Differences in regional prices of coated sheets

China's leadership in the coated sheet market

Published by Luca Sazzini. .

Ferrous Metals Coated sheets Price DriversCoated sheets are semi-finished products that provide advanced solutions to enhance the performance of steel in terms of corrosion resistance, durability, and aesthetic functionality.

These coatings are mainly divided into two categories: metals and plastics.

Metal coatings are primarily used to provide greater mechanical resistance and protect the sheets from corrosion and wear.

The most commonly used metallic coating is galvanization, which can be applied through a hot-dip or electroplating process.

In hot-dip galvanization, the steel is immersed in a bath of molten zinc, creating a thicker and more adherent coating, ideal for corrosion protection.

In the electroplating process, on the other hand, electrolysis is used to apply a layer of zinc onto the sheets, creating a thinner and more uniform coating compared to hot-dip galvanization.

Another metal that can be used as a coating for sheets is chromium, which is applied through the chroming process. Compared to zinc, it offers less corrosion protection but greater physical resistance and a shinier finish.

Plastic coatings, such as PVC, PET, or polyethylene, are used for products, such as household appliances, that require protection, aesthetics, and chemical-physical resistance at the same time.

In this article, we will provide an introductory analysis of the evolution of the global coated sheet trade, followed by an examination of price differences between the regional markets of Europe, the United States, and China. The price analysis will be structured according to a commodity breakdown, identifying three main categories of coated sheets:

- in zinc;

- in chromium;

- in plastics.

Evolution of Global Trade

Except for electro-galvanized sheets, which have seen a decline in global trade in recent years, other types of coated sheets have shown growth in global trade, supported by an increase in Chinese exports. This increase has been driven by significant technological investments in the steel sector, which have boosted production capacity and the competitiveness of the Chinese industry, making it the undisputed leader in the global coated sheet market.

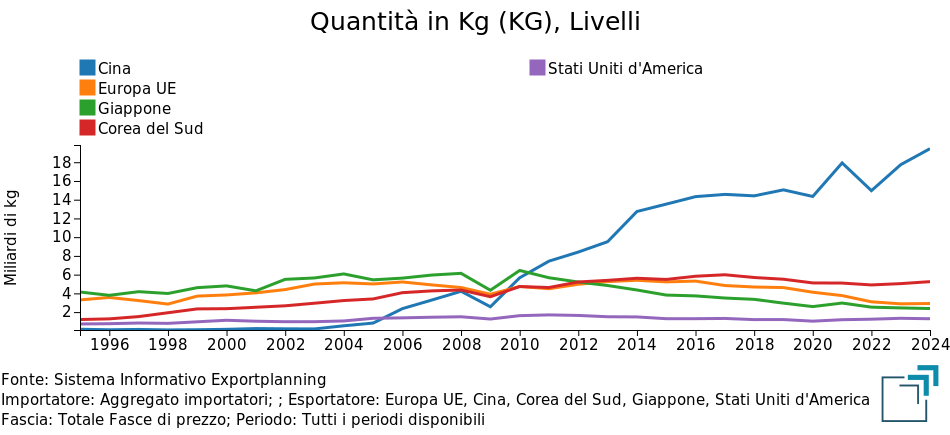

The following graph shows the overall trend of coated sheet exports from China, Europe, Japan, South Korea, and the United States.

Historical Export Series of Coated Sheets

Until the 2000s, coated sheet exports from Europe and Japan were five times higher than those of the United States and twenty times higher than those from China.

However, since 2004, Chinese coated sheet exports have experienced significant growth, surpassing other major exporters by 2011. Since then, Chinese exports have continued to rise, while those from Japan and the European Union have shown a slow decline, with South Korea surpassing both in 2015.

In the last year, Chinese exports reached about 15.5 million tons, with a share of global trade exceeding 50%.

Price Analysis by Coating Type

Zinc Coated Sheets

The table below shows the annual average prices from 2019 to 2024 for galvanized sheets: non-corrugated, electro-galvanized, and coated with aluminum-zinc alloys.

Annual Average Price Table for Zinc-Coated Sheets, in euro/ton

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|---|

| D-Last Price EU-Non-Corrugated Zinc Sheets | 675 | 627 | 950 | 1145 | 986 | 889 |

| D-Last Price EU-Electro-Galvanized Sheets | 766 | 720 | 961 | 1258 | 1042 | 994 |

| D-Last Price EU-Aluminum-Zinc Alloy Coated Sheets | 689 | 656 | 981 | 1200 | 886 | 843 |

| D-Historical USA-Non-Corrugated Zinc Sheets (thickness < 0.4 mm) (USA CIF) | 827 | 803 | 1226 | 1495 | 1147 | 1080 |

| D-Historical USA-Non-Corrugated Zinc Sheets (thickness > 0.4 mm) (USA CIF) | 859 | 759 | 1060 | 1424 | 1156 | 1091 |

| D-Historical USA-Aluminum-Zinc Alloy Coated Sheets (USA CIF) | 818 | 766 | 1107 | 1466 | 1063 | 975 |

| D-Historical China-Electro-Galvanized Sheets (China CIF) | 742 | 706 | 882 | 1159 | 1038 | 1023 |

| D-Historical China-Aluminum-Zinc Alloy Coated Sheets (China FOB) | 636 | 593 | 844 | 1013 | 741 | 640 |

From the data analysis, a certain uniformity of prices emerges between the different regional markets, with slightly higher values in the United States and generally lower values in China. The prices follow a common trend, with two significant increases in 2021 and 2022, followed by a progressive decrease in 2023-2024.

The prices of sheets coated with aluminum and zinc alloys are the lowest in each of the three regional markets, with Chinese prices being significantly lower than those in Europe and, especially, the United States. Except for the Chinese prices of sheets coated with aluminum and zinc alloys, which in 2024 stand at 640 euros/ton, other prices are relatively homogeneous, with levels close to 1000 euros/ton over the past year.

Prices for electro-galvanized sheets in China have generally been lower than European prices, except in 2024, when Chinese prices reached 1023 euros/ton, slightly surpassing Europe's 994 euros/ton.

The highest price among those analyzed so far is for galvanized sheets (non-corrugated) in the United States, which in 2024 reached levels close to 1100 euros/ton.

Chromium Coated Sheets

The table below shows the annual average prices of chromium-coated sheets, recorded at the customs of the European Union, the United States (CIF import prices), and China (FOB export prices).

Table of annual average prices of chromium-coated sheets, expressed in euros/ton

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|---|

| D-Last Price EU-Chromium coated sheets | 844 | 804 | 928 | 1562 | 1420 | 1159 |

| D-Historical USA-Chromium coated sheets (width 600-1050 mm) (USA CIF) | 1121 | 1020 | 1068 | 1830 | 1802 | 1622 |

| D-Historical USA-Chromium coated sheets (width > 1050 mm) (USA CIF) | 1121 | 1020 | 1077 | 1791 | 1696 | 1544 |

| D-Historical China-Chromium coated sheets (China FOB) | 739 | 654 | 950 | 1255 | 914 | 814 |

As in the previous case, Chinese prices are the lowest, while U.S. prices are the highest, but with a price discrepancy greater than what was observed for galvanized sheets. In the past year, U.S. prices for chromium-coated sheets with widths between 600 and 1050 mm have remained above 1600 euros/ton, double the prices of the Chinese market.

A second aspect that emerged from the analysis of this category is a higher viscosity in the price dynamics, compared to zinc-coated sheets. In 2021, the growth was generally more contained, while in 2023 there was a less pronounced decrease, with levels that deviated less from the peaks reached in 2022.

Plastic-Coated Sheets

The following table shows the annual average prices of plastic-coated sheets, recorded at the customs of the European Union, the United States (CIF import prices), and China (FOB export prices).

Table of annual average prices of plastic-coated sheets, expressed in euros/ton

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|---|

| D-Last Price EU-Plastic-coated sheets | 895 | 851 | 1185 | 1479 | 1213 | 1088 |

| D-Historical USA-Plastic-coated sheets (USA CIF) | 1407 | 1193 | 1282 | 2406 | 2091 | 1971 |

| D-Historical USA-Plastic-coated sheets (zinc-coated) (USA CIF) | 1062 | 938 | 1577 | 1917 | 1422 | 1440 |

| D-Historical USA-Plastic-coated sheets (other) (USA CIF) | 1025 | 1044 | 1482 | 2028 | 1527 | 1477 |

| Historic D-China-Plastic Coated Sheets (China FOB) | 672 | 640 | 958 | 1158 | 846 | 676 |

The analysis of the table highlights how, in this case, the price differences between the various regional markets have further widened. Over the past year, the price of plastic-coated sheets in the United States has been about three times higher than the Chinese price, which in turn is just over half of the European price.

Regarding the price dynamics, they align more closely with those of galvanized sheets, with significant increases in 2021 and 2022, followed by a notable drop starting in 2023.

Conclusions

In the analysis of coated sheet prices, three groups were identified, distinguished by the type of coating.

In each group, US prices were found to be the highest, while Chinese prices were the lowest. However, within the various types of coated sheets, the price differences vary significantly.

The prices of zinc-coated sheets show relatively homogeneous levels, with fairly contained discrepancies. In contrast, chrome-coated sheets exhibit more pronounced differences between regional markets, with US prices for sheets with a width of 600-1050 mm being, over the past two years, twice as high as Chinese prices. Finally, for plastic-coated sheets, the price differences are even more significant: Chinese prices are almost half of European prices and a third of US prices.

The strong price competitiveness of Chinese coated sheets solidifies China's leadership position in the global market. On the other hand, high prices in US imports signal generally higher domestic prices and limited competitiveness of the US steel industry.