Dextrin and maltodextrin: econometric analysis of European prices

Dextrin and maltodextrin prices are more sensitive to changes in labor and service costs than to changes in production inputs

Published by Luca Sazzini. .

Food Price DriversDextrin and maltodextrin are two carbohydrates derived from starch hydrolysis. Industrially, they are mainly used in the food sector as thickening agents or sweeteners.

Other relevant uses are in the pharmaceutical industry, where they are used as binders, and in the cosmetics industry, in products such as creams and lotions for skin care.

The main difference between the two carbohydrates is their molecular structure: maltodextrin is a more complex carbohydrate, with longer glucose chains, which reduce its solubility in water compared to dextrin. Furthermore, maltodextrin is mainly used as a sweetener in energy drinks and sports supplements, while dextrin is more commonly used as a thickener to improve the consistency of food products.

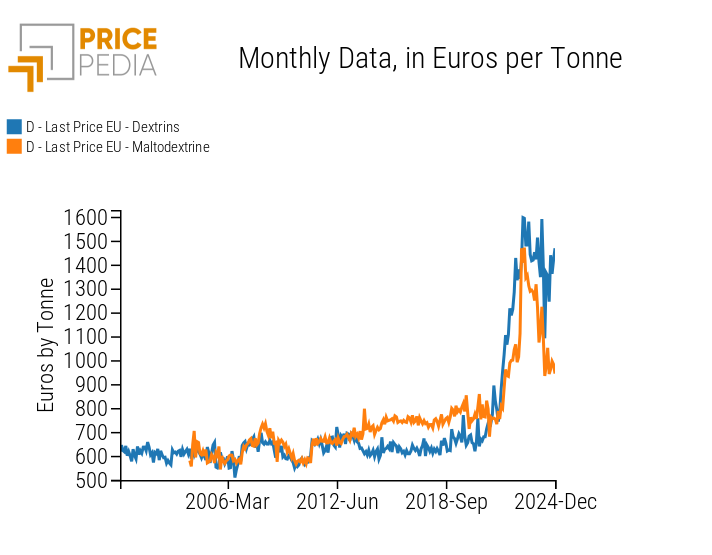

The following chart shows the price trends of dextrin and maltodextrin observed from European Union customs flows.

European customs prices of dextrin and maltodextrin, expressed in euros/ton

From the chart analysis, the viscosity[1] of the prices of dextrin and maltodextrin is evident. Both products have experienced significant price increases since the end of 2021, and despite a subsequent phase of reduction, prices have stabilized at levels significantly higher than those pre-COVID. This viscosity can be attributed to several factors that have contributed to increased production costs in recent years.

In this article, we will analyze the impact of production cost variations on the final price of dextrin and maltodextrin using a statistical regression approach.

Regression Model

In this analysis, the models used to estimate the price trends of dextrin and maltodextrin are both based solely on their respective production costs.

The first determinant chosen in the model is corn starch. This type of starch is the most commonly used for the production of dextrin and maltodextrin. Corn starch is relatively inexpensive and, most importantly, its chemical composition favors its solubility in water and greater ease of modification compared to other types of starch.

In the maltodextrin model, the price of potato starch has also been included as an additional production input.

Both models include the Euro Area Consumer Price Index as an explanatory variable. Adding this variable allows for the inclusion of labor and service costs involved in the production process, assuming that wages and services are both indexed to inflation trends.

Additionally, to capture periods characterized by prices significantly above the average, time dummies were introduced in both regression models.

To estimate the price elasticities relative to production costs, a logarithmic transformation was applied to all variables. This approach allows the estimated coefficients to be interpreted as the percentage change in dextrin and maltodextrin prices in response to a percentage change in the considered determinants.

The econometric model chosen to estimate the prices of dextrin and maltodextrin is the Engle and Granger model, which allows for the estimation of the dynamic specification in two distinct phases.

In the first phase, an OLS regression is performed to identify the structural relationship between the variables in the long run. Subsequently, an error correction model is applied to estimate the short-term adjustment processes toward the "theoretical" long-term values.

Dextrin Regression

The following tables present the long- and short-term estimation results of the dextrin econometric model.

Long-term estimation results of dextrin prices

| Variable | Coef | P-value | Lim inf | Lim sup | ||

|---|---|---|---|---|---|---|

| Intercept | 2.164 | 0.000 | 1.800 | 2.527 | ||

| Corn starch | 0.190 | 0.000 | 0.130 | 0.251 | ||

| Euro Area Consumer Price Index | 0.265 | 0.000 | 0.174 | 0.356 | ||

| Time dummy December 2021 - December 2024 | 0.566 | 0.000 | 0.527 | 0.605 | ||

| Adjusted R²: 0.929 | ||||||

Short-term estimation results of dextrin prices

| Variable | Coef | P-value | Lim inf | Lim sup | ||

|---|---|---|---|---|---|---|

| Intercept | 0.002 | 0.517 | -0.004 | 0.008 | ||

| Shock | 0.308 | 0.001 | 0.135 | 0.481 | ||

| Adjustment speed | -0.341 | 0.000 | -0.426 | -0.255 | ||

| Adjusted R²: 0.175 | ||||||

All coefficients are consistent with theoretical expectations and are statistically significantly different from zero.

The highest estimated parameter is the time dummy, which confirms the presence of market shocks that have caused a significant price increase in dextrin in recent years.

The coefficient for the consumer price index (0.27) is higher than that of corn starch, indicating that, ceteris paribus, variations in labor and service costs have a greater impact on dextrin prices than those of corn starch.

The corn starch coefficient is 0.19, implying that, ceteris paribus, a doubling of production input prices leads, on average, to a 19% increase in dextrin prices.

The short-term results show that 31% of the total variation in the determinants is immediately passed on to dextrin prices.

The adjustment coefficient is -0.34, signaling an adjustment speed of 34% of the previous period’s difference between the "theoretical" price and the actual price.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Regression of Maltodextrin

The following tables present the long-term and short-term estimation results of the econometric model for maltodextrin.

Long-term Estimation Results for Maltodextrin Prices

| Variable | Coef | P-value | Lim inf | Lim sup | ||

|---|---|---|---|---|---|---|

| Intercept | -0.757 | 0.003 | -1.256 | -0.259 | ||

| Corn Starch | 0.119 | 0.000 | 0.067 | 0.172 | ||

| Potato Starch | 0.130 | 0.000 | 0.069 | 0.191 | ||

| Euro Area Consumer Price Index | 0.905 | 0.000 | 0.749 | 1.061 | ||

| Time Dummy January 2023 - March 2024 | 0.240 | 0.000 | 0.199 | 0.282 | ||

| Corrected R²: 0.907 | ||||||

Short-term Estimation Results for Maltodextrin Prices

| Variable | Coef | P-value | Lim inf | Lim sup | ||

|---|---|---|---|---|---|---|

| Intercept | 0.000 | 0.972 | -0.006 | 0.006 | ||

| Shock | 0.845 | 0.000 | 0.617 | 1.073 | ||

| Adjustment Speed | -0.331 | 0.000 | -0.426 | -0.237 | ||

| Corrected R²: 0.257 | ||||||

The long-term estimation results show that the price of maltodextrin is highly sensitive to changes in labor and service costs, with an estimated elasticity of 0.85.

The sum of the estimated coefficients for the production inputs is 0.25, meaning that, ceteris paribus, a 10% increase in the prices of production inputs results in, on average, a 2.5% increase in maltodextrin prices.

The short-term shock coefficient indicates that 84.5% of the total changes in the determinants occur immediately. The adjustment speed coefficient is estimated at -0.33, suggesting that 33% of the difference relative to the long-term equilibrium will be corrected in each period.

Conclusions

The regression results show that the prices of dextrin, and particularly maltodextrin, are more sensitive to changes in labor and service costs than to those of production inputs. Analyzing the long-term coefficient parameters, we find that a doubling of production input prices leads to, on average, a 19% and 25% increase in dextrin and maltodextrin prices, respectively.

In both models, the considered time dummies were statistically significant and had relatively high estimated coefficients (especially for dextrin), confirming that there were market shocks during the considered periods that significantly raised price levels compared to other periods.

The short-term shock coefficient was significantly higher for maltodextrin (0.85) than for dextrin (0.31), indicating a much more pronounced immediate correction in the first case.

Both long-term models have corrected R² values above 0.9 out of a maximum of 1, indicating that the long-term models capture more than 90% of the overall price variability for dextrin and maltodextrin.

[1] For more on sticky prices, refer to the article: ”Sticky Prices and Future Risks”.