Uncertainty skyrockets after clash in Oval Office

Trump effect on commodity markets

Published by Luca Sazzini. .

Conjunctural Indicators Commodities Financial WeekThe clash between the new US administration and the European Union is becoming increasingly heated, fueling a climate of geopolitical and economic instability. After Friday night's attack by Donald Trump and J.D. Vance on Ukrainian President Volodymyr Zelensky in the Oval Office, it is clear that this is not just a matter of tariffs, but a broader strategic repositioning that could undermine the alliance between Western countries.

Before Friday night's meeting, financial markets seemed to be betting on the signing of the rare earth contract between the United States and Ukraine, seen as a point of mediation between the two allies and a possible first step towards a ceasefire in the Russia-Ukraine conflict. What happened in the Oval Office now calls everything into question. Although a de-escalation in tone is likely in the coming days, uncertainty remains high, and the diplomatic path appears more complex than expected.

The consequences for the global economy, financial markets, and, by extension, the commodity sector remain difficult to predict. At the moment, the bombastic statements have not translated into concrete measures, but the uncertainty generated by this political escalation could have significant effects on the volatility of commodity prices.

Weekly summary of financial commodity prices: the events before Friday night

This week, a general decline in financial prices was observed across all major asset classes, including commodities.

In commodity markets, energy prices were the most volatile, with sharp declines in the early days of the week, followed by a rebound starting on Thursday.

The drop in oil prices is mainly attributed to the announcement by the Iraqi Ministry of Oil regarding the resumption of crude oil exports via the Kirkuk-Ceyhan pipeline, which connects Iraq to Turkey.

The drop in prices was also exacerbated by the potential agreement between Ukraine and the United States for the exploitation of Ukrainian natural resources. The agreement proposed the creation of a jointly managed investment fund, half-funded by proceeds from the exploitation of Ukrainian natural resources, intended to finance reconstruction and development projects. Although the project did not include explicit security guarantees for Ukraine, it seemed to strengthen the economic partnership between the two countries, recently weakened by statements from US President Donald Trump. However, the events of Friday night have put everything into question, leaving uncertainty about the actual implementation of the agreement and future dynamics in the commodity markets.

Other factors that contributed, before Friday night, to the decline in prices were improved prospects for a peace agreement between Russia and Ukraine, as well as persistent trade and tariff concerns, which continued to negatively impact oil prices, fueling fears of a slowdown in the global economy and a possible contraction in future commodity demand.

After reaching a new low for the year, oil prices started to rise again on Thursday, supported by an unexpected drop in crude inventories in the US reported by the EIA (Energy Information Administration), aided by production disruptions in North Dakota.

The prices of natural gas followed a similar trend to oil but with even more intense fluctuations. The early-week price reductions were driven by the potential agreement between the United States and Ukraine and, more importantly, the prospects for a peace agreement between Russia and Ukraine. These expectations had mainly impacted TTF prices, increasing the expectations of a possible resumption of Russian gas flows to Europe.

However, by Thursday, European natural gas prices had partially recovered, rising back to around 45 euros/MWh. At present, Europe must continue to face challenges related to storage refilling, and European gas prices may remain high as long as the current geopolitical uncertainty persists. With Friday night's developments, the outlook may now change again.

The food market also saw significant price reductions. The sharpest drop was seen in coffee prices, which fell sharply due to both stock rebounds and concerns about consumer spending, amplified by the 7-point drop in the February US consumer confidence index, which stood at 98.3, the lowest level since April 2024.

In the industrial metals market, price stability was observed compared to the other markets analyzed earlier.

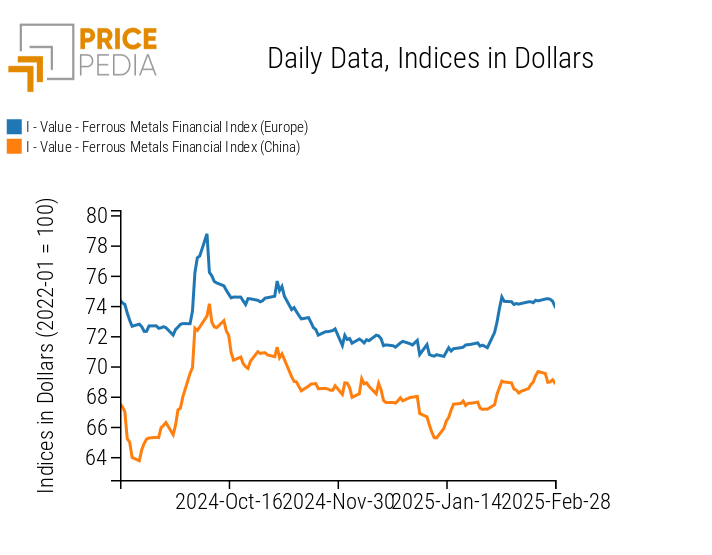

The European ferrous index showed mainly sideways price movements, while the Chinese index experienced a slight price fluctuation.

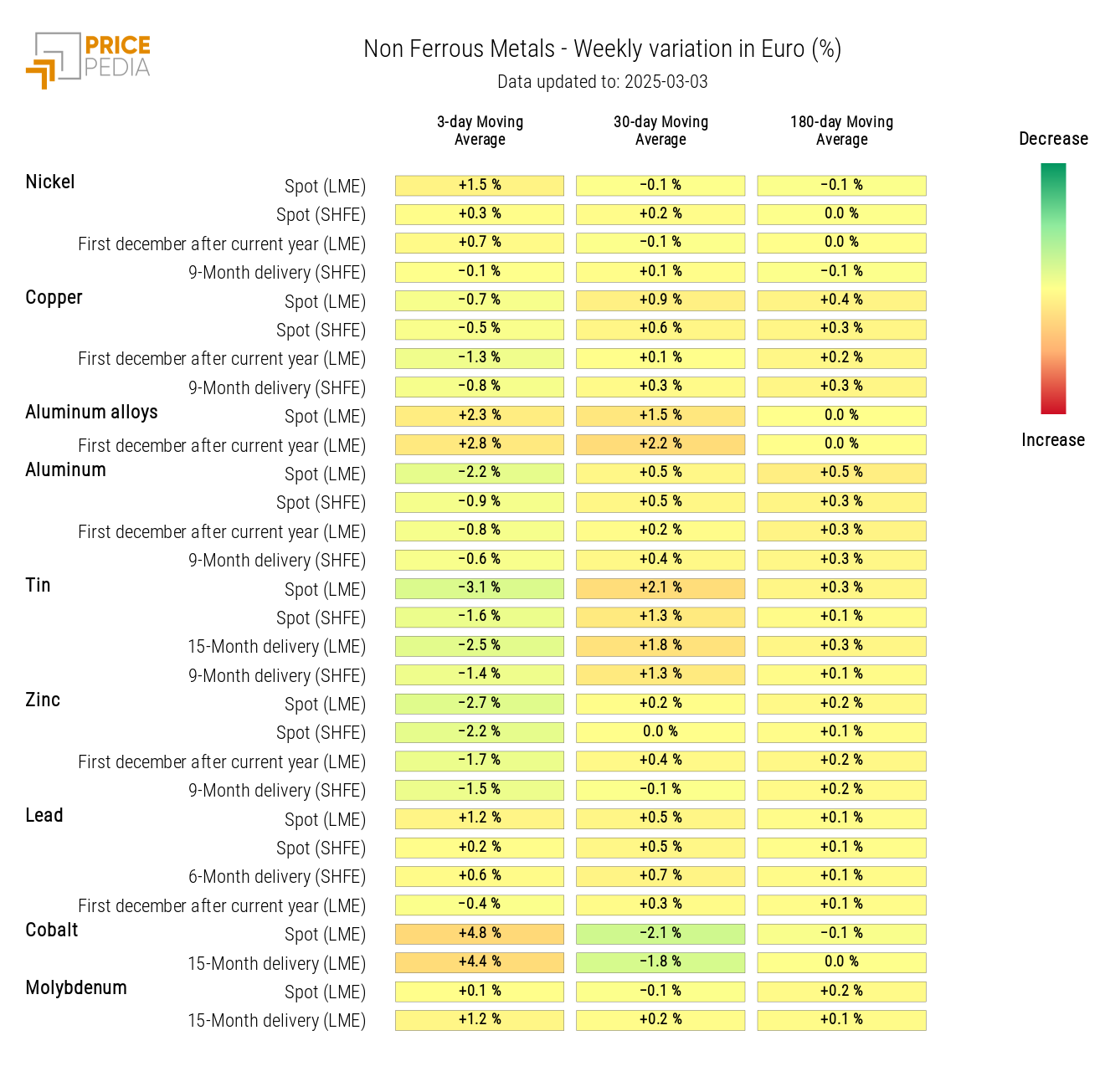

Non-ferrous metals saw relatively contained fluctuations, with slightly lower closes compared to the previous Friday. However, some exceptions stood out with a weekly price increase, such as in the case of cobalt, nickel, and aluminum alloys. Among them, the most notable increase was in cobalt, due to the export ban from the Democratic Republic of Congo, a measure aimed at countering the market’s downward trend. Political uncertainty may now also affect this sector, especially if tensions impact supply chains.

Inflation

Euro area

In January, inflation in the euro area, as recorded by the Consumer Price Index (CPI), was in line with analysts' expectations.

On an annual basis, the CPI index stood at 2.5% y/y;

on a monthly basis, there was a -0.3% m/m reduction, reinforcing the idea of a slowdown in inflation within the euro area.

In light of these data, market participants still expect a further 25 basis points rate cut at the European Central Bank (ECB) meeting next week.

United States

Data from the Personal Consumption Expenditures (PCE) report indicate a growth in US inflation of 2.5% y/y in January. The figure aligns with market expectations and shows a 0.1% decrease compared to December's data.

The core PCE index, excluding energy and food, recorded a +2.6% year-over-year and a +0.3% month-over-month change.

NUMERICAL APPENDIX

ENERGY

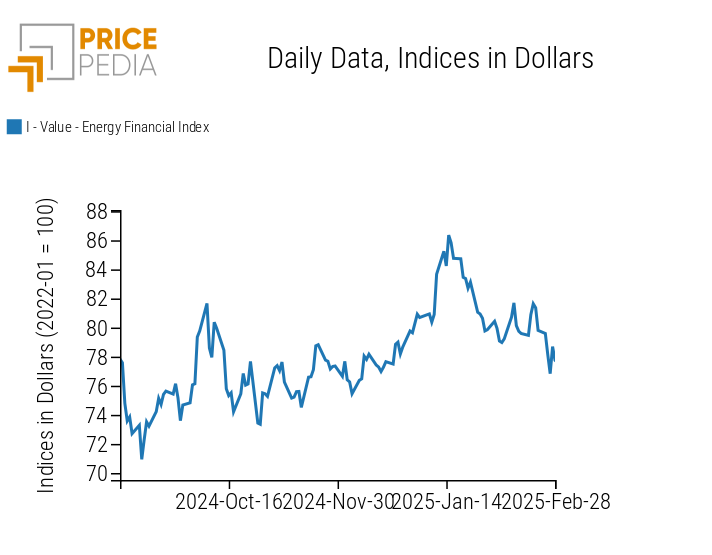

The PricePedia energy products index highlights the drop in prices at the start of the week, followed by a significant rebound on Thursday.

PricePedia Financial Index of energy prices in dollars

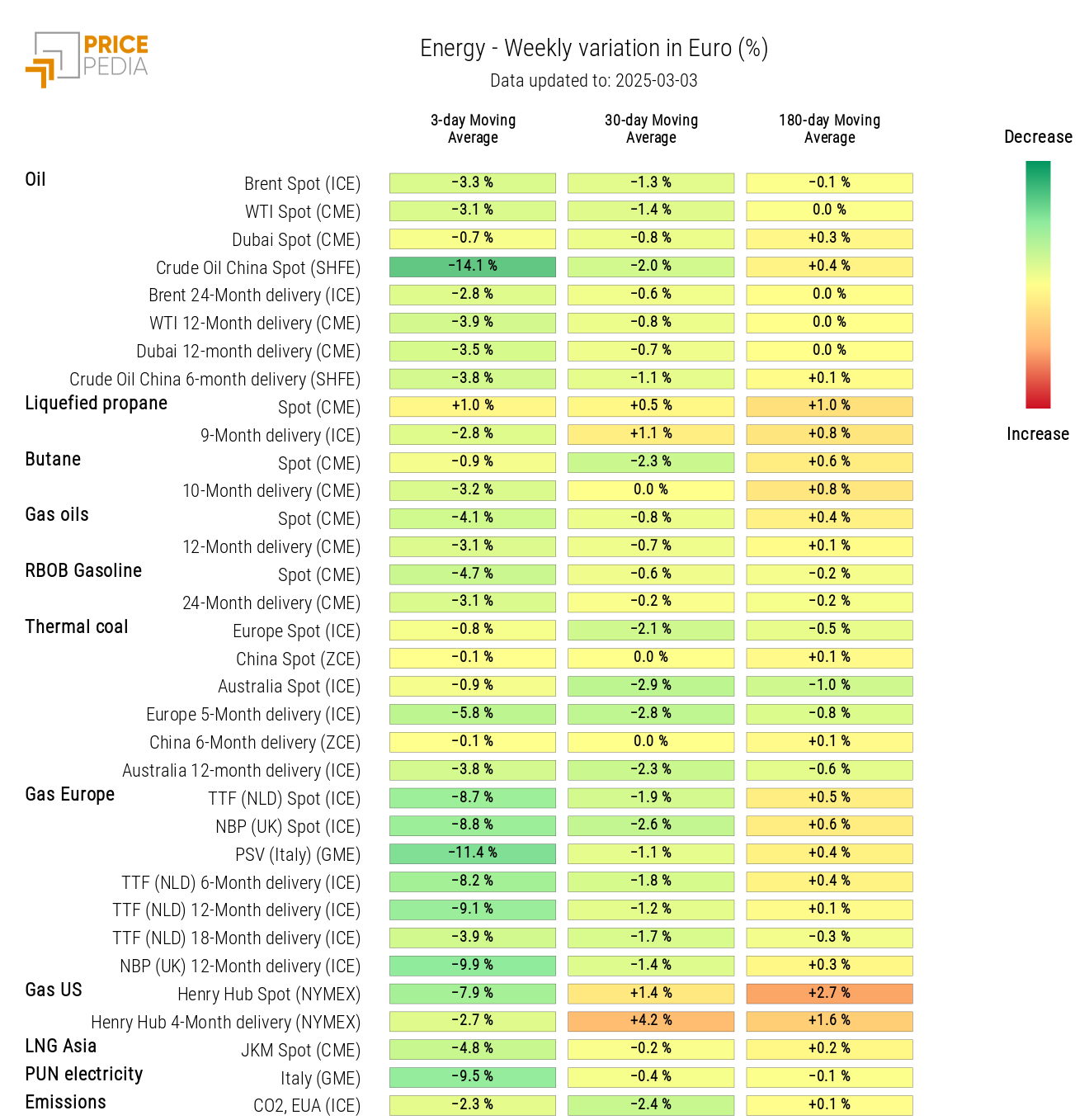

PricePedia's energy heatmap turns green, indicating an overall reduction in 3-day moving averages of energy prices.

Among the most significant drops are the declines in Shanghai (SHFE) oil prices and European TTF natural gas (Netherlands).

HeatMap of energy prices in euros

PLASTICS

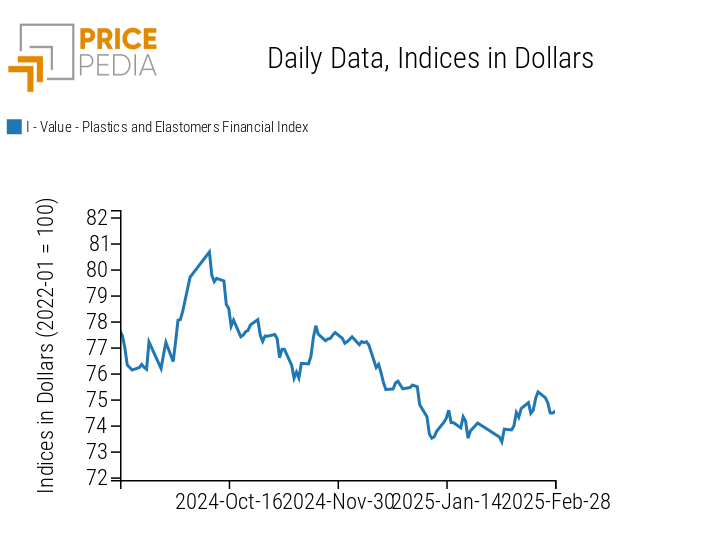

The financial index for plastics and elastomers in China shows a decline in prices this week.

PricePedia Financial Indices of plastics prices in dollars

FERROUS

The European ferrous metals index remains relatively stable, while the Chinese index experiences a slight price fluctuation.

PricePedia Financial Indices of ferrous metals prices in dollars

Do you want to stay up-to-date on commodity market trends?

Sign up for PricePedia newsletter: it's free!

NON FERROUS INDUSTRIALS

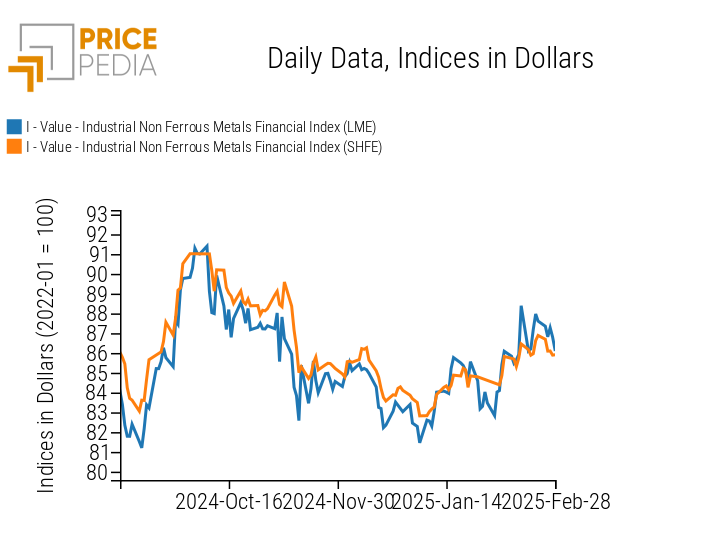

Net of some fluctuations, the two non-ferrous indices indicate a slight drop in prices, more pronounced in the Shanghai Futures Exchange (SHFE) market.

PricePedia Financial Indices of non-ferrous industrial metals prices in dollars

The heatmap of non-ferrous metals shows a weekly increase in the 3-day moving averages of cobalt, nickel, and aluminum alloys, contrasted with a reduction in tin, zinc, and aluminum prices.

HeatMap of non-ferrous prices in euros

FOOD

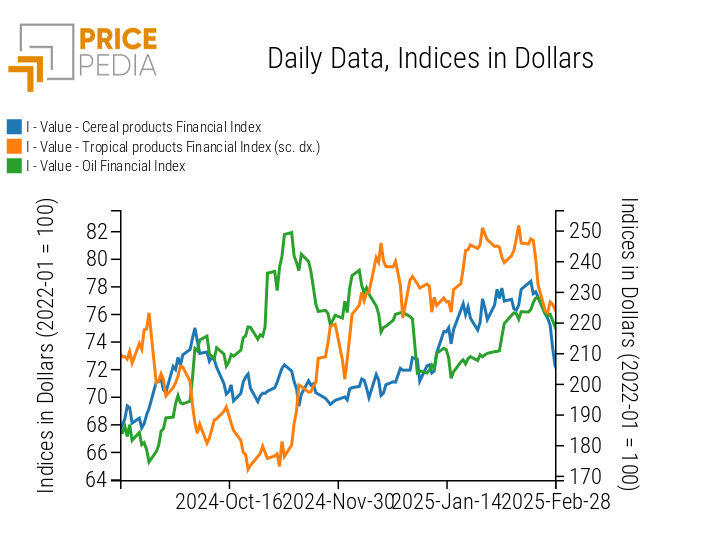

All three food indices show a marked decline in prices.

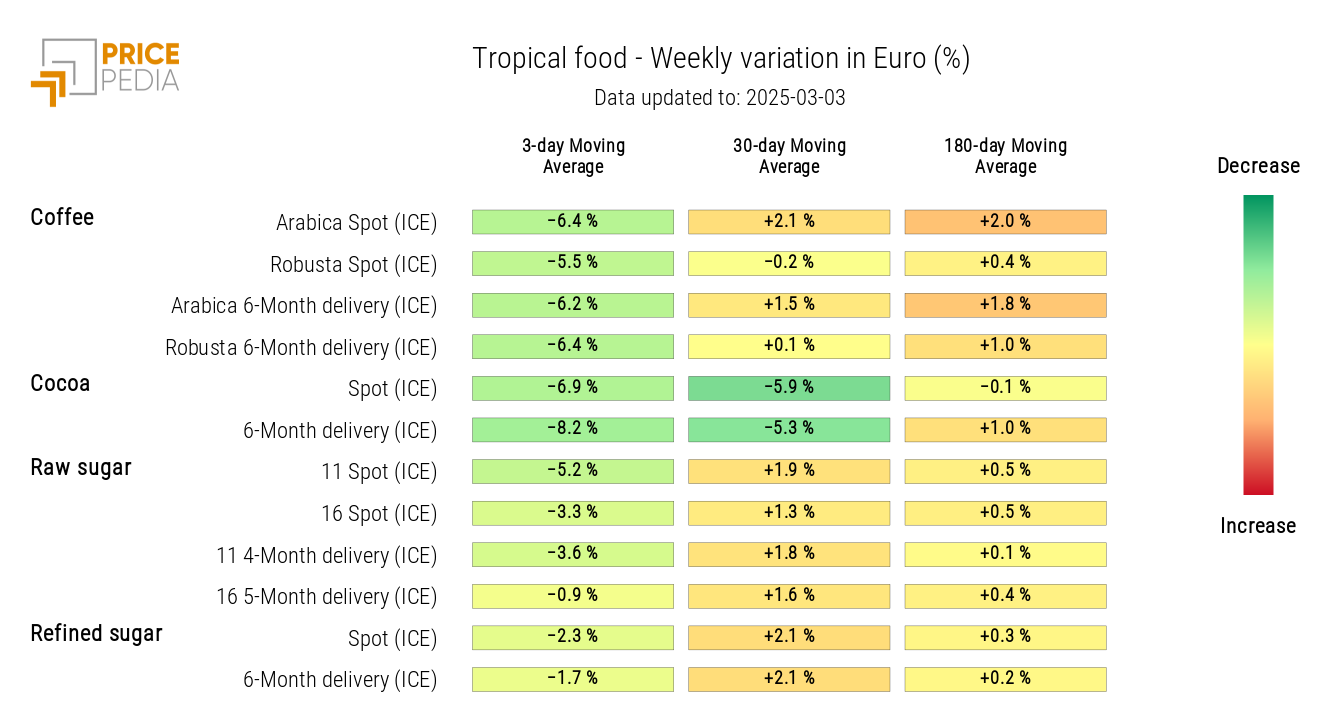

The tropical index recorded the most significant drop at the beginning of the week, but it also saw the largest positive daily change. Wednesday's slight recovery is linked to cocoa price dynamics, which experienced a positive fluctuation due to the slowdown in exports from Ivory Coast and the downward revision of harvest forecasts in Ghana, the second largest cocoa producer in the world.

PricePedia Financial Indices of food prices in dollars

CEREALS

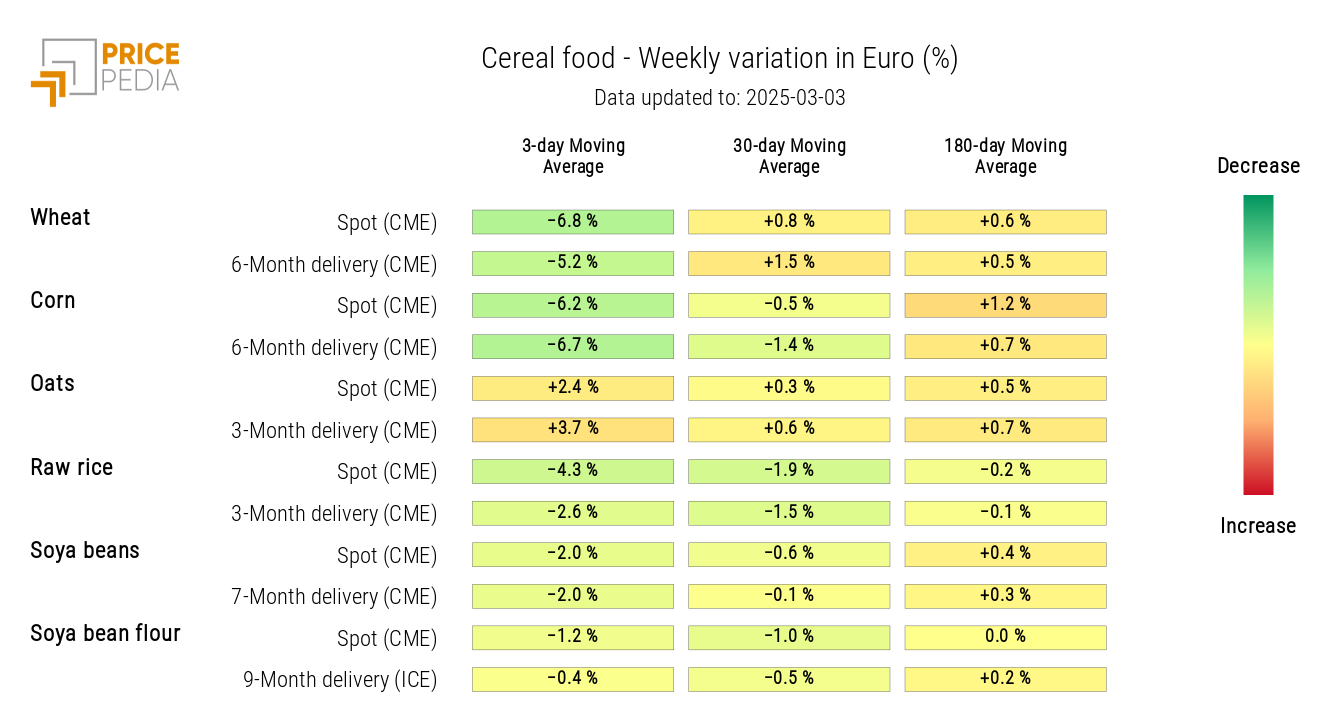

The analysis of the cereal heatmap shows a reduction in prices, particularly pronounced for wheat and corn, compared to a slight increase in oat prices.

HeatMap of cereal prices in euros

TROPICALS

The tropical heatmap highlights a generalized reduction in the weekly moving average of all prices in this category.

HeatMap of tropical food prices in euros

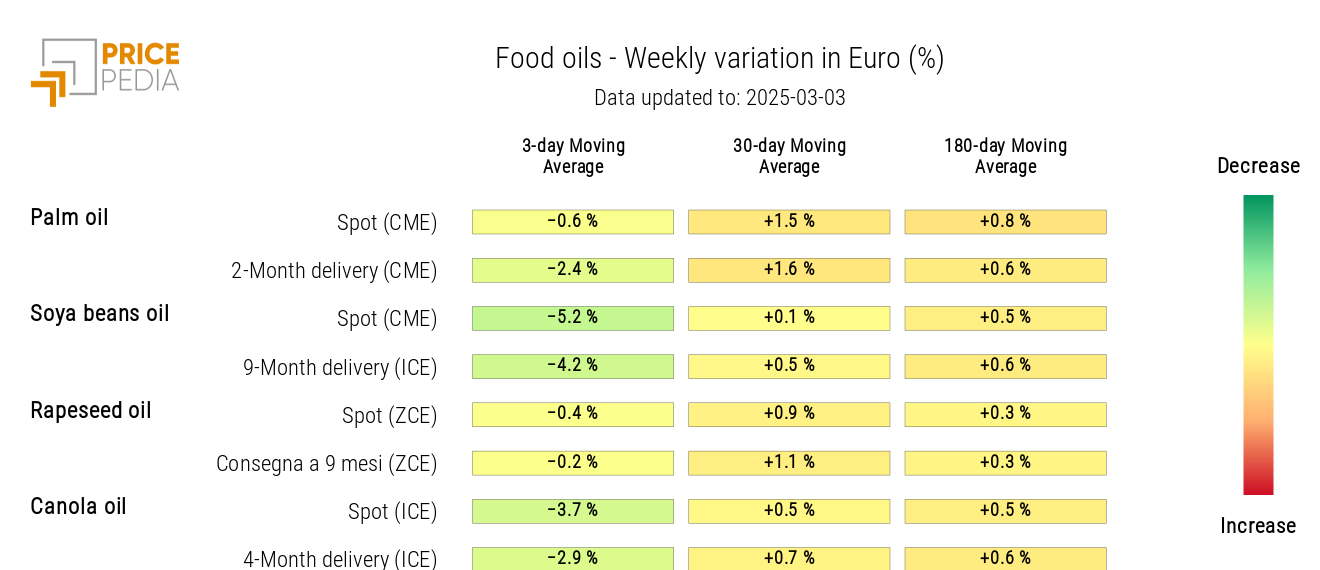

OILS

The analysis of the oils heatmap shows a reduction in prices for soybean oil and canola oil.

HeatMap of food oil prices in euros