI).

The headline index posted a monthly growth of 0.4% m/m, accelerating from 0.3% m/m in the previous month. On an annual basis, the CPI increased by 2.9% y/y, in line with analysts' forecasts and up from 2.7% recorded in November.

The core CPI, which excludes the most volatile components (energy and food), grew by 0.2% m/m on a monthly basis, below expectations of 0.3% m/m. Annually, core CPI growth was 3.2% y/y, slightly below the market's expected 3.3% rate, consistent with prior months.

Overall, December's data was relatively positive, particularly for the core component, which recorded the lowest monthly growth rate in five months.

Given this context, the Federal Reserve is expected to keep interest rates unchanged for an extended period, likely until the start of summer. At the moment, the U.S. economy continues to exhibit robust growth, and with the inauguration of the Trump administration, an uptick in inflation during the first quarter of 2025 cannot be ruled out.

ECB Minutes

The minutes from the ECB meeting on December 11-12 confirm the intention to pursue monetary easing to support the European economy, which is currently in a phase of stagflation.

The most notable revelation from the minutes is that some Governing Council members considered a potential 50-basis-point rate cut. Another significant point was the increased optimism regarding inflation control, which is expected to return to the 2% target by the first half of 2025.

Given these considerations, a 25-basis-point rate cut at the next meeting on January 30 seems highly likely. The European industry is currently in a severe crisis, as evidenced by November's industrial production index, which contracted by -1.9% y/y. Although monthly data showed a slight recovery of 0.2% m/m, it fell short of analysts' expectations, which predicted a 0.3% m/m increase. Attention now turns to next week's preliminary Purchasing Managers' Index (PMI) data, which will provide more detailed insights into the performance of Europe's manufacturing sector.

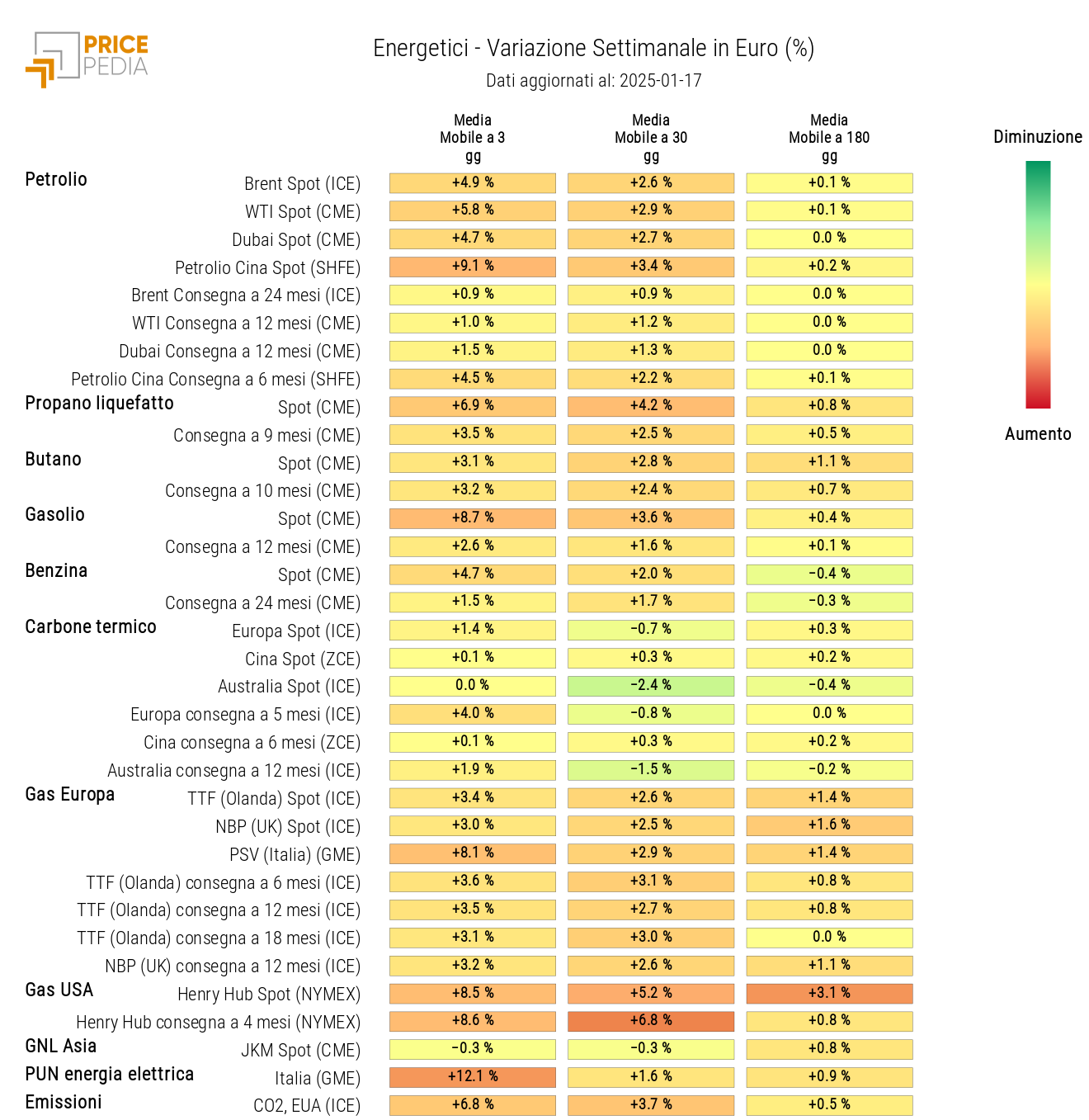

ENERGY

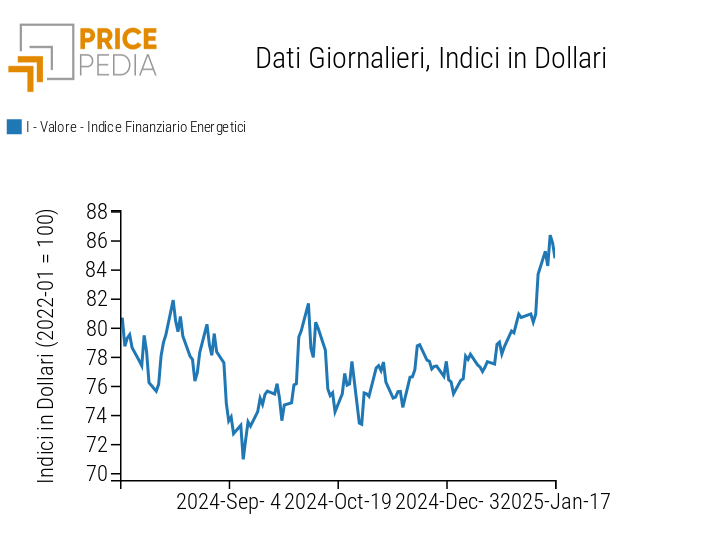

The PricePedia index of energy product prices showed an upward trend, but it was marked by numerous fluctuations caused by various news events: the TurkStream pipeline attack, the possibility of a Middle East truce, U.S. core inflation below expectations, declining oil and natural gas inventories in the U.S., and the announcement of a truce in Gaza.

PricePedia Financial Index of Energy Prices in Dollars

The PricePedia energy heatmap is shaded orange, indicating a general rise in the 3-day moving average of energy prices.

HeatMap of Energy Prices in Euros

PLASTICS

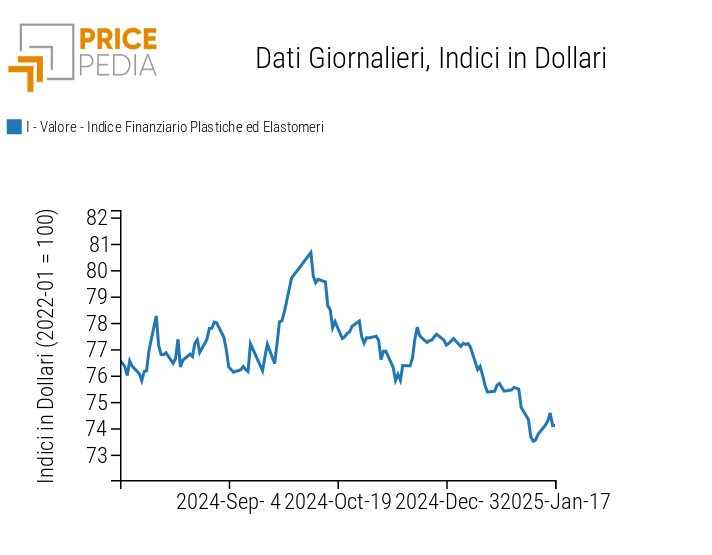

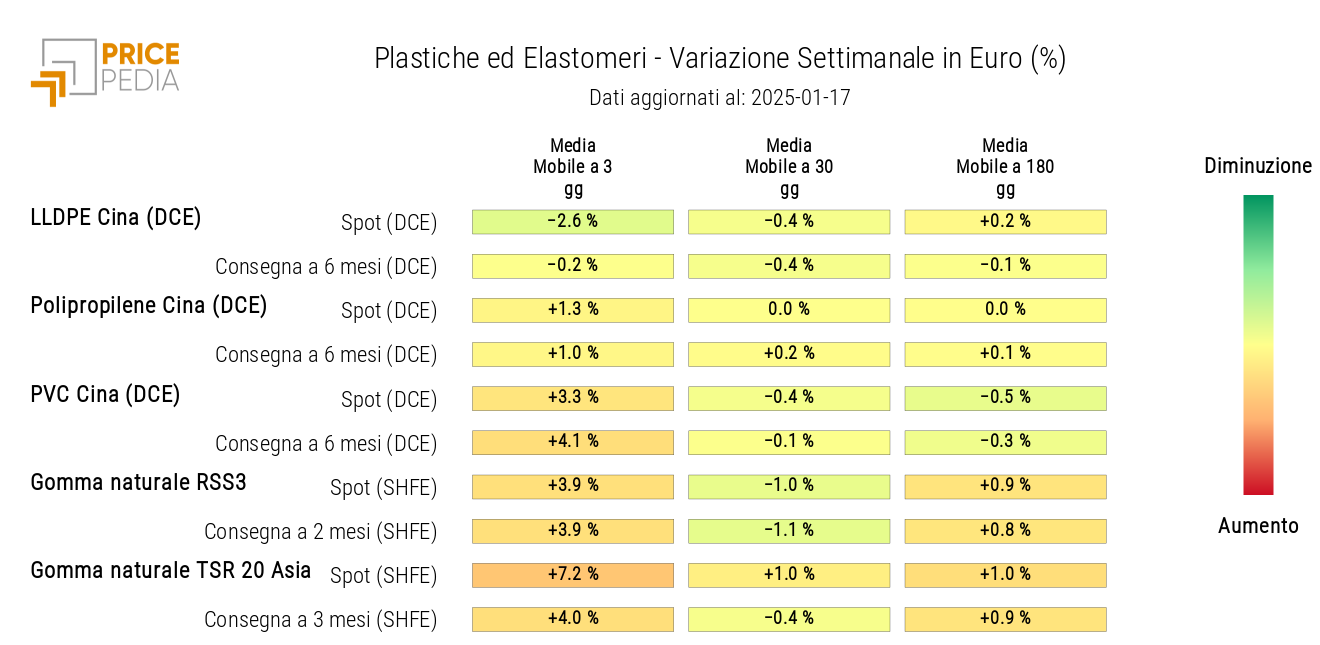

After a significant rise on Monday, the financial index of plastics and elastomers prices reverses the price trend.

PricePedia Financial Indices of Plastics Prices in US Dollars

The heatmap of plastics and elastomers indicates an increase in natural rubber and PVC prices.

HeatMap of Plastics and Elastomers Prices in Euros

FERROUS METALS

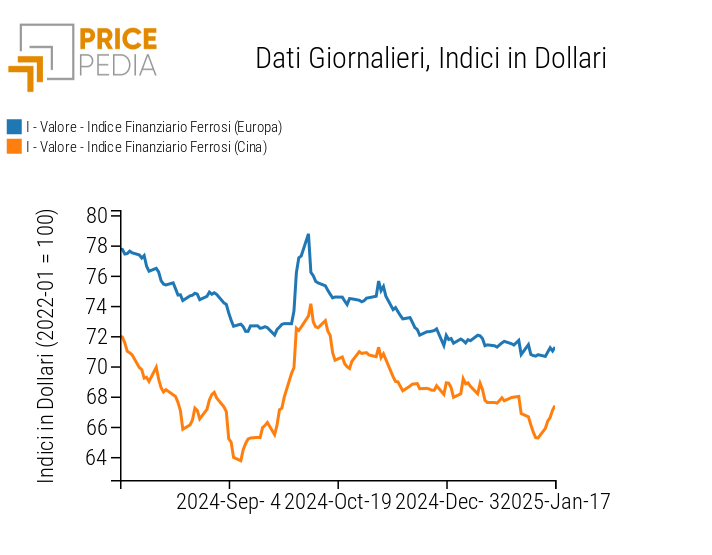

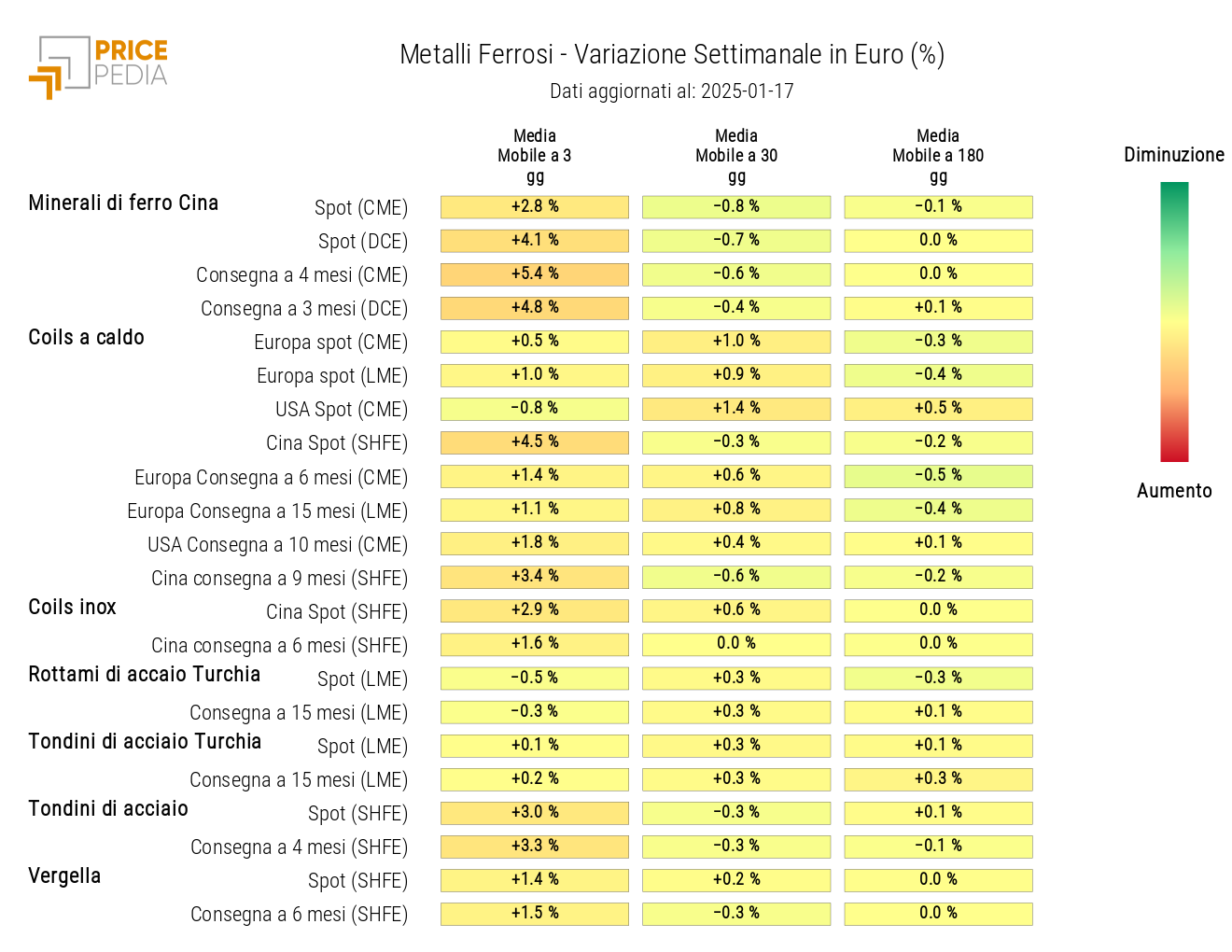

The following chart shows the growth of financial prices for ferrous metals in the Chinese and European markets.

PricePedia Financial Indices of Ferrous Metals Prices in US Dollars

The heatmap analysis highlights an increase in prices for Chinese iron ore, steel rebar, and steel coils.

HeatMap of Ferrous Metals Prices in Euros

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

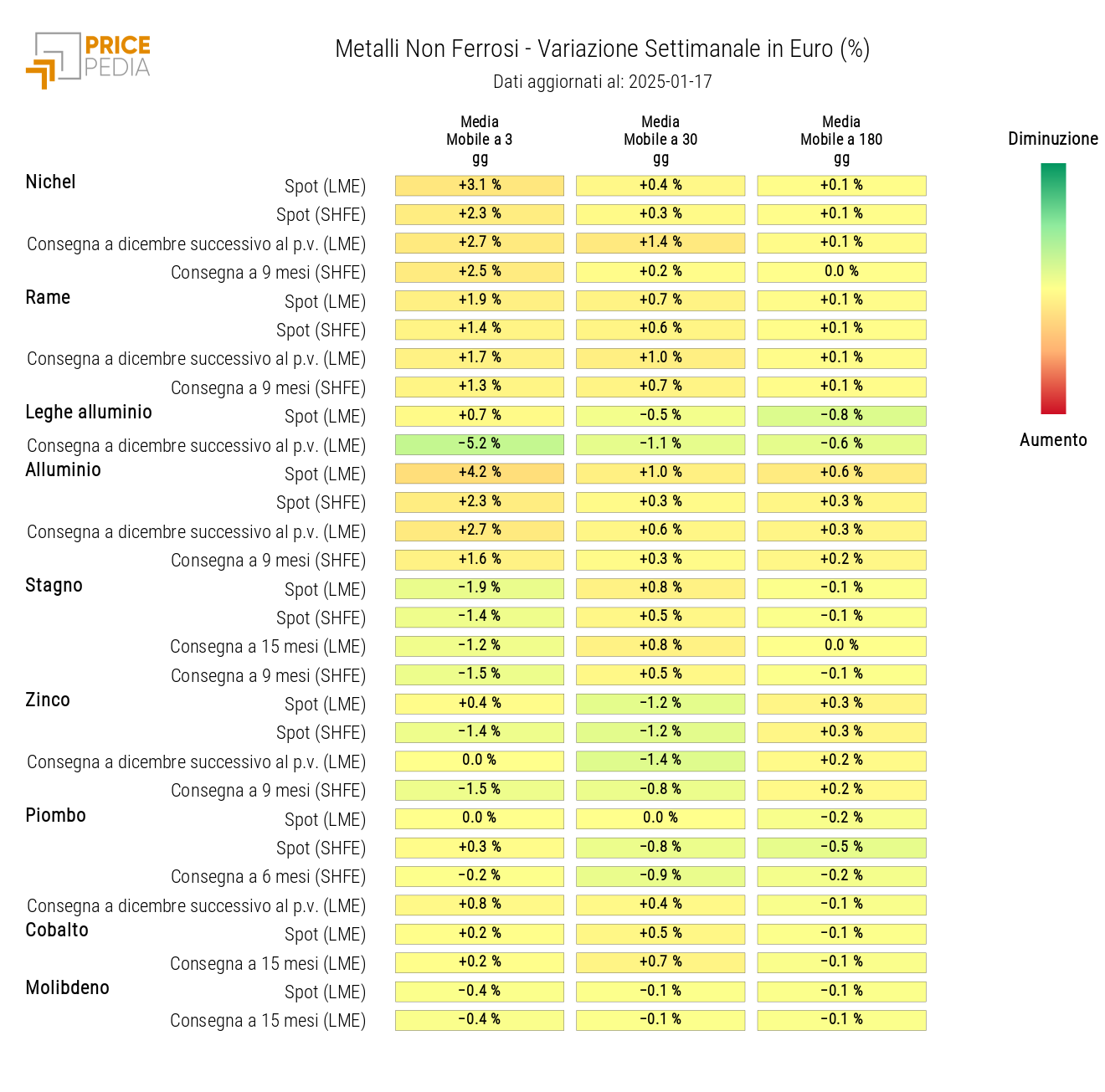

NON-FERROUS INDUSTRIAL METALS

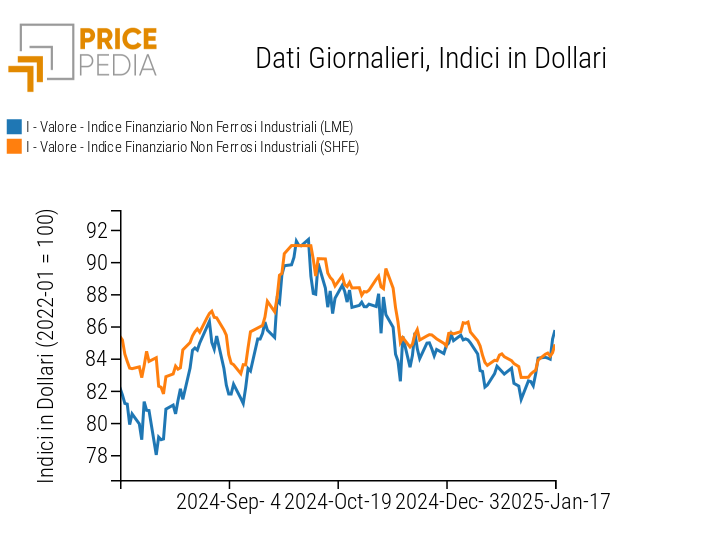

The financial indices for non-ferrous metals traded on the London Metal Exchange (LME) and the Shanghai Futures Exchange (SHFE) continue their upward trend.

PricePedia Financial Indices of Non-Ferrous Metals Prices in US Dollars

The heatmap for non-ferrous metals highlights a weekly increase in the prices of aluminum, copper, and nickel.

HeatMap of Non-Ferrous Metals Prices in Euros

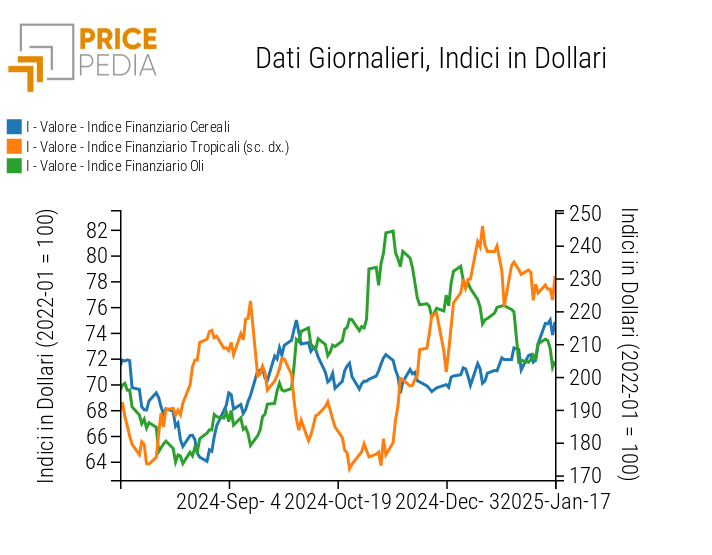

FOOD

All food indices experienced various fluctuations during the week, closing with a sideways trend for oils and tropical goods, and an upward trend for cereals.

PricePedia Financial Indices of Food Prices in US Dollars

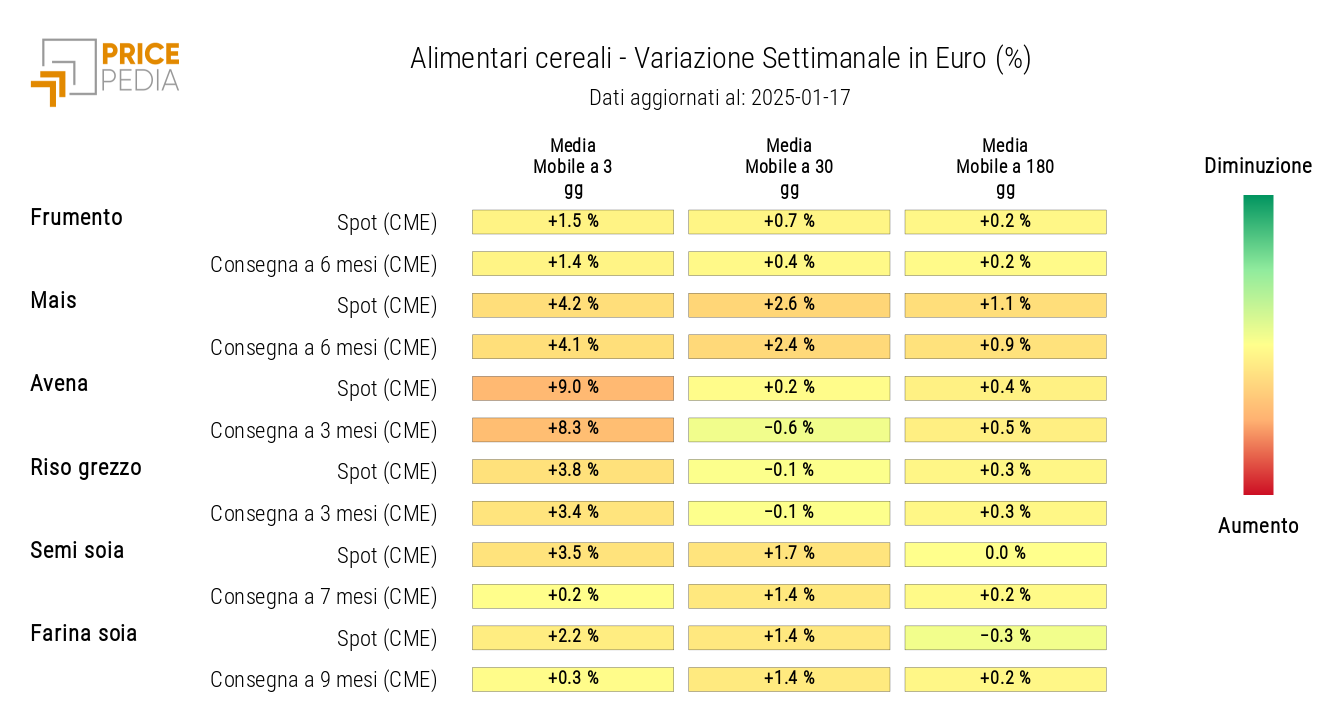

CEREALS

The cereals heatmap shows an increase in the prices of oats, corn, and rice.

HeatMap of Cereals Prices in Euros

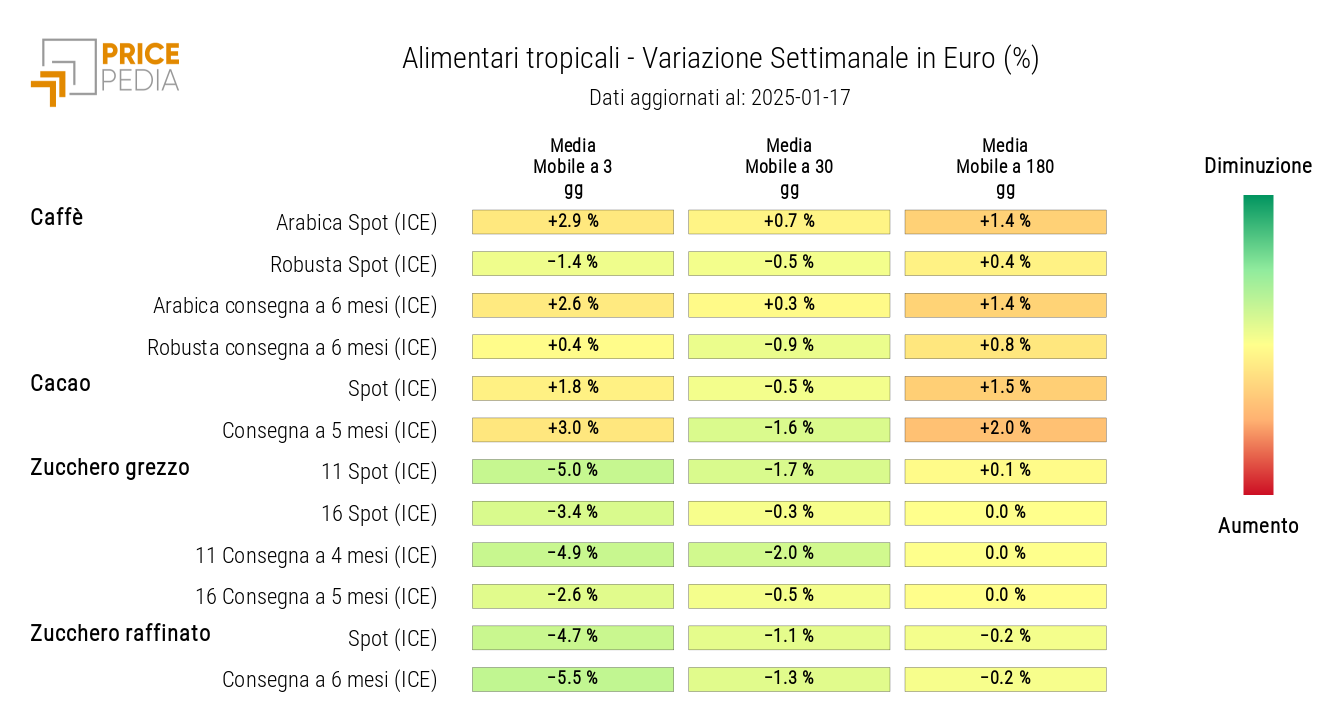

TROPICAL GOODS

The tropical goods heatmap reveals a weekly decrease in sugar prices.

HeatMap of Tropical Food Prices in Euros

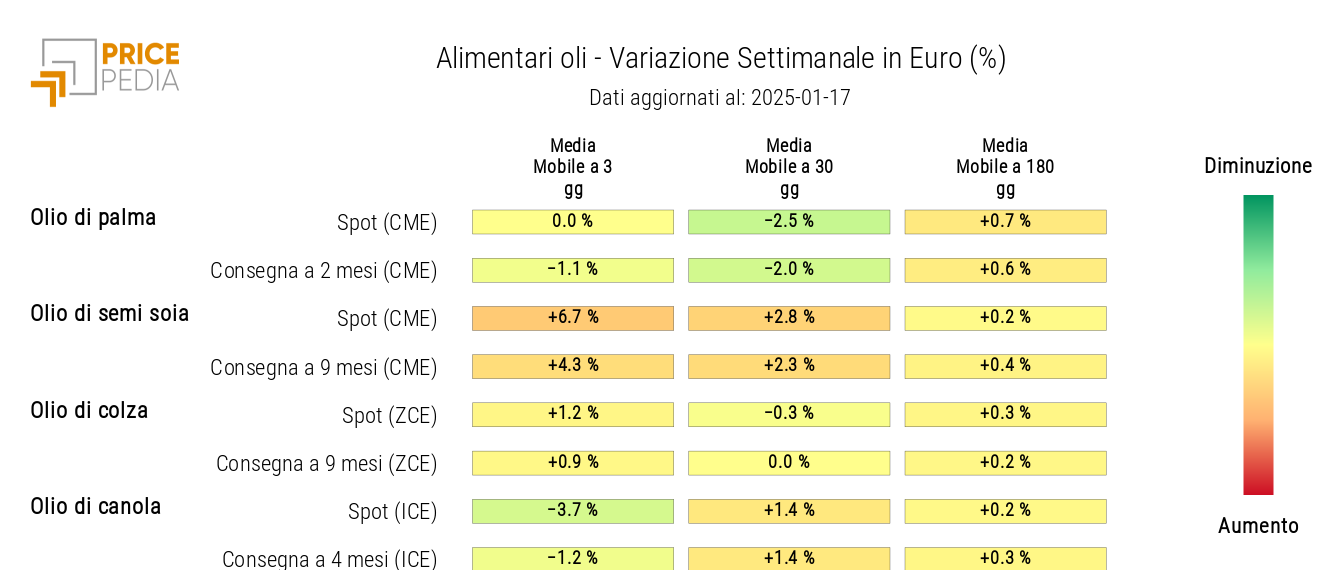

OILS

The oils heatmap highlights an increase in soybean oil prices, alongside a decrease in canola oil prices.

HeatMap of Edible Oil Prices in Euros