The price of electrical conductors: costs and product differentiation

Econometric analysis of determinants

Published by Pasquale Marzano. .

Copper Aluminium Price Drivers

Electrical cables are an essential component in manufacturing and infrastructure. Their use stretches multiple industrial sectors. A factor that will support their demand is certainly linked to technologies for the energy transition, such as smart grids, renewable energies, and electric mobility, as well as the increased demand for electrification.

Given their widespread use and growing economic importance, this article analyzes the price dynamics of electrical conductors and their main determinants.

Composition of Electrical Conductors

Electrical cables are primarily composed of conductive materials, which facilitate the transmission of electricity, and insulating materials, which prevent the flow of electric current outside the cable, protecting the conductor from external agents.

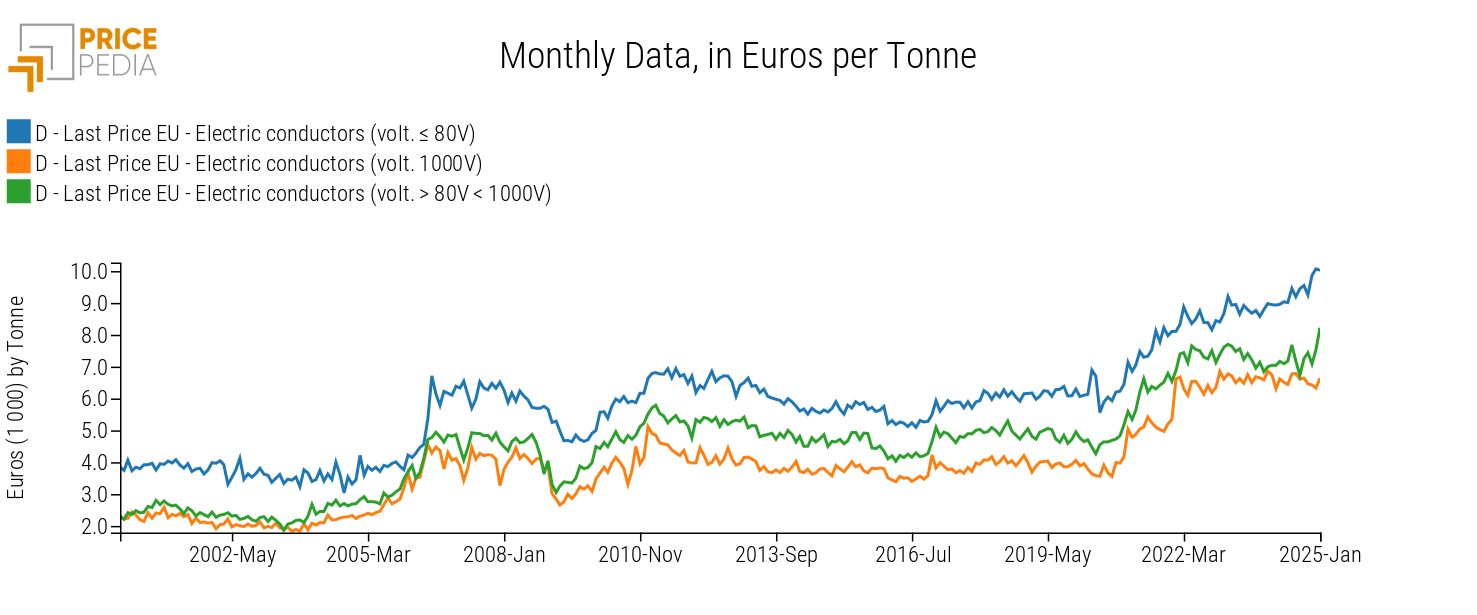

The following chart illustrates the dynamics of European prices for electrical conductors with a voltage of up to 1000V, expressed in euros per ton.

Electrical Conductor Prices for Different Voltages, in Euros per Ton

As seen in the chart, over the long term, the prices of the three different types of electrical conductors follow a common trend, with relatively stable price differentials. Electrical cables with a voltage below 80V has the highest price levels. Moreover, current quotations are at historical highs.

Econometric Model for Electrical Conductors

Among the most commonly used insulating materials in cable production, Polyvinyl Chloride (PVC) is the most prevalent. Other materials include Polytetrafluoroethylene (PTFE), rubbers, and thermoplastics. As for conductive materials, although many exist with specific characteristics tailored to different applications, the most commonly used are copper and aluminum.

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

To estimate an econometric model for the price of electrical conductors, determinants such as the price of insulating and conductive materials are considered. For the latter, the prices of unalloyed aluminum wires and copper winding wires are examined, as these are downstream products in the supply chain with greater product differentiation (see the in-depth analysis The price transmission mechanism: how much does market structure matter?) and are therefore significantly influenced by demand dynamics, not just raw metal costs.

The econometric model selected for estimating electrical cable prices is the Engle and Granger model, which estimates the dynamic specification in two distinct phases:

- The first identifies the structural relationship between variables in the long term (equilibrium relationship).

- The second estimates short-term adjustment processes towards the "theoretical" long-term values (error correction model).

To estimate the price elasticities concerning cost determinants, a logarithmic transformation was applied to all variables. The results obtained are described below.

Model Results

The table below presents the results of the estimated model for the three types of electrical conductors considered, distinguishing between long-term and short-term coefficients.

| Long-Term Equation Regressors | Short-Term Equation Parameters | Determination Coefficients | |||||

|---|---|---|---|---|---|---|---|

| Copper Wires | Unalloyed Aluminum Wires | Insulating Materials | k1 (Impact Effect) | k2 (Error Correction Speed) | R2 Long Term | R2 Short Term | |

| Electric conductors (volt. < 80V) | 0.62 | 0.23 | 0.10 | 0.37 | -0.31 | 0.94 | 0.20 |

| Electric conductors (volt. = 1000V) | 0.92 | 0.16 | 0.15 | 0.54 | -0.27 | 0.97 | 0.13 |

| Electrical conductors (volt. ≥ 80V < 1000V) | 0.71 | 0.37 | 0.15 | 0.71 | -0.33 | 0.95 | 0.20 |

As can be observed from the table, the models explain very well the price dynamics of electric conductors. A clear signal emerges from the coefficient of copper wires, which is always above 0.6 and higher than other cost components, confirming the greater use of copper in the production of electric conductors compared to aluminum.

In the case of electric conductors with voltages between 80-1000V, this coefficient is 0.92. This indicates that a 10% increase in the price of copper wires leads to an increase of over 9% in the price of electric conductors in the long term. The magnitude of the copper wire coefficients is also justified by the higher price level compared to other considered materials.

Although they have lower coefficients than copper wires, aluminum wires (coefficients ranging from 0.16 to 0.37) and insulating materials (coefficients between 0.10 and 0.15) are also relevant in the long run.

Regarding the short-term results, it can be observed that more than half of the total variation of the determinants tends to be immediately transferred (impact effect) to the final price in the case of electric conductors with 80-1000V and 1000V voltage. In the case of electric conductors (volt. < 80V), however, the immediate transmission of determinant variations is less intense (just under 40%).

The adjustment coefficient (which determines the speed at which the error is corrected) for all three products considered averages -0.3, indicating an adjustment speed of 30% of the difference existing in the previous period between the "theoretical" price and the actual price.

Conclusions

The analysis carried out shows that the price of electric conductors is determined by their components, conductive materials, and insulating materials. The greater differentiation of cables compared to the materials that compose them results in only a partial immediate adjustment of prices to cost dynamics and a relatively slow process in the following periods of complete adjustment between prices and costs.