Economic Introduction to Vegetable Fatty Acids

A key resource for many industries and for the ecological transition

Published by Luigi Bidoia. .

Fatty acids Price DriversVegetable fatty acids and their derivatives are obtained from the processing of vegetable oils such as palm, soybean, coconut, and sunflower oils. They include industrial fatty acids, distillates, salts, esters and alcohols of fatty acids and represent a key input for the chemical, food and cosmetics industries.

Commodity Classification

The family of vegetable fatty acids and their derivatives is composed of the following products:

- Natural and industrial fatty acids: obtained from the processing of vegetable oils; the industrial ones can be further refined or modified for specific applications.

- Distilled fatty acids: obtained through fractional distillation, which allows the separation of different fractions and increases their purity.

- Salts and esters of fatty acids: salts (soaps) are obtained by the reaction of a fatty acid with a strong base, while esters are produced by the reaction with an alcohol through esterification.

- Fatty acid alcohols: obtained by catalytic hydrogenation of fatty acids or their esters.

The most important vegetable fatty acids are:

- Lauric acid (C12:0): widely used in detergents, cosmetics, and the food industry. It is mainly derived from coconut oil and palm kernel oil.

- Palmitic acid (C16:0): present in vegetable oils such as palm and soybean oils, it is widely used in the food and cosmetic industries.

- Stearic acid (C18:0): used in the production of soaps, cosmetics, and pharmaceutical products, derived from vegetable fats and tall oil.

- Oleic acid (C18:1): a monounsaturated fatty acid used in food products, lubricants, and bioplastics.

This group also includes tall oil fatty acids (TOFA), a mixture of organic compounds derived from the distillation of crude tall oil, a by-product of the kraft process in pulp production.

Leading Exporters Worldwide

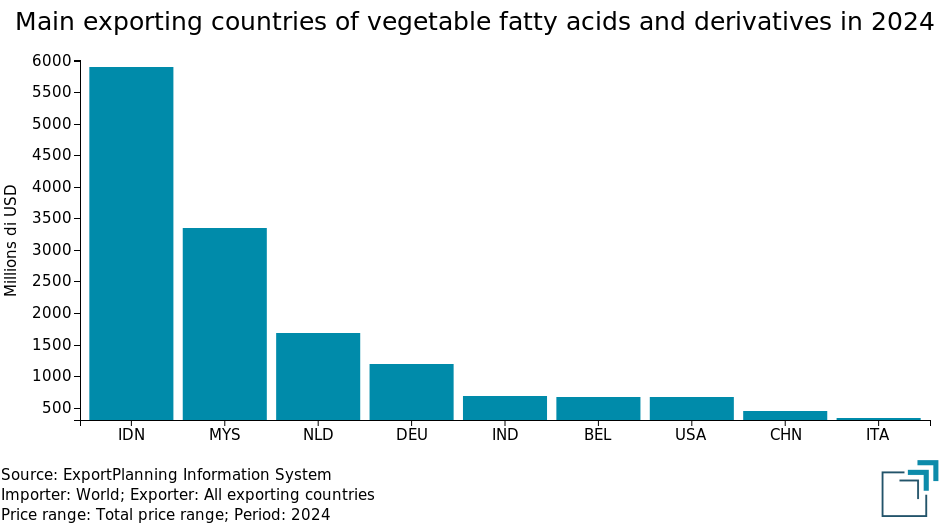

The global production of vegetable fatty acids is highly concentrated in countries with high vegetable oil production. The two largest exporters are Indonesia and Malaysia, as shown by the chart of the top ten exporting countries.

Following these two leading Asian producers are The Netherlands and Germany.

Global Market and Demand

The global market for vegetable fatty acids and their derivatives is expanding, driven by:

- Food Industry: used in margarines, hydrogenated oils, and food additives.

- Cosmetic and Detergent Industry: production of soaps, surfactants, and creams.

- Pharmaceutical Sector: formulations of excipients and drug bases.

- Production of Biofuels and Lubricants: increasing demand for sustainable alternatives to petroleum derivatives.

Price Determinants

The prices of vegetable fatty acids and their derivatives depend on:

- Availability and Prices of Raw Materials: fluctuations in agricultural markets affect production costs.

- Global Demand: the expansion of the cosmetic and food sectors influences the market.

- Environmental Regulations: increasingly stringent regulations encourage sustainable alternatives, altering the supply and demand landscape.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

EU Customs Prices

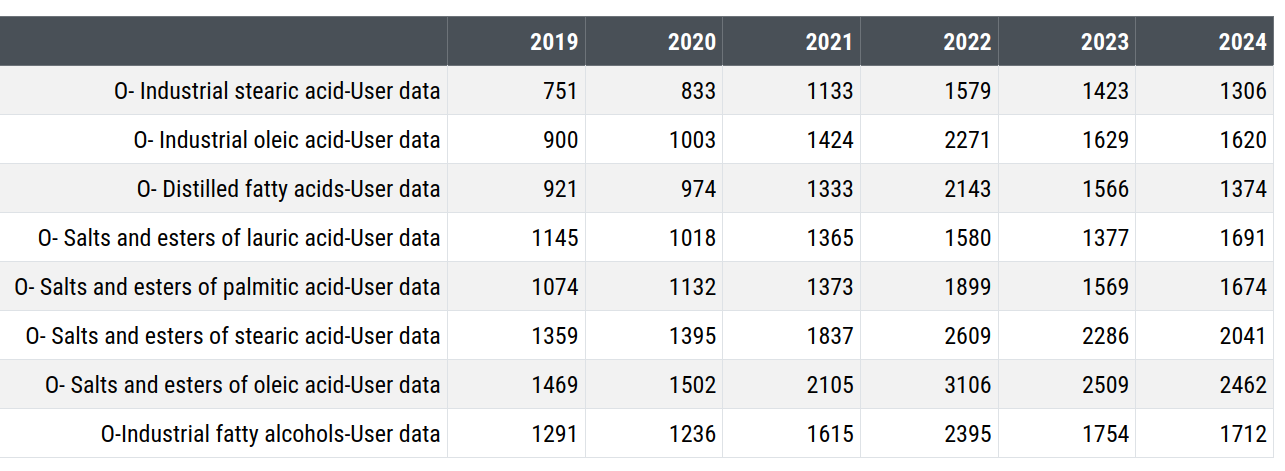

The following table shows the annual prices in euros for eight fatty acids and their derivatives from 2019 to 2024.

Prices in Euros per Ton of Vegetable Fatty Acids and Their Derivatives

The analysis of these data highlights the following facts:

- All these prices have aligned with the recent global commodity price cycle, showing strong increases between 30% and 40% in 2021, reaching an absolute peak in 2022, followed by a reduction phase during the 2023-2024 period;

- The cumulative variation of the various prices between 2019 and 2024 is significantly greater than the average prices of organic chemical products, with a maximum growth of 80% for those of industrial oleic acid. An important factor in this increase was the introduction of anti-dumping duties in 2023 on imports from Indonesia;

- Price dynamics have maintained essentially constant relationships between the different prices:

- The derivatives (salts, esters, and alcohols) generally have prices that are 50% higher than the price of the acid from which they are derived;

- Within the different acid types, lauric acid and palmitic acid—and their derived salts and esters—register the lowest prices; the prices of stearic acid and its derivatives are on average 15% higher than the corresponding compounds of lauric and palmitic acids; the prices of oleic acid and its derivatives are on average 20% higher than those of stearic acid.

EU Anti-dumping Duties

Vegetable fatty acids, with a carbon chain length of C6, C8, C10, C12, C14, C16, or C18, are subject to definitive anti-dumping duties introduced on January 20, 2023, under the EU Implementing Regulation 2023/111, on imports of fatty acids originating from Indonesia. For some Indonesian companies, the rates of these duties can reach up to 46.4%.

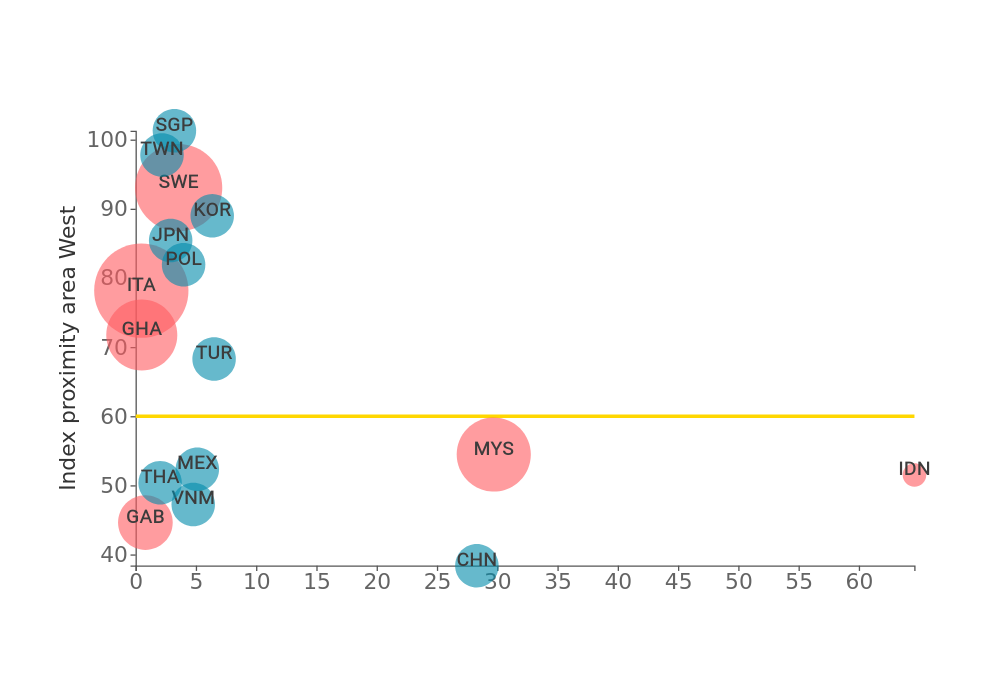

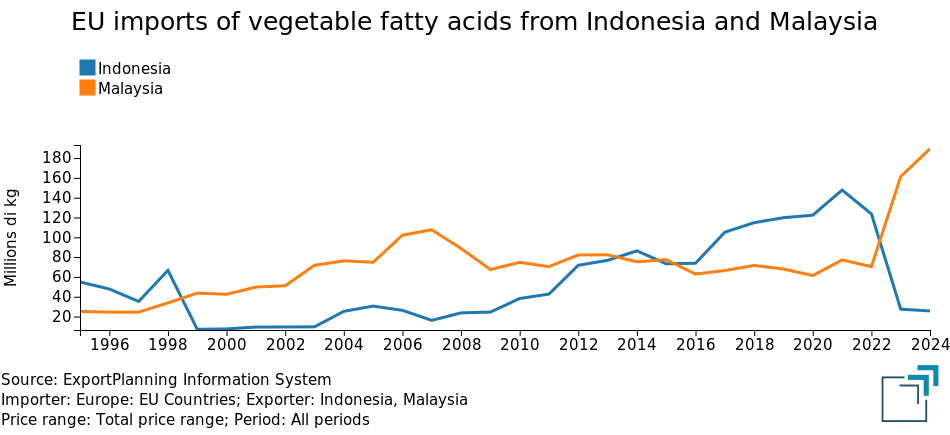

The effect of these duties, which affected the main producing and exporting country of vegetable fatty acids, was significant on EU market prices, as reported earlier, but less intense than might have been expected, due to a rapid process of substituting Indonesian imports with those from neighboring Malaysia, as shown in the chart below.

Conclusions

Vegetable fatty acids and the chemical products derived from them are an important input for companies in the food, cosmetics, pharmaceutical, and chemical sectors. Global production is highly concentrated, with Indonesia and Malaysia holding significant shares in both production and exports. The anti-dumping duties introduced by the EU in 2023 on imports from Indonesia have resulted in EU prices being on average 60% higher than prices before the 2021-2022 cycle. These levels could have been even higher if Indonesian imports had not been rapidly replaced by those from Malaysia.