The Globalization of Commodity Markets

Market forces in Europe and Asia tend to produce a single price between the two markets

Published by Luigi Bidoia. .

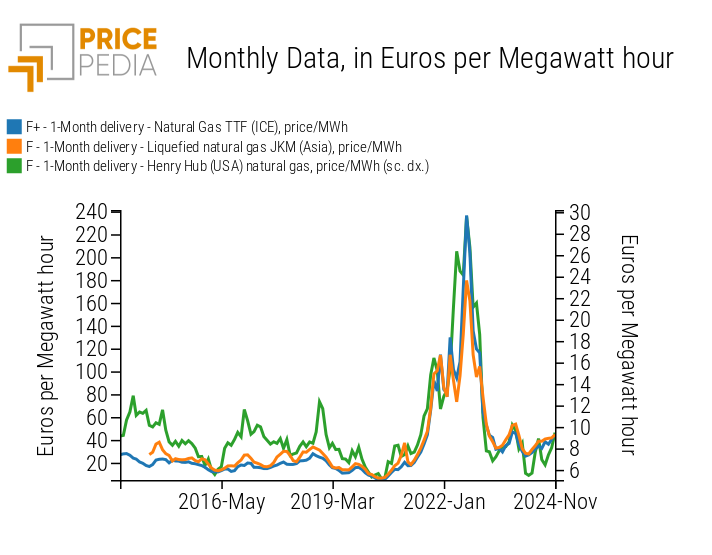

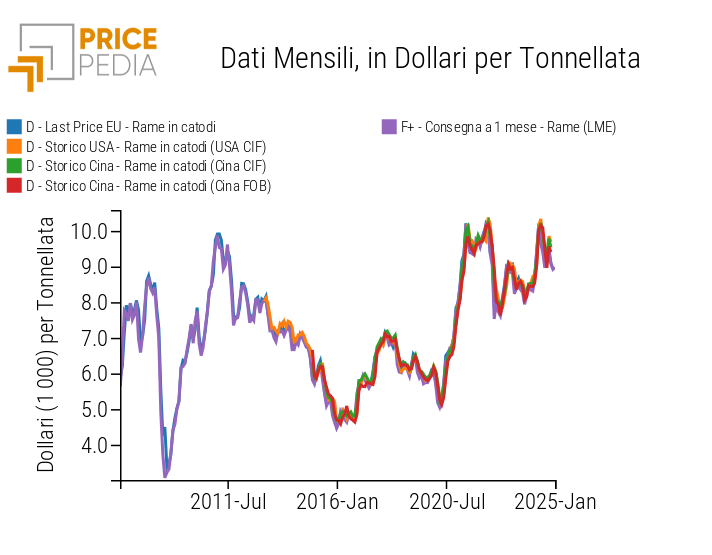

Strumenti Analysis tools and methodologiesThe existence of a single global price in the physical oil market is a well-known and widely studied phenomenon. The presence of benchmarks widely accepted by all operators, such as various financial oil prices, allows physical markets to align day by day, generating a single global price1. Another significant example of a single global physical price determined by financial pricing is that of pure copper cathodes with 99.99% purity. The trading of pure copper cathodes takes place daily around the world at the price set by the London Metal Exchange. This is highlighted in the following graph, which compares the prices of copper cathodes from different global flows.

Price of copper cathodes in various markets

There is, however, greater uncertainty regarding the ability of market forces to determine a single price across different continental markets in the absence of transparent information that is accessible and shared among all operators, as is the case with certain financial prices. In such cases, the transmission channel should be represented by trade flows between different regions. However, the effectiveness of these trade flows in transferring price signals from one area to another can vary on a case-by-case basis.

In this article, we will explore the case of basic chemicals and how the price formed in China can become a reference point for European prices as well. To do so, we will examine three sets of prices:

- Chinese FOB export prices, which represent the origin of price variation impulses in the destination markets of Chinese exports;

- EU customs prices, to measure the impact of Chinese prices on European prices;

- Japanese CIF import prices, as confirmation of how price variation impulses from China are transferred to other markets.

Japanese Import Prices

As part of the ongoing development of the information distributed by PricePedia, following the 2024 integration of the EU customs dataset with those covering customs flows declared by the United States and China, one of PricePedia's objectives for 2025 is to expand the available data to include Japanese customs prices. From the perspective of commodities both imported and exported, Japan ranks among the top countries globally. In 2023, Japan imported nearly 600 million tons of commodities, equivalent to half of the imports the EU received from the rest of the world. On the export side, Japan also recorded significant volumes. In 2023, it exported 75 million tons of commodities, mainly industrial raw materials, ranking among the top 30 exporting countries worldwide.

Japan is therefore a significant market in terms of commodity trade. Monitoring its price levels provides valuable insights into the trends and dynamics of prices across the broader Asian market.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Case Studies

To explore the role that, in many basic chemical products, the price of Chinese exports plays as a benchmark both in the Asian and European markets, we analyzed the following four chemical products where China holds a leading position globally:

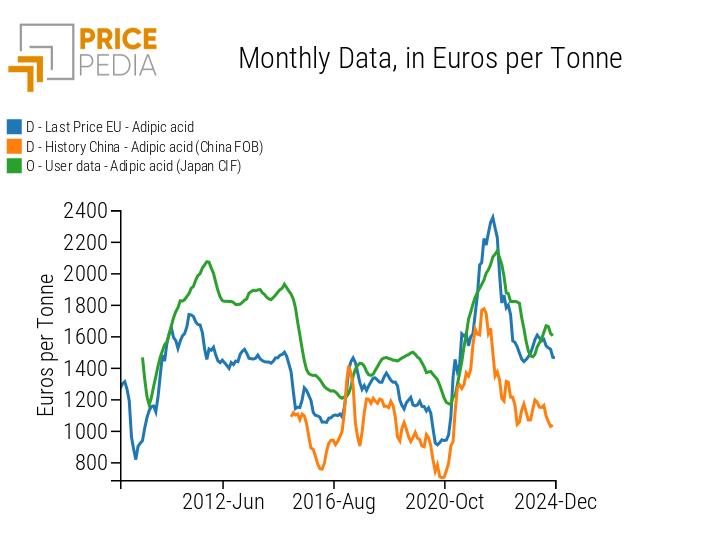

- Adipic acid: one of the most important raw materials for nylon production, also used to produce other types of polymers such as polyurethanes, polyester resins, and plasticizers. With 350 thousand tons exported in 2023, China is the world's largest exporter, followed by the United States and Germany with 115 thousand and 104 thousand tons, respectively.

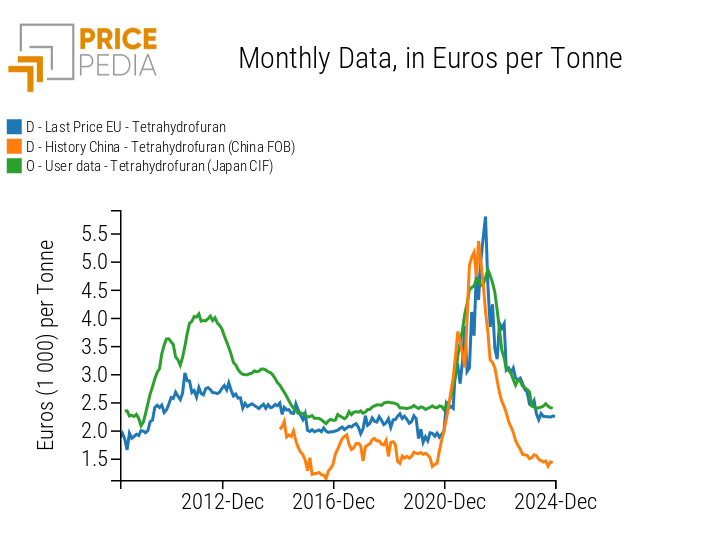

- Tetrahydrofuran: used as a solvent for polymers and resins, both natural and synthetic. In 2023, China confirmed its position as the world's leading exporter with 21 thousand tons, followed by Germany with 14 thousand tons exported.

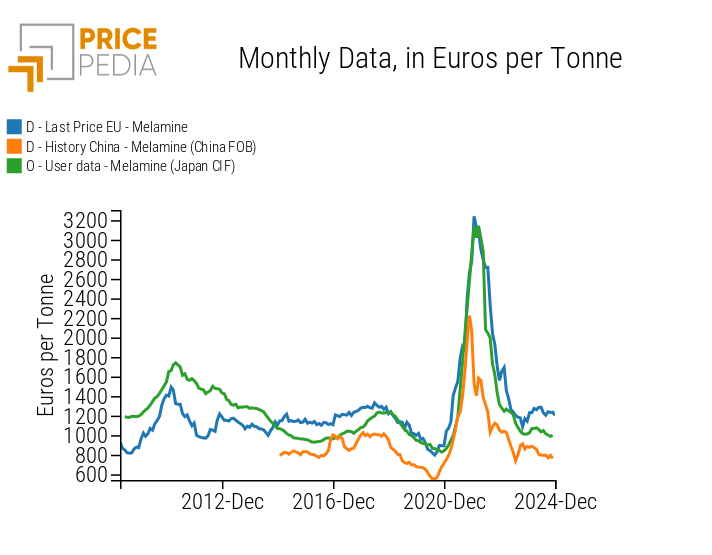

- Melamine: one of the most versatile and widely used chemical raw materials. It is employed in the production of plastics, resins, laminates, coatings, adhesives, and as a finishing agent in textiles. With 450 thousand tons exported in 2023, China dominates global flows. The second-largest exporter is Qatar, with a volume slightly exceeding 10% of that of China.

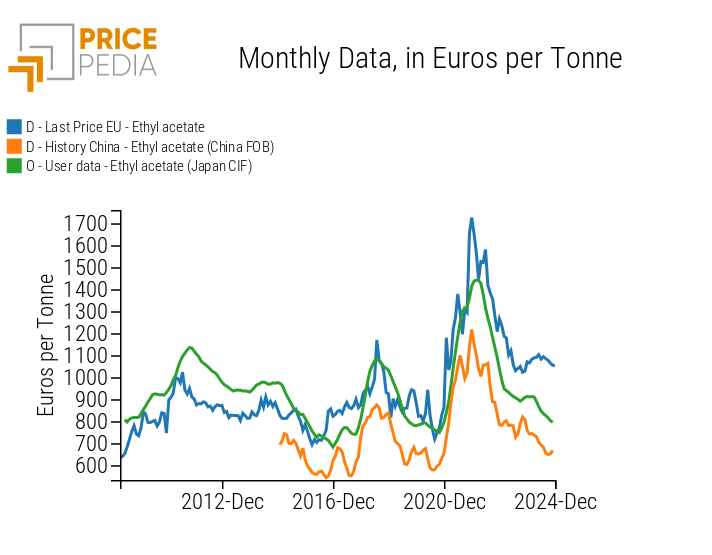

- Ethyl acetate: widely used as a solvent and also as a flavoring agent. China is the world's largest producer and exporter, with 350 thousand tons exported in 2023. Among the main producing countries, the United Kingdom ranked as the second-largest exporter with 110 thousand tons in the same year.

In the four charts below, the FOB export prices from China are compared with the CIF import prices in Japan and European customs prices.

Comparison of Chinese FOB export prices, Japanese CIF import prices, and EU customs prices

| Adipic Acid | Tetrahydrofuran |

|

|

| Melamine | Ethyl Acetate |

|

|

In all four cases, the FOB export prices from China are consistently lower than Japanese and European prices. Moreover, it is noteworthy that the dynamics of Chinese prices systematically anticipate, by one or two months, the variations in the other two prices.

The CIF import prices in Japan, however, align with European prices both in terms of levels and dynamics.

The overall picture emerging from these charts is that of a global system in which the price of the chemical product is formed in the Chinese market, subsequently influencing prices both in Japan (via Chinese exports to Japan) and in Europe. This phenomenon occurs even in cases where, as with ethyl acetate[1], the trade flows from China to Europe are relatively limited.

Conclusions

Even for commodities that are not traded on financial markets and therefore lack an easily accessible reference price for physical markets, global markets tend to define a single price across different regions. This is particularly true for many basic chemical products, a sector in which China has established a strong leadership in this century, surpassing both the American and European chemical industries. The global price of these products is often determined by the dynamics of costs, supply, and demand within the Chinese domestic market, subsequently propagating through Chinese exports and influencing both Asian and European prices.

In this context, monitoring developments in the Asian market and analyzing how Chinese FOB export prices influence CIF import prices in Asian countries become essential tools to anticipate probable price trends in the European market.

[1] For an in-depth analysis of the interrelations between the different regional markets for ethyl acetate, see the article Ethyl acetate: European and Chinese prices compared.