The steel trade war: from 2018 to the new phase of 2025

Knowing the past to anticipate future steel prices

Published by Luca Sazzini. .

USA customs duties Import tariffs

On February 10, the Trump administration reinstated the 25% tariffs, introduced in 2018, on U.S. steel imports from all countries, effective March 12, 2025.

To better understand the implications of this protectionist policy, it may be useful to review the developments of the first phase of the steel trade war, which began in 2018, in order to anticipate the possible effects that could emerge in this new phase.

The 2018 U.S. Steel Tariffs

On March 1, 2018, President Donald Trump announced the introduction of 25% tariffs on steel and 10% tariffs on aluminum imported into the U.S., invoking the National Emergency Act to justify this extraordinary measure aimed at protecting the country's national security and interests. The main reasons given were:

- Safeguarding the domestic steel industry, deemed essential for national security;

- Reducing dependence on imports, as the U.S. imported about one-third of the steel used domestically;

- Supporting production and employment in the U.S. steel industry.

Initially, the tariffs were applied globally, affecting all major steel exporters to the United States. Later, after numerous negotiations, some countries managed to obtain temporary exemptions or specific agreements:

- South Korea, Brazil, and Argentina: granted import quotas instead of tariffs;

- Australia: completely exempt from tariffs;

- Canada, Mexico, and the EU: initially exempted, but tariffs were reinstated in June 2018. However, in 2019, the United States decided to suspend tariffs on steel and aluminum imports from Canada and Mexico due to agreements reached under the new USMCA (United States-Mexico-Canada Agreement), which replaced NAFTA.

The European Union, on the other hand, did not benefit from this suspension and continued to face tariffs until 2021, when new agreements were reached with the Biden administration.

The decision sparked strong reactions from U.S. trade partners, leading to retaliatory measures.

In particular, the European Union responded with punitive tariffs on a range of American products, including bourbon, Harley-Davidson motorcycles, and Levi’s jeans.

The Shift from Tariffs to Import Quotas

In 2021, the Biden administration renegotiated certain aspects of the tariffs, particularly with the EU, introducing import quotas instead of fixed tariffs to reduce trade tensions. The quotas were set based on the historical volumes of bilateral trade for the two products, fixed at 3.3 million tons for steel and 380,000 tons for aluminum. European exporters were thus exempt from tariffs, provided they did not exceed these limits and that the production of these products was entirely carried out in Europe. This condition aimed to prevent circumvention practices, avoiding a scenario where the EU would import low-cost production inputs from other countries (such as China), merely completing the final processing phase in Europe before exporting the product to the U.S. market.[1]

The EU's Defense of Its Steel Industry

As highlighted in the article: Chinese steel prices have never been so low, the European Union, in response to the increased international competition caused by U.S. import tariffs, has protected its steel industry through three main measures:

- Additional tariffs: introduced in 2019 to protect the European steel industry in response to the tariffs imposed by the first Trump administration. The goal of these tariffs was to prevent exporters, excluded from the U.S. market due to tariffs, from redirecting their exports to the EU, further exacerbating difficulties in the steel sector;

- Anti-dumping duties, aimed at addressing unfair trade practices (dumping) on imports of hot-rolled flat steel products, both alloyed and non-alloyed;

- Countervailing duties on imports from China, to neutralize the benefits derived from government subsidies granted by the Chinese government to local steel companies.

Despite these measures, the protection of the European steel industry has not been complete. Chinese steel products have still managed to penetrate the EU market, circumventing tariffs through triangulations with third countries, further intensifying pressure on the European steel sector.[2]

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

The Impact on Steel Product Prices

The following table summarizes the impact of protectionist measures on steel prices in different regions between 2018 and 2024. It compares percentage changes between March 2018 (when the first Trump administration's protectionist policy began) and November 2024 for four different indices:

- USA steel industry producer prices: measuring the price increases applied in the U.S. market by American steel companies;

- EU steel industry producer prices: measuring the price increases applied in the EU market by European steel companies;

- EU customs prices of hot-rolled coils: representing price variations for this steel product, recorded in EU customs trade;

- FOB prices to Chinese exports of hot rolled coils: representing price variations of coils applied by Chinese steel companies in foreign markets.

Variation in HRC prices in US, EU and China

| Actual Period | Period Variation | |

|---|---|---|

| USA Steel Industry Producer Prices | 2018-03 - 2024-11 | +61.76% |

| EU Steel Industry Producer Prices | 2018-03 - 2024-11 | +25.47% |

| EU Customs Prices of Hot Rolled Coils | 2018-03 - 2024-11 | +18.96% |

| FOB prices to Chinese exports of hot rolled coils | 2018-03 - 2024-11 | -6.27% |

The data presented in the table leaves no doubt about the effects that the protectionist policies of the USA and the EU have had on steel prices in their respective markets. Given the importance of Chinese steel production and, above all, its large share in global trade, the FOB price of Chinese exports can be considered a benchmark for international steel industry prices. Therefore, despite a decline in global steel prices (-6%), prices in the EU market and, especially, in the US market have followed an opposite trend. Trade barriers have limited access to low-cost steel, leading to a 20% price increase in Europe and a 60% rise in the United States.

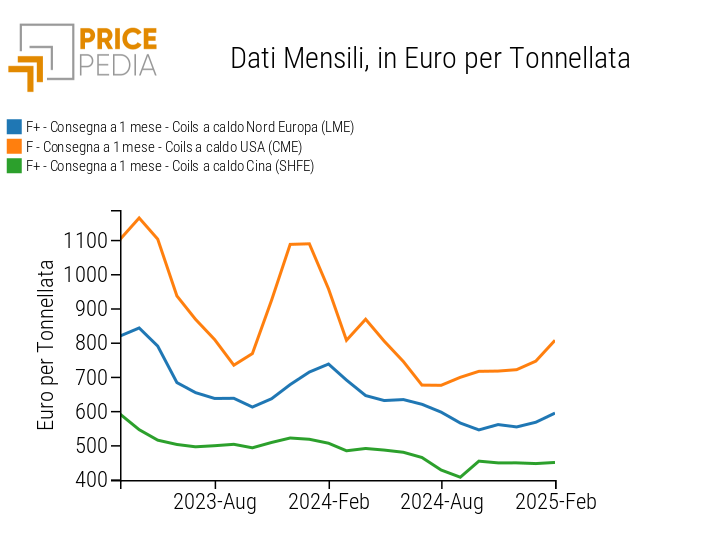

These dynamics are also confirmed by the analysis of financial prices of hot rolled coils, traded on the Chicago Mercantile Exchange (CME), London Metal Exchange (LME), and Shanghai Futures Exchange (SFHE), as shown in the following chart.

HRC Financial Price in the USA, EU, and China

US Tariffs in 2025: What to Expect

The steel import tariffs in the United States, set to take effect on March 12, are very likely to trigger reactions similar to those observed in 2018 from partner countries. In particular, European Commission President Ursula von der Leyen has stated that unjustified tariffs on the EU will not go unanswered. The European Union is, in fact, ready to issue new firm and proportionate countermeasures to protect its economic interests.

However, unlike what happened at the end of the last decade, it is unlikely that the EU will adopt additional measures beyond those already in place to protect its steel industry. Most likely, it will renew those expiring at the end of June 2025, but the level of protection will hardly exceed the previous one.

Conversely, the new US protectionist policy on steel could be stricter this time than in 2018, with fewer exceptions and greater restrictions. This would make the American market less accessible, intensifying competition in international markets.

Conclusions

Despite clear evidence of the price effects caused by the US steel protectionist policy over the past five years, the Trump administration is preparing to implement an even more aggressive version of this policy. As before, partner countries will respond with firm and proportionate countermeasures to protect their trade interests.

However, it is unlikely that the European Union will adopt stricter measures to protect its steel industry compared to what was done at the end of the last decade, unless it deviates from WTO regulations.

Therefore, European steel product prices are likely to reflect strong foreign competition, leading—if not to a price decline—at least to their stabilization at current levels, even in the event of a future recovery in steel demand on the continent.

[1] For further insights, refer to the Export Planning article: US and EU: the new Tone of the Transatlantic Partnership;

[2] See the article: How increased Chinese steel supply impacts European steel prices