Trump vs. the Rest of the World: technology and trade challenge intensifies

Commodity markets facing the economic transformation desired by the Trump administration

Published by Luca Sazzini. .

Conjunctural Indicators Commodities Financial WeekThis week started with a sharp drop in U.S. stock markets, triggered by DeepSeek's new artificial intelligence model, which surprisingly outperformed well-established models like ChatGPT, despite the latter having significantly larger budgets and training times. The news has raised concerns among investors about the real competitiveness of U.S. technology companies in the artificial intelligence sector.

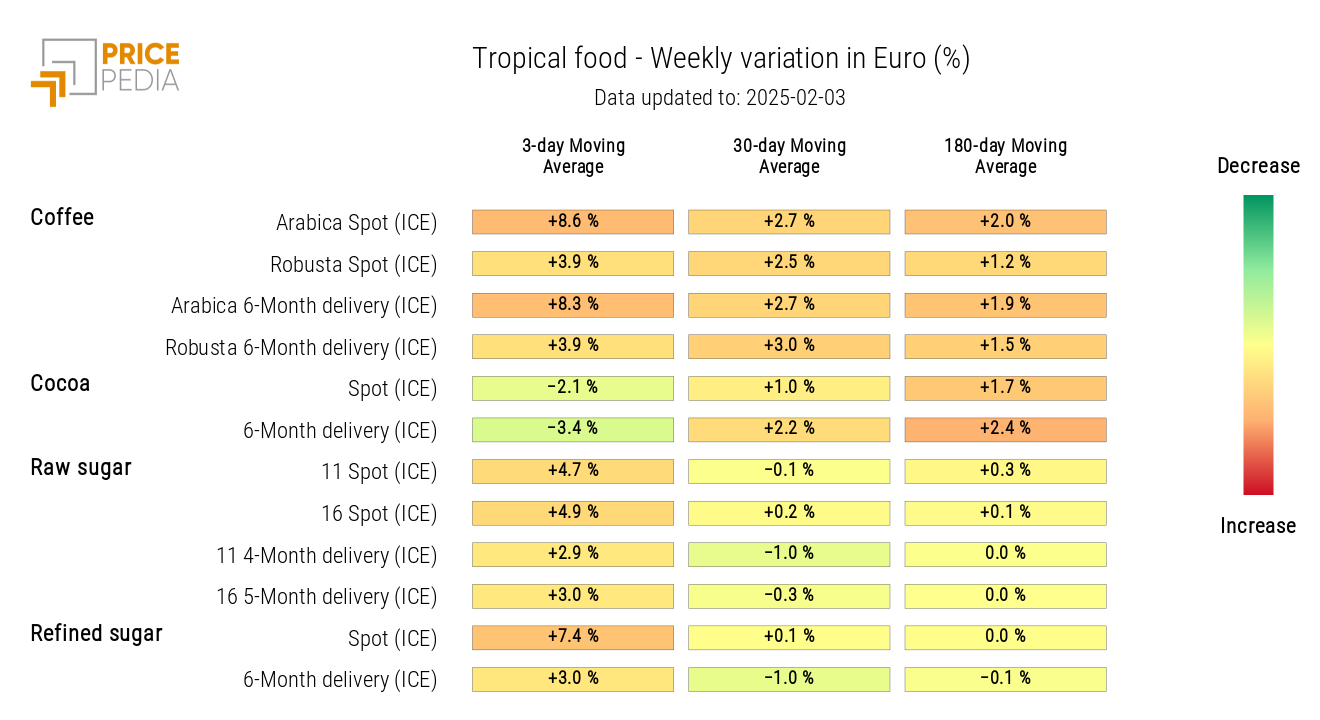

In the following chart, the trend of the NASDAQ Composite Index, the main benchmark for the technology sector in the United States, is shown.

Historical Series of the NASDAQ Composite Index USA

The analysis of the chart shows that, on Monday, the index of U.S. technology companies experienced a -3% decline.

China has proven to be a formidable competitor in technological innovation, and this week, Alibaba announced that its new artificial intelligence model could even surpass DeepSeek's performance, further fueling investor concerns.

Weekly Summary of Financial Commodity Prices

The innovation introduced by DeepSeek's new artificial intelligence model has impacted not only the U.S. stock market but also the prices of some commodities, such as oil and natural gas in the U.S. market. The improvement in energy efficiency could significantly reduce consumption in data centers, thereby influencing future forecasts for oil and natural gas demand. All of this contributed to a decline in energy prices, further accentuated by the strengthening of the dollar this week.

An exception is the price of European natural gas, which recorded increases due to the harsh climate and the slowdown in imports from Norway, accelerating storage depletion.

Another factor contributing to the decline in crude oil prices was the suspension of tariffs imposed by the Trump administration on Colombia after the latter agreed to repatriate expelled migrants. This news reduced concerns about potential disruptions in oil supplies from Colombia to the United States, thus contributing to the price decline.

The industrial metals sector declined following negative Chinese composite PMI data, raising doubts about the effectiveness of the stimulus measures adopted by the Beijing government. Concerns about Chinese demand contributed to the drop in ferrous and non-ferrous metal prices on Monday. These metals later partially recovered after Europe announced the introduction of tariffs on imports of primary aluminum from Russia.

In the food market, price increases were observed, mainly influenced by adverse weather conditions in Brazil.

Monetary Policy

FED

During the January 28-29 meeting, the Federal Reserve (FED) opted to keep interest rates unchanged on fed funds at 4.25-4.5%.

The FOMC's decision was unanimous and consistent with market and analyst expectations.[1]

The U.S. inflation rate remains too high, as confirmed by Friday's PCE data, which showed a price increase from 2.4% to 2.6% y/y in December. With inflation still far from the FED's target (2%) and a resilient economy, there is no urgency for further rate cuts.

Powell reiterated that the Federal Reserve will not follow a predefined path and that each decision will be data-driven, meeting by meeting. The FED is therefore waiting for further progress on the inflation front before considering a new rate cut. Thus, rates are expected to remain unchanged at the March 18-19 meeting.

The central bank president refrained from responding to recent pressures from Donald Trump, who, during the Davos Forum, urged a rate cut. President Trump's reaction, however, was immediate: he accused the Federal Reserve of doing a poor job.

BCE

The European Central Bank (ECB) cut interest rates by 25 basis points, in line with analyst and market expectations.[1]

During Thursday's press conference, President Christine Lagarde stated that domestic inflation remains high because wages and prices are still adjusting to the previous inflationary increase. This scenario aligns with analysts' forecasts, which expect inflation to return to the 2% target by the end of the year.

Lagarde also clarified that the current monetary policy remains restrictive and that the effects of previous rate hikes are still being transmitted to credit. This statement, coupled with GDP data released this week confirming eurozone stagnation with zero growth in the fourth quarter, reinforces the hypothesis of further interest rate cuts in the near future.

However, there is still no predetermined path for monetary policy, and the outcome of the next March meeting will largely depend on upcoming macroeconomic inflation data.

[1] See last week's article: "Trump's Impact on Commodity Prices"

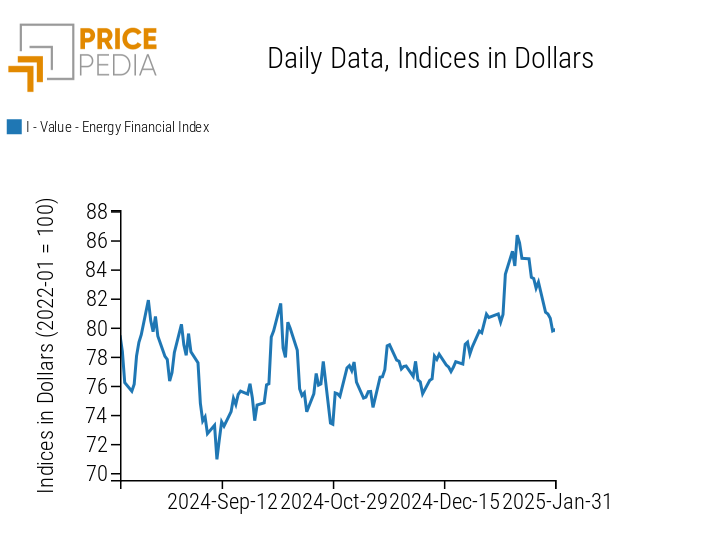

ENERGY

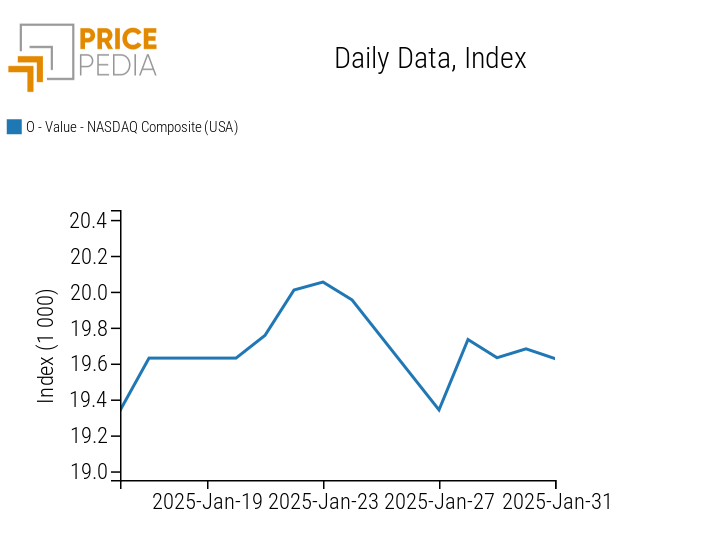

The PricePedia index of energy commodities signals a decline in energy prices in dollars.

PricePedia Financial Index of Energy Prices in dollars

The PricePedia energy heatmap highlights in green the decline in oil and Henry Hub USA natural gas prices. Among the different types of oil, the oil quoted on the Shanghai Future Exchange recorded the most significant drop. This sharp decrease results from a price level adjustment, which had reached entirely abnormal levels last week.

HeatMap of Energy Prices in Euro

PLASTIC MATERIALS

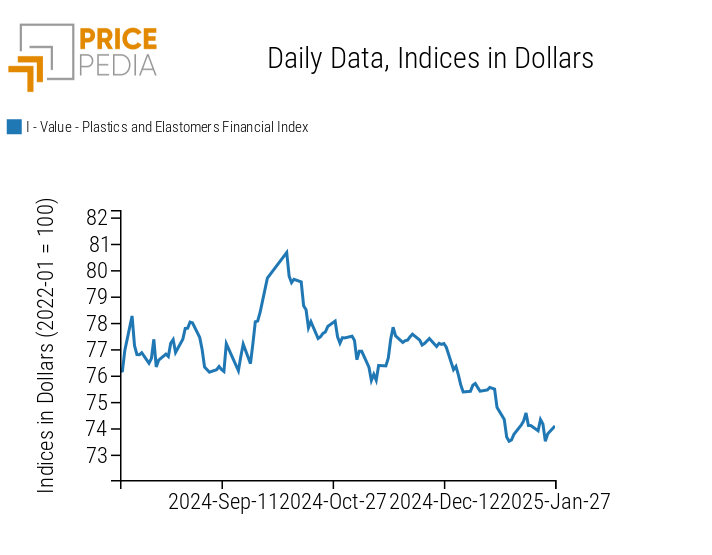

The PricePedia index of plastic materials and elastomers recorded a slight increase on Monday 27, only to stagnate in the following days due to the closure of Chinese markets for the Lunar New Year.

PricePedia Financial Indices of Plastic Material Prices in dollars

FERROUS

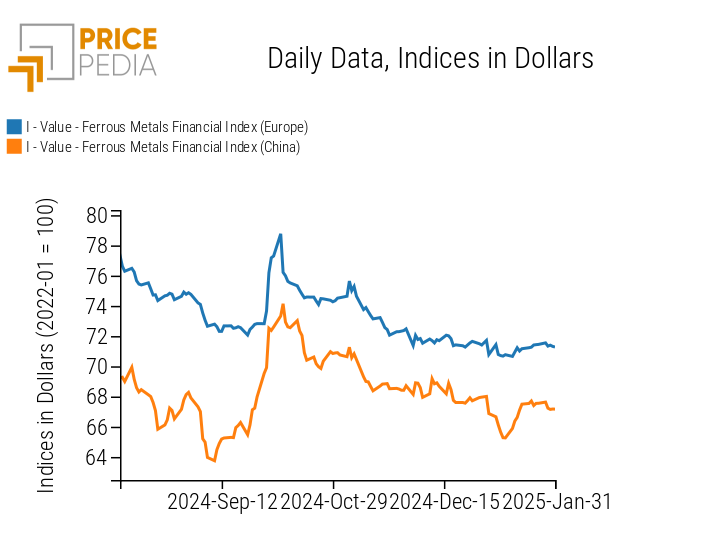

The ferrous metals index records a slight decline in prices, caused by concerns about weak Chinese demand and the steel tariffs imposed by the Trump administration.

PricePedia Financial Indices of Ferrous Metal Prices in dollars

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

NON-FERROUS INDUSTRIAL METALS

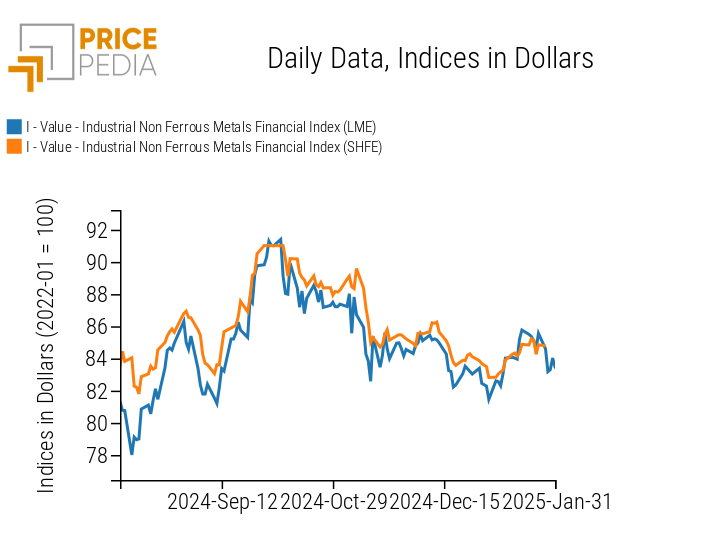

The LME non-ferrous metals index records a decline in prices at the beginning of the week, followed by a rebound after the European Union announced sanctions on primary aluminum of Russian origin.

PricePedia Financial Indices of Non-Ferrous Industrial Metal Prices in dollars

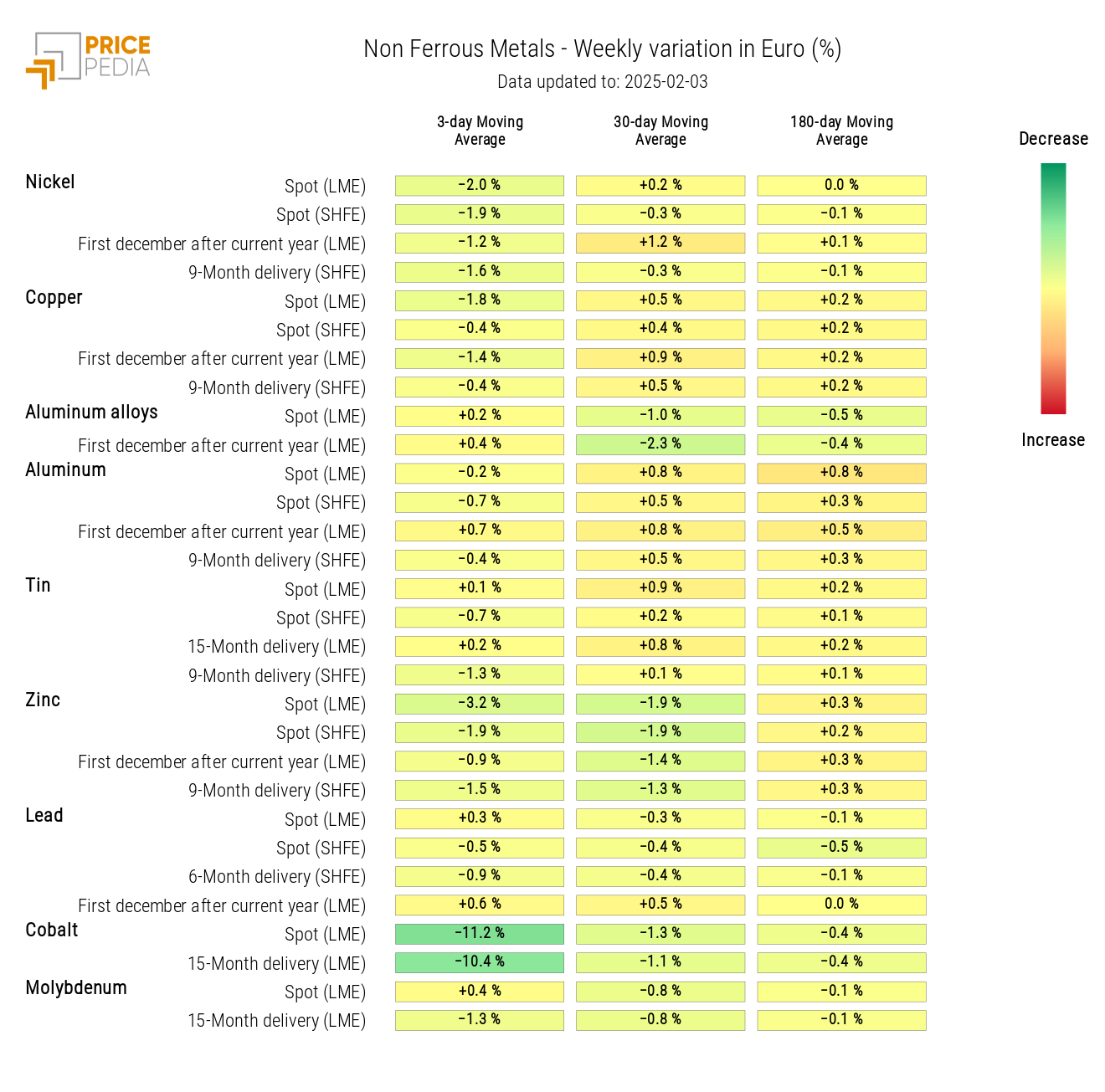

The non-ferrous heatmap reveals a sharp drop in cobalt prices and a decline in zinc and nickel prices.

HeatMap of Non-Ferrous Prices in euros

FOOD

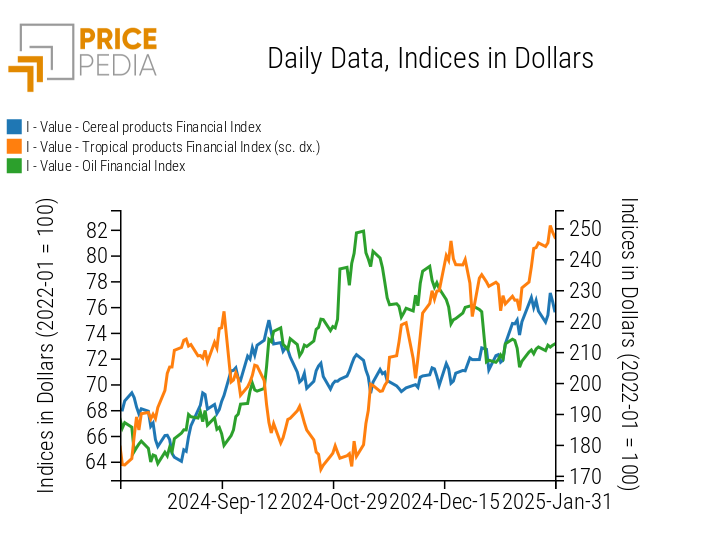

After an initial drop on Monday, the cereal and tropical indices record a price increase, followed by a decline in the last days of the week. Meanwhile, the edible oils index follows mostly sideways price dynamics, characterized by slight fluctuations.

PricePedia Financial Indices of Food Prices in dollars

CEREALS

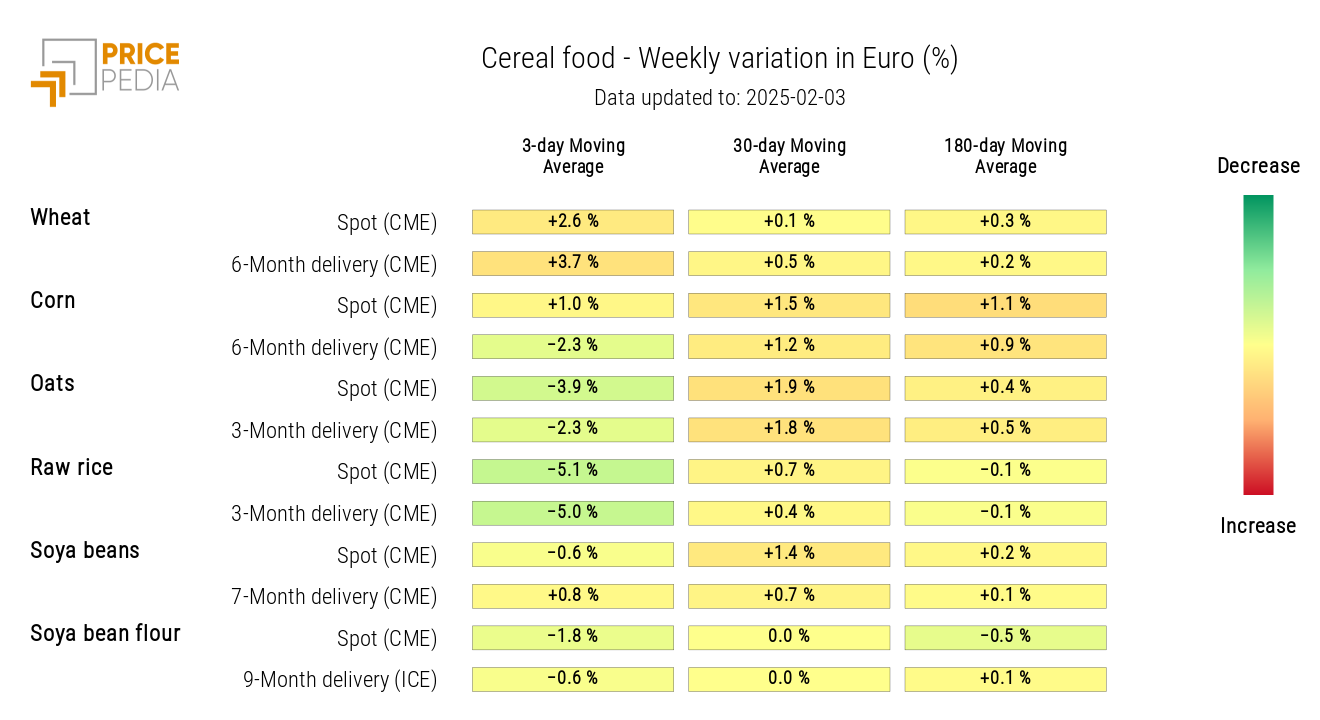

The cereal heatmap indicates a weekly drop in the three-day moving average of oat and rough rice prices, alongside a significant increase in wheat prices.

HeatMap of Cereal Prices in euros

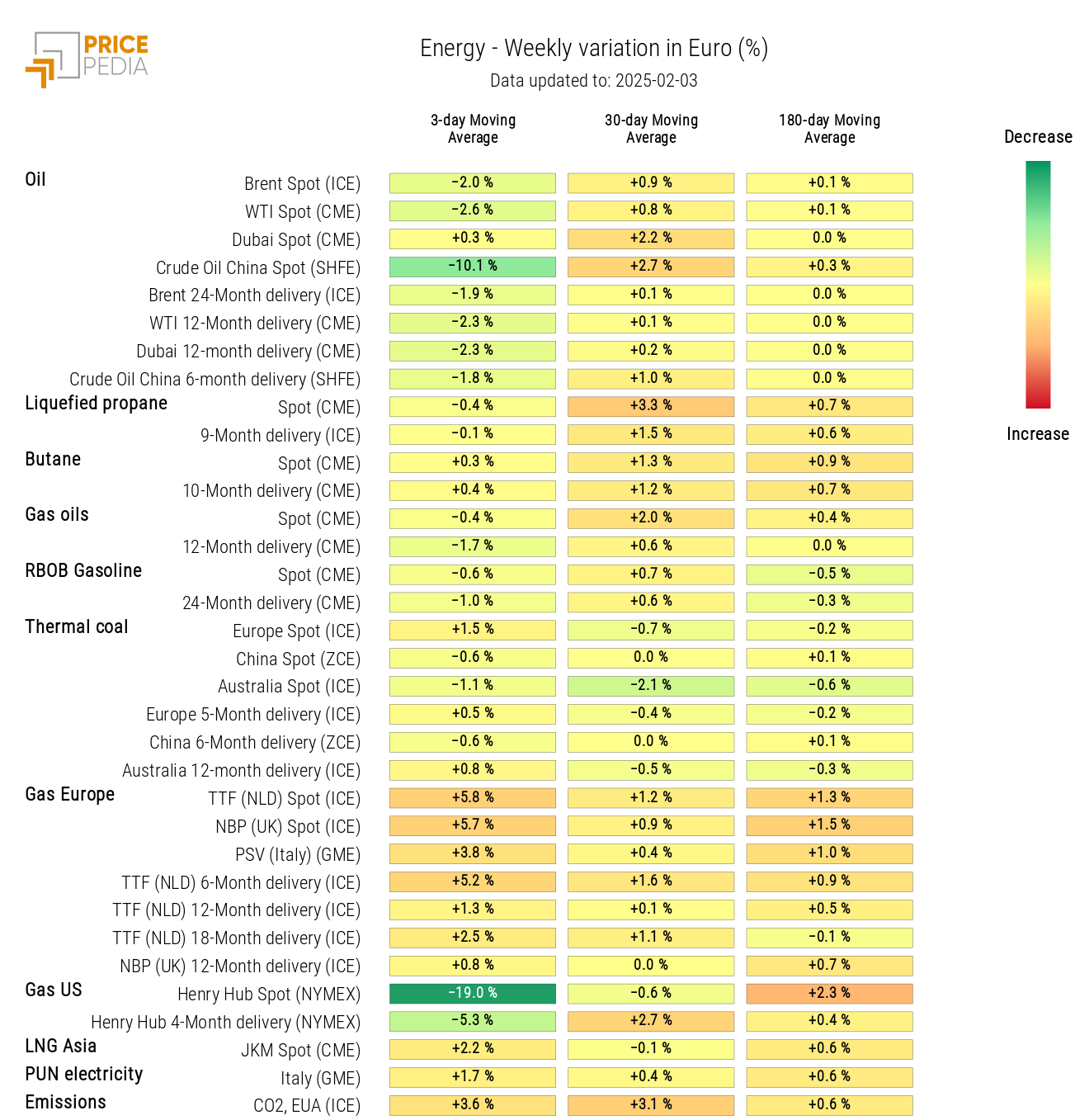

TROPICAL PRODUCTS

The tropical heatmap highlights a strong rise in coffee and sugar prices, driven by reports of adverse weather conditions in Brazil that could damage the harvest.

HeatMap of Tropical Food Prices in euros