Trump impact on commodity prices

After inauguration Trump softens his stance on the trade war with China

Published by Luca Sazzini. .

Conjunctural Indicators Price DriversDonald Trump's election campaign focused on increasing protectionism by proposing the introduction of new tariffs to protect the US economy from international competition. The numerous threats made by Trump fueled uncertainty in the financial markets, with fears that the onset of a trade war would further accentuate global divisions.

The expected effect on commodity prices was an increase in the US market and a decrease in the rest of the world.

However, since his inauguration in the White House, the new president's statements on tariffs have been more moderate compared to the radical positions expressed during the campaign, where he had announced generalized tariffs for all countries.

Since the beginning of his new term, the most significant protectionist threats have focused on the possible introduction of 25% tariffs on imports from Canada and Mexico, and 10% on Chinese imports, set to take effect from February 1, motivated by the flows of fentanyl from China to Canada and Mexico, and from them to the United States. These proposals are very different from those announced during the campaign, where Trump had considered tariffs of up to 60% on China.

On Thursday, January 23, during the Davos forum, President Trump expressed his intention to rebuild a balanced relationship with Beijing, praising President Xi Jinping. This radical change in approach has been officially attributed to the possibility that China could play a decisive role in ending the war in Ukraine, thanks to its close ties with Russia. However, according to analysts, the real motivations seem to lie in China's greater commercial strength compared to Trump's first term. Additionally, Beijing has already suspended exports of germanium, gallium, and antimony to the US, and in the event of a trade war, it could extend the blockade to other strategic raw materials.

As for Europe, no tariffs have been announced by the United States so far, although Trump has threatened to impose them if current trade imbalances are not corrected.

The European Union is ready to negotiate to protect its strategic partnership with the US, but, as stated by EU Commissioner for the Economy Valdis Dombrovskis, it will respond proportionally if necessary.

The main effect of Trump's potential tariff war has so far been an increase in metal prices at COMEX on the Chicago Mercantile Exchange (CME), especially copper, due to speculations by traders on the possible US tariffs. Conversely, price dynamics at the London Metal Exchange (LME) have tended to decline.

Weekly Summary of Financial Commodity Prices

The less severe tariffs, compared to those expected by financial markets, have mitigated the impact of the new administration on ferrous metals, which remained relatively stable during the week.

Non-ferrous metals have seen a price contraction attributed to the new environmental and energy policies of the Trump administration, which withdrew the US from the Paris Agreement and canceled subsidies for electric vehicles. These choices have reduced future demand prospects for non-ferrous metals related to the energy transition, thus favoring the decline in their prices.

However, the real contraction was not observed in the non-ferrous sector but in the energy commodity sector, which has been the most affected by the new US executive orders. Trump declared a national energy emergency to encourage domestic production of oil and natural gas, aiming to reduce energy prices.

The president is also determined to ask OPEC members to increase oil supply to reduce prices and intensify pressure on Russia, thereby facilitating a potential resolution of the war in Ukraine.

These statements have favored the decline of financial oil prices and US Henry Hub natural gas, although the latter partially recovered in the following days.

The European TTF (Netherlands) natural gas price, however, saw a sharp increase early in the week, caused by reduced activity at the Freeport LNG export terminal in the US and Germany's announcement of new subsidies for summer storage refills. Currently, the cold weather and reduced renewable energy production are depleting gas stocks in Europe more rapidly than expected, making the refilling of storage before the next winter season a priority.

PMI

Eurozone

The January flash estimate of the Purchasing Managers' Index (PMI) composite for the Eurozone rose above the 50-point threshold, considered the boundary between economic growth and contraction.

The composite PMI was estimated at 50.2, marking an improvement from the previous month (49.6) and surpassing analysts' expectations (49.7).

The contraction of the manufacturing PMI has decreased, recording an increase from 45.1 to 46.1, exceeding expectations of 45.6.

The services PMI stood at 51.4, in line with analysts' expectations. Although this figure is slightly lower than the previous value (51.6), it confirms solid growth in the sector.

Improvements in the European PMIs are primarily attributed to the recovery of Germany and France, whose composite PMIs rose from 48 and 47.5 to 50.1 and 48.3, respectively. The manufacturing sector remains in strong contraction for both economies, although improvements have been recorded compared to previous data. The manufacturing PMIs for Germany and France grew to 44.1 and 45.3, respectively, compared to the previous 42.5 and 41.9.

In the services sector, PMIs are higher than in December, rising from 51.2 and 49.3 to 52.5 and 48.9.

These new flash estimates are a positive signal for the European economy, thanks to the first tentative signs of recovery from the industrial crisis, driven by the services sector. However, the index levels are still not sufficient to change growth prospects, which remain mostly stagnant, with an expected expansion rate between 0.1% and 0.2% quarter on quarter.

United States

The US composite PMI for January is estimated at 52.2, consistent with economic growth but down from the previous reading of 55.4.

In the manufacturing sector, there was an improvement from 49.4 to 50.1, exceeding expectations of 49.8.

The real deterioration occurred in the services sector, where the PMI is estimated at 52.8. Although this value indicates sector growth (as it is above 50), it represents a marked decline compared to both expectations and the previous reading, which were both 56.8.

Monetary Policy Expectations

President Donald Trump has explicitly asked the Federal Reserve to cut interest rates at next week's FOMC meeting. Nevertheless, analysts continue to expect unchanged interest rates for the January meeting. The FED is an independent body and should not be subject to political pressures from the president.

Regarding the ECB meeting, a 25 basis points rate cut is expected with relative certainty.

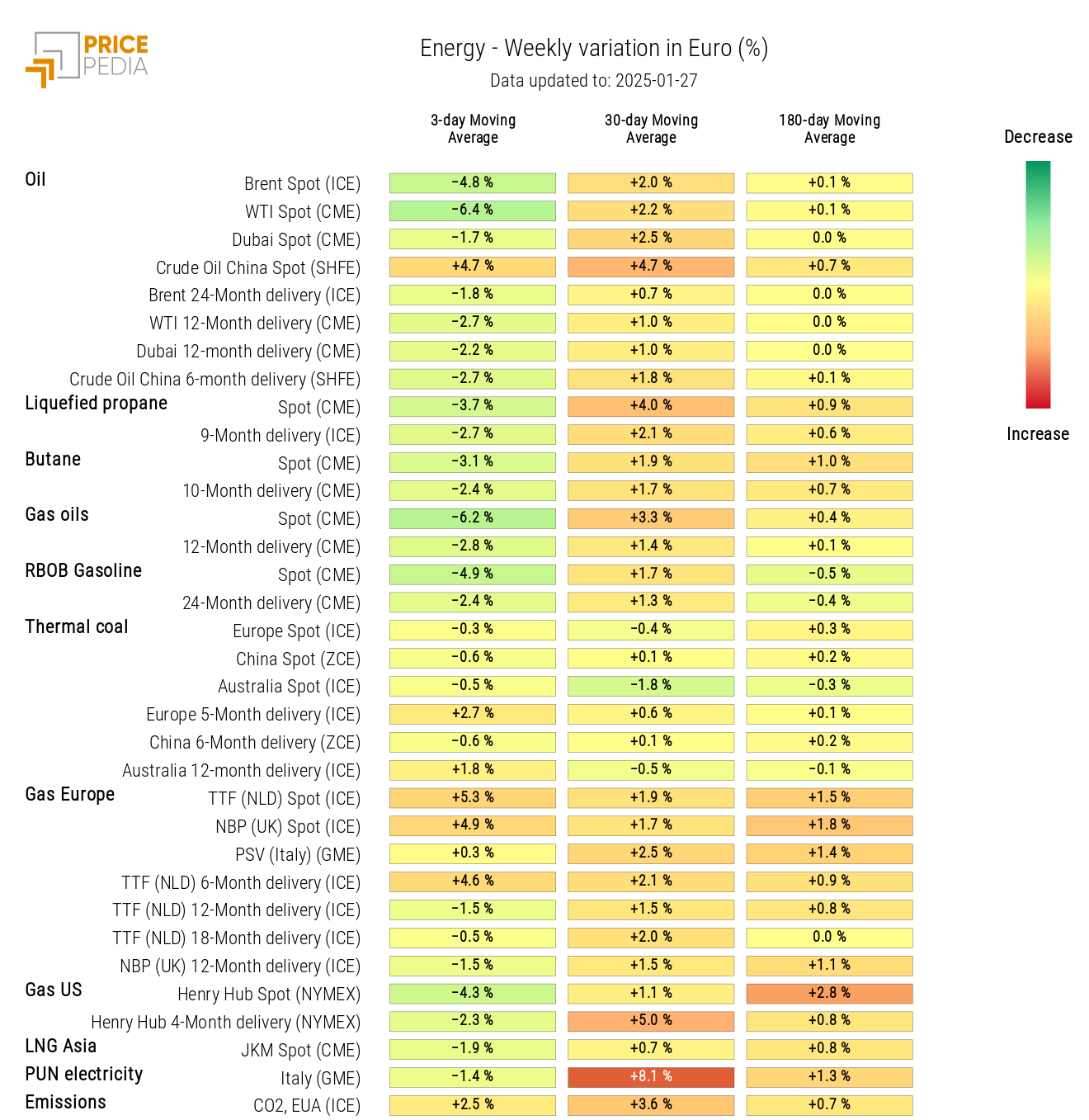

ENERGY

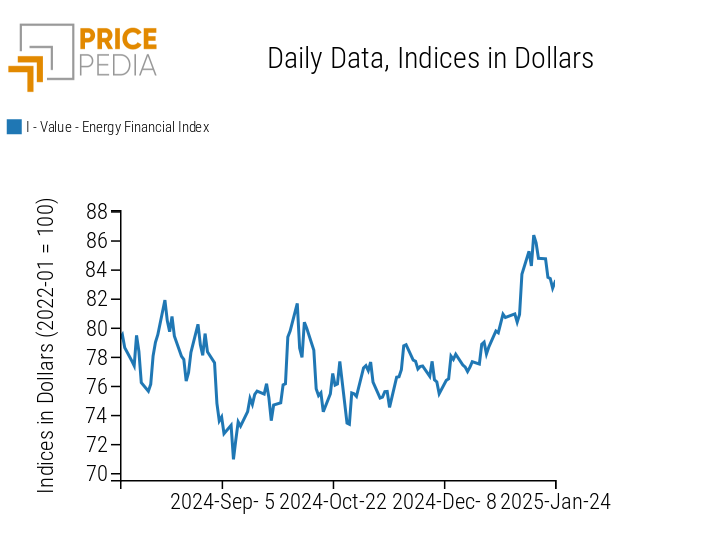

The PricePedia index of commodity prices recorded a sharp correction following the national energy emergency imposed by Trump.

PricePedia Financial Index of Energy Prices in Dollars

PricePedia's energy heatmap highlights the weekly drop in Brent and WTI prices, against the increase in TTF (Netherlands) prices.

HeatMap of Energy Prices in Euro

PLASTICS

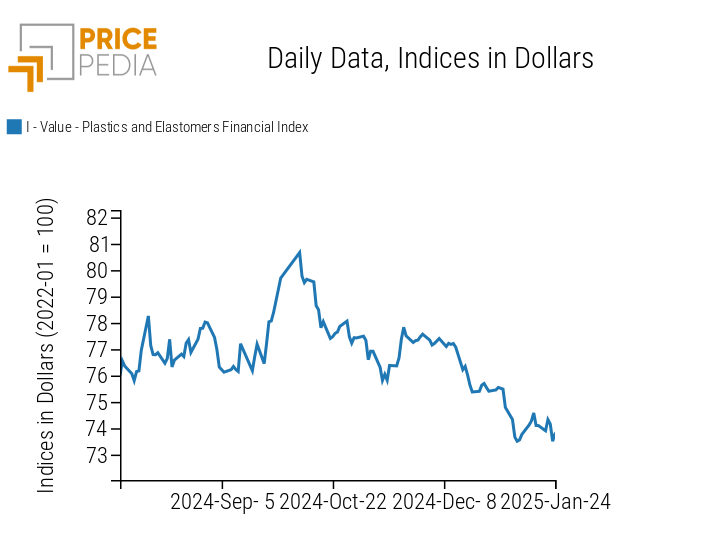

The PricePedia index of plastics and elastomers follows a phase of price reduction.

PricePedia Financial Indices of Plastic Prices in Dollars

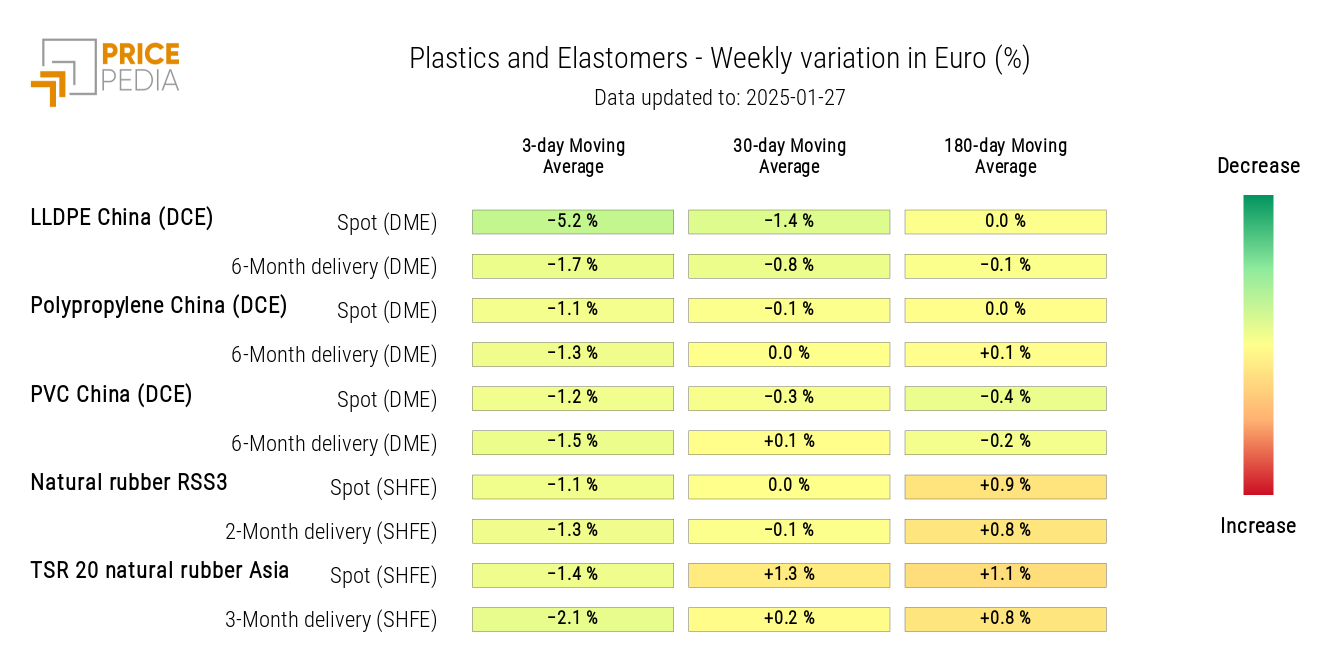

The plastics and elastomers heatmap indicates a decrease in Chinese prices of low-density polyethylene (LLDPE).

HeatMap of Plastic Prices in Euro

FERROUS METALS

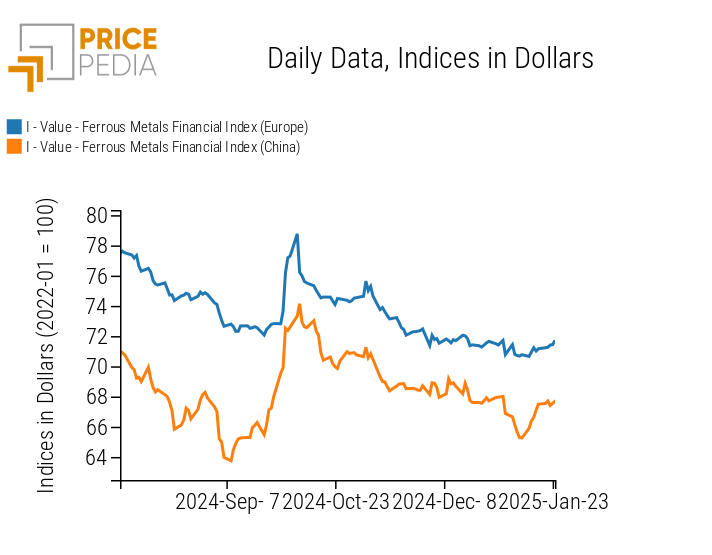

The indices for ferrous metals show very slight price increases, which do not significantly alter the price levels.

PricePedia Financial Indices of Ferrous Metal Prices in USD

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

NON-FERROUS INDUSTRIAL METALS

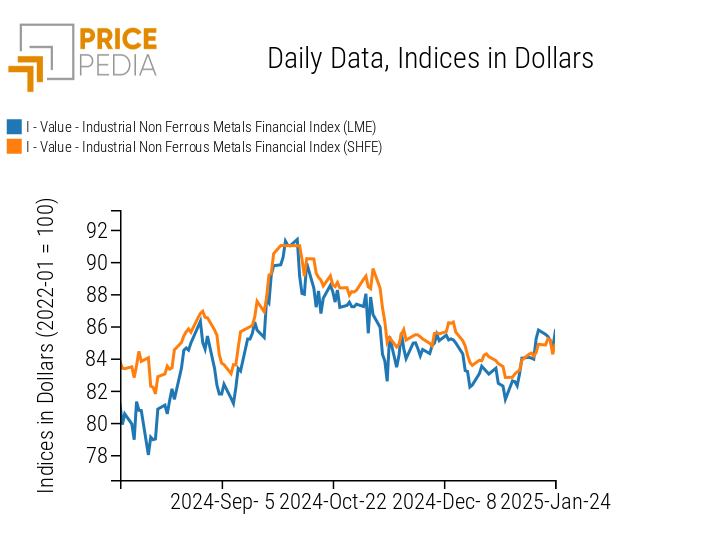

Apart from some fluctuations, both non-ferrous metal indices indicate a slight decrease in prices.

PricePedia Financial Indices of Non-Ferrous Industrial Metal Prices in USD

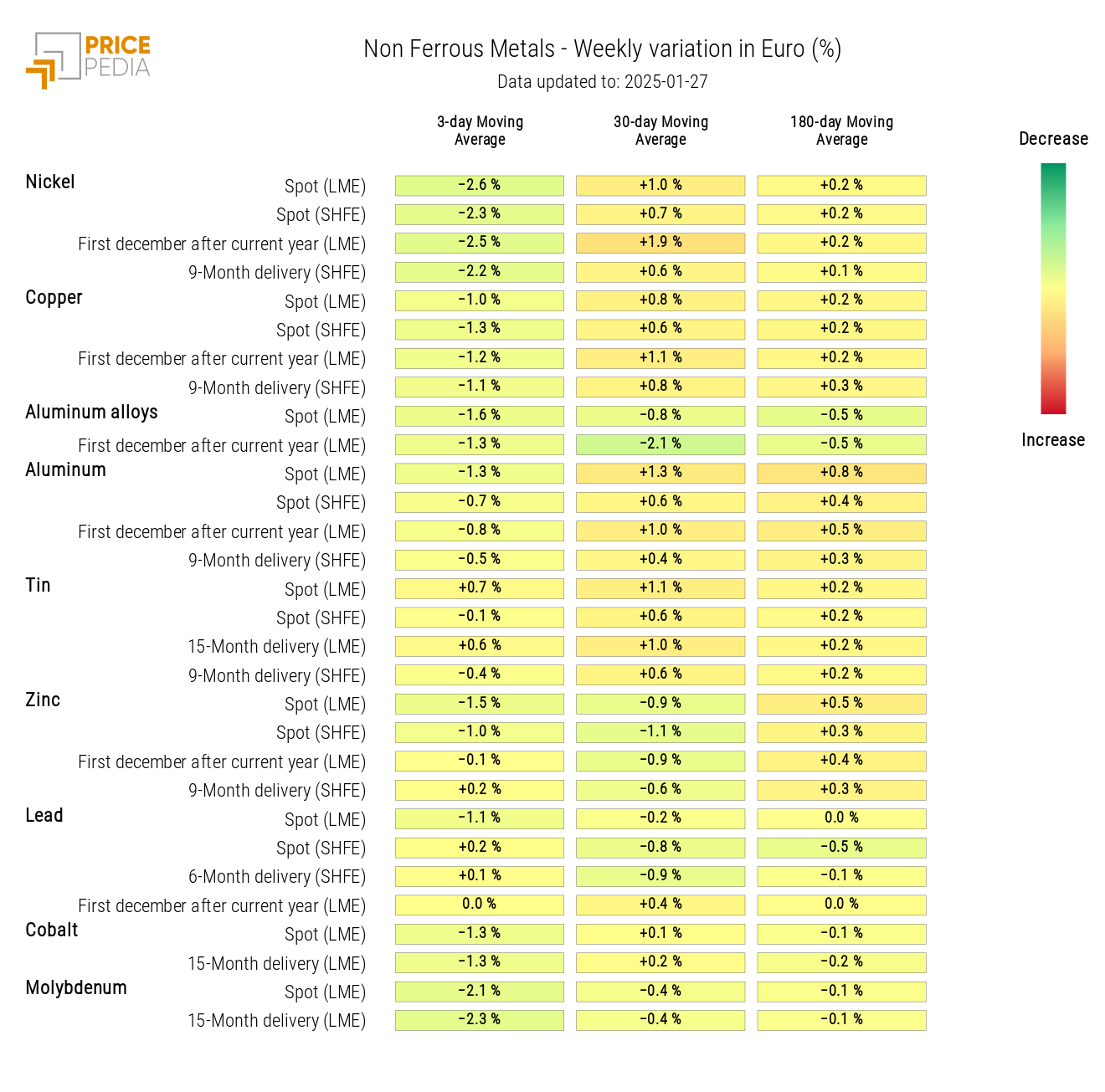

The non-ferrous heatmap shows a decline, especially in nickel and molybdenum prices.

HeatMap of Non-Ferrous Metal Prices in Euros

FOODSTUFFS

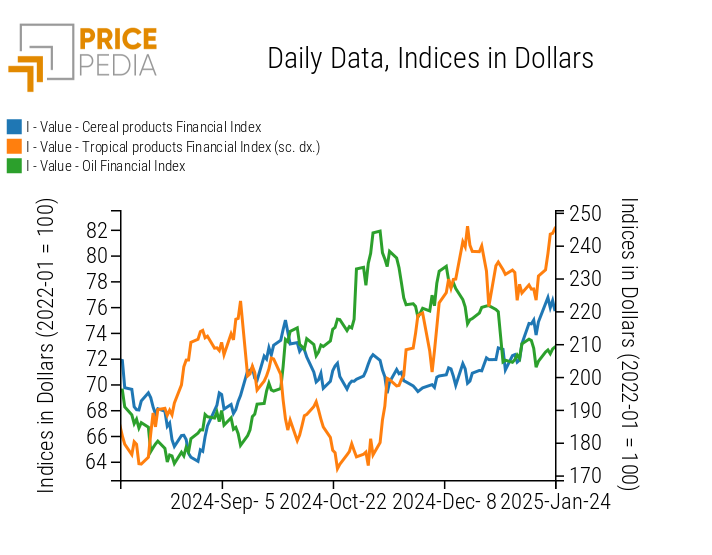

The index for tropical foodstuffs shows a price increase, while the indices for cereals and edible oils fluctuate, maintaining an average constant level.

PricePedia Financial Indices of Food Prices in USD

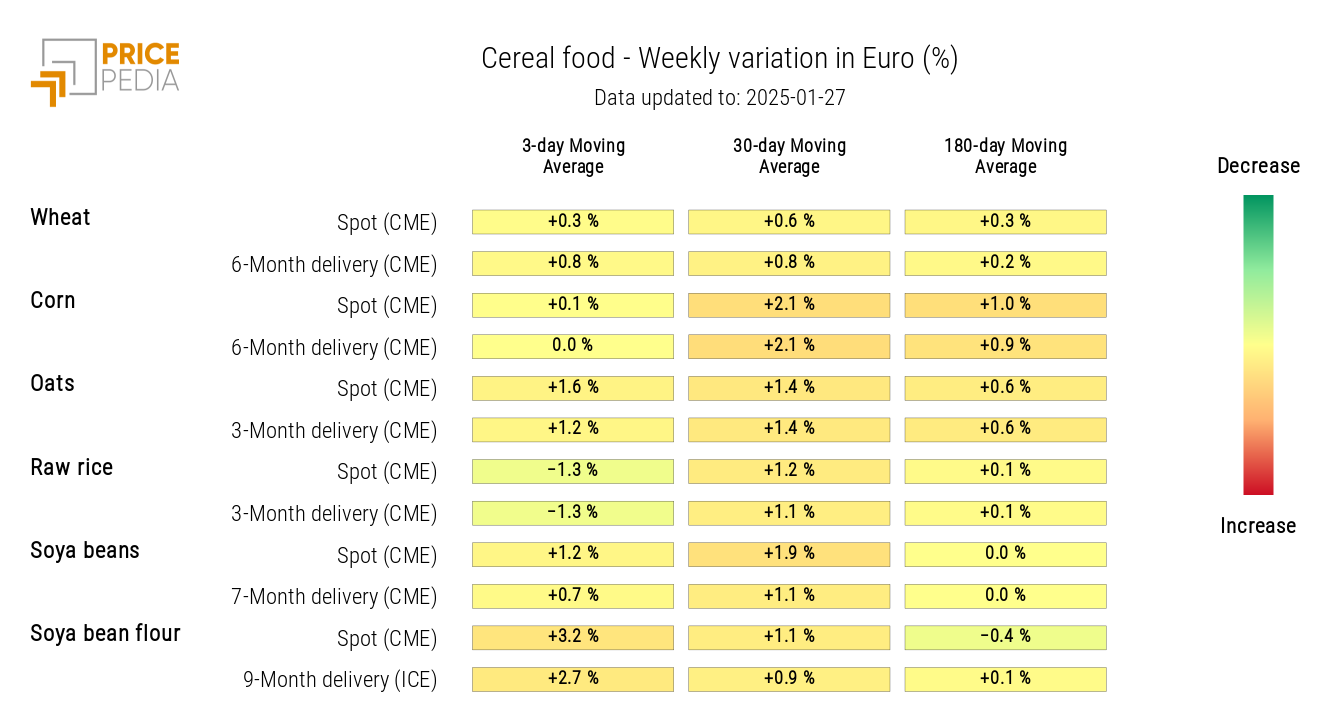

CEREALS

The cereal heatmap shows a slight increase in soy bean flour and oats prices, along with a slight reduction in rice prices.

HeatMap of Cereal Prices in Euros

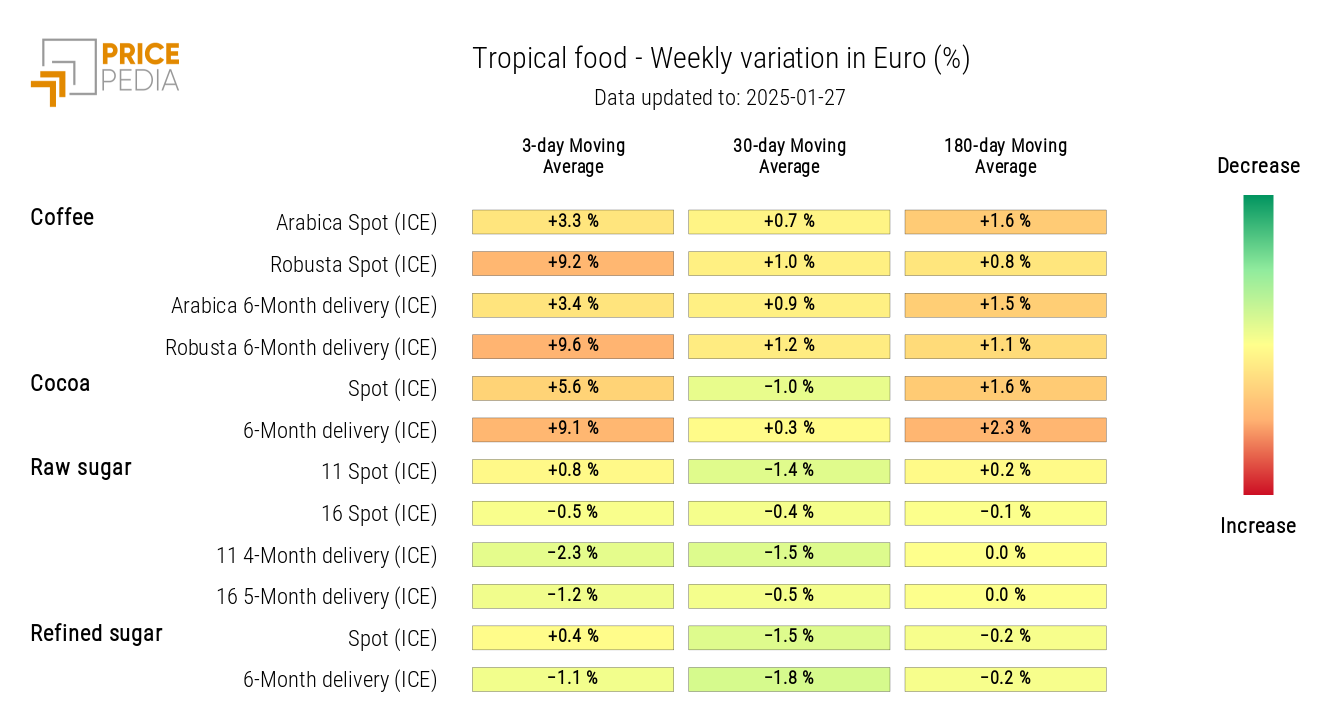

TROPICAL FOODS

The tropical food heatmap shows a strong increase in cocoa and coffee prices.

HeatMap of Tropical Food Prices in Euros

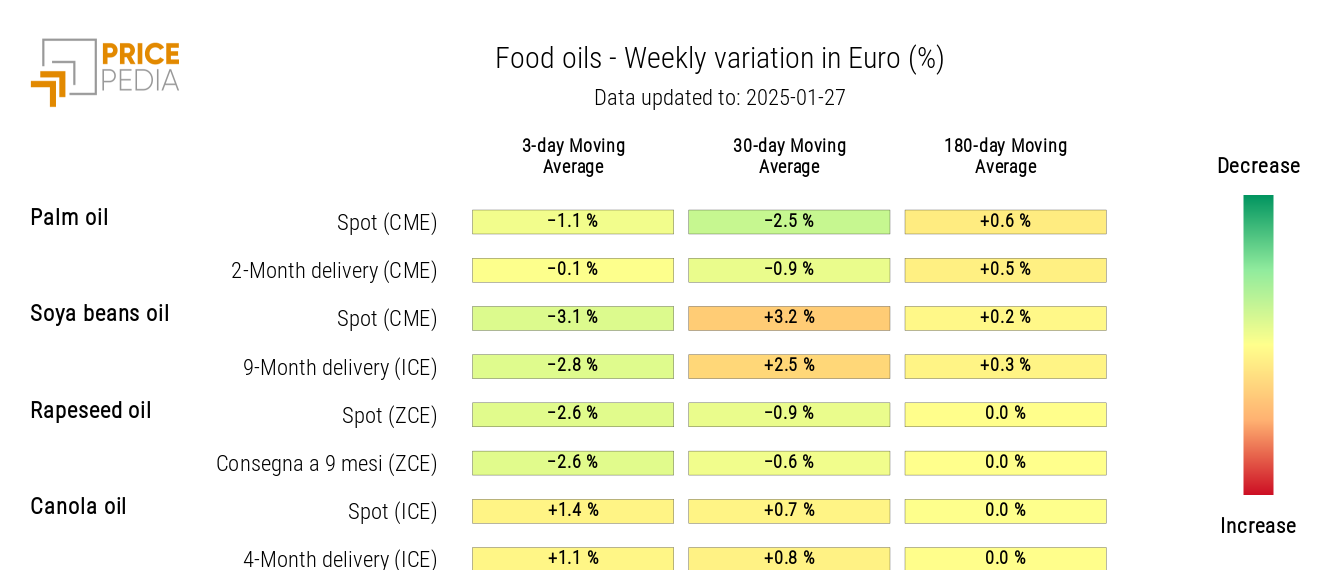

OILS

The oil heatmap shows a reduction in soybean and rapeseed oil prices.

HeatMap of Edible Oil Prices in Euros