Determinants of European gas price at 50 euros/MWh

Analysis of these determinants can help us predict possible developments in 2025

Published by Luigi Bidoia. .

Natural Gas Price DriversIntroduction – Why Has the Price of Gas Returned to €50/MWh?

Since March 2024, gas prices have entered a prolonged phase of growth, culminating in late January 2025 when the Dutch TTF trading point surpassed the €50/MWh threshold. To better understand the key drivers behind this trend and assess potential future developments, it is useful to break this period into two distinct phases.

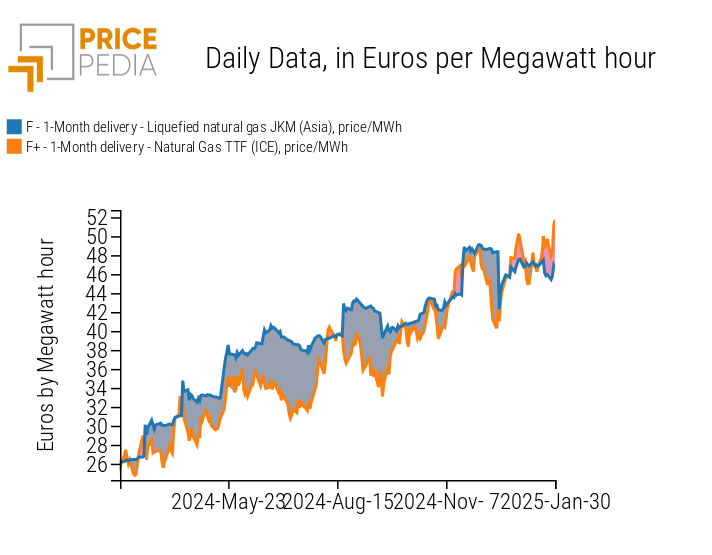

The first phase, from March to December 2024, was driven primarily by global liquefied natural gas (LNG) prices, which significantly influenced the price of gas distributed across the European network. In the second phase, which began at the end of 2024, the dynamic reversed: the price of gas traded at the TTF started to support global LNG prices. This shift becomes evident when comparing TTF gas prices with those of LNG imported by Japan and South Korea (JKM index), as illustrated in the following chart.

Comparison of TTF price of European gas and JKM price of LNG

In the chart, the price difference is shaded in gray when the JKM LNG price exceeds the TTF gas price. During these periods, the LNG market played a key role in sustaining European gas prices. Conversely, pink-shaded areas indicate moments when the TTF price exceeded the JKM price, signaling Europe as the region with the highest supply tensions. The first signs of this inversion appeared in November 2024, before becoming more pronounced and persistent in January 2025.

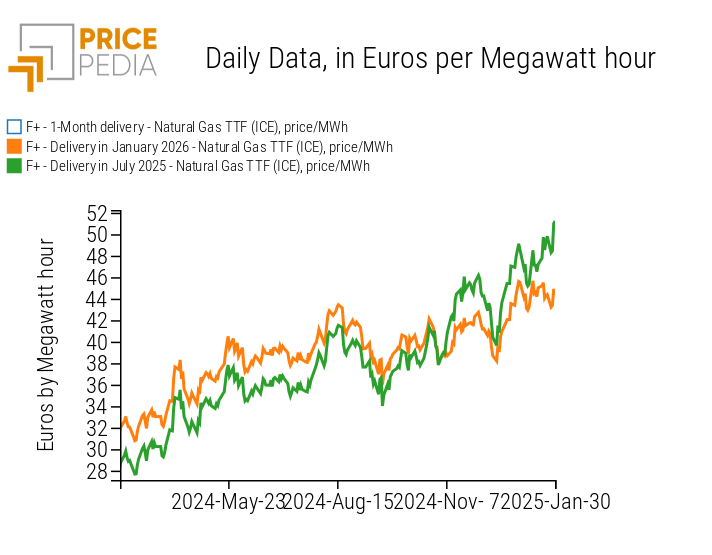

This distinction between the two phases is also clearly reflected in the trends of TTF futures contracts for July 2025 and January 2026. Historically, in the European gas market, summer contracts have been priced lower than winter contracts to encourage stock replenishment during the warmer months in preparation for higher winter consumption.

However, as shown in the next chart, until early November 2024, the price of gas for July 2025 delivery was lower than that for January 2026 delivery, in line with traditional seasonality. Subsequently, the two curves reversed: the price of summer deliveries started exceeding that of winter deliveries, indicating increasing short-term supply stress.

Comparison of TTF gas future prices for expiration in July 2025 and January 2026

This price inversion raises a energy security concern for the winter of 2025-2026. The loss of the traditional economic incentive to accumulate reserves during the summer could jeopardize market preparedness for colder months, increasing the risk of shortages and price volatility in the coming months.

Two Phases of Price Increases in 2024-2025

To better understand the evolution of gas prices, it is useful to analyze the key factors that characterized the two phases of price increases observed in 2024 and early 2025.[1]

Phase 1: European Gas Prices Driven by Rising Global LNG Prices

During the first period, the JKM LNG price was supported by rising demand in Asia, particularly due to efforts to transition away from coal in thermal power generation. This dynamic made Asia a more competitive market for LNG supplies, leading to a global price increase. As a result, European gas prices at the TTF followed the trend of global LNG markets, with price growth primarily driven by competition for supply.

Phase 2: Declining European Gas Storage Levels Push Prices Higher

In the more recent phase, the relationship between the European and global markets reversed: the TTF gas price began to support the JKM LNG price. This shift was driven by several factors that increased pressure on gas availability in Europe:

- Closure of the Ukrainian gas pipeline – As of January 1, 2025, the transit of Russian gas through Ukraine to Central Europe was halted, reducing a historically significant supply source.

- Increased gas consumption for heating and thermal power generation – The strong rise in demand for domestic heating, due to colder-than-expected temperatures, along with higher electricity generation from thermal power plants, intensified market pressure.

- Faster-than-expected depletion of winter gas storage – European gas reserves were depleted more quickly than anticipated, fueling concerns about supply security and driving prices higher.

These factors have contributed to making Europe an increasingly attractive market for LNG supplies, directly influencing global price trends.

Increase in Gas Consumption in Europe

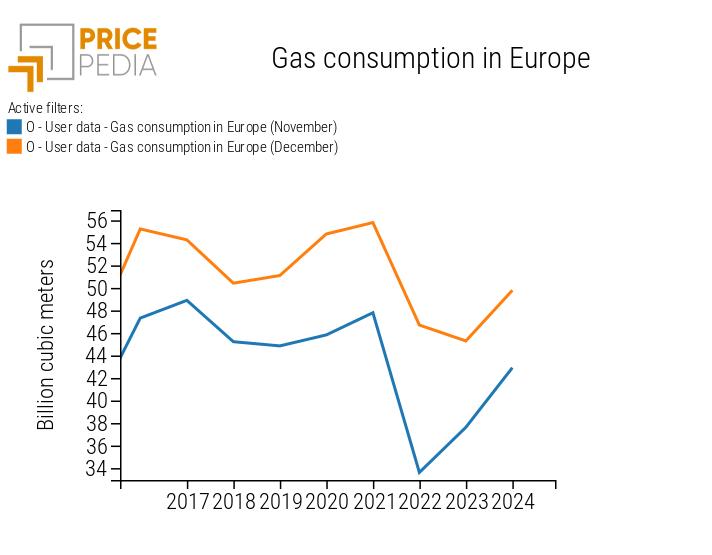

The winter season in Europe began with relatively low gas consumption levels when compared to a sufficiently long historical period. However, demand has risen significantly compared to the start of last winter.

The following chart illustrates gas consumption trends in Europe, highlighting data for the months of November (blue line) and December (orange line) across different years.[2]

Analysis of EU gas consumption in November and December of various years

The chart clearly shows that in 2024, gas consumption recorded a sharp increase compared to 2023, both in November and December. This growth was primarily driven by higher demand for heating and thermal power generation.

However, when comparing November and December 2024 consumption levels with those recorded in the same months before 2022, it becomes evident that recent consumption remains lower than during the 2016-2021 period.

This analysis suggests that while the increase in winter demand has created greater market pressure than in the 2022-2023 period, overall consumption levels still cannot be considered high in absolute terms.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Gas Storage in Europe: Critical Levels or Under Control?

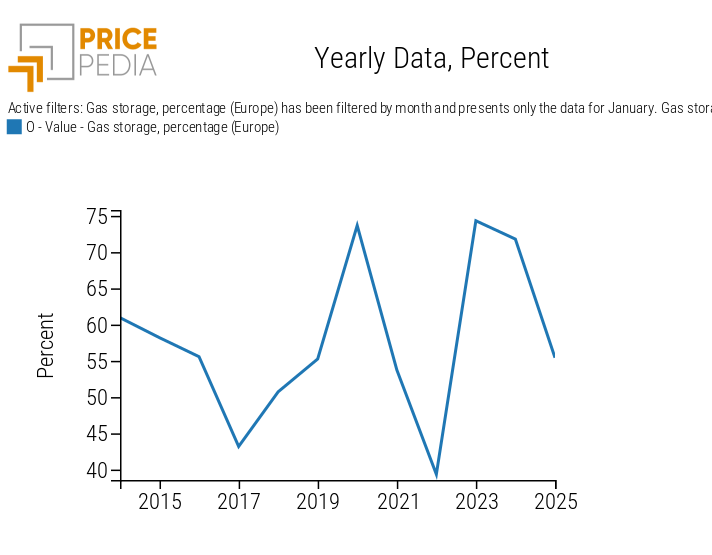

The increase in gas consumption during the winter months has led to a faster-than-expected depletion of storage levels, prompting some market operators to warn about a possible shortage before the end of the winter season.

The following chart illustrates the percentage of gas storage capacity filled in Europe on January 27 for different years.[2] This comparison allows for an immediate assessment of the current situation relative to previous years.

Analysis of gas stocks in Europe on January 27 of multiple years.

As of January 27, 2025, European gas storage levels were at 55.4% capacity, significantly lower than the 71.4% recorded on the same date in 2024. This highlights a stark contrast between the current situation and the storage levels observed in early 2024 and 2023.

However, when considering a longer historical period, the chart indicates that the 2025 situation is not entirely unusual. Over the past ten years, the average storage level on January 27 has been 57.7%, only slightly higher than the current fill rate.

Therefore, while the decline in storage levels in 2025 is more pronounced compared to the last two years, the current level remains within historical norms. This suggests that while the situation requires close monitoring, it cannot yet be classified as critical.

Conclusion – What to Expect in 2025?

Throughout 2024, European gas prices experienced a prolonged phase of growth, rising from €23/MWh at the end of February to surpass €50/MWh in the early days of 2025. Initially, this increase was driven by the rising global price of liquefied natural gas (LNG), but more recently, the European market has taken the lead in price formation.

The financial price of gas traded at the Dutch TTF has been influenced primarily by two key factors: higher-than-expected gas demand and a faster-than-anticipated depletion of winter storage levels. Additionally, a significant role has been played by the speed at which financial market participants react to short-term market data, often driving price fluctuations based on immediate sentiment rather than long-term structural analysis.

However, a longer-term analysis suggests that, as of early 2025, both gas consumption and storage levels remain within the normal historical range for the European market. This indicates that any price premium on European gas over global LNG prices is likely to be a short-term phenomenon, primarily driven by traders' reactions to news regarding supply, demand, and storage conditions specific to Europe. Over the medium to long term, European gas prices appear increasingly anchored to global LNG market dynamics.

Following the initial impact of the strong growth in European gas demand in recent years, the global LNG market is still undergoing a supply adjustment process, which is nearing its final stages. The stabilizing effects on prices are expected to begin materializing in the near term, reducing the likelihood of prolonged market tensions. Consequently, while short-term volatility remains possible, it is less likely that sustained periods with LNG prices – and, consequently, European gas prices – above €50/MWh will occur throughout 2025.

[1] For a broader analysis of all the factors influencing gas prices globally and across different geographical areas, see the article Determinants of Gas Prices

[2] This chart was created using a new feature in PricePedia that allows filtering historical series data by months across different years or for a specific day.