Analysis of differences in regional lithium prices

The different concentration of supply determines the relative prices of different types of lithium derivatives

Published by Luca Sazzini. .

Non Ferrous Metals Lithium Price DriversLithium is a strategic metal essential for the energy transition, thanks to its key role in the production of rechargeable batteries for electric vehicles and energy storage systems.

In international markets, lithium is mainly traded in the form of carbonate, hydroxide, and oxide. These compounds, while distinct, can be converted into one another through specific chemical processes, allowing greater flexibility in industrial applications. This characteristic results in a high correlation between their prices, which tend to follow a common trend. Although this trend is partly driven by global factors, such as the worldwide demand for electric vehicles (EVs), the lithium market remains predominantly regional: local prices reflect the specific demand in each area and can vary significantly across different regions.

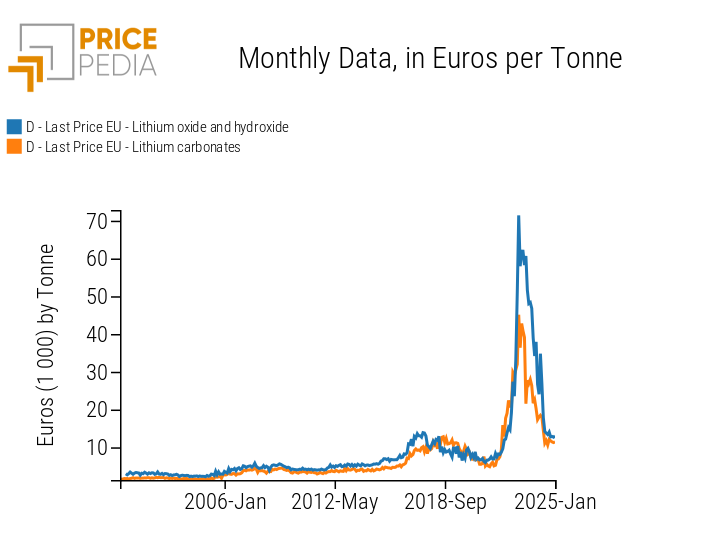

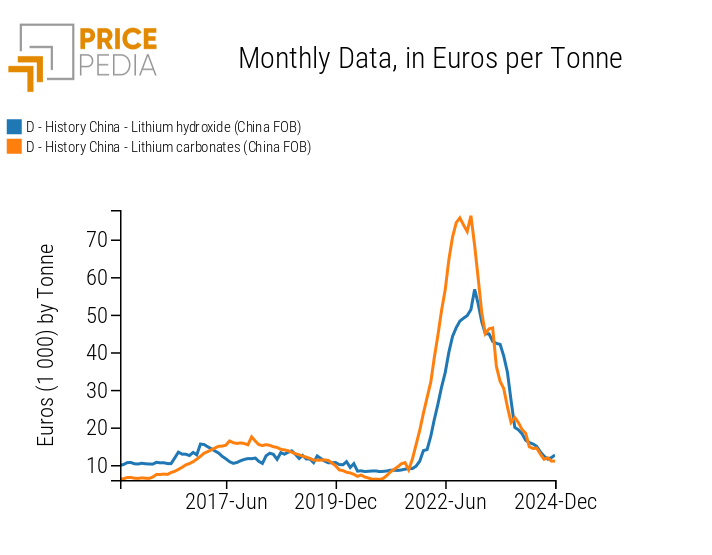

To confirm this statement, historical price series of lithium recorded at the customs of the European Union and China are presented.

| Lithium prices recorded at the customs of the European Union, expressed in euros per ton | Lithium prices recorded at Chinese customs, expressed in euros per ton |

|

|

The analysis of customs prices highlights differences in price levels and variations for different types of lithium in the two regional markets.

During the 2021-2023 price cycle, in Europe, there was a much sharper increase in prices for lithium oxide and hydroxide compared to carbonate. In January 2023, lithium oxide and hydroxide prices exceeded 70,000 euros per ton, while carbonate prices were “only” 45,000 euros per ton.

Conversely, in China, the trend was reversed: in January 2023, FOB prices for lithium carbonate exceeded 75,000 euros per ton, while hydroxide prices were around 50,000 euros per ton.

This divergence in the prices of different types of lithium between the two regional markets is attributable to differing battery demands. In China, the dominance of LFP (lithium-iron-phosphate) batteries, which primarily use lithium carbonate, has driven up its prices. In Europe, however, demand is still mainly focused on NMC (nickel-manganese-cobalt) batteries, which require lithium in the form of hydroxide, explaining the much sharper price increase in Europe compared to China.

Another factor that has amplified the differences in price growth between the two types of lithium in the two markets is the market risk associated with potential disruptions in global supply. This risk varies significantly between China and Europe and depends on the specific type of lithium.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

Supply Concentration

Lithium is a strategic commodity characterized by high market risk due to its strong geographical concentration. Global production depends on a limited number of countries that dominate the extraction and refining of the mineral.

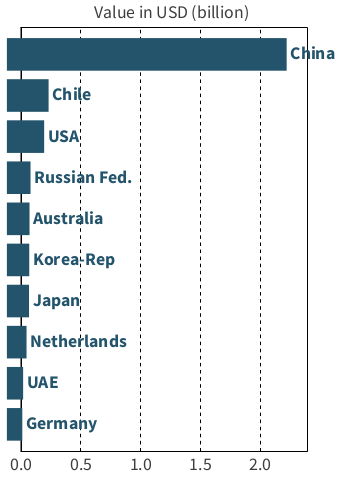

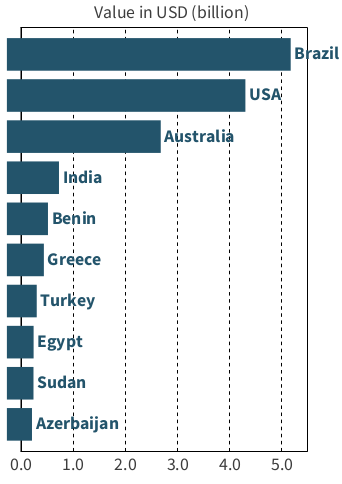

The left graph shows the main exporters of lithium oxide and hydroxide in 2024, while the right graph shows the main exporters of lithium carbonate in 2024.

| Main global exporters of lithium oxide and hydroxide in 2024 | Main global exporters of lithium carbonate in 2024 |

|

|

China is the world's largest exporter of lithium oxide and hydroxide, controlling over 70% of global exports. At the same time, it is also the main importer of lithium carbonate, importing nearly 27% of global exports. This means that in the Chinese market, the supply of lithium oxide and hydroxide is relatively less concentrated compared to lithium carbonate. Any disruptions or delays in lithium carbonate exports from countries such as Brazil, the United States, or Australia can create tensions in the Chinese market, leading to local price increases for carbonate.

In the European market, the situation is the opposite. The European Union has a higher supply concentration for lithium oxide and hydroxide than for carbonate. The lithium oxide and hydroxide market is almost entirely dependent on Chinese exports, while the carbonate market is controlled by three major exporting countries with which Europe maintains more stable trade relations than with China. In this regard, Europe is implementing various strategies to reduce its dependence on Chinese exports of lithium oxide and hydroxide.

Strategies Adopted by the European Union

To increase its supply diversification of lithium oxide and hydroxide, in 2024, the European Union signed the Advanced Framework Agreement with Chile, the world’s second-largest exporter of lithium oxide and hydroxide. This agreement will enable greater trade liberalization, reducing customs costs for several strategic sectors, including lithium.

Other strategies adopted by the EU to reduce its reliance on Chinese lithium oxide and hydroxide supplies include increasing recycling efforts and investing in alternative technologies that do not use lithium as a production input. The EU has set a goal to recover at least 50% of the lithium contained in batteries by the end of 2027.

Conclusions

This analysis has highlighted how, in the latest price cycle, the European Union has experienced much sharper increases in lithium oxide and hydroxide prices compared to carbonate. Conversely, in China, there has been a more significant rise in lithium carbonate prices. These differences reflect both the varying domestic demand for batteries and the different degrees of supply concentration in the two regions. In Europe, despite the growing adoption of LFP batteries, the demand for NMC batteries, which use lithium in the form of oxide and hydroxide, remains predominant. On the other hand, in China, the electric battery market is almost entirely dominated by LFP batteries, which rely on lithium carbonate.

China faces a higher concentration risk for lithium carbonate compared to oxides and hydroxides. In fact, China is simultaneously the largest exporter of lithium oxides and hydroxides and the biggest importer of lithium carbonate.

On the other hand, the European Union has a higher supply concentration for lithium oxides and hydroxides, as its supply depends almost entirely on China. To partially reduce this dependency, the EU has recently signed the Advanced Framework Agreement with Chile, the world's second-largest exporter of lithium oxides and hydroxides.